The process of splitting a bill between insurance and the customer can be a confusing and frustrating experience, especially in the case of medical or ambulance bills. In the US, the practice of split billing in healthcare has become increasingly common, causing patients to receive separate bills for physician services (professional component) and facility fees (technical component). This can lead to surprise bills and financial hardship for patients, who may be unaware of the billing practices of their healthcare providers. To avoid this, patients should understand the two components of split billing and be transparent with their physicians and hospitals about billing practices. Additionally, when dealing with ambulance services, it is important to know that insurance carriers may not cover the full cost, especially if the patient is transported to an out-of-network facility.

| Characteristics | Values |

|---|---|

| Reasons for splitting a bill | Exhaustion of sum assured or policy limits |

| Claim settlement processes | Cashless mode or reimbursement |

| Cashless mode | Requires treating hospital to be registered as a network hospital with the insurer |

| Reimbursement mode | Requires submission of all bills, receipts, and medical papers to the insurer |

| Ambulance billing | Patient responsibility varies depending on insurance coverage and ambulance services provided |

| Medicare split claim billing | Comprised of professional and technical charges |

| Professional charges | Physician's fee |

| Technical charges | Facility overhead, materials, medications, nurses, support staff, etc. |

| Inappropriate fragmented or split billing | Services rendered by the same provider on the same date but submitted on multiple claims |

What You'll Learn

Ambulance billing

Ambulance rides can be costly, and it's important to understand how these bills are split between the patient and the insurance carrier. In the US, healthcare services, including ambulance rides, can be expensive without insurance. While insurance can help cover these costs, it's not always straightforward, and patients often find themselves facing large bills even when they have insurance coverage.

Patient vs Insurance Carrier Responsibility

There is often a lack of clarity regarding how much the patient is responsible for and how much the insurance carrier will cover. In some cases, insurance carriers may not be obliged to pay any part of the ambulance bill, leaving the patient with a hefty bill. This issue is particularly thorny as patients usually have little to no choice in selecting an ambulance company during an emergency.

Out-of-Network Facilities

One of the main reasons for high ambulance bills is that a large percentage of ambulance services transport patients to healthcare facilities that are considered out-of-network by their insurance carriers. This results in inflated costs as the insurance carrier has no working arrangement with the hospital. Even when the hospitals are in-network, there is often no agreed-upon standard rate between the ambulance service and the insurance carrier, allowing the ambulance company to charge whatever amount they deem appropriate.

Paramedic and Additional Services

When an ambulance is staffed with paramedics, and any kind of paramedic service is provided, these services can significantly increase the total ambulance bill. For example, if oxygen administration or revival procedures are performed, these will be reflected in the bill.

Best-Case Scenario

In the ideal situation, the insurance carrier will have an agreement with the ambulance company regarding standard costs for a trip to the hospital. While this scenario is rare, it helps cover the cost of an expensive trip and prevents the ambulance company from imposing excessive charges. However, even in this case, patients usually don't have the option to choose a specific ambulance company that collaborates with their insurance carrier during an emergency.

Protecting Patients

The lack of choice and the potential for high reimbursement costs highlight the need for greater protection for patients who require ambulance services. This protection could include regulations or agreements that set standard rates for ambulance services or require insurance carriers to cover a larger portion of the bill.

Understanding Your Insurance Coverage

It is essential for individuals to understand their insurance coverage and know what types of ambulance services are included. Auto insurance may cover ambulance rides if certain criteria are met, such as the ambulance ride being directly related to a car accident and the purchase of specific coverage types. Health insurance plans generally cover ambulance rides but are subject to copays, deductibles, and coinsurance, which vary depending on the plan.

Dealing with Out-of-Network Ambulance Bills

If you receive an out-of-network ambulance bill, there are a few steps you can take:

- Ask questions and understand your insurance coverage.

- Check your state laws, as some states have passed laws against surprise medical bills, including restrictions on ground ambulance billing.

- Consider an ambulance service membership, where you pay an annual fee to avoid out-of-pocket costs.

- Negotiate the bill with your insurance carrier and the ambulance company to see if they can lower the charge or offer a payment plan.

The Complexities of Abortion Coverage: Unraveling Privacy Concerns and Insurance Trails

You may want to see also

Physician and hospital fees

In the context of split billing, it is essential to distinguish between the professional component and the technical component of a medical bill. The professional component refers solely to the physician's fee, which patients typically expect to pay when they pay their copay. This fee covers the physician's services, the cost of running their office, and their liability insurance. On the other hand, the technical component represents the hospital's fee for utilising their facilities and resources. This includes expenses such as equipment, medications, supplies, and the salaries of support staff.

When a patient receives treatment at a hospital, they will typically receive separate bills from the hospital and the physician. For example, if a patient visits the emergency room and undergoes an X-ray and laboratory tests, they may receive a bill from the hospital for technical resources and another bill from the emergency room physician for their professional services. Additionally, they may receive bills from the radiologist for interpreting the X-rays and the pathologist for analysing any specimens.

It is important to note that the distinction between physician and hospital fees can become blurred when hospitals acquire independent physician practices. This practice, known as "split billing," has become increasingly common and can lead to confusion and frustration among patients. Patients may be unaware that their physician's practice has been acquired by a hospital, resulting in unexpected charges on their medical bills.

To mitigate the impact of split billing, patients should seek transparency from both physicians and hospitals regarding potential fees. Hospitals should clearly communicate their ownership status and provide estimates of facility fees to patients in advance. Physicians should also disclose any affiliations with hospitals or health systems to enable patients to make informed decisions about their care.

Furthermore, patients can take proactive steps to understand their potential financial responsibility. Checking with their insurer and discussing potential fees with their doctor before receiving treatment can help patients anticipate and plan for any out-of-pocket expenses. In the event of receiving a surprise bill, patients can negotiate with the healthcare provider to waive or reduce the fee or appeal to their insurer to cover a larger portion of the cost.

Protecting Your Short-Term Rental Condo: Navigating Insurance Options

You may want to see also

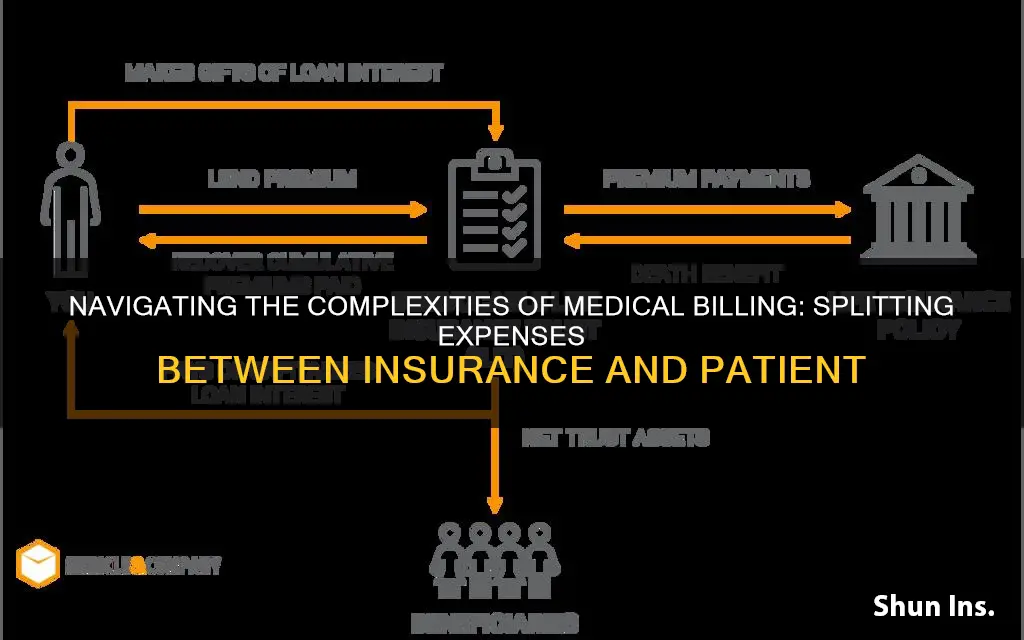

Cashless and reimbursement modes

Cashless Claims

Cashless claims are applicable for policyholders who prefer to take medical treatment in the network of hospitals the insurance provider provides. A network hospital partners with the insurance company or Third-Party Administrator (TPA) to provide cashless claim benefits. The policyholder will have to get the approval of the insurance provider, or a TPA, to begin with the treatment. After receiving the request, the insurer will verify the details with the hospital and pay the expenses directly to the hospital.

The policyholder can choose any hospital from the network of hospitals provided by the insurance provider. The policyholder must fill out the form for health insurance coverage provided by the TPA at the hospital and produce the same to the TPA with the claim request. The policyholder will have to provide all the documents related to the health condition, treatment taken, payments made, etc. It can include diagnostic test reports, discharge summary, payment receipt, etc.

The insurer will directly pay for the hospitalisation and the medical expenses directly to the hospital on behalf of the policyholder. Cashless claims are approved within the stipulated TAT of 2 hours for each transaction.

Reimbursement Claims

The reimbursement claim benefit applies to policyholders who prefer to take medical treatment in a hospital of their choice. The policyholder will pay the bills from their pocket for the hospitalisation and medical expenses. Further, they will have to raise a claim request to the insurance provider for reimbursement by providing the necessary bills and invoices. Upon receiving the request, the insurer or TPA will verify the details and the supporting documents and reimburse the expenses as per policy coverage.

The policyholder must get the treatment done in a hospital of their choice and pay the respective bills. They must provide the medical records and the applicable bills to the insurer and raise a claim request. The insurer will verify the claim request and approve the same.

The policyholder need not get the approval before the start of the treatment. However, it is best advised to inform and verify the health insurance coverage for the specific scenario. Reimbursement claims are initiated after the treatment, so the insurer will have to verify and process the requests. It can take up to 45 days for the settlement.

Invisalign Insurance Coverage: Understanding the Billing Process

You may want to see also

Medicare split claim billing

Professional charges cover the fees of the physician, while technical charges include facility overhead, materials, medications, nurses, support staff, and more. Typically, hospitals and RHCs (Rural Health Clinics) bill charges to Medicare Part A on a UB-04 form, while outpatient clinics bill Medicare Part B using a CMS 1500 form. However, there are exceptions to this rule, such as when RHCs bill professional charges to Medicare Part A and technical charges to Medicare Part B.

One example of Medicare split claim billing is when an inpatient admission crosses over the provider's fiscal year-end, the federal fiscal year-end, or calendar year-end. In such cases, the claim needs to be split accordingly. The fiscal year can end on March 31, June 30, September 30, or December 31, while the federal fiscal year ends on September 30. A calendar year, on the other hand, begins on January 1 and ends on December 31.

Another scenario where Medicare split claim billing is applicable is when there are split/shared evaluation and management (E/M) visits. This typically involves collaboration between a physician and a non-physician practitioner (NPP) from the same group, contributing to the history, exam, or medical decision-making (MDM). NPPs can include nurse practitioners, physician assistants, certified nurse specialists, and certified nurse-midwives.

It's important to note that Medicare reimburses services provided by NPPs at 85% of the rate paid when physicians furnish the same service. Additionally, there are specific requirements for medical record documentation, such as identifying the individual who performed the substantive portion of the visit and signing and dating the medical record.

Overall, Medicare split claim billing is a complex process that requires a good understanding of the applicable rules and regulations to ensure proper payment of claims.

Updating Term Insurance: Changing Nominees and Ensuring Peace of Mind

You may want to see also

Inappropriate fragmented or split billing

Some examples of inappropriate fragmented or split billing include:

- An office visit with modifier 25 and a procedure with 0, 10, or 90 days global.

- Claim 1 contains a joint injection procedure with a 0-day global period, and Claim 2 contains an established evaluation and management service with modifier 25.

- Two or more procedures with the CMS National Physician Fee Schedule Relative Value Multiple Procedure (MPFS) indicators of 2 and 3 that are subject to Multiple Procedure Payment Reduction (MPPR).

- Two or more diagnostic imaging services with an MPFS indicator of 4 that is subject to MPPR.

Understanding Extended-Term Insurance: Unraveling the Dividend Option Mystery

You may want to see also

Frequently asked questions

Split billing is the division of a medical bill between physician services and facility fees.

The two components of split billing are:

The Technical Component: This is the hospital's fee, which includes equipment usage, supplies, technicians, nurses, and support staff salaries.

In most cases, insurance carriers do not have a standard rate agreement with ambulance services, leading to surprise bills. To avoid this, check with your insurance carrier beforehand to understand your coverage and any potential out-of-network transport costs.