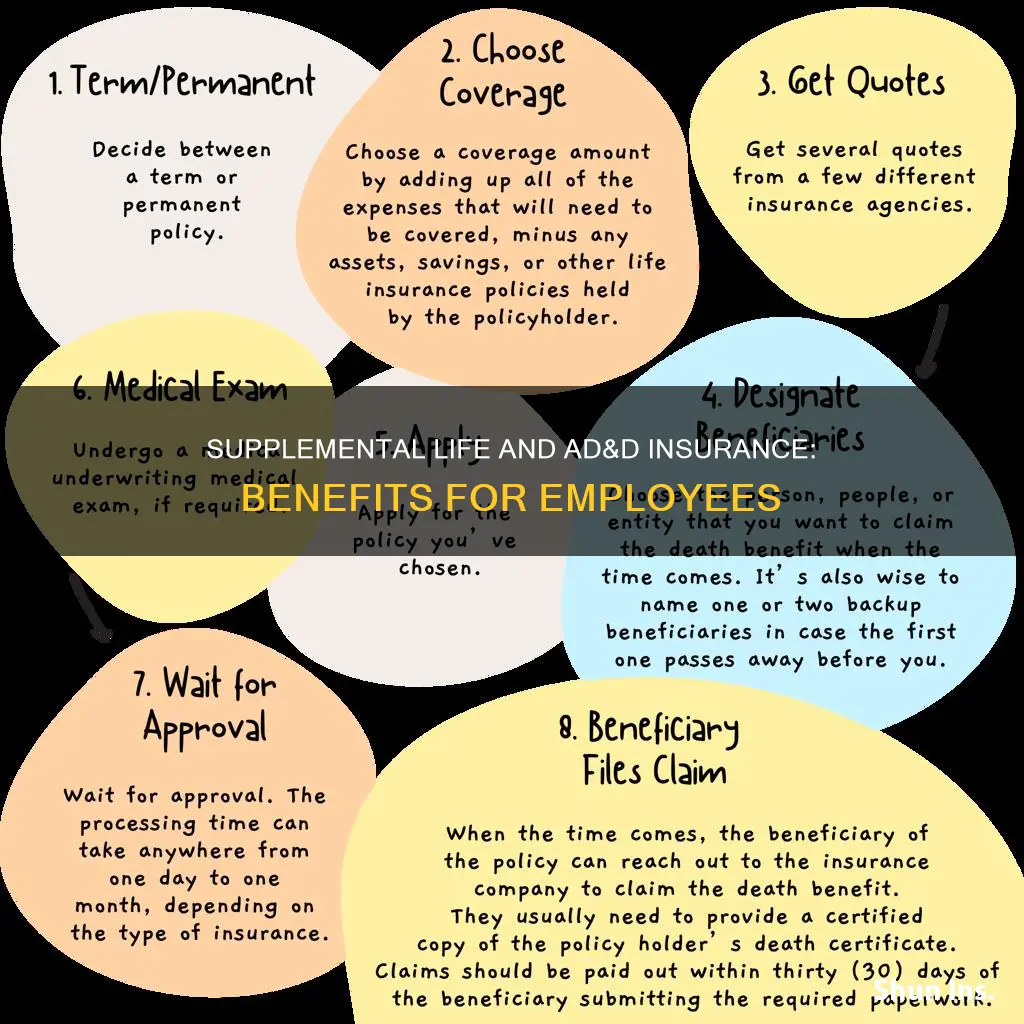

Employee supplemental life and AD&D insurance are two types of insurance that an employer may offer as part of an employee benefits package. Supplemental life insurance is an optional coverage that an employer may offer at no cost or as an option for employees to purchase. It provides additional coverage and is typically associated with a much lower payout than traditional life insurance policies. AD&D insurance, on the other hand, covers accidental death and disability. It pays your beneficiaries if your death is caused by an accident or pays you if you become disabled due to an accident.

| Characteristics | Values |

|---|---|

| What is it? | Supplemental insurance is extra life insurance (above the minimum that your employer provides for free). |

| What does it cover? | Death by any circumstance, including accidents, health issues, and dismemberment. |

| Who is it for? | Employees can choose to purchase it as part of their benefits package. |

| How much does it cost? | The cost depends on the amount of coverage selected. |

| What is the benefit? | Supplemental insurance is designed to provide additional coverage and is typically associated with a much lower payout than traditional life insurance policies. |

What You'll Learn

- Supplemental insurance is extra life insurance on top of what your employer provides for free

- AD&D insurance covers accidental death and disability

- Supplemental insurance covers death by any circumstance, including accidents and health issues

- Supplemental insurance is optional and is typically associated with a lower payout than traditional life insurance policies

- Supplemental insurance can be a good way to take advantage of additional protection for your family

Supplemental insurance is extra life insurance on top of what your employer provides for free

Supplemental insurance covers death by any circumstance, including accidents, but also health issues that you may not know about. It can also be used to cover final expenses, such as burial costs, and can be a good way to take advantage of additional protection for your family.

Employee Supplemental Accidental Death & Dismemberment (AD&D) insurance coverage provides protection by paying benefits to your beneficiary(ies) in the event your death is due to accidental causes. Full or partial AD&D insurance benefits are also payable to you following certain serious accidental injuries.

The cost of this benefit is paid on an after-tax basis and depends on the amount of coverage you select. For example, one person reported that the rate for AD&D was $0.25 (25 cents) and the employee supplemental was $0.44 annually for every $1,000 of coverage.

Life Insurance and VA Loans: What You Need to Know

You may want to see also

AD&D insurance covers accidental death and disability

Employee supplemental life insurance is an optional extra insurance coverage that an employer may offer at no cost or as an option for employees to purchase. It provides additional protection for your family and is typically associated with a much lower payout than traditional life insurance policies.

AD&D insurance, which stands for Accidental Death and Disability, is one type of employee supplemental life insurance. It covers accidental death and pays your beneficiaries if you die by accident (e.g. in a car crash). It also covers disability, paying you if you become disabled through accident.

Full or partial AD&D insurance benefits are also payable following certain serious accidental injuries, such as dismemberment. No evidence of insurability is required. The cost of this benefit is paid on an after-tax basis and depends on the amount of coverage selected.

Supplemental life insurance policies may include other things like burial, final expense, and traditional life insurance.

Fasting for Life Insurance Tests: Is It Necessary?

You may want to see also

Supplemental insurance covers death by any circumstance, including accidents and health issues

Supplemental insurance is extra life insurance that employees can take out on top of the minimum that their employer provides for free. It covers death by any circumstance, including accidents and health issues. This means that if you die, your beneficiaries will receive a payout, no matter how you died. This is different from AD&D insurance, which only pays out if your death is caused by an accident.

Supplemental insurance is designed to provide additional protection for your family. It can be a good way to ensure that your family has enough money to cover your final expenses when you die. These expenses could include things like burial costs or medical bills.

The cost of supplemental insurance depends on the amount of coverage you select. Typically, these policies have a very low benefit associated with them, which could be anywhere between $5,000 and $10,000. However, some employers may offer supplemental insurance at no cost to their employees.

Supplemental insurance is optional, and you may not need it if you already have adequate life insurance coverage. However, it can be a good way to get additional protection for your family at a low cost.

Understanding Conversion Privilege in Life Insurance Policies

You may want to see also

Supplemental insurance is optional and is typically associated with a lower payout than traditional life insurance policies

Supplemental insurance is designed to provide additional coverage and protection for your family. It can be a good way to take advantage of extra protection, especially if you want to ensure your family has enough money to cover your final expenses when you die. These policies typically have a very low benefit, which could be anywhere between $5,000 and $10,000, depending on the employer.

Accidental Death and Disability (AD&D) insurance is a type of supplemental insurance that pays your beneficiaries if your death is caused by an accident, such as a car crash. It can also pay you if you are disabled through an accident. AD&D insurance can be taken out as a full or partial policy, and no evidence of insurability is required.

Supplemental insurance is a good option for those who want extra peace of mind and protection for their loved ones. It is important to consider your own financial situation and needs when deciding whether to take out supplemental insurance.

SGLI: Current-Owned Life Insurance Contract?

You may want to see also

Supplemental insurance can be a good way to take advantage of additional protection for your family

Supplemental insurance is designed to provide additional coverage and is typically associated with a much lower payout than traditional life insurance policies. It may include things like burial, final expense, accidental death and dismemberment. For example, if you were to die in a car crash, your beneficiaries would be paid. If you were to suffer serious accidental injuries, you would be paid.

The cost of supplemental insurance depends on the amount of coverage selected and is paid on an after-tax basis. Typically, these policies have a very low benefit associated with them and could be anywhere between $5,000 and $10,000, depending on what your employer offers. The purpose of these policies is to provide your family with enough money to cover your final expenses when you die.

Who Gets the Payout? Girlfriend as Life Insurance Beneficiary

You may want to see also

Frequently asked questions

Supplemental life insurance is an optional coverage that an employer may offer at no cost or may offer as an option for employees to purchase. It provides additional coverage and is typically associated with a much lower payout than traditional life insurance policies.

AD&D insurance pays your beneficiaries if your death is caused by an accident or pays you if you are disabled through an accident.

Employee supplemental life insurance covers death by any circumstance, including accidents and health issues. AD&D insurance only covers death or injury by accident.