Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, hence the name. It offers a range of benefits and features that set it apart from other insurance products. One of the key advantages of whole life insurance is its guaranteed death benefit, which means that the insurance company will pay out a specified amount to the policyholder's beneficiaries upon their passing. Additionally, whole life insurance policies accumulate cash value over time, allowing policyholders to build a savings component within their insurance plan. This cash value can be borrowed against or withdrawn, providing financial flexibility. Another important aspect is the fixed premium, which remains consistent throughout the policy's duration, providing long-term financial planning certainty. Understanding the true nature and benefits of whole life insurance is essential for individuals seeking a reliable and comprehensive financial protection solution.

What You'll Learn

- Affordability: Whole life insurance offers long-term coverage at a fixed rate, making it a cost-effective choice

- Lump Sum Payout: Provides a tax-free death benefit, ensuring financial security for beneficiaries

- Investment Component: Includes an investment account, allowing policyholders to grow their money over time

- Guaranteed Premiums: Premiums remain consistent, providing stability and predictability in insurance costs

- Death Benefit: The death benefit is non-cancellable and guaranteed, ensuring financial protection for loved ones

Affordability: Whole life insurance offers long-term coverage at a fixed rate, making it a cost-effective choice

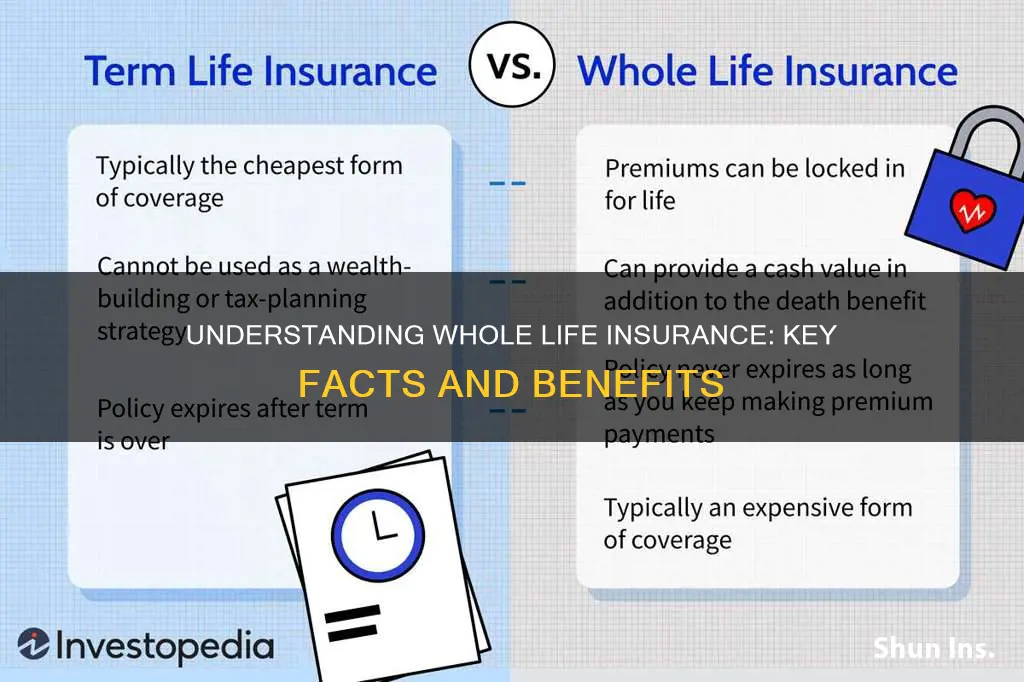

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, hence the name. One of the key advantages of whole life insurance is its affordability and long-term value. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers a fixed rate of premium that remains constant throughout the policy's duration. This predictability in pricing makes it easier for policyholders to plan and budget for their insurance needs.

The fixed rate of whole life insurance is determined by various factors, including the insured's age, health, and the amount of coverage chosen. When you purchase a whole life policy, you lock in a premium that will not increase over time, even as you age. This stability in pricing is particularly beneficial for long-term financial planning. For example, if you take out a whole life insurance policy at a young age, your premiums will be lower compared to someone who purchases the same coverage later in life. As you age, the risk to the insurer increases, but the fixed rate ensures that your premiums remain affordable and predictable.

Over time, whole life insurance policies accumulate cash value, which can be borrowed against or withdrawn. This feature provides an additional source of financial flexibility. Policyholders can access this cash value without affecting the death benefit, making it a valuable asset that can be utilized for various financial goals. The combination of long-term coverage and the potential for cash accumulation makes whole life insurance an attractive and affordable option for individuals seeking comprehensive financial protection.

In contrast to term life insurance, which is typically more affordable for shorter periods, whole life insurance offers a more stable and predictable financial commitment. With term life, the rate can increase significantly over time, making it less cost-effective in the long run. Whole life insurance, on the other hand, provides a consistent and affordable premium, ensuring that your coverage remains accessible and affordable throughout your life. This predictability is especially important for those who want to ensure their loved ones are financially protected for the long term.

In summary, whole life insurance stands out for its affordability and long-term value. The fixed rate of premium ensures that policyholders can budget effectively, knowing their coverage will remain accessible even as they age. Additionally, the potential for cash value accumulation and the ability to utilize the policy's assets provide further financial benefits. For individuals seeking a stable and cost-effective insurance solution, whole life insurance is a reliable choice that offers both protection and financial flexibility.

Hartford Life Insurance: AARP's Ownership and Benefits Explored

You may want to see also

Lump Sum Payout: Provides a tax-free death benefit, ensuring financial security for beneficiaries

Whole life insurance offers a unique and valuable feature known as a lump sum payout, which is a significant advantage for policyholders and their beneficiaries. When a policyholder passes away, the insurance company pays out a predetermined amount, often referred to as the death benefit, to the designated beneficiaries. This lump sum payment is a crucial aspect of whole life insurance and provides several benefits.

One of the most notable advantages of the lump sum payout is its tax-free nature. Unlike other forms of insurance payments, the death benefit received by the beneficiaries is typically exempt from income tax. This means that the entire amount is available to the beneficiaries without any deductions, ensuring that the financial support is provided tax-free. This feature is particularly attractive as it allows the beneficiaries to utilize the funds for various purposes, such as covering funeral expenses, paying off debts, or investing for the future.

The lump sum payout also ensures financial security for the beneficiaries. It provides a one-time, substantial payment that can serve as a safety net during challenging times. This financial security can be especially important for beneficiaries who may be facing unexpected costs or need immediate support. The lump sum can help cover essential expenses, provide a financial cushion, or even be used to start a new business or invest in education.

Furthermore, the lump sum payout offers flexibility in how the funds are utilized. Beneficiaries have the freedom to decide how to allocate the tax-free death benefit. This flexibility allows them to make decisions based on their specific needs and goals, ensuring that the financial support is tailored to their circumstances. Whether it's using the funds to pay off a mortgage, start a business, or create a retirement fund, the lump sum payout provides the beneficiaries with the means to make significant financial decisions.

In summary, the lump sum payout in whole life insurance is a powerful tool that provides tax-free financial security for beneficiaries. It offers a substantial and immediate payment, ensuring that the designated individuals receive the necessary support during their time of need. With this feature, whole life insurance becomes a valuable asset, providing both financial protection and peace of mind to policyholders and their loved ones.

Life Insurance: Missed Payments and Policy Termination

You may want to see also

Investment Component: Includes an investment account, allowing policyholders to grow their money over time

The investment component of whole life insurance is a unique feature that sets it apart from other insurance products. It is a powerful tool that allows policyholders to grow their money over time, providing financial security and potential wealth accumulation. This component is an integral part of the whole life insurance policy, offering a way to build a substantial investment portfolio alongside the insurance coverage.

When you purchase a whole life insurance policy with an investment component, you are essentially combining insurance and investment in one product. The policy includes an investment account, which is a separate account designed to grow your money through various investment strategies. This investment account is funded by the premiums you pay, and it operates independently of the insurance coverage. Over time, the money in this account can accumulate and grow, providing you with a valuable asset.

The investment strategies employed in the investment account are carefully managed by the insurance company or a designated investment manager. These strategies aim to maximize returns while also ensuring the safety and preservation of your capital. Common investment options include stocks, bonds, mutual funds, and other diversified assets. The insurance company typically offers different investment options to cater to various risk appetites and financial goals. Policyholders can choose from a range of investment portfolios, allowing them to align their investments with their desired level of risk and return expectations.

One of the key advantages of the investment component is its long-term nature. Unlike some other investment vehicles, whole life insurance with an investment component is designed to grow over an extended period. This long-term perspective allows for the potential accumulation of significant wealth, providing financial security for the policyholder and their beneficiaries. As the investment account grows, it can contribute to the overall value of the policy, enhancing its cash value and potential death benefit.

Additionally, the investment component offers flexibility. Policyholders can typically adjust their investment allocations over time to match changing financial goals and risk tolerances. This flexibility ensures that the investment strategy remains aligned with the policyholder's evolving needs. As the investment account grows, it can be used for various purposes, such as funding education expenses, starting a business, or simply building a substantial retirement fund. The investment component provides a way to grow your money while also ensuring that you have a reliable insurance policy in place.

Life Insurance Payout: Investing for Security and Growth

You may want to see also

Guaranteed Premiums: Premiums remain consistent, providing stability and predictability in insurance costs

Whole life insurance offers a unique and attractive feature in the insurance world: guaranteed premiums. This aspect of the policy is a cornerstone of its long-term value and financial security. When you purchase a whole life insurance policy, you lock in a fixed premium rate for the life of the policy. This means that your insurance costs will remain the same, year after year, without any increases.

The concept of guaranteed premiums is straightforward: you pay a set amount regularly, and in return, the insurance company provides a death benefit to your beneficiaries when you pass away. This predictability is a significant advantage, especially for long-term financial planning. With traditional term life insurance, premiums can vary based on market conditions and the insurance company's assessments, which may lead to unexpected cost increases over time. In contrast, whole life insurance offers a consistent and stable financial commitment.

The stability of guaranteed premiums is particularly beneficial for budgeting and financial planning. Policyholders can accurately predict their insurance expenses, making it easier to manage personal finances and plan for the future. This predictability also ensures that the insurance cost does not become a financial burden, especially for those on a fixed income or with limited financial resources.

Furthermore, the consistency of premiums in whole life insurance encourages long-term savings. As the premiums are guaranteed, the insurance company can invest the regular payments, allowing for the accumulation of cash value over time. This cash value can be borrowed against or withdrawn, providing policyholders with a financial resource that can be used for various purposes, such as funding education, starting a business, or supplementing retirement income.

In summary, guaranteed premiums in whole life insurance provide a sense of financial security and stability. Policyholders can rely on consistent insurance costs, ensuring that their financial commitments remain predictable. This feature is especially valuable for those seeking long-term financial planning and a reliable insurance solution. Understanding and appreciating the concept of guaranteed premiums is essential for anyone considering whole life insurance as a part of their comprehensive financial strategy.

Canceling Jubilee Life Insurance: A Step-by-Step Guide

You may want to see also

Death Benefit: The death benefit is non-cancellable and guaranteed, ensuring financial protection for loved ones

Whole life insurance is a type of permanent life insurance that offers a unique and valuable feature: a non-cancellable and guaranteed death benefit. This aspect is a cornerstone of whole life insurance and sets it apart from other insurance products. When you purchase whole life insurance, you are essentially locking in a financial safety net for your loved ones, no matter what the future holds.

The death benefit is a predetermined amount of money that is paid out to your beneficiaries upon your passing. This benefit is a promise made by the insurance company, and it is non-cancellable, meaning the insurance company cannot revoke or change this promise. It is a long-term commitment, providing peace of mind and financial security for your family. Once the policy is in force, the death benefit remains in effect for the entire life of the insured individual, hence the term "whole life."

This guarantee is a significant advantage, especially when compared to term life insurance, which provides coverage for a specified period. With whole life, the death benefit is assured, ensuring that your loved ones receive the intended financial support even if you outlive the policy's initial term. This feature is particularly important for those who want to provide long-term financial security and peace of mind.

The non-cancellable nature of the death benefit means that the insurance company cannot increase the cost of the policy or reduce the benefit over time. This predictability allows policyholders to plan and budget effectively, knowing that the death benefit will remain consistent throughout the policy's duration. It also ensures that the insurance company's financial obligations are met, providing a stable and reliable product for consumers.

In summary, the non-cancellable and guaranteed death benefit of whole life insurance is a powerful tool for financial protection. It offers a consistent and reliable source of financial support for your loved ones, providing peace of mind and ensuring that your family's financial needs are met, even in the event of your passing. This feature is a key differentiator and a true testament to the value of whole life insurance.

Life Insurance Beneficiaries: Earned Income or Not?

You may want to see also

Frequently asked questions

Whole life insurance is a permanent policy that provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. It offers a guaranteed death benefit and an accumulation of cash value over time, which can be borrowed against or withdrawn. Term life insurance, on the other hand, provides coverage for a specified term or period, such as 10, 20, or 30 years, and does not accumulate cash value.

The cash value in whole life insurance is a feature that allows policyholders to build up a savings component within the policy. A portion of the premium payment goes towards covering the policy's expenses and building this cash reserve. Over time, the cash value grows and can be used for various purposes, such as taking out loans, making premium payments, or withdrawing funds (though withdrawals may incur penalties).

Yes, whole life insurance offers several guarantees. Firstly, as long as premiums are paid, the policy will remain in force for the insured's entire life. Secondly, the death benefit is guaranteed, meaning the insurance company will pay out a specified amount to the beneficiary(ies) upon the insured's death. Additionally, the cash value growth is guaranteed, providing a secure investment component.

Yes, one of the advantages of whole life insurance is the flexibility it offers. Policyholders can typically convert their whole life policy to a different type of insurance, such as term life or universal life, if their needs or circumstances change. This conversion option allows individuals to adapt their insurance coverage as their financial goals and priorities evolve.