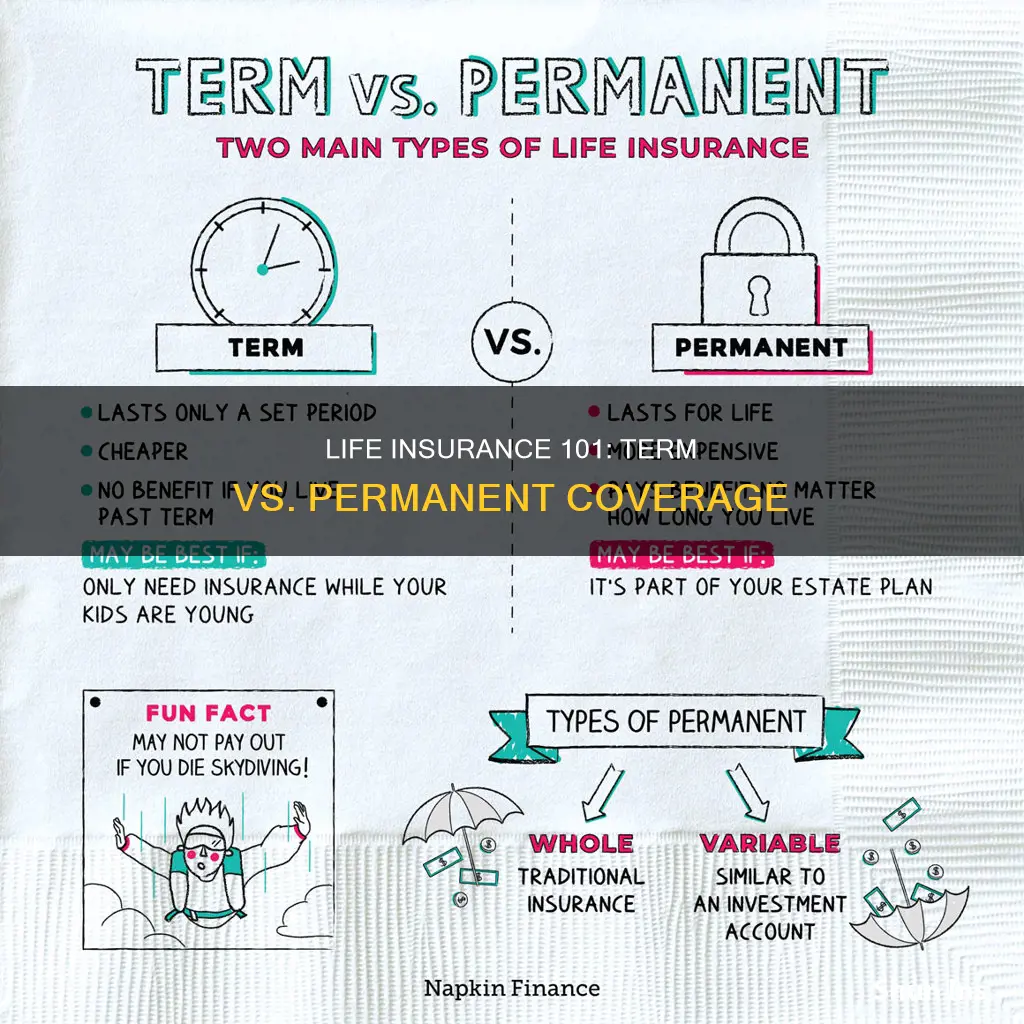

Life insurance is a financial tool that provides coverage and protection for individuals and their loved ones. It offers two main types: term and permanent life insurance. Term life insurance is a temporary policy that provides coverage for a specified period, such as 10, 20, or 30 years. It offers a death benefit if the insured person passes away during the term. On the other hand, permanent life insurance, also known as whole life insurance, provides lifelong coverage and a cash value component that grows over time. This type of insurance offers a death benefit and a guaranteed payout upon the insured's death, making it a long-term financial security option. Understanding the differences between these two types of life insurance is essential for individuals to choose the right coverage based on their needs and financial goals.

What You'll Learn

- Term Life Insurance: Temporary coverage for a specific period, offering affordable protection

- Permanent Life Insurance: Long-term coverage with a cash value component, providing lifelong protection

- Death Benefit: The amount paid to beneficiaries upon the insured's death

- Premiums: Regular payments made to maintain insurance coverage

- Conversion Clause: Option to convert term insurance to permanent insurance

Term Life Insurance: Temporary coverage for a specific period, offering affordable protection

Term life insurance is a type of life insurance that provides coverage for a specific period, often ranging from 10 to 30 years. It is a more affordable and straightforward option compared to permanent life insurance, making it an attractive choice for individuals seeking temporary protection. This type of insurance is designed to offer financial security during a particular phase of life, such as when you have a family to support or significant financial obligations.

The beauty of term life insurance lies in its simplicity and cost-effectiveness. It is a pure insurance product, meaning it primarily focuses on providing a death benefit to the policyholder's beneficiaries if they pass away during the specified term. This benefit is typically paid out as a lump sum, ensuring financial security for the loved ones left behind. The premiums for term life insurance are generally lower because the coverage is limited to a specific duration, and the risk of death is lower during this period compared to permanent insurance.

One of the advantages of term life insurance is its flexibility. Policyholders can choose the duration of coverage that aligns with their needs. For instance, a young professional with a growing family might opt for a 20-year term, ensuring their children's education and other financial commitments are covered. As individuals progress through life, they can reassess their insurance needs and potentially convert their term policy into a permanent one or choose a new term with extended coverage.

When considering term life insurance, it's essential to evaluate your current and future financial obligations. This type of insurance is particularly beneficial for those with temporary financial responsibilities, such as mortgage payments, business loans, or supporting a family. By securing coverage for a defined period, you can rest assured that your loved ones will be financially protected during this critical phase. Additionally, term life insurance can be a strategic tool for wealth accumulation, as the premiums are often lower, allowing more significant portions of your income to be allocated towards savings or investments.

In summary, term life insurance offers a practical and affordable solution for individuals seeking temporary coverage. Its straightforward nature, combined with the ability to choose the term duration, makes it an excellent choice for those with specific financial obligations. By understanding the benefits and flexibility of term life insurance, individuals can make informed decisions to protect their loved ones and manage their finances effectively.

Understanding Fund Value: A Key to Life Insurance Success

You may want to see also

Permanent Life Insurance: Long-term coverage with a cash value component, providing lifelong protection

Permanent life insurance, often referred to as whole life insurance, is a long-term financial product designed to provide coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, permanent life insurance offers lifelong protection. This type of insurance is a comprehensive financial tool that combines insurance coverage with a savings component, making it a valuable asset for individuals seeking both protection and long-term financial growth.

The key feature of permanent life insurance is its ability to accumulate cash value over time. As the insured individual makes regular premium payments, a portion of these payments goes towards building a cash reserve. This cash value grows tax-deferred, providing a substantial savings component. The cash value can be borrowed against or withdrawn, offering financial flexibility and a source of funds that can be used for various purposes, such as funding education, starting a business, or supplementing retirement income.

One of the primary benefits of permanent life insurance is its lifelong coverage. Once the policy is in force, the death benefit is guaranteed to be paid out upon the insured's passing, providing financial security for beneficiaries. This lifelong protection ensures that the insured's family or designated recipients receive the intended financial support, regardless of when the insured passes away. Additionally, permanent life insurance policies typically offer a fixed premium, which remains the same throughout the life of the policy, providing long-term financial stability.

Another advantage is the potential for investment growth. The cash value component can be invested in various investment options offered by the insurance company, allowing the policyholder to benefit from potential market gains. This investment aspect makes permanent life insurance a valuable tool for wealth accumulation and can be particularly attractive to those seeking a more comprehensive financial strategy.

In summary, permanent life insurance offers a unique combination of long-term coverage and a cash value component, providing lifelong protection and financial security. It is a powerful financial tool that can serve multiple purposes, from ensuring the financial well-being of loved ones to building a substantial savings portfolio. Understanding the features and benefits of permanent life insurance is essential for individuals seeking a comprehensive and reliable insurance solution.

Canceling Life Insurance: Over the Phone Possible?

You may want to see also

Death Benefit: The amount paid to beneficiaries upon the insured's death

When it comes to life insurance, understanding the death benefit is crucial as it represents the core purpose of the policy. The death benefit is the financial payout that beneficiaries receive when the insured individual passes away. This amount is predetermined and agreed upon at the time of purchasing the insurance policy. It serves as a safety net for the insured's loved ones, providing financial support during a difficult time.

In term life insurance, the death benefit is straightforward. It is a temporary coverage that provides financial protection for a specific period, often 10, 20, or 30 years. If the insured dies during this term, the beneficiaries receive the death benefit. Term life insurance is known for its simplicity and affordability, making it a popular choice for those seeking short-term coverage. The key advantage is that the policyholder can choose the duration, ensuring the coverage aligns with their specific needs.

On the other hand, permanent life insurance offers long-term financial security. This type of policy provides coverage for the insured's entire lifetime, as long as the premiums are paid. The death benefit in permanent life insurance is typically higher compared to term life, as it accumulates cash value over time. This cash value can be borrowed against or withdrawn, providing policyholders with a financial resource. Permanent life insurance is ideal for those seeking a lifelong financial safety net and the potential for tax-advantaged growth.

The death benefit is a critical aspect of both term and permanent life insurance, as it ensures financial stability for the insured's family or designated beneficiaries. It is essential to carefully consider the coverage amount, ensuring it aligns with the insured's financial obligations and the needs of their loved ones. Adequate coverage can provide peace of mind, knowing that the financial responsibilities will be met even in the event of the insured's passing.

When choosing a life insurance policy, it is advisable to assess your specific circumstances and consult with an insurance professional. They can help determine the appropriate death benefit amount based on your financial obligations, income, and the number of dependents. Understanding the death benefit and its implications is a vital step in making an informed decision about life insurance coverage.

Life Insurance Proceeds and Maryland's Inheritance Tax Laws

You may want to see also

Premiums: Regular payments made to maintain insurance coverage

Term life insurance is a type of coverage that provides protection for a specific period, known as the "term." During this term, the insurance company promises to pay out a predetermined death benefit if the insured individual passes away. This coverage is often more affordable than permanent life insurance because it is designed to meet a particular need for a set duration. The premiums for term life insurance are typically lower compared to other types of policies, making it an attractive option for those seeking cost-effective coverage. These regular payments are essential to ensure that the insurance remains in force and that the policyholder's beneficiaries receive the intended financial support in the event of their death.

When purchasing term life insurance, individuals typically choose a term length that aligns with their specific needs. Common term lengths include 10, 20, or 30 years, after which the policy may be renewed or converted to a permanent policy. The premium amount is calculated based on various factors, including the insured's age, health, lifestyle, and the chosen term length. Younger individuals often pay lower premiums as they are considered less risky by insurance companies.

Premiums are a critical aspect of term life insurance as they determine the cost of maintaining coverage. These payments are usually made annually, semi-annually, quarterly, or monthly, depending on the insurance provider and the policyholder's preferences. It is essential to understand that missing a premium payment can result in the policy becoming inactive, and the coverage may lapse. Therefore, policyholders should set up payment reminders or automate their premium payments to ensure they remain current.

The frequency of premium payments can also impact the overall cost of the insurance. Monthly payments, for instance, may result in slightly higher premiums compared to annual payments, as the insurance company bears the cost of more frequent transactions. However, this frequency can provide peace of mind, knowing that the coverage remains active even if the policyholder forgets to make an annual payment.

In summary, term life insurance premiums are the regular financial contributions required to sustain the insurance policy during the chosen term. These payments are a vital component of the insurance contract, ensuring that the policy remains in force and that the insured individual's beneficiaries are protected. Understanding the factors influencing premium calculations and the importance of timely payments is essential for anyone considering term life insurance.

Globe Insurance: Term Life Insurance Options and Availability

You may want to see also

Conversion Clause: Option to convert term insurance to permanent insurance

The conversion clause is a valuable feature in term life insurance policies, offering policyholders a unique opportunity to enhance their coverage. This clause allows term insurance holders to transform their policy into a permanent life insurance plan without the need for a new application or medical examination. It provides a seamless transition, ensuring that individuals can secure long-term financial protection without any disruptions.

When purchasing term life insurance, individuals typically select a specific period, such as 10, 20, or 30 years, during which the policy provides coverage. While term insurance is an excellent choice for temporary needs, it may not offer the same level of long-term financial security as permanent life insurance. The conversion clause bridges this gap, allowing policyholders to make a strategic decision to convert their term policy into a permanent one.

Upon reaching a predetermined point in the term policy, usually after the first year or a few years, the conversion clause becomes active. At this stage, the policyholder can exercise their right to convert the remaining term insurance into a whole life or universal life policy. This process is often straightforward and requires minimal effort, as the insurance company has already assessed the individual's risk during the initial application.

The conversion option is particularly beneficial for those who initially purchased term insurance as a temporary measure but later realized the need for long-term financial protection. It provides a sense of security, knowing that their coverage can be adjusted to meet changing life circumstances without the hassle of switching providers. Additionally, converting to permanent insurance can offer a guaranteed death benefit, cash value accumulation, and the potential for dividend participation, which are features typically associated with permanent life insurance.

In summary, the conversion clause empowers term insurance holders with the flexibility to adapt their coverage to their evolving needs. It simplifies the process of transitioning from temporary to permanent life insurance, ensuring that individuals can make informed decisions about their financial protection. Understanding this clause and its benefits can help individuals make the most of their insurance policies and provide a sense of security for the future.

Samsung Life Insurance: Benefits for Samsung Employees

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit if the insured person passes away during the term. Permanent life insurance, on the other hand, is a long-term or lifelong coverage option. It includes a death benefit and an investment component, where a portion of the premium goes into an accumulation account, allowing for potential cash value growth over time.

Term life insurance is a straightforward policy that provides coverage for a predetermined period. If the insured individual dies during the term, the beneficiary receives the death benefit. The policy does not have an investment component, and the premiums are typically lower compared to permanent life insurance. After the term ends, the policy may need to be renewed, and the cost could increase.

Permanent life insurance offers several benefits. Firstly, it provides lifelong coverage, ensuring protection for the insured person's entire life. The policy also includes an investment aspect, allowing the policyholder to build cash value over time, which can be borrowed against or withdrawn. Additionally, permanent life insurance offers income tax advantages and can be an effective wealth-building tool.

Yes, many term life insurance policies offer the option to convert to permanent coverage at the end of the term. This conversion allows policyholders to continue their insurance coverage without interruption. The process typically involves a medical examination to determine eligibility for the new permanent policy. It's a convenient way to ensure long-term protection without the need for a new application process.