Whole life insurance is a type of permanent life insurance that provides coverage for your entire life as long as you pay the premiums. It is a good option for those who want lifelong coverage and don't mind paying higher rates for it. Whole life insurance typically comes with a cash value component, which can be used to supplement your retirement income, help pay for your children's education, or grow your business. The policy also provides peace of mind, knowing that your loved ones will be financially protected regardless of when you pass away. However, it's important to note that whole life insurance costs significantly more than term life insurance due to the difference in cash value and policy length. So, can you purchase whole life insurance at any age?

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Coverage | Lifelong |

| Premium | Higher than term life insurance |

| Cash Value | Yes |

| Beneficiaries | Spouses, children, business partners, trusts, charities |

| Age | Can be purchased at any age |

What You'll Learn

- Whole life insurance is a permanent policy that offers lifelong coverage

- Whole life insurance can be purchased at any age, but the younger and healthier you are, the lower your premium will be

- Whole life insurance has a cash value that grows over time and can be used for various expenses

- Whole life insurance is more expensive than term life insurance but offers more benefits

- Whole life insurance is a good option for those with long-term financial needs, such as owning a business or having a pension plan

Whole life insurance is a permanent policy that offers lifelong coverage

Whole life insurance policies also differ from term life insurance in that they have a cash value component. This means that a portion of each premium payment is deposited into a separate account that the insurance company controls. This account functions as a tax-deferred savings or investment account, with the funds able to be accessed by the policyholder in several ways, including withdrawals, loans, or the payment of premiums. The cash value of the policy typically increases over time, and can be used to supplement retirement income, help pay for a child's education, or grow a business.

Whole life insurance policies also provide a death benefit, which is a guaranteed payout to the policy's beneficiary upon the death of the insured. This death benefit remains the same regardless of how long the policyholder lives. In addition, the payout is generally tax-free for the beneficiary, although any interest earned on the benefit may be taxable.

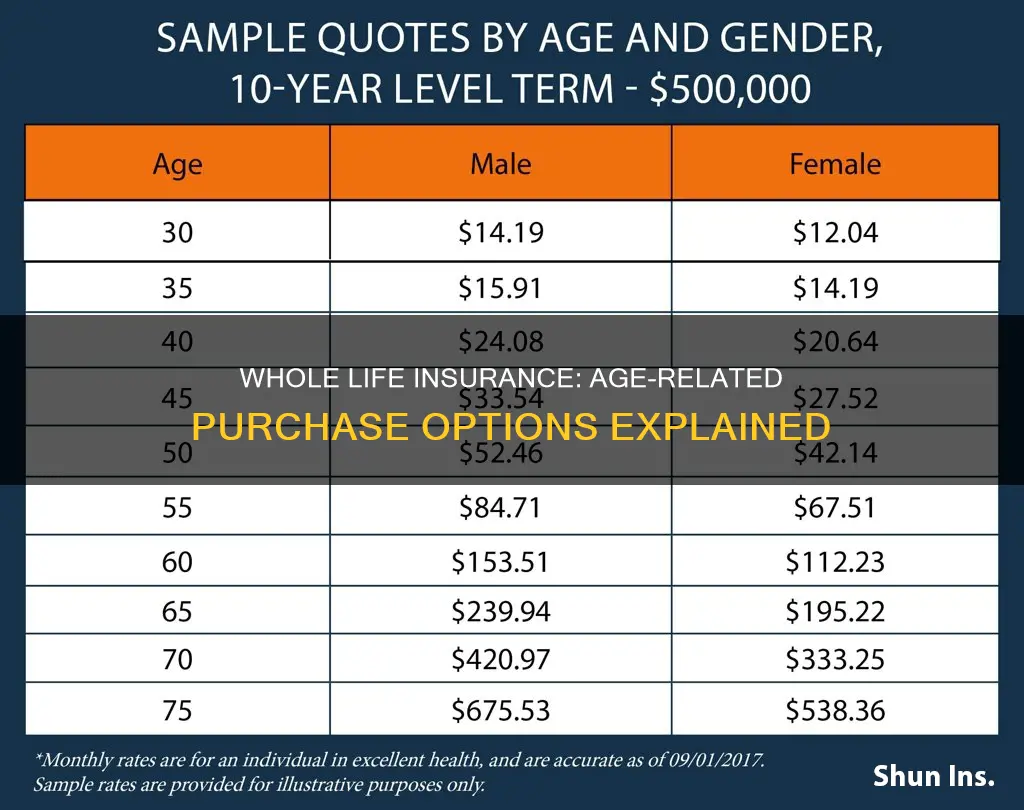

The cost of whole life insurance varies depending on several factors, including age, health, gender, and the specific policy chosen. Generally, the younger and healthier a person is when they purchase a policy, the lower their premiums will be. Whole life insurance policies also typically cost more than term life insurance policies due to the lifelong coverage and the addition of a cash value component.

While whole life insurance offers the advantage of lifelong coverage and a savings component, it may not be the best option for everyone. Term life insurance, for example, may be more affordable for those on a tight budget or who only need coverage for a limited period. Ultimately, the decision to purchase whole life insurance depends on an individual's financial obligations, goals, and preferences.

Adjustable vs. Flexible Life Insurance: What's the Difference?

You may want to see also

Whole life insurance can be purchased at any age, but the younger and healthier you are, the lower your premium will be

Whole life insurance is a permanent life insurance policy that provides coverage for your entire life or as long as you pay the premiums. It offers a guaranteed death benefit and a cash value component that grows over time. While you can purchase whole life insurance at any age, it is important to understand that the younger and healthier you are, the lower your premium will be.

Age and health are significant factors in determining the cost of life insurance. As we get older, our health tends to deteriorate, and we become more susceptible to various medical conditions. Insurers consider individuals in their 20s and 30s less risky to insure, which translates to lower premiums. For example, a 30-year-old non-smoker in good health may pay around $451 per month for a $500,000 whole life insurance policy. On the other hand, waiting until you are 40 or 50 years old will significantly increase the premium, with rates potentially exceeding $785 or even $1,000 per month, respectively, for the same level of coverage.

By purchasing whole life insurance at a younger age, you can lock in lower rates and ensure that your loved ones have a financial safety net. This is especially beneficial if you have dependents, as the death benefit can help cover their living expenses and debts in the unfortunate event of your passing. Additionally, the cash value component of whole life insurance can serve as a savings or investment tool, providing additional financial security.

While the cost of whole life insurance may be a deterrent for some, it is important to consider the long-term benefits. The peace of mind that comes with knowing your loved ones are financially protected, regardless of when you pass away, is invaluable. Furthermore, the cash value component can be accessed during your lifetime to supplement retirement income, fund a new business venture, or assist with significant expenses such as purchasing a home or education costs.

In conclusion, while whole life insurance can be purchased at any age, doing so when you are younger and healthier will result in lower premiums. This not only provides financial protection for your loved ones but also offers additional benefits that can enhance your financial portfolio and security.

Life Insurance: Exploring Unique Characteristics and Features

You may want to see also

Whole life insurance has a cash value that grows over time and can be used for various expenses

Whole life insurance is a permanent life insurance policy that provides coverage for your entire life, regardless of your age when you pass away. It is a type of permanent life insurance, which also includes universal and variable life insurance. As long as you pay your premiums, the policy will pay out a death benefit to your beneficiaries when you die.

Whole life insurance has a cash value component that grows over time and can be used for various expenses. This cash value is a tax-favoured investment account within the policy. A portion of your premium payments goes into the cash value, which grows through interest accruals and, if you choose, dividends. This cash value can be accessed during your lifetime and used for various expenses.

The cash value in a whole life insurance policy grows at a fixed rate determined by the policy's terms. This accumulation typically starts slowly and then picks up pace over time. The growth rate is influenced by factors such as premiums paid, dividends received, and interest earnings. While the cash value can be accessed during the policyholder's life, it is important to note that withdrawals or loans from the cash value will reduce the death benefit payout to beneficiaries.

The cash value of a whole life insurance policy can be used for various expenses, including:

- Paying policy premiums

- Taking out loans at lower rates than banks offer

- Creating an investment portfolio

- Supplementing retirement income

- Funding a new business

- Purchasing a home

- Paying for education expenses

Whole life insurance policies also offer the advantage of locked-in premiums. This means that, unlike term life insurance, the premium remains the same throughout the duration of the policy. This can make whole life insurance a more expensive option than term life insurance but provides the benefit of predictable payments.

Canceling Life Insurance: What You Need to Know

You may want to see also

Whole life insurance is more expensive than term life insurance but offers more benefits

Whole life insurance is a permanent life insurance policy that provides coverage for your entire life, whereas term life insurance covers a specific period, such as 10, 15, or 20 years. Whole life insurance is more expensive than term life insurance, but it offers several additional benefits that may make it a more appealing option depending on your circumstances.

One of the key advantages of whole life insurance is that it offers lifelong protection. Unlike term life insurance, which expires after a set number of years, whole life insurance remains in place as long as you continue to make premium payments. This means that your loved ones will receive a death benefit regardless of when you pass away. Whole life insurance also offers a cash value component that grows over time, providing a source of funds for future needs. This cash value can be borrowed against or withdrawn while you are still alive, making it a flexible financial tool. The cash value growth is guaranteed and accumulates tax-free, providing a valuable addition to your financial portfolio.

Whole life insurance policies also offer the advantage of fixed premiums, which means you pay the same rate throughout the duration of the policy. This can make budgeting easier and, over time, may make the premiums seem relatively affordable. Additionally, whole life insurance policies often include living benefits and other riders that provide extra coverage and features.

However, it is important to consider the drawbacks of whole life insurance. The main disadvantage is the significantly higher cost compared to term life insurance. The higher premiums may be a financial burden for some individuals, and the complexity of the policies can also be overwhelming. Additionally, if you take out a loan or withdrawal from the cash value, your death benefit will be reduced by the corresponding amount unless you repay it.

In summary, while whole life insurance is more expensive than term life insurance, it offers the benefits of lifelong coverage, a cash value component, fixed premiums, and additional living benefits. These advantages need to be weighed against the higher cost and complexity of whole life insurance when deciding which type of policy is best suited to your needs.

Life Insurance for Seniors: Options for 60-Year-Olds

You may want to see also

Whole life insurance is a good option for those with long-term financial needs, such as owning a business or having a pension plan

For business owners, whole life insurance can be a valuable tool for holistic financial strategy and protection. It can help fill the gap left by a lack of certain retirement plans, employer-sponsored life insurance, or sick pay that may be available to employees of larger companies. The cash value of a whole life insurance policy can be used to cover business expenses, such as rent or disaster-related costs, or to fund business expansion. Additionally, the death benefit provided by whole life insurance can help protect your business in the event of your death or that of a key employee.

Whole life insurance can also be beneficial for those with pension plans. It can be purchased through some qualified retirement plans, like a 401(k) or a pension, allowing you to pay for the coverage using pre-tax dollars and providing tax advantages. The cash value component of whole life insurance can serve as an alternative to saving, providing guaranteed growth that is insulated from market downturns. This can be especially useful for retirement income, although it should ideally be complemented by other retirement investments, such as an IRA or 401(k) plan.

The permanent nature of whole life insurance, with its guaranteed cash value accumulation and consistent premiums, makes it a good option for those seeking long-term financial security and stability. However, it is important to consider the higher costs associated with whole life insurance compared to term life insurance and the potential for lower returns over time. Consulting a financial professional can help individuals determine if whole life insurance aligns with their specific long-term financial needs and goals.

Life Insurance Payout: Impact on Scholarship Money

You may want to see also

Frequently asked questions

Whole life insurance is a permanent life insurance policy that covers you for your entire life, as long as you keep up with premium payments. It also has a cash value component that can be used during your lifetime.

Whole life insurance offers a guaranteed death benefit, a cash value that is insulated from market fluctuations, and tax-advantaged funding options. It also provides peace of mind, knowing that your loved ones will be financially protected no matter when you pass away.

Yes, whole life insurance can be purchased at any age. However, it is generally recommended to buy life insurance as early as possible, as the premiums are typically lower when you are younger and healthier.

The cost of whole life insurance depends on various factors, including age, health, gender, and the specific policy. For example, a $500,000 whole life insurance policy for a 30-year-old non-smoker in good health may cost around $450 to $550 per month.

When choosing a whole life insurance policy, it is important to determine your coverage needs, gather multiple quotes from different companies, and consider the added benefits offered by each insurer, such as dividend payments or waiver of premium riders.