Life insurance is a contract between a policyholder and an insurance company. The policyholder agrees to pay regular premiums, and in return, the insurance company promises to pay a death benefit to the policyholder's chosen beneficiaries if they pass away while the policy is active. There are two main types of life insurance: term and permanent. Term life insurance covers the policyholder for a set period, such as 10 or 20 years, and is usually the most affordable option. Permanent life insurance is designed to last the policyholder's entire life and often includes additional features like cash value, which can be used to borrow against or supplement retirement income. When comparing life insurance options, it is essential to consider your personal circumstances, financial goals, and the different types of policies available.

| Characteristics | Values |

|---|---|

| Types of life insurance | Term life insurance, Permanent life insurance (Whole life insurance, Universal life insurance, Variable life insurance, Final expense life insurance) |

| Who needs life insurance? | People with financial dependents, e.g. families with children, people with outstanding debt, business owners, etc. |

| How much life insurance is needed? | Depends on age, income, mortgage and other debts, anticipated funeral expenses, etc. |

| How to get life insurance quotes | Online, by phone, or via an in-person meeting with a life insurance agent |

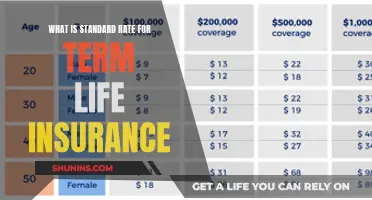

| Factors determining term life insurance rates | Age, health, policy term, coverage amount, gender, tobacco usage, job, hobbies, driving records, etc. |

| How to compare term life insurance rates | Coverage amount, term length, insurer underwriting the policy |

| How to save on life insurance premium | Making health and lifestyle changes, considering different policy types, buying life insurance sooner |

| Life insurance beneficiaries | Children, partner, a favourite charity, business, etc. |

| Life insurance ratings methodology | Consumer experience, complaint index scores, financial strength ratings |

What You'll Learn

Term vs. Whole Life Insurance

When comparing life insurance, it's important to consider your needs and financial situation. Two main types of life insurance are term life insurance and whole life insurance. Here's a detailed comparison between the two:

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is more affordable than whole life insurance due to its temporary nature and lack of cash value buildup. Term life insurance is ideal for individuals who only need coverage for a certain period, such as while their children are dependent on them or when paying off a mortgage. The premiums tend to be lower, making it a cost-effective option for young families or those on a budget. Additionally, term life insurance is straightforward, with fixed premiums and a death benefit that remains constant throughout the term. However, one of the cons of term life insurance is that if you outlive the policy term, your coverage ends, and you won't receive any benefits.

Whole Life Insurance

Whole life insurance, on the other hand, provides coverage for your entire life, as long as you pay the premiums. It tends to have higher premiums because it serves as an investment and accumulates cash value over time. The cash value grows at a guaranteed rate in a tax-deferred account, providing financial flexibility. Whole life insurance is suitable for those who want lifelong coverage, such as for end-of-life planning or providing for a lifelong dependent. The premiums remain the same throughout the policy, and the payout is guaranteed. However, whole life insurance is more complex, and the death benefit can change if you borrow against the policy's cash value.

Key Differences

When deciding between term and whole life insurance, consider the following key differences:

- Policy Length: Term life insurance offers coverage for a set period, while whole life insurance provides coverage for your entire life.

- Cash Value: Term life insurance has no cash value component, whereas whole life insurance allows you to build cash value that grows at a fixed rate.

- Cost: Term life insurance is generally cheaper than whole life insurance due to its temporary nature and lack of cash value.

- Complexity: Term life insurance is simpler and more straightforward, while whole life insurance is more complex due to its investment features.

Life Insurance Rates: Recession Impact and You

You may want to see also

How to Get Quotes

Getting quotes for life insurance is a straightforward process. You can get quotes for term life insurance policies online, by phone, or via an in-person meeting with a life insurance agent. Many insurers offer free quotes online, so you can compare your options at the click of a button. You can also use an online life insurance comparison tool that generates quotes from a range of companies at once. However, keep in mind that brokers and comparison tools may not work with every insurer on the market.

- Gather personal details: To get life insurance quotes, you will need to provide basic details about yourself, such as your age, weight, height, smoking habit, home address, income, marital status, and occupation.

- Choose a comparison method: You can go directly to each life insurer by visiting their website or speaking to one of their agents. Alternatively, you can work with a broker, who will collect quotes from multiple companies for you.

- Compare the same policy details: Ensure that you are comparing similar policies by checking that the policy type, term length, coverage amount, and riders are relatively similar.

- Assess your needs: Decide whether you need term or permanent life insurance. Term life insurance is ideal if you only want coverage for a specific period, such as until your children graduate from college. On the other hand, permanent life insurance provides lifelong coverage and includes a cash value component.

- Research multiple life insurance providers: Compare each provider based on customer satisfaction and financial strength ratings from third-party agencies like J.D. Power and AM Best.

- Compare life insurance options: Look at the type of policy, coverage amount, and death benefit each insurer offers. Shopping around can help you save money, as insurers evaluate risk factors differently, leading to varied premiums.

- Apply for a policy: After selecting an insurer and deciding on the type of insurance that suits your needs, apply either through a licensed agent or online. Keep in mind that you will likely have a "free look" period after purchasing your policy, allowing you to review the policy in detail and ensure it meets your expectations and requirements.

By following these steps, you can get life insurance quotes and make an informed decision about the best coverage for your needs.

Life Insurance Proceeds: Impact on FAFSA Eligibility

You may want to see also

How Much Coverage You Need

The amount of life insurance coverage you need depends on several factors, including your age, income, mortgage, debts, and anticipated funeral expenses.

A general rule of thumb is to multiply your income by 10, but this doesn't take into account your savings or existing life insurance policies. A more detailed estimate can be obtained by using the DIME formula, which stands for Debt, Income, Mortgage, and Education. This formula considers future expenses in addition to future earnings.

- Debt: Calculate your total debt, excluding your mortgage. This includes car payments, credit cards, student loans, and any other personal obligations. Also, add an estimate of your funeral expenses to this amount.

- Income: Determine how many years your family would need financial support if you were to pass away. Multiply your annual income by the number of years to get the total income replacement needed.

- Mortgage: Calculate the amount needed to pay off your mortgage.

- Education: Estimate the cost of sending your children to school and college.

Add these four factors together to get your estimated coverage needs. You can then subtract any current savings and existing life insurance policies from this amount to get a more accurate figure.

Another method to estimate your coverage needs is to replace your income and add a cushion. With this approach, you calculate the amount of coverage needed so that your beneficiaries can invest the payout and generate enough income to replace your income. For example, if your income is $50,000 and you estimate a 5% rate of return, you would need a policy with a $1 million payout ($50,000 / 0.05 = $1,000,000).

Keep in mind that the above calculations are just estimates, and the right amount of coverage depends on your unique circumstances, budget, and priorities. It is always a good idea to consult a financial professional or use an online life insurance calculator to get a more accurate estimate of your coverage needs.

Cashing in on Employer Whole Life Insurance: Your Options Explained

You may want to see also

How to Compare Quotes

Comparing quotes from different life insurance companies is an important step in the process of buying life insurance. Here are some steps to help you compare quotes effectively:

Calculate your coverage needs

Start by calculating how much money your dependents would need to pay off all your major debts, such as mortgages, car loans, medical and credit card bills, and school loans. You should also consider future expenses such as your children's college tuition, funeral costs, and retirement income. A good rule of thumb is to aim for a death benefit that is around four to five times your annual salary.

Consider riders

Life insurance riders provide additional protection or coverage for specific costs, which is added to your monthly premium. Common riders include accelerated death benefits, critical illness, and disability. Research the available riders and their costs with each company, as some riders are included at no upfront cost.

Understand the different types of life insurance

There are two main types of life insurance: term and permanent. Term life insurance covers you for a specific period, usually between 10 and 30 years, and is generally more affordable. Permanent life insurance, on the other hand, covers you for your entire life and includes a cash value component that grows over time. Whole life and universal life are the most common types of permanent life insurance policies.

Compare quotes from multiple companies

Once you know your coverage needs and preferences, get quotes from multiple companies to compare prices. You can use online quote calculators or speak to a licensed life insurance agent to get estimates. Remember that online quotes are usually just estimates, and the final rates may vary based on your health, lifestyle, and other factors.

Evaluate the financial strength and reputation of the insurance company

When selecting a life insurance company, be sure to consider their financial strength ratings, customer satisfaction scores, and the number of customer complaints. You want to choose a company with high financial stability that is likely to be able to pay out your death benefit when needed.

Seek advice from professionals

Consider consulting an insurance agent or financial professional to help you navigate the complexities of life insurance. They can provide valuable guidance in comparing alternative options, determining the most suitable policy for your financial situation, and tailoring the policy to meet your specific needs.

Health Insurance vs. Life Insurance: What's the Difference?

You may want to see also

How to Apply for a Policy

Applying for a life insurance policy is a straightforward process. Here's a step-by-step guide on how to apply:

Assess Your Needs:

Determine whether you need term or permanent life insurance. Term life insurance is ideal if you only want coverage for a specific period, such as until your children finish college. Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component. Consider factors like financial obligations, income replacement, and future expenses to decide on the amount of coverage you need.

Research Multiple Providers:

Explore life insurance companies that offer the type of policy you require. Compare providers based on customer satisfaction and financial strength ratings from agencies like J.D. Power and AM Best. This will give you insight into their stability and ability to pay out claims.

Compare Options:

Gather quotes from multiple insurers and carefully compare them to find the best policy for your needs. Consider the type of policy, coverage amount, and death benefit offered by each insurer. Shopping around can help you save money, as insurers evaluate risk factors differently, resulting in varied premiums.

Choose a Payment Schedule:

You will likely have the option to choose how frequently you pay your premiums. Common options include monthly or annual payments. Be aware that some insurers may charge an additional administrative fee for paying monthly.

Select a Beneficiary:

Decide who will receive the payout when you pass away. Ensure you have their personal details, such as Social Security numbers and dates of birth, as you will need this information when applying.

Apply for the Policy:

Once you've selected an insurer and the type of insurance that suits your needs, you can apply through a licensed agent or online. The application process may include a medical examination, depending on the specifics of the policy. Remember that you'll have a "free look" period after purchasing the policy, typically ranging from 10 to 30 days, during which you can review and ensure it meets your expectations.

It's important to note that the application process can vary between companies and policy types, so if you have any questions, don't hesitate to ask your agent or the insurance company for clarification.

Life Insurance Licenses in Florida: Renewal Frequency Explained

You may want to see also

Frequently asked questions

When comparing life insurance quotes, it is important to consider the type of policy, coverage amount, and death benefit offered by each insurer. Additionally, working with a broker can simplify the process as they can shop around on your behalf and provide expert guidance.

You can obtain life insurance quotes online, by phone, or by meeting with a life insurance agent. Online quote calculators provide ballpark estimates, and some websites allow you to compare quotes from multiple companies simultaneously.

Life insurance rates are influenced by various factors, including age, health, lifestyle choices, policy length, and coverage amount. Younger and healthier individuals generally receive more favourable rates.