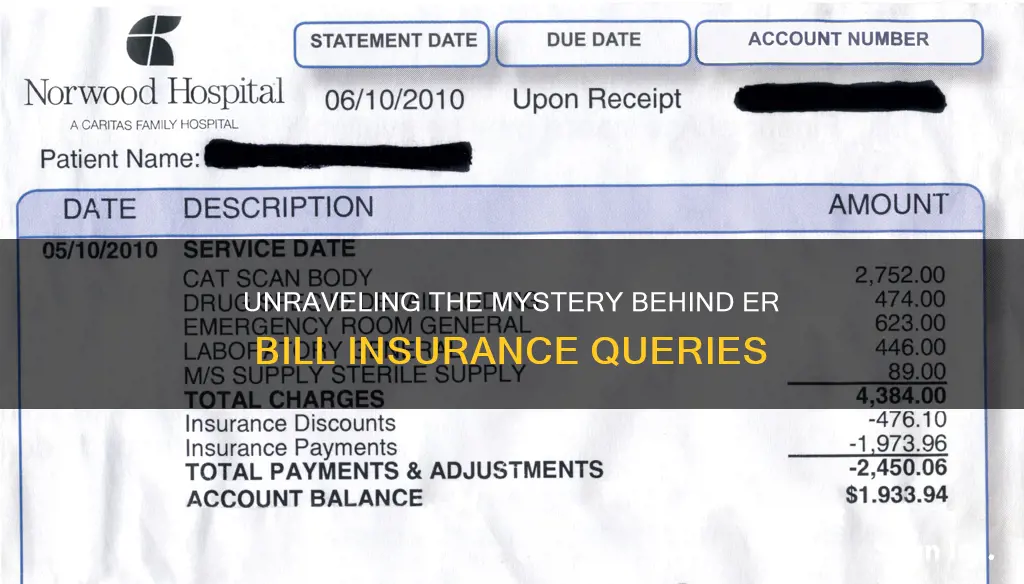

When you receive a bill from the ER, it is important to confirm whether your insurance details have changed to avoid unexpected out-of-network charges, also known as surprise billing. Surprise billing occurs when a patient receives care from an out-of-network provider or facility, resulting in additional charges that their insurer may not cover. To prevent this, patients should ensure their insurance information is up to date and understand their insurance plan's coverage, including any recent changes. By doing so, patients can avoid unexpected financial burdens and navigate the complex medical billing system with greater ease.

| Characteristics | Values |

|---|---|

| Reason for being asked about insurance changes | To ensure correct billing and avoid surprise billing |

| What is surprise billing | Unexpected bill from an out-of-network provider or facility |

| Protection against surprise billing | The No Surprises Act |

| Who is protected by the No Surprises Act | People with a group health plan or individual/group health insurance coverage |

| When did the No Surprises Act come into effect | January 1, 2022 |

What You'll Learn

The No Surprises Act

The NSA protects consumers from surprise billing for emergency services, even if they are out-of-network and without prior authorization. It also bans out-of-network cost-sharing for emergency and some non-emergency services, as well as out-of-network charges and balance bills for certain additional services (like radiology or anesthesiology) provided by out-of-network providers working at an in-network facility.

The Act requires healthcare providers and facilities to give patients an easy-to-understand notice explaining the applicable billing protections and their rights, including the requirement for patient consent to waive billing protections. It also establishes an independent dispute resolution process for payment disputes between plans and providers, and provides new dispute resolution opportunities for the uninsured and self-pay individuals.

Under the NSA, providers are prohibited from billing patients more than the applicable in-network cost-sharing amount, with a penalty of up to $10,000 for each violation. Providers must first find out the patient's insurance status and submit the surprise out-of-network bill directly to the health plan. The health plan will then send an initial payment to the provider and notify the consumer of the in-network cost-sharing amount they owe the out-of-network provider.

The NSA also allows for certain exceptions, where patients can waive their rights and consent to be billed more by out-of-network providers. However, this consent must be given voluntarily and cannot be coerced, although providers can refuse care if consent is denied.

The NSA is enforced by various federal and state agencies, depending on the type of health plan and provider involved. The federal government has exclusive enforcement responsibility for most private health plans, while states lead enforcement for state-regulated plans.

Unraveling the Acronyms: CV and IV in the Insurance Realm

You may want to see also

Surprise medical billing

In the United States, the No Surprises Act (NSA) was introduced to protect patients from surprise medical billing. The Act came into effect on January 1, 2022, and it protects patients with group or individual health insurance coverage from surprise billing for emergency services and limits the amount of:

- Surprise bills for emergency services from out-of-network providers or facilities without prior authorization.

- Out-of-network cost-sharing for emergency and some non-emergency services.

- Out-of-network charges and balance bills for supplemental care, like radiology or anesthesiology, provided by out-of-network providers working at an in-network facility.

The Act also establishes an independent dispute resolution process for payment disputes between plans and providers and provides new dispute resolution opportunities for uninsured and self-pay individuals when they receive a medical bill that is substantially higher than the good faith estimate provided by the provider.

In addition to the NSA, there are also state laws in place that offer protection against surprise medical billing, such as the law in Washington State, which took effect on January 1, 2020. These state laws may offer greater protections than the NSA, and in these cases, the state law will generally apply.

Understanding Insurable Interest: Unraveling the Intricacies of Insurance Eligibility

You may want to see also

Balance billing

To protect consumers from balance billing, the No Surprises Act (NSA) was implemented in 2022. This federal legislation aims to limit the amount paid out of pocket by consumers to a level closer to what they would pay if the healthcare provider were in-network. The Act also requires healthcare facilities and providers to disclose patient protections against balance billing and sets forth complaint processes for violations. Additionally, state laws also provide protections against balance billing, varying by state.

If you believe you have been wrongly balance billed, you can contact the provider or facility and inform them of the issue. You can also file a complaint with the appropriate office, which will investigate on your behalf. It is important to remain engaged and ask questions to confirm you are being billed correctly.

The Unfamiliar World of Short-Term Health Insurance: Understanding the Basics

You may want to see also

Out-of-network charges

In some cases, patients may need to go out-of-network for certain types of care, especially if they have a rare illness or require specialized treatment. With prior approval from their insurer, patients may be able to receive out-of-network care and still pay the lower, in-network rate. However, this depends on the patient's insurance plan and the laws in their state.

To avoid unexpected out-of-network charges, patients should familiarize themselves with their insurance plan's benefits and limitations. They should also ask their insurance provider or refer to their plan documents to understand the cost-sharing requirements for out-of-network care, as these costs are usually higher than for in-network services.

Billing Insurance for Mini-Mental Examinations: Understanding Coverage and Reimbursement

You may want to see also

In-network cost-sharing

Copayments, or copays, are a set amount that the patient pays for certain medical services. Copays are usually much smaller than deductibles. For example, a health plan might have a deductible of $1,500 but only require a $35 copay to see a primary care physician. In this case, the patient would pay $35 to see their healthcare provider, and their health plan would pay the rest of the bill. It's important to note that there might be other services performed in conjunction with the office visit, such as lab work, that are counted towards the deductible and have to be paid in addition to the copay.

A deductible is the amount that the patient has to pay for certain services before their health plan starts to cover their expenses. For most health plans, the deductible applies once per calendar year, although there may be separate deductibles for medical and prescription expenses. Deductibles vary considerably in size, with some plans having deductibles as low as $250 or $500, or even $0, while others have deductibles exceeding $5,000. Unlike coinsurance, the deductible is a predetermined amount rather than a percentage of the bill.

Coinsurance is the patient's percentage of the total costs for covered services, after they have been reduced by the health plan's network agreement with the medical provider. Coinsurance usually starts to apply after the deductible is met, and the patient continues to pay it until they hit their out-of-pocket maximum for the plan. For example, if a plan has an 80/20 coinsurance structure and a $4,000 maximum out-of-pocket limit, the patient will pay 20% of the bill after meeting their deductible until they reach the $4,000 limit. At that point, the insurance plan will pay 100% of the remaining covered costs for the year.

The No Surprises Act, which came into effect on January 1, 2022, protects patients from unexpected out-of-network charges ("surprise bills") for emergency medical services. If a patient's health insurance covers emergency care, they cannot be charged more for emergency medical services than the in-network cost-sharing rate. This protection applies to charges from the providers giving care at the hospital and from air ambulance providers.

The Intricacies of Experience Rating: Unraveling Insurance's Impact on Businesses

You may want to see also

Frequently asked questions

A surprise medical bill is an unexpected bill from an out-of-network provider or facility, which can occur when you receive emergency care or are treated by an out-of-network provider at an in-network hospital.

The No Surprises Act, effective January 1, 2022, protects you from surprise billing for emergency services if you have a group health plan or health insurance coverage. It limits the amount you can be charged for out-of-network services and balances billing for supplemental care.

If you receive a surprise medical bill, you can contact the provider or facility and inform them that you believe you have been wrongly billed. You can also file a complaint with the appropriate office, which will investigate the issue on your behalf.

Balance billing occurs when you are billed for the difference between what your insurer has agreed to pay and the amount the out-of-network provider billed for their services. This can happen when you receive care from a provider or facility that is not contracted with your health insurer.

To avoid surprise medical bills, it is important to understand your insurance coverage and which providers are in your network. Ask your insurance company or health plan if you are unsure about what your plan covers. Stay engaged and ask questions to confirm you are being billed correctly, and be cautious of potential medical billing scams.