Taxable life insurance is a financial product that combines life coverage with tax benefits. It allows individuals to secure their loved ones' financial future while also providing potential tax advantages. This type of insurance offers a way to build a tax-deferred cash value, which can be used for various purposes, such as funding education, starting a business, or creating a retirement nest egg. Understanding the tax implications of taxable life insurance is crucial for individuals seeking to optimize their financial planning and ensure a stable financial legacy.

What You'll Learn

- Taxable Payouts: Proceeds from life insurance may be taxed as income

- Exclusions: Certain types of insurance are exempt from taxation

- Policy Value: The cash value of a policy can be taxable

- Premiums: Payments made to insurance companies may be deductible

- Estate Taxes: Life insurance proceeds can affect estate tax liability

Taxable Payouts: Proceeds from life insurance may be taxed as income

When an individual receives a life insurance payout, it is important to understand that these proceeds may be subject to taxation. This is a crucial aspect of financial planning that can significantly impact the overall value of the insurance policy. The tax treatment of life insurance payouts can vary depending on several factors, including the type of policy, the beneficiary, and the tax laws in the relevant jurisdiction.

In many countries, life insurance proceeds are generally considered taxable income. This means that the amount received by the policyholder or the designated beneficiary as a result of the insured individual's death is treated as income and is subject to income tax. The tax authorities typically view these payouts as a form of financial compensation or a lump sum payment, which may be taxable in the year it is received. For example, if a person receives a $100,000 life insurance payout, they may be required to pay income tax on that entire amount, depending on their tax bracket and the applicable tax rates.

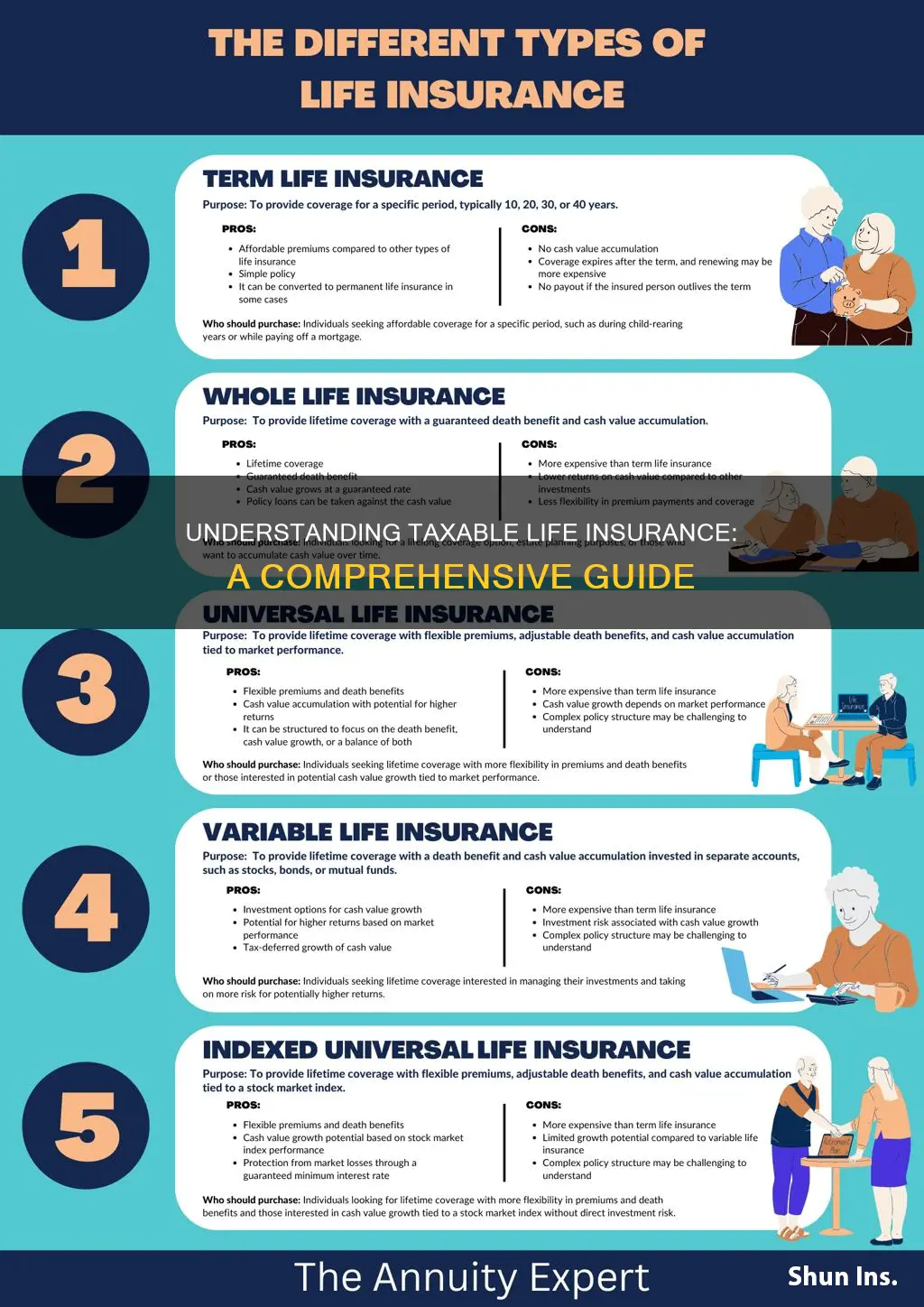

The taxation of life insurance proceeds can be complex and may have specific rules and regulations. One important consideration is the distinction between different types of life insurance policies. Term life insurance, for instance, typically has a fixed payout amount upon the insured's death, and these proceeds are often taxable. On the other hand, permanent life insurance policies, such as whole life or universal life, may have various features, including cash value accumulation, and the tax treatment can vary. In some cases, the cash value growth within these policies may be tax-deferred, allowing policyholders to build up a tax-free investment over time.

It is essential for individuals to be aware of these tax implications when purchasing life insurance. Proper financial planning can help mitigate the tax burden. Strategies such as tax-efficient investing, utilizing tax-advantaged accounts, or structuring the policy in a way that aligns with one's tax situation can be beneficial. Consulting with a tax professional or financial advisor can provide personalized guidance on how to navigate the tax complexities associated with life insurance payouts. Understanding the tax rules and making informed decisions can ensure that the benefits of life insurance are maximized while minimizing potential tax liabilities.

Life Insurance with Cancer: Is Term Coverage Possible?

You may want to see also

Exclusions: Certain types of insurance are exempt from taxation

When it comes to understanding taxable life insurance, it's important to know that certain types of insurance are exempt from taxation, which can provide some financial relief. These exclusions are crucial to consider as they can impact the overall cost and benefits of your insurance policy. Here's a detailed breakdown of the key points:

Health and Accident Insurance: One of the primary exclusions from taxation is health and accident insurance. This type of coverage is designed to protect individuals from the financial burden of medical expenses, accidents, or injuries. Since these policies are intended to provide essential healthcare benefits, they are generally exempt from income tax. This exclusion ensures that individuals can access necessary medical services without incurring additional tax liabilities.

Life Insurance with No Cash Value: Another category of insurance that is often exempt from taxation is life insurance with no cash value. These policies are typically term life insurance plans, which provide coverage for a specified period. As long as the policy does not have any investment or savings components, it may be exempt from taxation. This exclusion is beneficial as it simplifies the tax implications, making it easier for individuals to understand and manage their insurance finances.

Disability Insurance: Disability insurance is designed to replace a portion of your income if you become unable to work due to illness or injury. This type of coverage is crucial for maintaining financial stability during challenging times. Fortunately, disability insurance is generally exempt from taxation, allowing individuals to receive tax-free benefits when they need them the most. This exclusion provides a safety net for those facing unexpected health issues.

Long-Term Care Insurance: As individuals age, the need for long-term care services may become a concern. Long-term care insurance is specifically designed to cover the costs associated with extended periods of care, such as nursing home stays or in-home assistance. This type of insurance is often exempt from taxation, ensuring that individuals can access necessary care without incurring additional tax burdens. This exclusion is particularly valuable for those planning for potential future healthcare needs.

Understanding these exclusions is essential for managing your insurance finances effectively. By recognizing which types of insurance are exempt from taxation, you can make informed decisions about your coverage and potentially save on taxes. It's always advisable to consult with a financial advisor or insurance professional to ensure you are maximizing the benefits of your insurance policies while staying compliant with tax regulations.

Flight Instructor Life Insurance: Is It Worth the Cost?

You may want to see also

Policy Value: The cash value of a policy can be taxable

The concept of taxable life insurance is an important aspect to understand when dealing with insurance policies, especially those with long-term financial implications. When it comes to the policy value, or the cash value of an insurance policy, there are certain tax considerations that policyholders should be aware of.

In simple terms, the cash value of a life insurance policy refers to the amount of money that has accumulated within the policy over time. This value can grow through various means, such as regular premium payments, investment returns, and interest. As the policyholder, you have the option to borrow against this cash value or even take out loans against it. However, it's crucial to understand that this growing cash value is not entirely tax-free.

Tax regulations consider the policy's cash value as a form of investment or savings. When you access or withdraw this cash value, it may be subject to taxation. For instance, if you take a loan against the policy's cash value, you'll typically be required to pay back the loan amount with interest, and this repayment could be taxable income. Similarly, if you surrender the policy or withdraw funds early, you might face tax consequences. The tax implications can vary depending on the type of policy, the jurisdiction, and the specific circumstances of the policyholder.

It is essential to consult with financial advisors or tax professionals to fully comprehend the tax implications related to your insurance policy. They can provide personalized advice based on your unique situation, ensuring you make informed decisions regarding your insurance and financial planning. Understanding the tax treatment of the policy value is a critical step in managing your insurance effectively and minimizing any potential tax liabilities.

Life Insurance: Contesting Concealment and its Limits

You may want to see also

Premiums: Payments made to insurance companies may be deductible

Taxable life insurance is a type of policy that is subject to certain tax implications, particularly regarding the premiums paid to the insurance company. When you purchase a taxable life insurance policy, you make regular premium payments, which are essentially contributions to the policy. These premiums are typically tax-deductible expenses, meaning they can be subtracted from your taxable income, thus reducing your overall tax liability. This tax benefit is an attractive feature for many individuals and businesses, as it provides a way to manage and potentially reduce their tax obligations.

The deductibility of premiums is a significant advantage, especially for high-income earners or businesses with substantial taxable income. By deducting these payments, individuals and entities can effectively lower their taxable income, which can result in a lower tax bill. This is particularly useful for those who want to optimize their financial planning and ensure that their insurance premiums contribute to their overall financial strategy.

To claim the deduction, you must meet specific criteria set by the tax authorities in your jurisdiction. Generally, the premiums must be paid for a taxable life insurance policy that provides coverage for a term of at least one year. Additionally, the policy should be held for the benefit of a person other than the insured, ensuring that the primary purpose of the insurance is not to benefit the insured directly. These rules help distinguish taxable life insurance from other forms of insurance and ensure that the tax benefits are applied appropriately.

It's important to note that the deductibility of premiums may be limited or phased out for certain income levels. Tax laws often impose a cap on the amount that can be deducted, especially for high-income individuals or businesses with substantial premium payments. This limitation ensures that the tax benefit is accessible to a broader range of taxpayers and prevents excessive tax deductions.

Understanding the tax implications of taxable life insurance is crucial for effective financial planning. By recognizing the deductibility of premiums, individuals and businesses can make informed decisions about their insurance choices and overall tax strategy. Consulting with a tax professional or financial advisor can provide personalized guidance on maximizing the tax benefits of taxable life insurance while ensuring compliance with relevant tax regulations.

Life Insurance Payouts: Are They Taxable?

You may want to see also

Estate Taxes: Life insurance proceeds can affect estate tax liability

Estate taxes can significantly impact the value of an individual's estate, and life insurance proceeds are an essential consideration in this context. When a person purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a death benefit, which is the amount paid out upon the insured individual's passing. This death benefit is often a valuable asset within an estate, and its taxation can have a substantial effect on the overall tax liability.

In many jurisdictions, life insurance proceeds are generally not subject to income tax. However, they are typically included in the taxable estate of the deceased. This means that the value of the death benefit must be reported on the estate's tax return, and any applicable estate taxes must be paid. The tax laws surrounding life insurance can be complex, and the rules vary depending on the country and specific state regulations.

The impact of estate taxes on life insurance proceeds is particularly relevant when the death benefit exceeds the individual's adjusted gross estate (AGE). The AGE is calculated by subtracting certain deductions and exclusions from the total value of the estate. If the life insurance payout surpasses the AGE, it may trigger an estate tax liability. For example, in the United States, the federal estate tax exemption amount (as of 2023) is $12.06 million per individual, and any amount exceeding this threshold is subject to taxation.

To minimize the estate tax burden, individuals can employ various strategies. One approach is to utilize life insurance as a tool for wealth transfer. By carefully planning the insurance policy, such as choosing a term life insurance with a specific death benefit, individuals can ensure that the proceeds are paid out to beneficiaries rather than being included in the estate. This strategy can help reduce the overall tax liability, as the proceeds are not subject to estate taxes if they are not part of the deceased's estate.

Additionally, individuals can consider splitting their life insurance policies to take advantage of the federal estate tax exemption. By splitting the policy, the death benefit can be distributed among multiple beneficiaries, potentially reducing the taxable value. It is crucial to consult with financial advisors and tax professionals to navigate these complexities and make informed decisions regarding life insurance and estate planning. Understanding the tax implications of life insurance proceeds is essential for effective estate management and ensuring that one's assets are distributed according to their wishes while minimizing tax obligations.

Standard Life Health Insurance: Maternity Coverage Explained

You may want to see also

Frequently asked questions

Taxable life insurance refers to the proceeds received from a life insurance policy that are subject to income tax. When an insured individual passes away, the death benefit paid to the beneficiaries is typically taxable income for the recipient.

The key difference lies in the tax treatment of the death benefit. Nontaxable life insurance, often provided by certain employers, has death benefits that are not subject to income tax. This type of policy is usually funded through pre-tax dollars, making it tax-free upon payout.

Yes, you should report the death benefit received from taxable life insurance on your tax return. The amount received will be included in your income and taxed accordingly. It's important to provide accurate details to ensure proper tax compliance.

In some cases, there can be exceptions. For instance, if the policyholder had a right to a refund of premiums paid, and the death benefit is less than the total premiums paid, the excess amount may be tax-free. Additionally, certain types of life insurance policies, like those used for estate planning, may have specific tax considerations.

Tax planning strategies can help reduce the tax burden. Consulting a financial advisor or tax professional can provide personalized advice. Strategies may include choosing the right policy type, understanding the tax implications of different payout options, and considering the timing of policy purchases or payouts.