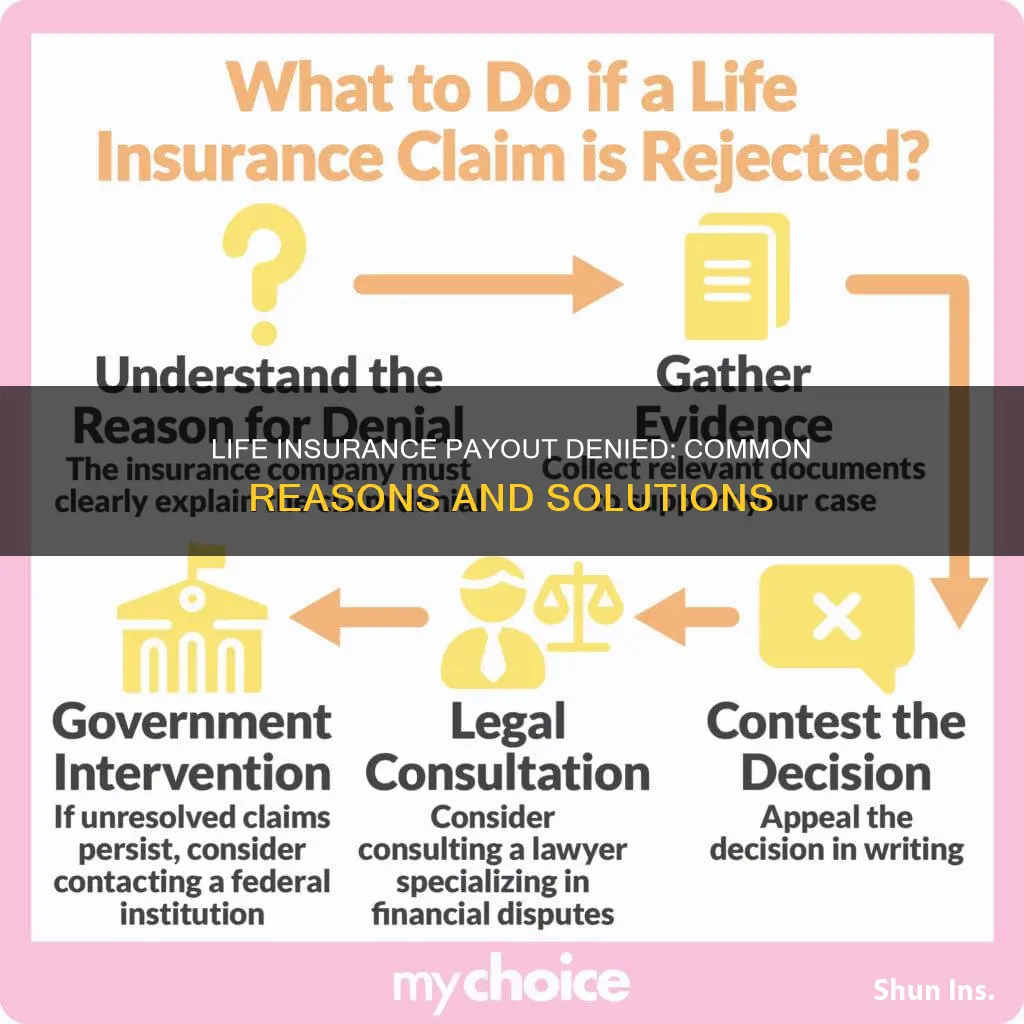

Life insurance is a vital financial tool that provides a safety net for loved ones in the event of the insured's death. However, there are instances where the promised payout may not be received by the intended beneficiaries. This can occur due to various reasons, including administrative errors, missing documentation, or even fraud. Understanding the potential pitfalls and knowing how to navigate the claims process can help ensure that the financial support intended for beneficiaries is received as intended.

What You'll Learn

- Policy Misunderstanding: Lack of clarity on coverage and conditions

- Death Certificate Issues: Incomplete or inaccurate death documentation

- Fraud and Forgeries: False claims or documents can delay or deny payouts

- Medical Negligence: Misrepresentation of health status may void claims

- Legal Disputes: Complexities in beneficiary rights and disputes can halt payments

Policy Misunderstanding: Lack of clarity on coverage and conditions

Many life insurance claims are denied due to a fundamental issue: policyholders often don't fully understand the terms and conditions of their insurance policies. This lack of clarity can lead to unexpected rejections when it's time to make a claim. Here's a breakdown of why this happens and how to avoid it:

The Complexity of Policies: Life insurance policies are intricate documents filled with legal jargon and technical language. They outline specific conditions for coverage, exclusions, and eligibility criteria. These terms can be confusing for the average person, even those who have purchased insurance before. For instance, a policy might exclude coverage for pre-existing conditions, accidents resulting from risky activities, or certain health issues. Without a thorough understanding, policyholders might assume they are covered for situations that are actually excluded.

Misinterpreting Coverage: Even if a policyholder believes they have comprehensive coverage, they might misinterpret what is actually included. For example, a term life insurance policy might provide coverage for a specific period (e.g., 10 years) and only pay out if the insured individual dies during that time. If the policyholder mistakenly believes it's a whole life policy with lifelong coverage, they could be surprised when the claim is denied.

Neglecting Regular Review: Insurance policies are not static documents. They can change over time, especially with policy adjustments or updates. It's crucial to review your policy periodically, especially if you've made significant life changes (e.g., getting married, having children, or purchasing a new home). Failing to update your policy with these changes can lead to gaps in coverage and potential claim denials.

Communicating with the Insurer: When in doubt, it's essential to communicate openly with your insurance provider. If you're unsure about a specific aspect of your policy, ask questions. Insurance companies often have dedicated customer service teams that can explain the terms in simpler language. They can also guide you on how to properly document and submit a claim to ensure a smooth process.

Proactive Approach: To avoid policy misunderstanding, take a proactive approach. Carefully read and understand your policy documents. If needed, seek professional advice from a financial advisor or insurance specialist who can explain the terms in a clear and understandable manner. Regularly reviewing your policy and staying informed about any changes will also help ensure you're aware of any adjustments to your coverage.

Get a Life Insurance License: Colorado Requirements Guide

You may want to see also

Death Certificate Issues: Incomplete or inaccurate death documentation

Life insurance payouts can sometimes be delayed or denied due to various reasons, and one of the most common issues is related to the death certificate. The death certificate is a crucial document that provides official verification of an individual's passing. However, when it comes to life insurance claims, incomplete or inaccurate death documentation can lead to significant problems.

When a person dies, the attending physician or medical examiner is responsible for completing the death certificate. This document should include essential details such as the cause of death, the date of death, and any relevant medical information. Unfortunately, errors or omissions in this critical paperwork can have severe consequences for life insurance claims. Incomplete death certificates may fail to mention pre-existing conditions or underlying health issues that could have influenced the insured individual's death. This lack of information can lead to disputes and delays in the insurance company's decision-making process.

Moreover, inaccurate death certificates can also arise due to human error or negligence. Misspelled names, incorrect dates, or wrong causes of death can all contribute to confusion and uncertainty. Insurance companies rely on accurate and comprehensive death documentation to assess the validity of a claim. If the death certificate contains errors, the insurance provider may request additional evidence or documentation to verify the insured's passing, causing unnecessary delays and frustration for the beneficiaries.

To address this issue, it is crucial for the attending medical professional to ensure the death certificate is completed thoroughly and accurately. This includes providing all relevant medical details, double-checking dates and names, and ensuring that the cause of death is properly documented. In some cases, multiple medical professionals may need to collaborate to ensure the accuracy of the death certificate, especially in complex or unusual circumstances.

Beneficiaries of life insurance policies should also be aware of the importance of obtaining a correct and complete death certificate. They should promptly request a copy of the death certificate from the relevant authorities and review it carefully. If any discrepancies or errors are found, they should take immediate action to rectify the situation, as this can significantly impact the insurance company's decision-making process and potentially affect the payout.

Understanding the Role of the Organization for Life Insurance

You may want to see also

Fraud and Forgeries: False claims or documents can delay or deny payouts

Life insurance is a vital financial safety net, providing peace of mind and financial security to policyholders and their loved ones. However, the process of claiming a payout can sometimes be fraught with challenges, and one of the most significant obstacles is fraud and forgery. These malicious activities not only threaten the integrity of the insurance system but can also result in delayed or denied payouts, causing further distress to those already facing difficult circumstances.

Fraud and forgery in life insurance claims often take various forms. One common tactic is the submission of false or altered documents, such as death certificates, medical records, or even policy documents. These fraudulent documents are designed to deceive the insurance company into believing that the claim is legitimate. For instance, a claimant might forge a doctor's signature on a death certificate, claiming an earlier date of death to expedite the payout. Alternatively, they might manipulate medical records to suggest a pre-existing condition that qualifies for a higher payout.

The impact of such fraudulent activities can be severe. When an insurance company detects forgery or false claims, it triggers a thorough investigation, which can be time-consuming and resource-intensive. During this process, the claim may be temporarily suspended or even denied, leaving the policyholder or their family without the expected financial support. In some cases, the insurance provider may take legal action against the fraudulent claimant, leading to potential legal battles that further delay the payout.

To protect themselves and ensure timely payouts, insurance companies employ various measures. Advanced document verification techniques, including signature verification and forensic document examination, are used to detect forgeries. They also maintain strict internal policies and procedures to identify suspicious claims. It is crucial for policyholders to understand the importance of providing accurate and authentic documentation to avoid any unnecessary delays or rejections.

In summary, fraud and forgery in life insurance claims can significantly impact the timely receipt of payouts. Policyholders and their representatives must be vigilant and ensure that all claims and supporting documents are genuine and accurate. By maintaining transparency and integrity, both the policyholders and the insurance companies can work together to minimize the risks associated with fraud, thereby ensuring that life insurance benefits reach those who need them most without unnecessary delays.

Becoming a Life Insurance Agent in Louisiana: A Guide

You may want to see also

Medical Negligence: Misrepresentation of health status may void claims

The concept of medical negligence and its impact on life insurance claims is a critical aspect to consider when understanding why life insurance payouts may be denied. One of the primary reasons for such denials is the misrepresentation or incorrect disclosure of an individual's health status during the application process. This issue can lead to significant complications and potentially void the entire claim, leaving beneficiaries in a challenging position.

When applying for life insurance, policyholders are required to provide detailed information about their health, including any existing medical conditions, treatments, and past illnesses. Misrepresenting this information, whether intentionally or due to negligence, can have severe consequences. For instance, if an applicant fails to disclose a chronic condition that requires regular medical attention, the insurance company may consider this a breach of the terms and conditions of the policy. In such cases, the insurance provider has the right to deny the claim, especially if the condition significantly impacts the individual's life expectancy or poses a high risk.

Medical professionals play a crucial role in this scenario. Misinterpretation or miscommunication of health status by doctors or healthcare providers can lead to incorrect information being provided to insurance companies. This could result in the insurance provider denying a claim based on inaccurate details. It is essential for individuals to ensure that their medical records are accurate and up-to-date, and that they provide a comprehensive and honest account of their health during the insurance application process.

Furthermore, the insurance industry has strict guidelines and regulations to prevent fraud and ensure fair practices. Misrepresenting health status can be considered fraudulent behavior, and insurance companies take such actions very seriously. They may investigate further, and if evidence of misrepresentation is found, the claim could be rejected, and the policy may be terminated. This highlights the importance of transparency and honesty when dealing with insurance providers.

In summary, medical negligence in the form of misrepresentation of health status can have detrimental effects on life insurance claims. It is crucial for individuals to provide accurate and detailed information about their health to ensure a fair and successful claim process. Understanding the potential risks and consequences of such negligence is essential for both policyholders and insurance companies to maintain trust and integrity in the insurance industry.

The Source of Life Insurance Payouts: Unveiling the Funding Mystery

You may want to see also

Legal Disputes: Complexities in beneficiary rights and disputes can halt payments

Life insurance is a financial safety net designed to provide financial security to beneficiaries upon the insured individual's death. However, the process of receiving a life insurance payout can sometimes be fraught with legal complexities, especially when it comes to beneficiary rights and disputes. These legal disputes can significantly delay or even halt the payment of the insurance benefit, causing financial strain for the intended recipients.

One of the primary reasons for legal disputes in life insurance is the ambiguity or lack of clarity in the beneficiary designation. When an insured person names beneficiaries, they can do so in various ways, such as through a will, a life insurance policy, or even verbally. If the beneficiary information is not clearly documented or if there are multiple conflicting claims, it can lead to legal battles. For instance, if the insured person had named multiple individuals as beneficiaries in different documents, and these documents are not properly executed or witnessed, it may result in a legal challenge regarding the validity of the beneficiary's claim.

The complexity of beneficiary rights is further exacerbated by the various types of life insurance policies available. Term life insurance, whole life insurance, and universal life insurance each have unique features and payout structures. Understanding the specific terms and conditions of the policy is crucial for beneficiaries to know their rights and entitlements. Misinterpretation or misunderstanding of the policy terms can lead to disputes, especially if the insurance company argues that certain conditions were not met for a payout to be made.

In many cases, legal disputes arise when beneficiaries contest the validity of the insured person's will or the appointment of an executor or administrator. If the insured individual did not have a valid will or if there are disputes regarding the interpretation of the will, it can lead to lengthy legal proceedings. During this time, the insurance company may be required to hold the payout in trust, causing a significant delay in the financial support that the beneficiaries were entitled to receive.

Additionally, the process of resolving legal disputes can be costly and time-consuming. Beneficiaries may need to hire legal counsel to represent their interests, which can further delay the payout. The insurance company also has a responsibility to investigate and resolve any disputes, which can involve extensive documentation and legal proceedings. These factors contribute to the potential for prolonged delays in receiving the life insurance benefit.

In conclusion, legal disputes related to beneficiary rights and policy interpretation can significantly impact the timely payment of life insurance benefits. It is essential for insured individuals to ensure that their beneficiary information is clearly and accurately documented, and for beneficiaries to understand their rights and the specific terms of the insurance policy. Seeking legal advice and promptly addressing any disputes can help mitigate the complexities and potential delays associated with life insurance payouts.

Uncover the Secrets: Essential Questions to Ask Your Life Insurance Agent

You may want to see also