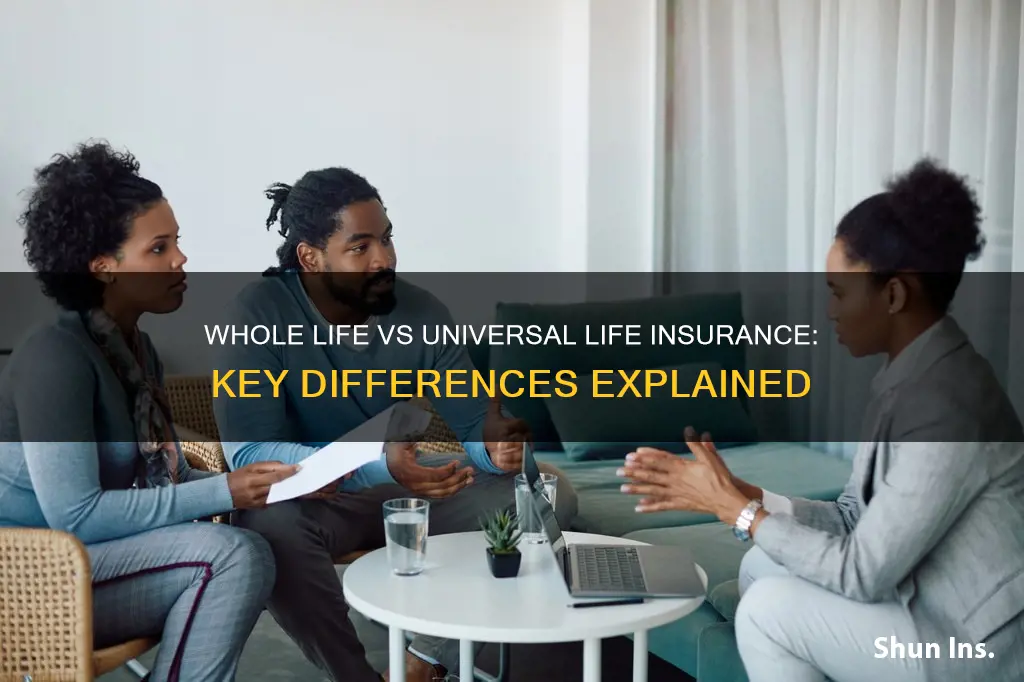

Whole life and universal life insurance are both permanent life insurance policies that offer lifelong coverage. However, they differ in terms of flexibility, premium payments, death benefits, and cash value accumulation. Whole life insurance provides more stability with fixed premiums, guaranteed cash value accumulation, and a guaranteed death benefit. On the other hand, universal life insurance offers flexibility, allowing adjustments to premium payments and death benefits. While whole life insurance has a fixed interest rate on the policy's cash value, universal life insurance offers a variable interest rate based on market conditions. These differences make whole life insurance more predictable and universal life insurance more customizable to changing needs.

What You'll Learn

- Whole life insurance is permanent, universal life offers long-term protection

- Whole life premiums are fixed, universal life premiums are flexible

- Whole life offers more stability, universal life is more flexible

- Whole life has a guaranteed death benefit, universal life doesn't

- Whole life is more expensive than universal life

Whole life insurance is permanent, universal life offers long-term protection

Whole life insurance is permanent, while universal life insurance offers long-term protection. Both are types of permanent life insurance, meaning they are designed to last your entire life and won't expire after a certain period, provided that premiums are paid. However, there are some key differences between the two.

Whole life insurance offers more stability and predictability. It has fixed premiums, meaning you pay the same amount each year for coverage. Whole life insurance also has a guaranteed death benefit, which means that, as long as premiums are paid, your beneficiaries will receive the benefit when you die. Whole life insurance also offers guaranteed cash value accumulation, which can be borrowed against or withdrawn. The cash value grows at a fixed interest rate, making it more predictable than universal life insurance.

Universal life insurance, on the other hand, offers more flexibility. It allows you to adjust your premiums and death benefit to fit your needs, within certain limits. You can also skip premium payments if your cash value is enough to cover the required expenses for that month. The cash value in a universal life policy can increase your death benefit when you pass away. However, the cost of keeping the policy can go up significantly as you get older, and there is a risk that the policy could end if it is not adequately funded. The interest rate on a universal life policy is also variable, depending on market conditions, which means there is a chance of higher returns but also greater risk.

In summary, whole life insurance offers the stability and predictability of fixed premiums, a guaranteed death benefit, and guaranteed cash value accumulation. Universal life insurance provides more flexibility, allowing you to adjust your premiums and death benefit, and potentially grow your cash value more rapidly. The choice between the two depends on your circumstances and preferences for stability versus flexibility.

Credit Score Impact on Life Insurance: What's the Link?

You may want to see also

Whole life premiums are fixed, universal life premiums are flexible

Whole life insurance offers stability and predictability, with fixed premiums that guarantee lifelong protection. This means that as long as you continue to pay the premiums, your beneficiaries will receive the life insurance benefits. The premiums are locked in for life, so you don't have to worry about unexpected increases as you age. This reliability is a significant factor for many people when choosing an insurance policy.

Universal life insurance, on the other hand, provides flexibility. It allows you to adjust your premium payments and death benefit over time, which can be helpful if your financial situation changes. You can also skip premium payments if your cash value is sufficient to cover the required expenses for that month. However, the cost of keeping the policy can increase significantly as you get older, and if the policy is not adequately funded, it could end.

The interest rates on whole life insurance policies are fixed, whereas those on universal life insurance policies are variable, based on prevailing market conditions. This means that the cash value of a whole life insurance policy grows at a predictable rate, while that of a universal life insurance policy can fluctuate.

Both whole life and universal life insurance policies are considered permanent policies, designed to last your entire life. They both have the potential to accumulate cash value over time, which you may be able to borrow against or withdraw. However, the flexibility that a universal life policy provides is a key differentiator over whole life.

Marijuana Use and Life Insurance: What's the Impact?

You may want to see also

Whole life offers more stability, universal life is more flexible

Whole life insurance and universal life insurance are both permanent life insurance policies that can offer lifelong coverage. However, they differ in terms of stability and flexibility. Whole life insurance provides more stability with fixed premiums and guaranteed cash value growth, while universal life insurance offers more flexibility in premium payments and death benefits.

Whole life insurance offers the stability of fixed premiums, meaning you pay the same amount each year for your coverage. It also provides a guaranteed death benefit and a fixed interest rate on the policy's cash value. This makes whole life insurance more predictable and requires less management compared to universal life insurance. The cash value in a whole life policy grows at a guaranteed rate, providing a stable and consistent increase over time. This predictability is a significant advantage for those who value certainty and want to ensure their loved ones will receive a guaranteed benefit. Additionally, whole life insurance policies may offer dividends, further enhancing the policy's value.

On the other hand, universal life insurance stands out for its flexibility. It allows you to adjust your premium payments and death benefit amounts to suit your changing financial needs. This adaptability is beneficial if your income fluctuates or you experience financial hardships. Universal life insurance also offers a variety of payment options, including the ability to skip premium payments if your cash value is sufficient to cover the required expenses. The interest rate on the cash value of a universal life policy is typically higher than that of a whole life policy, providing the potential for faster growth. However, it's important to note that the interest rate on a universal life policy can fluctuate over time, depending on market conditions.

In summary, whole life insurance appeals to those seeking stability, predictability, and a guaranteed death benefit. It offers fixed premiums, a consistent growth of cash value, and the potential for dividends. Universal life insurance, on the other hand, is attractive to those who prioritize flexibility and control. It allows for adjustments in premium payments and death benefits, offers a range of payment options, and provides the potential for higher returns on the cash value. When choosing between whole life and universal life insurance, it's essential to consider your financial goals, risk tolerance, and the level of involvement you want in managing your policy.

Life Insurance: Monumental's Comprehensive Coverage Benefits

You may want to see also

Whole life has a guaranteed death benefit, universal life doesn't

Whole life insurance is a permanent life insurance policy that offers fixed premium payments, a guaranteed death benefit, and a fixed interest rate on the policy's cash value. This means that the policyholder's beneficiaries will receive a guaranteed payout upon the policyholder's death, provided that premium payments are up to date. Whole life insurance policies also offer the benefit of lifelong coverage, typically up to a maximum age of 95 to 121.

Universal life insurance, on the other hand, offers more flexibility in terms of premium payments and death benefits. Policyholders can adjust their premium payments and death benefit amounts to suit their changing financial needs. However, unlike whole life insurance, universal life insurance does not guarantee a death benefit. While universal life policies may offer the potential for higher returns, they require careful management to avoid lapses in coverage.

The interest rate on a whole life insurance policy is fixed, providing predictable and stable growth. In contrast, the interest rate on a universal life policy is variable, based on prevailing market conditions, and can change over time. This introduces an element of risk to the policyholder, as poor market performance may result in lower returns or increased premiums.

In summary, whole life insurance offers the security of a guaranteed death benefit, fixed premiums, and stable growth. Universal life insurance, while more flexible in terms of premium payments and death benefits, does not provide the same level of security, as the death benefit is not guaranteed and the interest rate is subject to market fluctuations.

Chronic Tonic Seizures: Life Insurance Impact and Exclusions

You may want to see also

Whole life is more expensive than universal life

Whole life insurance is more expensive than universal life insurance. As a rule of thumb, you will pay about twice as much for whole life insurance as you would for universal life insurance. This is because whole life insurance offers more guarantees, such as a fixed premium, a guaranteed death benefit, and a guaranteed growth of cash value.

Whole life insurance has fixed premiums, which means that you pay the same amount each year for your coverage. It also has a guaranteed death benefit, which means that your beneficiaries will receive a fixed amount when you pass away, regardless of when that is, as long as you have paid your premiums. Whole life insurance also offers a guaranteed growth of cash value, which means that the cash value of your policy will increase at a fixed rate, such as 2%. This gives whole life insurance more predictability than universal life insurance.

Universal life insurance, on the other hand, offers more flexibility. It allows you to adjust your premiums and death benefit to fit your needs, within certain limits. This type of policy can also grow cash value, but the rate of growth depends on the type of universal life insurance you choose. While whole life insurance has a fixed interest rate, universal life insurance has a variable interest rate that is based on market conditions. This means that the cash value of a universal life insurance policy can fluctuate over time.

The higher cost of whole life insurance is due to the embedded guarantees that it offers. These guarantees include the fixed premium, guaranteed death benefit, and growth of cash value. Whole life insurance also offers the potential for dividends, which can further increase the value of the policy. Universal life insurance, on the other hand, offers more flexibility but carries a certain degree of risk for policyholders.

In summary, whole life insurance is more expensive than universal life insurance because it offers more guarantees and less flexibility. It is a stable and predictable choice, whereas universal life insurance is more flexible and adjustable. The decision between the two types of insurance depends on your needs and preferences for flexibility, risk tolerance, and involvement in managing your policy.

Genworth Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Whole life insurance is permanent, whereas universal life insurance offers long-term protection and more flexibility. Whole life insurance has fixed premiums, whereas universal life insurance premiums can be adjusted.

Whole life insurance has a guaranteed cash value that grows at a fixed rate. Universal life insurance can also build cash value but it may fluctuate over time.

No, only whole life insurance policies may earn dividends.

This depends on your personal circumstances and preferences. If you want guaranteed premiums and cash value, whole life insurance is a good option. If you want more flexibility and are willing to take on more risk, universal life insurance may be better.