A retroactive date in insurance terms is the date on which your coverage begins. It is sometimes called the retro date or retroactive date of inception. This date is important because it determines whether or not your current policy will cover the costs of a lawsuit. If the disputed incident occurred after the retroactive date, your policy will cover your costs. If it occurred before, you will have to cover the costs yourself. Retroactive dates are found in claims-made policies, such as errors and omissions (E&O) and directors and officers (D&O) insurance.

| Characteristics | Values |

|---|---|

| Definition | A retroactive date is a provision found in claims-made policies that determines the earliest point in time that your insurance policy will cover an incident or dispute. |

| Alternative Names | Retro date, retroactive date of inception |

| Application | Retroactive dates are generally found in claims-made policies, such as errors and omissions (E&O) and directors and officers (D&O) insurance. |

| Purpose | Retroactive dates eliminate coverage for situations or incidents known to insureds that have the potential to give rise to claims in the future. Retroactive dates also make policies more affordable by precluding coverage for events that are remote in the past. |

| Coverage | Retroactive date insurance pays for claims that occurred while you were covered by an insurance policy, even if you are no longer covered by that particular policy at the time you file the claim, as long as you have been continuously covered. |

What You'll Learn

Retroactive date vs. inception date

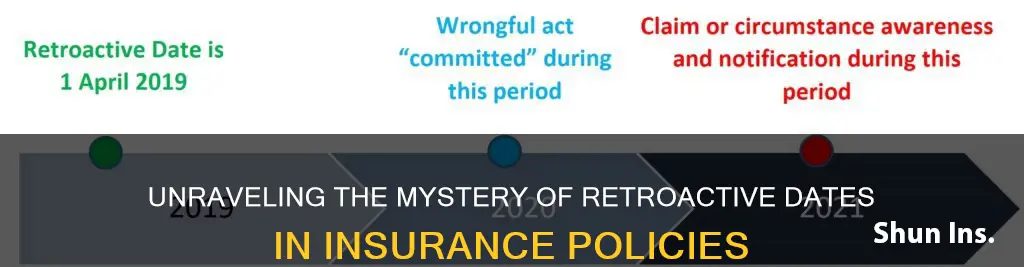

A retroactive date is a feature of claims-made policies, such as errors and omissions (E&O) and directors and officers (D&O) insurance. It is the earliest point in time that your insurance policy will cover an incident or dispute. It is sometimes called the retro date or retroactive date of inception. The retroactive date is usually the inception date of the insured's first claims-made liability policy, but not always.

The retroactive date is the date on which your coverage begins. It is usually the same as your inception date or the date since you've held uninterrupted insurance coverage. If you've had insurance since 2010 and still do, you could be covered for incidents outside your current period, as long as they took place after 2010 when you first got covered.

The inception date is the date when the new policy begins or is put into effect. When buying a new policy, the insured is asked from when they want the policy to run. If the insured already has an existing policy in place, they should inform the new insurer of the date that the existing policy started. This becomes the retroactive date, and the new policy will then start on the inception date.

Retroactive dates are important because they determine how far back in time an incident can occur and still be covered by the insured's current policy. They can also help to address claims arising from past work, benefiting both the policyholder and the insurance company.

The Mystery of HO-1733: Unraveling the Intricacies of Insurance Terminology

You may want to see also

Retroactive date and continuous coverage

The retroactive date in insurance terms is the earliest point in time that an insurance policy will cover an incident or dispute. It is sometimes called the retro date or retroactive date of inception. It is the date that coverage begins.

A retroactive date is a feature of claims-made policies, such as errors and omissions (E&O) and directors and officers (D&O) insurance. It is important because it determines how far back in time an incident can occur for a policy to still provide cover. Claims-made policies will only cover liability claims that surface while the policy is active. The original loss can occur in the past, but to provide a continuous safety net, the policyholder must avoid any gaps in insurance coverage.

The continuity date, or earliest date of continuous coverage, is the earliest date that coverage can be traced back to before any break or gap in that coverage. If the policyholder has maintained coverage with the same insurance company since they first began their coverage, then the retroactive date and the continuity date should be the same.

If the policyholder changes insurance companies, their current insurer may not grant continuity, resulting in a gap in coverage. This is due to the warranty statement that is often found in D&O insurance applications. The warranty statement asks if the insured is aware of any fact, circumstance, or situation that may result in a claim against the organization or any of its directors, officers, or employees. If the insured answers no, then the insurer should honour the continuity date of the prior policy. However, if the insured completes a new application rather than a renewal application, and the new insurer does not acknowledge the continuity date, then the continuity is broken, and coverage is only provided for acts that occurred as of the new retroactive date.

To maintain continuous coverage when switching providers, policyholders can often choose a retroactive date that includes the period of time they held a similar policy with a previous insurer. This ensures that the new policy covers lawsuits regarding incidents that occurred before the switch. It is important to note that the previous insurer will not take any claims after the policy is cancelled, so prior acts coverage should be in place.

The Fine Print of Renewable Term Life Insurance: Understanding Expiry and Renewal Clauses

You may want to see also

Retroactive date and prior acts coverage

Prior acts coverage is an insurance policy feature that covers claims made on insurable events that occurred before a policy was purchased. This is usually sold in the context of liability insurance, which protects entities from legal repercussions for certain activities they undertake that inadvertently cause injury or damage to others. For example, malpractice insurance may cover legal costs and damages in the event a patient sues a medical practitioner for providing negligent care.

Prior acts coverage is particularly important because claims of this nature can take time to adjudicate, and a business could end up filing a claim for an action it committed in the previous year or even earlier. Prior acts coverage ensures that the new insurance company will cover any claims filed for events that occurred after the retroactive date, even if those events took place under a different insurance provider.

The retroactive date is usually the date when the insured first obtains a professional liability policy. This date defines the limitations of prior acts coverage. For example, if a claim is made against the insured and the claim arose from a wrongful act that took place before the retroactive date, there would be no coverage under the policy.

Claims-made policies typically contain a retroactive date limitation, which must be satisfied for the policy to provide coverage. This limitation can be found in a policy's insuring agreement or in an exclusion or endorsement to a claims-made policy. The retroactive date is typically based on the date from which the insured has had uninterrupted professional liability coverage.

Retroactive dates often pre-date the policy's inception, providing coverage for claims that arise from acts or omissions that took place before the policy's start date. A retroactive date that is the same as the policy's inception date means that the act or omission giving rise to the claim must take place during the policy period. Claims-made policies with no retroactive date provide full prior acts coverage, meaning the timing of the act or omission is irrelevant.

A Decade of Security: Unraveling the Benefits of 10-Year Level Term Insurance

You may want to see also

Retroactive date and full prior-acts coverage

Prior acts coverage is an insurance policy feature that covers claims made on insurable events that occurred prior to a policy's purchase. This is typically sold as part of liability insurance, which protects entities from legal repercussions for certain activities they undertake that inadvertently cause injury or damage to others. For example, malpractice insurance may cover legal costs and damages in the event a patient sues a medical practitioner for providing negligent care.

Prior acts coverage usually includes a retroactive date, which is a date in the past before the first date of the current coverage period. The retroactive date dictates when an insured's error or omission giving rise to a claim can take place. The insurance company will then cover any claims filed for events that occurred after the retroactive date, even if the policyholder was covered by a different insurance provider at the time of the event.

However, some policies provide full prior acts coverage, which does not contain a retroactive date. This means that the policyholder will be covered for any claims made during the coverage period, regardless of when the activity giving rise to the claim took place. Insurers typically shy away from offering full prior acts coverage to individuals or businesses who operated without previous liability insurance coverage. This is because such customers likely purchased insurance upon perceiving a heightened risk of claims being filed against them.

Universal Truths: Unraveling the Similarities Between Universal and Term Life Insurance

You may want to see also

Retroactive date and claims-made policies

Retroactive dates are a feature of claims-made insurance policies, such as professional indemnity insurance, errors and omissions (E&O) insurance, and directors and officers (D&O) insurance. Claims-made policies are designed to provide cover when a claim is first made against a business during the policy period. This means that claims are only covered if they are notified or submitted during the period of an active policy.

The retroactive date is the earliest point in time that a claims-made insurance policy will cover an incident or dispute. It is sometimes called the retro date or retroactive date of inception. The retroactive date is usually the date that coverage begins, but it can also be set to a date before the policy was purchased if the policy includes prior acts coverage.

The retroactive date serves two main purposes. Firstly, it eliminates coverage for situations or incidents known to the insured that have the potential to give rise to claims in the future. Secondly, it prevents coverage for obsolete or "stale" claims that arise from events far in the past, even if such events were unknown to the insured. This makes policies more affordable by excluding coverage for events that are remote in time.

There are three common types of retroactive dates: policy inception, specific date, and unlimited. A policy inception retroactive date means that the policy only responds to claims for professional services provided by the insured after the inception of the policy. This type of retroactive date is usually applied when the insured is taking out professional indemnity insurance for the first time. A specific date retroactive date means that the policy covers claims for breaches of professional duty that occurred on or after the specified retroactive date, as long as the claim is received and notified during the policy period. An unlimited retroactive date means that the policy covers claims for breaches of professional duty regardless of when they occurred, as long as the claim is made and notified during the policy period.

When switching insurance providers, it is important to try and maintain continuous insurance coverage. This can be done by choosing a retroactive date that includes the period of time you held a similar policy from a previous insurer. Additionally, if you are renewing a claims-made policy or changing insurers, it is important to try and preserve your policy's original retroactive date.

Understanding Term Insurance Compatibility with Islamic Principles

You may want to see also

Frequently asked questions

A retroactive date is the date on which your insurance coverage begins. It is sometimes called the retro date or retroactive date of inception.

A retroactive date determines how far back in time an incident can occur and still be covered by your current policy. It is the earliest point in time that your insurance policy will cover an incident or dispute.

A retroactive date is the date on which your coverage begins, whereas a policy period is the term over which your policy provides coverage.