Select Term Insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. It offers a death benefit to the policyholder's beneficiaries, which can be used to cover expenses such as mortgage payments, education costs, or everyday expenses. The key advantage of Select Term Insurance is its affordability, with locked-in rates for the chosen term length, making it budget-friendly. Additionally, it offers flexibility, allowing policyholders to choose the length of coverage and the desired amount of protection. This type of insurance is ideal for those seeking temporary coverage for specific financial obligations, such as raising children or paying off loans.

| Characteristics | Values |

|---|---|

| Length of term | 10, 20, or 30 years |

| Coverage amount | $100,000 and above |

| Premium | Level for the term selected; can be paid monthly or annually |

| Coverage beyond level premium term | Up to 95 years of age |

| Death benefit | Tax-free |

| Auto insurance discount | Available if auto insurance is with the same provider |

| Conversion to permanent coverage | Available regardless of state of health |

| Riders | Children's Term Rider, Select Term Rider, Waiver of Premium for Disability |

What You'll Learn

How does term life insurance work?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, such as 10, 15, 20, or 30 years. It is called "term" life insurance because it is designed to cover you for a set amount of time. The key features of term life insurance are that it is generally the most affordable way to buy life insurance, it has a fixed length, and it does not accumulate cash value.

When you buy term life insurance, you choose the length of the term and the coverage amount. The annual costs of the policy remain the same for the duration of the term, but if you outlive the policy, you will not receive any of the premiums paid unless you have a return of premium term life insurance policy. If you pass away while the policy is in force, your beneficiary will receive the death benefit. This benefit is intended to help your beneficiaries cover expenses, such as mortgage payments, education costs, or everyday expenses.

Once the term expires, you have a few options. You can renew the policy, but the premiums will be higher. You can also convert the term life policy to a permanent life policy, such as whole life or universal life insurance. Additionally, you may be able to simply let the term life insurance policy lapse.

Term life insurance premiums are based on factors such as the insured person's age, health, and life expectancy. The insurance company will also consider its business expenses, investment earnings, and mortality rates for each age when setting premiums. In some cases, a medical exam may be required, and the insurance company may inquire about your driving record, current medications, smoking status, occupation, hobbies, and family history.

Weighing the Benefits: Navigating the Decision to Continue Term Insurance

You may want to see also

Who is term life insurance suitable for?

Term life insurance is suitable for people who want to provide a financial safety net for their loved ones for a specific period of time. It is often chosen by those who want an affordable and straightforward option to protect their families in the event of their death. Here are some scenarios where term life insurance may be appropriate:

- Newlyweds or married couples: Term life insurance can provide financial support to a spouse if their partner dies or can no longer contribute to the household income.

- Parents or guardians: This type of insurance is an affordable way to ensure children's financial security if something happens to their parents or guardians.

- Homeowners with a mortgage: Term life insurance can help dependents or family members cover mortgage payments and other debts if the insured person passes away.

- People with specific debts: Term life insurance can be tailored to cover specific debts, such as a child's college education or a co-signed loan.

- Young, healthy individuals: Term life insurance is generally the cheapest option for young and healthy individuals who want high coverage amounts at low premiums.

- Low-income families: Some insurance companies offer free or low-cost term life insurance for low-income parents or guardians to provide financial security for their children's future.

- Older individuals: While term life insurance premiums increase with age, it can still be an option for older individuals who want coverage for a specific period, such as until their children become financially independent.

- Those seeking temporary coverage: Term life insurance is ideal for those who want coverage for a specific period, such as the duration of a mortgage or until their children reach adulthood.

Juggling Multiple Policies: Navigating Short-Term Insurance Overlap with New Coverage

You may want to see also

What are the different types of term life insurance?

Term life insurance is a type of insurance that provides a death benefit to the beneficiaries of the policyholder for a specified period. There are several types of term life insurance, and the best option will depend on individual circumstances. Here are some of the most common types:

Level Term or Level-Premium Policy

The most common type of term life insurance, level-premium insurance, offers a fixed monthly payment for the life of the policy. The death benefit also remains fixed. Level-term policies generally provide coverage for a period ranging from 10 to 30 years. Because actuaries must account for the increasing costs of insurance over time, the level premium is usually higher than that of yearly renewable term life insurance.

Yearly Renewable Term (YRT) Policy

Yearly renewable term policies are one-year policies that can be renewed annually without providing evidence of insurability. While the premiums increase each year as the insured person ages, YRT policies may be a good option for those who need temporary insurance.

Decreasing Term Policy

Decreasing term policies offer a death benefit that declines annually according to a predetermined schedule. The policyholder pays a fixed, level premium for the duration of the policy. Decreasing term policies are often used in conjunction with a mortgage, with the policyholder matching the payout to the declining principal of the home loan.

Return of Premium

With most types of term insurance, if you haven't filed a claim by the time the policy expires, you won't receive a refund of the premium. Some insurers, however, have created term life policies with a "return of premium" feature. The premiums for this type of policy are typically higher, and they generally require that you keep the policy in force until the end of the term.

Convertible Term Life Insurance

Convertible term life insurance is a term life policy that includes a conversion rider. The rider guarantees the right to convert an in-force term policy—or one about to expire—to a permanent plan without additional evidence of insurability. While overall premiums will increase significantly since whole life insurance is more expensive, the advantage is guaranteed approval without a medical exam.

Understanding Franchising in the Insurance Industry: Exploring the Unique Dynamics

You may want to see also

How much does term life insurance cost?

Term life insurance is usually the most affordable option when you want life insurance to cover financial obligations that are temporary. It is the simplest and typically the most affordable type of life insurance. It is designed to help ease financial burdens on your loved ones and help them cover everything from groceries to the mortgage.

The cost of a term life insurance policy is based largely on the insured person's health and age at the beginning of the term. Declining health or increasing age can make it difficult or more expensive to acquire a new term policy as you get older. The younger and healthier you are, the cheaper your premiums.

The cost of a 10-year, $250,000 term life insurance policy is typically between $21 and $29 per month for a healthy 20 to 40-year-old. A 30-year-old woman can get a $20,000 term life insurance policy for less than $8/month. A 55-year-old woman can get a $20,000 policy for around $25.50/month. A $50,000 policy for a healthy 25-year-old woman will cost approximately $14 a month, while a premium for a 55-year-old woman for the same amount would be $60 a month.

The average cost of a 20-year, $250,000 term life insurance policy is $14 a month ($162 a year) for a 30-year-old man and $12 a month ($143 a year) for a 30-year-old woman. The average cost for a 40-year-old man is $19 a month ($226 a year) and $16 a month ($196 a year) for a 40-year-old woman. The average cost for a 50-year-old man is $41 a month ($487 a year) and $32 a month ($387 a year) for a 50-year-old woman.

The average annual rates for a 10-year term life insurance policy for a $500,000 payout are $115 for a 30-year-old man and $95 for a 30-year-old woman. For a 40-year-old man, the average annual rate is $155, and for a 40-year-old woman, it is $125. For a 50-year-old man, the average annual rate is $250, and for a 50-year-old woman, it is $200.

The cost of term life insurance can be very affordable, but it depends on a number of factors, including age, gender, health, lifestyle, occupation, and the length of the term and amount of coverage.

Term Insurance for the Mature: Exploring Options for Peace of Mind at 57

You may want to see also

What happens when the term ends?

When the term ends, you have several options. You can renew your term life insurance every year, but your premiums will likely increase. You can also convert your term life insurance to a permanent life policy, which will remain in force for the rest of your life as long as your premiums are paid on time. Alternatively, you can purchase a new term life policy or a permanent life policy.

Renewing Your Term Life Insurance

When most term life policies reach the end of their level premium, they typically become annually renewable term insurance. This means that if you continue paying the premiums on time, the policy will remain in force and will continue to renew every year until its expiration. However, your premiums will be based on your attained age, so they are highly likely to increase – and not just once, but every year the policy is kept in force.

Converting to a Permanent Life Policy

Most term policies have a conversion privilege, which allows you to convert all or a portion of your coverage to whole life. With a permanent policy, you won't need to worry about your premiums increasing every year because it offers level premiums for as long as you live. Additionally, a permanent policy offers guaranteed cash value, but it may not be as affordable as a term policy.

Purchasing a New Term Life Policy

Another option is to qualify for another term life policy, which will give you guaranteed level premiums for the length of the term. This is a viable choice if you have a specific need for coverage for a certain amount of time, such as helping to provide money to pay off a mortgage or education expenses. However, you may be required to undergo a medical exam to qualify, and depending on your age, you may not qualify for the length of the term policy you want.

Purchasing a Permanent Life Policy

If your term policy does not allow for conversion to a permanent life policy, you can purchase a new permanent life insurance policy after the term policy expires. Permanent life insurance policies are more expensive than term policies, but they offer lifelong coverage and have a tax-deferred cash value account. A portion of the premium is placed in a savings vehicle that grows and can be used as collateral for a loan or withdrawn.

Insurance Contract Litigation: Exploring the Enforceability of 'Against Us' Clauses

You may want to see also

Frequently asked questions

Select Term Insurance is a type of term life insurance offered by State Farm Life Insurance Company and State Farm Life and Accident Assurance Company. It provides coverage for a specified period, typically 10, 20, or 30 years, and guarantees a death benefit to the insured's beneficiaries if they pass away during the term.

When purchasing Select Term Insurance, you choose the length of coverage (10, 20, or 30 years) and the desired coverage amount. The policy's annual costs remain the same during the initial term, and it can be renewed at higher rates after the term ends. If the insured person passes away during the policy term, the beneficiaries receive the death benefit.

Select Term Insurance is designed to provide financial protection for your loved ones in the event of your death. It helps ease the financial burden on your family by covering expenses such as mortgage payments, education costs, or everyday expenses. Additionally, the death benefit is generally tax-free, and you have the option to convert the term policy to permanent coverage if needed.

The cost of Select Term Insurance depends on various factors, including the insured person's age, health, and life expectancy. Premiums are typically higher for older individuals or those with health issues. State Farm offers coverage starting at $100,000, with the initial premium guaranteed for the selected term.

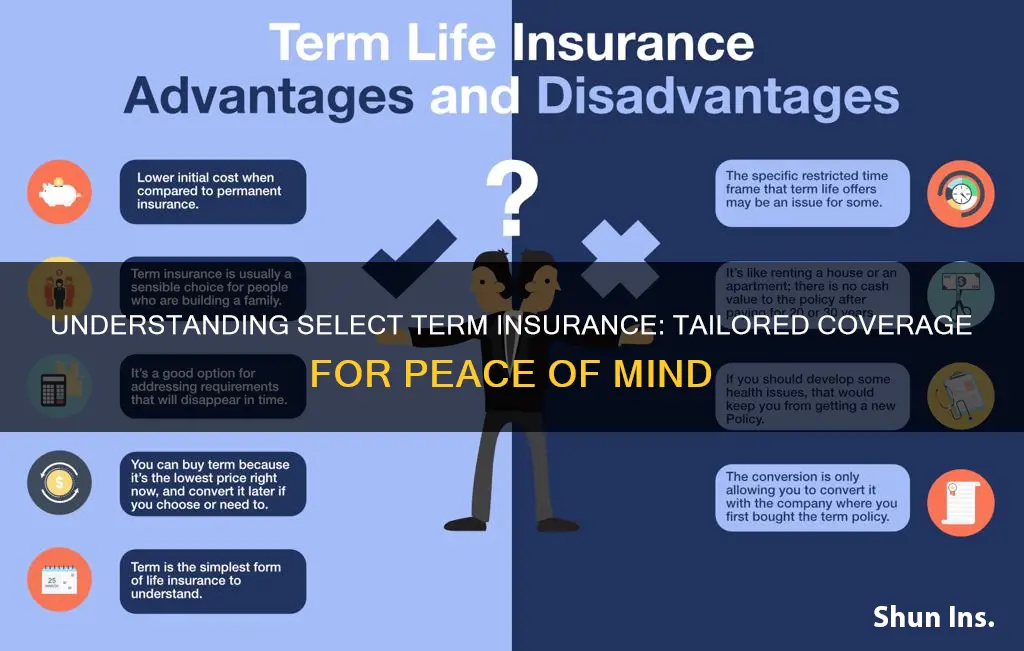

Select Term Insurance is a form of term life insurance, which is generally the most affordable option compared to permanent life insurance. Term life insurance provides coverage for a specified period, whereas permanent life insurance offers lifelong coverage. Additionally, term life insurance does not accumulate cash value, while permanent life insurance policies often include an investment or savings component.