A lien is a legal claim or right against assets that are typically used as collateral to satisfy a debt. In the context of insurance, a lien is a legal claim that an auto insurance company, health care provider, or health insurance company has over settlement claims after paying the injured party's bills. In other words, a lien is a debt owed from the settlement. For example, if an injured person has medical bills that are covered by an insurance company, the insurance company can place a lien on the settlement to ensure they are reimbursed for the medical bills.

| Characteristics | Values |

|---|---|

| Definition | A lien is a legal claim or financial interest in a property or asset that is used as collateral to satisfy a debt. |

| Who can place a lien? | Creditors, legal judgments, tax authorities, financial institutions, governments, small businesses, contractors, and healthcare providers. |

| Who can have a lien placed on them? | Property owners, borrowers, and injured parties. |

| Types of liens | Bank lien, real estate lien, tax lien, floating lien, judgment lien, mechanic's lien, mortgage lien, statutory lien, and medical lien. |

| Lien release | A lien is released once it is paid, waived, or lifted, and the property becomes free and available for purchase. |

| Lien satisfaction | The lienholder is usually paid first from the settlement or verdict. |

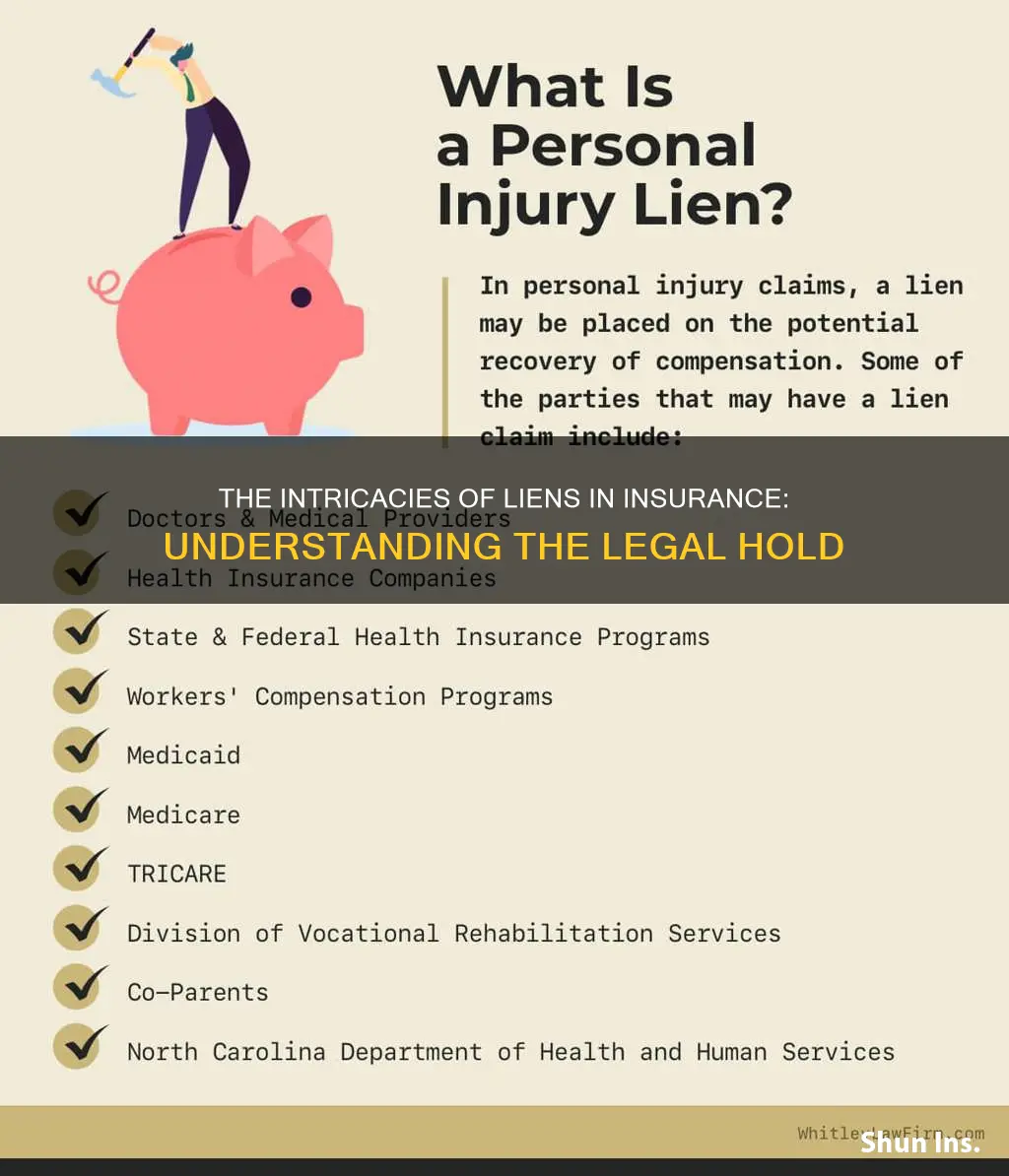

| Personal injury settlements | A lien is a claim by a third party on the proceeds of a settlement, usually an insurance company, government agency, or healthcare provider. |

| Avoiding liens | Pay all medical bills and attorney fees in full before receiving settlement funds. |

What You'll Learn

- A lien is a legal claim against a property or asset

- Liens are used to guarantee an underlying obligation, such as a loan

- If the underlying obligation is not met, the creditor may seize the asset

- Liens can be voluntary or consensual, or involuntary or statutory

- Liens can be placed by financial institutions, governments, and small businesses

A lien is a legal claim against a property or asset

A lien is a legal claim or financial interest in a property or asset that typically belongs to a third party. The person who claims this right is called a lienholder and can be a creditor, contractor, or the government. A lien is usually created when the lienholder has performed work on or advanced funds for the property or asset in question.

In the context of insurance, a lien is a legal claim that an auto insurance company, health care provider, or health insurance company has over settlement claims after paying the injured party's bills. For example, if an injured person's medical bills are covered by an insurance company, the insurance company can place a lien on the settlement to ensure they are reimbursed for the medical bills.

Liens can also be asserted by government-based benefit providers. For instance, if an individual gets injured due to the neglect of another party, they are still responsible for their medical bills. In such cases, healthcare providers can choose to provide medical care in return for a lien, allowing the injured individual to cover their medical expenses.

A lien remains attached to the title of the property until it is paid off, waived, or lifted. Once this happens, a lien release occurs, and the property becomes free and available for purchase.

Securing Short-Term Rental Insurance: Navigating the Path to Comprehensive Coverage

You may want to see also

Liens are used to guarantee an underlying obligation, such as a loan

For example, if an individual purchases a vehicle with funds borrowed from a bank, the bank is granted a lien on the vehicle. This means that if the borrower fails to repay the loan, the bank may seize and sell the vehicle to recoup the loan amount. This type of lien is known as a consensual or voluntary lien, as the borrower consents to the lien as part of the loan agreement.

In addition to consensual liens, there are also involuntary or non-consensual liens, which are placed on assets without the borrower's consent due to non-payment. For instance, if a taxpayer fails to pay taxes owed to the government, a tax agency can impose a tax lien on their real or personal property.

Liens can also be established by contractual agreements, such as mortgages or car loans. In the case of a mortgage, the lender holds a lien on the property until the borrower pays off the loan in full. If the borrower defaults on the loan, the lender has the legal right to seize and sell the property to recoup their losses.

Overall, liens serve as a safeguard for lenders and creditors, providing them with a legal means to recover debts or secure underlying obligations.

Unraveling the Intricacies of Insurance: Exploring Trade Dress Infringement

You may want to see also

If the underlying obligation is not met, the creditor may seize the asset

A lien is a legal claim or a financial interest over a property that belongs to a third party. The person who has a claim against another’s property is called a lienholder. A lienholder may be a creditor who granted a loan for the purchase of the property, or a contractor who provided services for its completion.

In the context of insurance, a lien is a legal claim that an auto insurance company, health care provider, or health insurance company has over settlement claims after paying the injured party’s bills.

For example, if an individual purchases a vehicle with a loan from a bank, the bank would be granted a lien on the vehicle. If the borrower fails to repay the loan, the bank can execute the lien, seize the vehicle, and sell it to recoup the loan amount.

It is important to note that creditors must follow legal procedures to seize assets, and debtors have certain rights and protections in place. Additionally, not all assets may be eligible for seizure, as some states have exemptions for certain types of property.

Capitalization Conundrum: Navigating the World of Insurance Terminology

You may want to see also

Liens can be voluntary or consensual, or involuntary or statutory

Liens are legal claims against assets or properties that are used as collateral to secure debts. They can be established by creditors or legal judgments. Liens can be voluntary or consensual, or involuntary or statutory.

Voluntary liens are those that are agreed upon by the property owner. They are often used for mortgages for real estate, but they can also be used for other types of financing, such as car loans or secured personal loans. In the case of a mortgage, the property acts as collateral for the loan, and the lender can seize the property if the borrower fails to make payments.

Involuntary liens, on the other hand, are placed on the property without the consent of the owner. These liens arise when the owner fails to meet their financial obligations, such as non-payment of taxes or failure to pay a contractor for services rendered. In such cases, creditors may seek legal action, resulting in a lien being placed on the owner's assets, including property and bank accounts.

Statutory liens are a type of involuntary lien that arises from state or federal laws. For example, if an individual fails to pay their taxes, the IRS or other government entities can place a tax lien on their property.

Judgment liens are another type of involuntary lien that results from a court ruling. For instance, if an individual is involved in a lawsuit and loses, the court may place a judgment lien on their property to satisfy the creditor's requirements.

Unraveling the Myth: Exploring the True Nature of Term Insurance as an Investment Strategy

You may want to see also

Liens can be placed by financial institutions, governments, and small businesses

A lien is a legal claim or financial interest in a property that is used as collateral to secure the repayment of a loan or to guarantee some other underlying obligation. Liens can be placed by financial institutions, governments, and small businesses. Here are some common scenarios where each of these entities may place a lien:

Financial Institutions

Financial institutions, such as banks, are often involved in placing liens on properties. This typically occurs when an individual takes out a loan from a bank to purchase an asset, such as a vehicle or a house. The bank will be granted a lien on the asset until the borrower repays the loan in full. If the borrower defaults on the loan, the bank may execute the lien, seize the asset, and sell it to recoup the loan amount.

Governments

Governments, particularly tax authorities, can also place liens on properties. For example, if an individual fails to pay property taxes, income taxes, or other delinquent taxes, the government may place a tax lien on their property. This gives the government the legal right to seize and sell the property to recover the unpaid taxes. Similarly, if an individual owes money to a government-based benefit provider, such as Medicare or VA benefits, a government lien may be placed.

Small Businesses

Small businesses and contractors often place liens on properties to secure payment for services rendered. For instance, a mechanic's lien can be placed by contractors, subcontractors, or construction firms that have completed work on a property but have not received full payment. This type of lien gives the contractor the right to take possession of the improved property or have it auctioned off to recover the amount owed.

Frequently asked questions

A lien is a legal claim or a financial interest over a property that belongs to a third party. The person who has a claim against another’s property is called a lienholder.

A lienholder can be a creditor who granted a loan for the purchase of the property, or a contractor who provided services for its completion. The government may also have a lien over the property of another, such as in a case where the owner of the property fails to pay real estate taxes.

In the context of insurance, a lien is a legal claim that an auto insurance company, health care provider, or health insurance company has over settlement claims after paying the injured party’s bills.