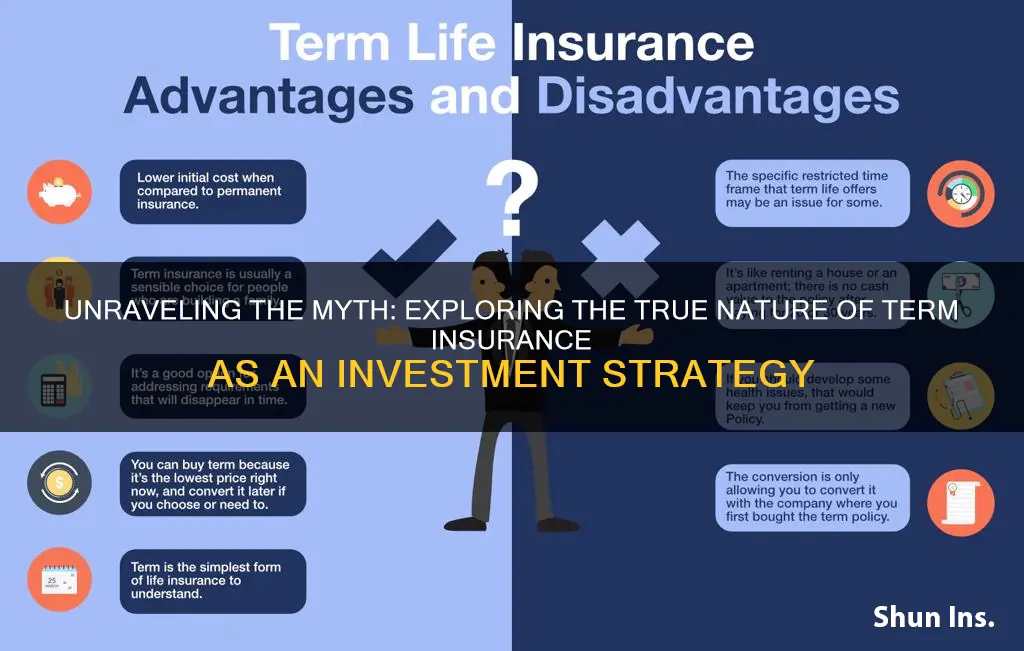

Term insurance has value as an investment. It is the least expensive type of life insurance and provides a death benefit that pays the beneficiaries of the policyholder throughout a specified period. Term life insurance is a good option for people who want substantial coverage at a low cost but it does not have a cash value component like permanent life insurance.

| Characteristics | Values |

|---|---|

| Type of insurance | Term insurance |

| Investment value | Yes |

| Cost | Less expensive than permanent life insurance |

| Coverage | Set period of time |

| Peace of mind | Yes |

| Return on investment | Depends on whether the policy is claimed or not |

What You'll Learn

- Term insurance provides peace of mind and financial security for your loved ones in case of your untimely death

- Term insurance is generally more affordable than other types of life insurance because it does not build cash value

- Term insurance premiums are typically based on age, health, and life expectancy, making it a cost-effective option for younger individuals

- Term insurance plans offer flexibility in terms of policy term and payout options, allowing you to choose what suits your financial needs

- Term insurance may provide tax benefits, such as deductions on premiums and tax-free death benefits in some countries

Term insurance provides peace of mind and financial security for your loved ones in case of your untimely death

Term insurance is a type of life insurance that provides peace of mind and financial security for your loved ones in the event of your untimely death. It is a guaranteed life benefit paid to the beneficiaries of the insured after their death. Term insurance is an important tool for financial planning and can provide invaluable support for your family if you are no longer around.

Term life insurance is designed to cover you for a set period, usually offered in terms of 10, 15, 20, or 30 years. During this time, if the insured person passes away, the beneficiaries will receive a death benefit. This benefit is guaranteed by the insurance company and provides financial protection for your loved ones. The death benefit can be used to settle healthcare and funeral costs, consumer debt, mortgage debt, or any other expenses. It ensures that your family can maintain their standard of living and helps them cope with the loss of your income.

The value of term insurance lies in this financial security it offers. While it may not provide investment opportunities like permanent life insurance, it serves a crucial purpose in safeguarding your family's future. Term life insurance is typically more affordable than permanent life insurance, making it accessible to individuals and families from various economic backgrounds. The premiums are based on factors such as age, health, and life expectancy, and the younger and healthier you are, the lower your premiums are likely to be.

Term insurance provides the reassurance that your loved ones will be taken care of financially, even in your absence. It is a way to ensure that your family can maintain their lifestyle, continue their education, and manage any debts or expenses without the added stress of financial hardship. While no one wants to think about their own mortality, term insurance is a responsible choice that demonstrates your commitment to their well-being.

When considering term insurance, it is essential to assess your financial situation and the needs of your dependents. By purchasing term insurance, you are investing in their future and ensuring they have the resources to cope with the unexpected. This type of insurance provides a safety net and allows your loved ones to grieve without the added burden of financial worries.

Understanding Short-Term Insurance: Temporary Coverage, Long-Term Peace of Mind

You may want to see also

Term insurance is generally more affordable than other types of life insurance because it does not build cash value

In contrast, permanent life insurance covers the policyholder for their entire life as long as premiums are paid and often includes an investment component. This component allows the policy to accumulate a cash value that grows tax-free and can be borrowed against or withdrawn. However, permanent life insurance typically requires higher premiums than term life insurance.

The affordability of term life insurance is due to its limited duration and lack of cash value. It assumes less risk for the insurance company, resulting in lower premiums. Term life insurance is suitable for those seeking coverage for a specific period, such as young people with children or those with growing families.

While term life insurance does not build cash value, it can still be considered an investment in the sense that it provides peace of mind and financial security for loved ones at a relatively low cost. If the insured passes away during the policy term, their beneficiaries receive a substantial death benefit. However, if the policyholder outlives the term, there is no payout, and the premiums are forfeited.

In summary, term insurance is more affordable than other types of life insurance because it is designed for a limited duration and does not accumulate cash value. It offers a cost-effective way to provide financial protection for beneficiaries in the event of the policyholder's death during the specified term.

The Intricacies of Level Term Insurance: Unraveling the Meaning of "Level

You may want to see also

Term insurance premiums are typically based on age, health, and life expectancy, making it a cost-effective option for younger individuals

Term insurance premiums are calculated based on several factors, with age, health, and life expectancy being the most significant ones. These factors make term insurance a cost-effective option, especially for younger individuals.

Age is a primary factor in determining life insurance premiums. The older an individual is when purchasing a policy, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that predict the likelihood of dying while the policy is in force. As age increases, the probability of death within the policy term also rises, leading to higher premiums. Typically, the premium amount increases by about 8% to 10% for every year of age. However, this increase can be as low as 5% annually for individuals in their 40s and as high as 12% annually for those over 50.

In addition to age, health status also plays a crucial role in determining term insurance premiums. The insurance company will consider an individual's overall health, including weight, pre-existing conditions, and participation in risky activities. The healthier an individual is, the lower the premiums are likely to be. For example, pre-existing conditions like heart disease, stroke, diabetes, or cancer can significantly impact premiums.

Life expectancy is another factor that influences term insurance premiums. As individuals get closer to their life expectancy, the risk of the insurance company having to pay out a claim increases, resulting in higher premiums. This is particularly true for older individuals, as their life expectancy is shorter, and the probability of death within the policy term is higher.

Term insurance premiums are typically lower for younger individuals because they are generally healthier and have a longer life expectancy. By purchasing term insurance at a younger age, individuals can lock in lower rates for the duration of the policy term. This makes term insurance a cost-effective option for younger individuals seeking life insurance coverage.

Moreover, term life insurance policies offer flexibility in terms of coverage length. Individuals can choose policies with terms of 10, 20, or 30 years, depending on their needs. The shorter the term, the lower the premiums will be. This allows younger individuals to obtain adequate coverage at a reasonable cost.

In summary, term insurance premiums are based on age, health, and life expectancy, making it a cost-effective option for younger individuals. By purchasing term insurance early in life, individuals can benefit from lower premiums and ensure financial protection for their loved ones.

Exploring Short-Term Insurance Options with Horizon

You may want to see also

Term insurance plans offer flexibility in terms of policy term and payout options, allowing you to choose what suits your financial needs

Term insurance is a type of life insurance that provides coverage for a specific period, or "term". It offers a death benefit to the policyholder's beneficiaries if they pass away during the policy term. The policy term can be based on individual financial needs, ranging from a decade to several decades.

Term insurance plans offer flexibility in terms of policy term and payout options. You can choose a policy term that suits your financial needs, ranging from 5 years to 40 years or even whole life coverage up to 100 years of age. This ensures that your family is protected for as long as you need.

Term insurance plans also offer flexible payout options to meet the diverse needs of families. You can opt for a lump-sum payment, regular income, or a combination of both. This helps cover various financial needs, including household expenses, outstanding debts, and other expenses.

Additionally, term insurance plans provide the option to increase the sum assured if you have opted for the life-stage option. This allows you to adjust your coverage as your financial needs change over time.

Term insurance plans also offer flexible premium payment options, such as monthly, quarterly, or annual payments. You can also choose to pay premiums for a limited period while enjoying benefits for the entire policy term.

When selecting a term insurance plan, it is important to consider your financial situation, family's needs, and future expenses to determine the coverage amount and term that best suits you. By choosing a plan that offers flexibility in policy term and payout options, you can ensure that your financial needs are met and your family is protected.

Understanding Extended Term Nonforfeiture: An Important Decision for Policyholders

You may want to see also

Term insurance may provide tax benefits, such as deductions on premiums and tax-free death benefits in some countries

Term life insurance provides a death benefit that pays the beneficiaries of the policyholder throughout a specified period. Once the term expires, the policyholder can either renew it for another term, convert the policy to permanent coverage, or let the term life insurance policy lapse.

Term life insurance premiums are typically less expensive than permanent life insurance premiums. This is because term life insurance offers a death benefit for a restricted time and doesn't have a cash value component like permanent insurance.

In some countries, term life insurance may offer tax benefits. The death benefit paid to beneficiaries is typically not taxable, and beneficiaries are not required to use the insurance proceeds to settle the deceased's debts. Additionally, term life insurance policies may provide deductions on premiums, further reducing the cost of coverage.

While term life insurance can provide tax advantages, it is important to note that it does not have an investment component like permanent life insurance. Term life insurance is purely a protection tool, providing financial security for loved ones in the event of the policyholder's death during the specified term.

When considering the investment potential of term life insurance, it is essential to weigh it against other investment options. In most cases, individuals may be better off purchasing term life insurance for protection and investing the difference in premium costs in other tax-efficient investment vehicles.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Frequently asked questions

Term insurance is not an investment in the traditional sense, but rather a form of financial protection. It provides a large life cover for a relatively small premium, offering peace of mind and ensuring your loved ones are financially secure in the event of your untimely death.

Term insurance offers a high sum assured with low investment. It is a cost-effective form of life insurance, especially when purchased at a young age. It provides tax benefits in some countries and offers flexible payout options to beneficiaries.

Term insurance is more affordable than permanent life insurance, which may offer a cash value component. While term insurance does not provide a return on investment if the policyholder outlives the term, it ensures financial security for beneficiaries in case of an unexpected tragedy.

There are several types of term insurance policies, including level term, decreasing term, increasing term, convertible term, and renewable term. The choice depends on individual needs and circumstances.

A common misconception is that term insurance is a waste of money if the policyholder outlives the policy term. However, it is designed as a safety net to provide financial protection, similar to car insurance. Additionally, term insurance may be necessary even for young and healthy individuals, as it is generally cheaper to purchase term insurance at a younger age.