Auto insurance rates in Georgia have been on the rise, with Insurify predicting a 7% increase in 2023. In response, the state passed an insurance reform bill, effective July 1, that prevents auto insurance carriers from increasing rates at their discretion. This bill gives the Office of the Commissioner of Insurance and Safety Fire the ability to review all car insurance rate filings before they go into effect. While this legislation aims to protect consumers from exorbitant price increases, it's important to note that insurance companies determine rates based on various factors, including individual circumstances, location, and driving record.

| Characteristics | Values |

|---|---|

| Average annual auto insurance cost | $1,535 |

| Average monthly auto insurance cost | $128 |

| State minimum coverage | Bodily injury: $25,000 per person; $50,000 per accident. Property damage: $25,000 per accident. |

| Optional coverage | Uninsured/underinsured motorist coverage, comprehensive and collision. |

| Average cost of minimum coverage | $49 per month or $582 yearly |

| Average cost of full coverage | $1,016 more than minimum coverage |

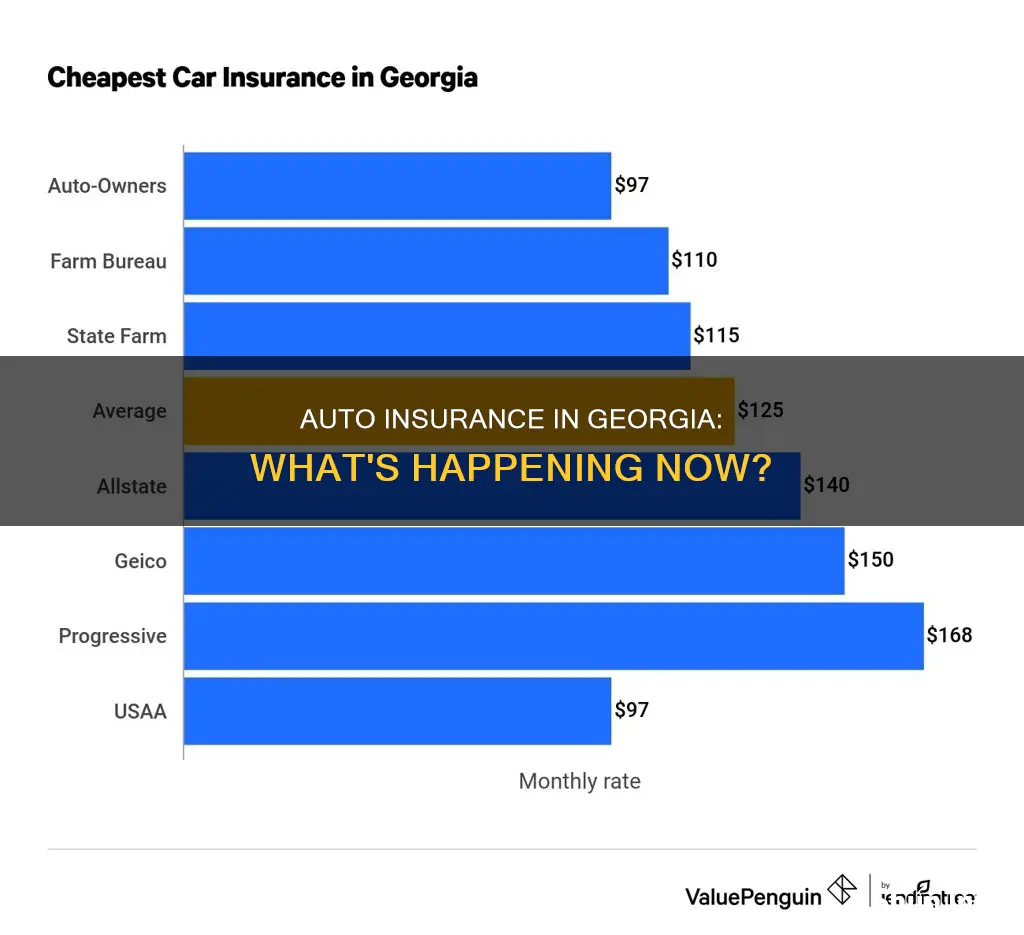

| Cheapest auto insurance company in Georgia | Auto-Owners |

| Cheapest auto insurance company for bad credit | Nationwide |

| Cheapest auto insurance company after at-fault accident or DUI | Auto-Owners |

| Best car insurance company in Georgia | Travelers |

| Best car insurance company for budget | Auto-Owners |

| Best car insurance company for customer complaints | Acuity |

| Best car insurance company for ease of use | State Farm |

What You'll Learn

Georgia's auto insurance law

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage per accident

This basic coverage pays for the medical and property damage bills of drivers, passengers, and pedestrians injured or whose vehicles are damaged in an accident that the policyholder causes.

While Georgia law only requires liability insurance, additional coverage can provide further protection and should be considered. Collision coverage, for example, can help pay for repairs to your own vehicle if it collides with another vehicle or object. Comprehensive coverage will help pay for damages to your vehicle from causes other than collisions, such as fire, severe weather, vandalism, floods, and theft.

Uninsured motorist coverage is also available and important to consider, as it will protect you if you are in an accident with a driver who does not have insurance or whose insurance is insufficient to cover the damages.

When purchasing auto insurance in Georgia, it is important to shop around and compare quotes from different companies to find the best price and coverage for your needs. It is also crucial to read and understand the terms of your insurance policy, as it is a legal contract outlining your rights and responsibilities.

Driving without insurance in Georgia can result in various penalties, including fines, jail time, license suspension, and vehicle impoundment.

ASI Auto Insurance: What You Need to Know

You may want to see also

Factors that determine insurance rates

The cost of car insurance in Georgia is influenced by various factors, which can be broadly categorized into two: underwriting and rating. Underwriting assesses the risk associated with an applicant, while rating assigns a price based on the insurer's belief about assuming the financial responsibility for the applicant's potential claim. Here are the factors that determine insurance rates:

- Age and Driving Experience: Age is a significant factor, especially for young drivers. Teen drivers are considered very risky and tend to pay much higher premiums than older drivers. Insurance costs decrease as drivers gain more experience and reach their mid-50s, then rise again for older drivers aged 70 and above.

- Driving Record: A history of tickets, violations, accidents, or DUI/DWI convictions will increase insurance rates. Safe drivers with clean records are generally considered lower-risk and are rewarded with lower premiums.

- Credit Score: In most states, insurance companies consider credit scores when calculating premiums. A higher credit score typically leads to lower insurance rates, as data suggests that drivers with good credit file fewer and less expensive claims.

- Location: Insurance rates vary by state and ZIP code. Urban areas tend to have higher insurance rates due to increased risks of accidents, car theft, and vandalism. Additionally, locations with higher medical care costs, car repair costs, and frequent auto accident lawsuits can impact insurance rates.

- Vehicle Type: The type of car driven affects insurance rates. Factors such as repair costs, replacement value, theft rates, engine size, safety record, and the likelihood of causing damage in a collision are considered.

- Insurance Coverage: The more coverage you opt for, the higher the premiums will be. Beyond the state-mandated minimum coverage, additional insurance options like comprehensive and collision coverage will increase the cost.

- Deductible Amount: The deductible is the amount you pay out-of-pocket when filing a claim. Choosing a higher deductible typically leads to lower insurance premiums, as you are assuming more financial responsibility.

- Claims and Insurance History: A history of frequent claims suggests a higher risk of future claims, leading to increased rates. Additionally, lapses in coverage or failure to maintain continuous insurance can result in higher premiums.

- Marital Status: Married couples often enjoy lower insurance rates since data indicates that they are less likely to file auto insurance claims compared to single individuals.

- Gender: In states that allow gender to be considered, women usually pay less for car insurance than men, especially in their teens and early adulthood. This is because young male drivers are statistically more likely to engage in risky driving behavior.

- Annual Mileage: High-mileage drivers are considered more likely to be involved in accidents. Therefore, those who drive more than 15,000 miles per year often pay higher premiums, while low-mileage drivers may be eligible for discounts.

Nevada's Auto Insurance: No-Fault or Not?

You may want to see also

Discounts to reduce insurance rates

There are a number of discounts available to help reduce insurance rates in Georgia. These include:

- Good driver discounts: Drivers with a clean record (no at-fault accidents, DUIs or speeding tickets in the last three years) can benefit from lower rates.

- Multi-policy discounts: You can save money by bundling two or more insurance policies with the same company.

- Multi-vehicle discounts: Insuring multiple cars under the same policy or combining auto insurance policies can reduce your rates.

- Senior discounts: Drivers over the age of 55 can often get cheaper insurance.

- Homeowner discounts: If you own your home, you may be eligible for a discount.

- Good student discounts: Students in college or high school who maintain a B average in their courses can often get cheaper insurance.

- Defensive driving discounts: Taking a defensive driving course can get you a discount.

- Driver training discounts: Taking a driver education training course can help reduce your insurance rates.

- New car discounts: Buying a new car that is three years old or newer can net you a discount.

- Safe car discounts: If your vehicle has safety features such as anti-theft technology, you may be eligible for a discount.

- Paperless discounts: Opting into paperless payments can save you money on your insurance premium.

- Paid-in-full discounts: Paying your policy premium upfront can get you a discounted rate.

- Occupation discounts: Teachers, firefighters, police officers, EMTs and paramedics can often get cheaper insurance.

Aspen Insurance Auto: Understanding SR-22 Requirements

You may want to see also

How to choose the best insurance company

Auto insurance in Georgia costs $1,535 per year, just over $6 more than the national average rate. The cost of your insurance is highly individual and depends on factors such as your age, location, driving record, and more.

- Determine your unique needs: Evaluate your circumstances to narrow down the selection of carriers and focus on the ones offering the coverage options you need. For example, if you are a defensive driver, look for a carrier with a telematics program that rewards safe driving habits with a personalized discount.

- Find insurance providers that match your priorities: Once you know your needs, seek out insurance companies that align with your circumstances. You can choose between large and small insurers, each with its own advantages. Large insurers may have more policy options and 24/7 customer service, while small insurers may offer more personalized and localized service.

- Check trusted third-party ratings: Use third-party ratings like J.D. Power's customer satisfaction survey or AM Best's financial health analysis to take the guesswork out of finding companies with strong customer service and financial strength.

- Consider digital tools and customer resources: Choose a company that offers the interaction options you prefer, such as a mobile app, online portal, phone support, or local agent. Also, consider additional customer resources, such as roadside assistance programs or unique add-on opportunities.

- Compare insurance quotes based on coverage: Compare quotes from different carriers using the same coverage choices, limits, and deductibles to find the best price for the coverage you need. Work with a licensed insurance agent to understand your coverage needs and match those levels across all quotes. Remember that some companies may not offer certain endorsements, so you may not be able to get identical quotes.

- Shop around: Get at least three price quotes from companies, agents, and the internet. Your state insurance department may also publish a guide to insurer charges for different policies in your state.

- Check licensing and complaint history: Only buy from a company licensed in your state so that you can rely on your state insurance department for support if there's a problem. Contact your state insurance department to check for licensing and to find out if the company has had many consumer complaints relative to the number of policies it sold.

Clearcover Auto Insurance: Is It Worth the Hype?

You may want to see also

The insurance claims process

When it comes to auto insurance in Georgia, there are a few things to keep in mind. Firstly, Georgia drivers must have liability insurance that meets the minimum limits required by law to drive on public roads and highways. This includes Bodily Injury Liability and Property Damage Liability. Additionally, people can also opt for physical damage insurance, which covers losses to their own vehicle, and uninsured motorist insurance, which protects them in case an uninsured driver causes an accident.

Now, here is a detailed and instructive guide on the insurance claims process for auto insurance in Georgia:

Step 1: Understand Your Policy

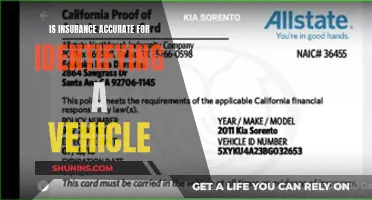

Know what is covered, what is excluded, and what the deductibles are. Familiarize yourself with the claims process outlined in your policy. Keep your insurer's claim service card with your agent's contact information and your policy identification number in your vehicle.

Step 2: File a Claim Promptly

If an accident occurs, notify the police immediately and gather all relevant information, including the other driver's and witnesses' contact details, vehicle information, and insurance details. Make detailed notes about the accident, including vehicle speeds, weather conditions, traffic signs, and road conditions. Take photographs or draw diagrams if possible.

Contact your insurance company or agent as soon as possible, even if you are not at fault. They will guide you through the next steps and inform you of the required documents to support your claim.

Step 3: Provide Complete and Accurate Information

When filing a claim, provide complete and correct information. Share all relevant details about the accident, including any photographs or diagrams you have created. Be transparent about the extent of the damage and any injuries sustained.

Step 4: Keep Records and Ask Questions

Maintain copies of all correspondence with your insurance company. Document telephone and in-person conversations, including the dates, names, and titles of the individuals you speak with, as well as the content of the discussions. Keep track of your time and expenses related to the claim.

If there are any disagreements or uncertainties about the claim settlement, don't hesitate to ask questions. Request clarification from the insurance company and refer to the specific language in your policy. Obtain a written explanation if your claim is denied, citing the relevant policy provisions.

Step 5: Temporary Repairs and Negotiation

If necessary, make temporary repairs to prevent further damage to your vehicle or property. Keep in mind that permanent repairs should not be made until after the claims adjuster has inspected the damage. Determine the estimated repair costs beforehand and provide records of any improvements made to your vehicle.

If you receive an initial settlement offer from the insurance company that doesn't meet your expectations, be prepared to negotiate. Seek professional advice if needed to ensure you receive a fair settlement.

Step 6: Medical Claims

For accident and health claims, collaborate with your physician to provide the insurance company with detailed information about your treatment, medical conditions, and prognosis. This will help support your claim and ensure you receive the necessary coverage for your medical expenses.

Step 7: Handling Complaints

If you have any complaints or concerns about your insurance provider, agent, or the handling of your claim, you can seek assistance from the Department of Insurance's Consumer Services Division. They can help resolve issues related to insurance claims and ensure your rights as a consumer are protected.

Foster Parenting: Insuring Your Foster Child's Vehicle

You may want to see also

Frequently asked questions

The minimum liability insurance required under Georgia law is $25,000 per person and $50,000 per incident for bodily injury, and $25,000 per incident for property damage.

The average rate in Georgia is $1,535 per year, or $128 per month. This is just over $6 more than the national average.

Auto-Owners has the cheapest rates in Georgia, with full coverage policies starting at $96 per month.