Pure term insurance is a type of life insurance that provides coverage for a certain period of time, or a specified term of years. It is a pure form of insurance protection that pays a predetermined sum if the insured person passes away during the specified period. Term insurance is regarded as the most cost-effective way of providing future financial security for dependents in the event of an unforeseen death. The premiums for term insurance are based on a person's age, health, and life expectancy, and the policy can be renewed or converted to permanent coverage upon expiration.

| Characteristics | Values |

|---|---|

| Type of insurance | Life insurance |

| Period of coverage | Limited period of time |

| Premium | Fixed regular premium |

| Cost | Least expensive to acquire |

| Coverage term | 35 years |

| Minimum premium | USD 50 |

| Min entry age | 18 |

| Max entry age | 74 |

| Payout | Pays a predetermined sum if the insured expires during a specified period of time |

| Beneficiary | Pays the face value of the policy to the nominated/legal beneficiary |

| Premium usage | All premiums paid are used to cover the cost of insurance protection with no survival benefit |

| Renewal | Unless renewed, the insurance coverage ends when the term of the policy expires |

What You'll Learn

- Pure term insurance is a type of life insurance policy that provides coverage for a certain period of time

- The insured person's nominee or legal beneficiary receives the face value of the policy if the insured person passes away during the policy term

- Term insurance is the most cost-effective way to ensure future financial security for dependents

- Term insurance premiums are based on a person's age, health, and life expectancy

- Term insurance policies are renewable, and the insured person can choose to renew the policy for another term or convert it to permanent coverage

Pure term insurance is a type of life insurance policy that provides coverage for a certain period of time

Term insurance policies have a fixed premium, which means that the policyholder pays the same amount at regular intervals for the duration of the policy. The premiums are based on factors such as age, health, and life expectancy. When purchasing a term policy, the insurance company may require a medical exam and information about the insured person's driving record, medications, smoking status, occupation, hobbies, and family history.

In the unfortunate event of the insured person's demise during the policy term, term insurance pays the face value of the policy to the nominated or legal beneficiary. The beneficiary can use this payout to settle healthcare and funeral costs, consumer debt, mortgage debt, or other expenses. However, if the policy term expires before the insured person's death, there is no payout, and the policyholder may need to renew the policy at a higher premium based on their age.

Term insurance is typically more affordable than permanent life insurance because it offers coverage for a limited period. Unlike permanent life insurance, term insurance does not accumulate cash value and is purely designed to provide financial protection for a specified term. The minimum entry age for term insurance is usually 18, with a maximum entry age of around 74.

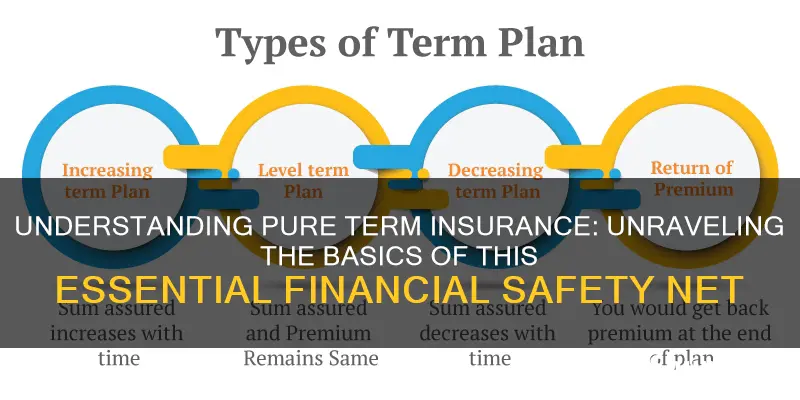

Term insurance plans can vary, with some offering level premiums and coverage for a set number of years, such as 10, 20, or 30 years. Other types of term insurance include decreasing term policies, where the death benefit declines over time, and convertible term policies, which can be converted into permanent life insurance policies.

Understanding Renewable Term Insurance: Unraveling the Benefits and Mechanics

You may want to see also

The insured person's nominee or legal beneficiary receives the face value of the policy if the insured person passes away during the policy term

Pure Term Insurance plans provide financial protection for your dependents for a limited period and at a fixed regular premium. Term Insurance is a straightforward and cost-effective method of ensuring future financial security for your dependents in the event of your unexpected death. It is a straightforward form of insurance that pays a predetermined sum if the insured dies during the policy period.

The death benefit is guaranteed to be paid to the insured person's nominee or legal beneficiary if the insured person dies during the policy term. The face value of the policy is paid to the nominee or beneficiary, and all premiums paid are used to fund the cost of insurance protection, with no survival benefit. This means that if the insured person passes away during the policy term, their nominee or legal beneficiary will receive the full amount of the policy's face value, providing financial security and support during a difficult time.

The nominee or beneficiary can use the cash benefit to settle healthcare and funeral expenses, consumer debt, mortgage debt, and other expenses. However, they are not obligated to use the insurance proceeds to pay off the deceased's debts. The benefit is typically tax-free, providing additional financial relief to the nominee or beneficiary.

Term Insurance is a cost-effective way to provide financial security because it offers a death benefit for a limited time and does not accumulate cash value like permanent insurance policies. This means that if the insured person lives beyond the policy term, there is no payout, and the policy expires. However, the insured person has the option to renew the policy, although the premiums will be recalculated based on their age at the time of renewal, resulting in higher costs.

Term Insurance is an ideal solution for individuals who want substantial coverage at a low cost. It provides peace of mind and financial protection for loved ones during the policy term. By nominating a beneficiary or legal beneficiary, the insured person can ensure that the benefits are directed to the intended recipient, offering a sense of security and stability for their dependents in the event of their untimely demise.

Capitalization Conundrum: Navigating the World of Insurance Terminology

You may want to see also

Term insurance is the most cost-effective way to ensure future financial security for dependents

Pure term insurance plans are a cost-effective way to ensure your dependents' future financial security. Term insurance is a type of life insurance that provides coverage for a specific number of years, or a fixed term. These plans are an affordable way to provide financial protection to your loved ones in the event of your death. The premiums for term insurance are typically much lower than those for whole life insurance, as they only cover a limited period. This makes it a budget-friendly option for individuals seeking life protection and tax savings.

Term insurance plans offer high benefits at low premium rates. For example, a healthy, non-smoking 30-year-old male can purchase a term cover of 1 crore for his family for the next 20 years by paying a monthly premium of only Rs. 641. This high coverage amount ensures that his family can maintain their current lifestyle even in his absence. Term insurance plans also offer tax benefits, allowing individuals to reduce their taxable income under Section 80C of the Income Tax Act, 1961.

In addition to financial protection, term insurance plans can also provide coverage against critical illnesses and disabilities. Various term plans offer critical illness benefits, which can help individuals seek treatment for life-threatening diseases without worrying about hospital bills. Accidents can also lead to permanent or temporary disabilities, and disability coverage under a term policy will provide financial support to the policyholder's family in such cases.

Term insurance is a straightforward and cost-effective way to ensure your loved ones' financial stability, making it a crucial consideration in your overall financial planning. By purchasing a term insurance plan, you can rest assured that your family will be taken care of, even in your absence.

Term insurance premiums are based on a person's age, health, and life expectancy

Pure term insurance is a type of life insurance that provides coverage for a limited period. It is a cost-effective way to ensure future financial security for your dependents in the event of your death. Term insurance is a pure form of insurance protection that pays a predetermined sum if the insured person passes away during the policy period. The policy pays the face value of the policy to the legal beneficiary, and all premiums paid are used to cover the cost of insurance protection.

In addition to age, insurance companies consider an individual's health when determining premiums. The insurance company may require a medical exam to review the insured person's health and family medical history. Pre-existing health conditions, such as heart disease, diabetes, or cancer, can increase premiums. Lifestyle choices, such as smoking or engaging in risky hobbies, can also impact premiums.

Gender is another factor influencing term insurance premiums. Women tend to have longer life expectancies than men and, therefore, typically pay lower premiums.

The amount of coverage also affects the cost of term insurance. The higher the coverage amount, the higher the premiums will be.

Overall, term insurance premiums are calculated based on a combination of factors, including age, health, life expectancy, and coverage amount, to determine the likelihood of a payout during the policy period.

The Fine Print: Understanding Riders in Term Insurance Policies

You may want to see also

Term insurance policies are renewable, and the insured person can choose to renew the policy for another term or convert it to permanent coverage

Pure term insurance is a type of life insurance that provides coverage for a limited period of time, typically between 10 and 30 years. It is a cost-effective way to ensure future financial security for your dependents in case of an unforeseen event, such as your death. Term insurance policies are renewable, which means that the insured person can choose to extend the coverage for another term without having to re-qualify for new coverage. This is especially beneficial if the insured person's health has declined, as they won't need to pass a new medical screening. However, the premiums will be recalculated based on the insured person's age at the time of renewal, resulting in higher costs.

When the term of a pure term insurance policy expires, the policyholder has several options. They can choose to renew the policy for another term, ensuring continued coverage. Alternatively, they can convert the term policy to permanent coverage, such as whole life or universal life insurance. This conversion option allows the policyholder to switch to lifelong coverage without undergoing additional medical examinations or providing evidence of insurability. The conversion option may be included in the basic insurance contract, or it can be added later by purchasing a special rider.

The ability to renew or convert a term insurance policy provides flexibility and peace of mind for the insured person. If their circumstances change, such as developing health issues or acquiring additional financial obligations, they can extend their coverage accordingly. However, it is important to note that the premiums will increase with each renewal, and converting to permanent coverage will also result in higher costs.

In summary, term insurance policies offer the advantage of renewability, allowing the insured person to extend their coverage as needed. Additionally, the option to convert to permanent coverage provides a pathway to lifelong insurance protection. While renewals and conversions result in higher premiums, they offer valuable alternatives to ensure continued financial security for dependents.

The Enigma of Residual Markets: Unraveling the Insurance Industry's Niche Terminology

You may want to see also

Frequently asked questions

Pure term insurance is a type of life insurance that provides coverage for a certain period of time, or a specified "term" of years. It is a pure form of insurance protection that pays a predetermined sum if the insured person passes away during the specified period.

Pure term insurance offers a fixed premium for the duration of the policy. If the insured person passes away before the policy expires, the insurance company will pay the death benefit to their beneficiaries. If the policy expires before the insured person's death, there is no payout. The policy can often be renewed, but the premium will be recalculated based on the person's age at the time of renewal.

Pure term insurance is initially much less expensive compared to permanent life insurance. It is ideal for people who want substantial coverage at a low cost. It is also a good option for young people with children, as it provides financial security for dependents in the event of an unforeseen death.

Pure term insurance is a temporary form of insurance that offers coverage for a specified period, whereas whole life insurance is permanent coverage that lasts for the entire life of the insured person. Whole life insurance also accumulates cash value over time, which can be withdrawn or borrowed against, making it a combination of an investment product and an insurance policy.