Term conversion life insurance is a financial product that offers a unique way to secure long-term coverage and financial protection. It allows individuals to convert their term life insurance policies into permanent life insurance, providing a sense of security and peace of mind. This type of insurance is particularly useful for those who initially purchased term life insurance for a specific period, such as 10, 20, or 30 years, and now want to ensure their loved ones are protected for the rest of their lives. By converting, policyholders can lock in their current rates and benefits, ensuring that their coverage remains affordable and comprehensive as they age. Additionally, term conversion life insurance can be a strategic financial move, as it may offer tax advantages and the potential to build cash value over time, providing both insurance protection and a source of money for future financial goals.

What You'll Learn

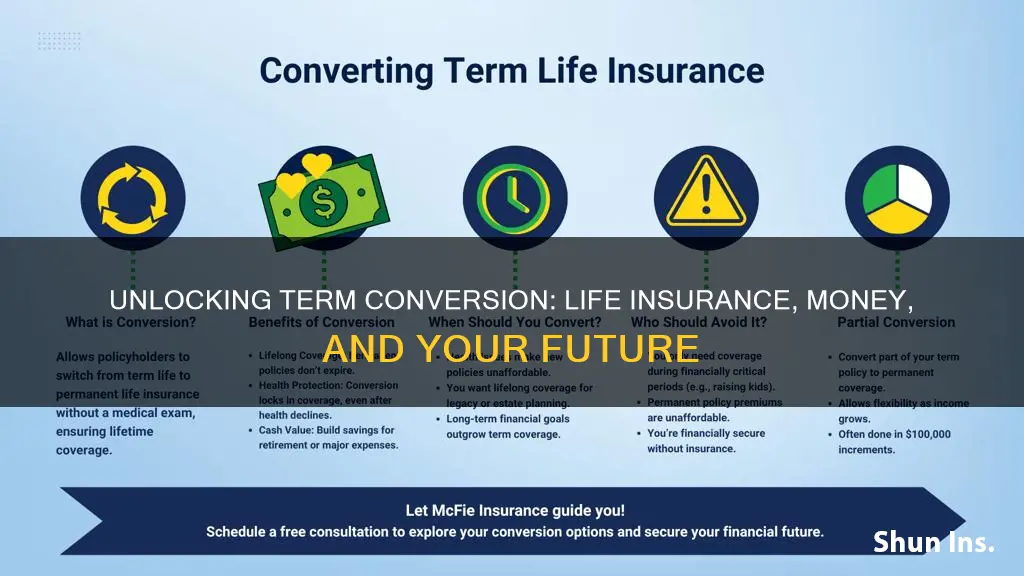

- Definition: Conversion life insurance is a policy that can be changed to a permanent plan

- Benefits: It offers flexibility and potential savings compared to term life

- Cost: Premiums may be higher, but it provides long-term coverage

- Term vs. Permanent: Conversion allows you to switch from term to permanent insurance

- Financial Planning: This type of insurance is a valuable tool for financial security

Definition: Conversion life insurance is a policy that can be changed to a permanent plan

Conversion life insurance is a unique feature in the life insurance industry, offering policyholders a valuable option to adapt their coverage to their evolving needs. This type of policy is designed with flexibility in mind, allowing individuals to transform their term life insurance into a permanent, whole life insurance plan. Understanding this concept is essential for anyone considering long-term financial protection.

When you purchase a term life insurance policy, it typically provides coverage for a specified period, often 10, 20, or 30 years. During this term, the policy offers financial protection to your beneficiaries if you were to pass away. However, once the term ends, the coverage usually expires unless you decide to convert it. This is where the concept of conversion life insurance comes into play.

Conversion life insurance empowers policyholders to make a simple yet powerful decision. At the end of the term, or even before, you have the option to convert your term policy into a permanent one. This conversion process ensures that your insurance coverage continues without interruption, providing lifelong protection. The beauty of this feature is that it allows you to lock in the current rates and benefits, often at a lower cost compared to purchasing a new permanent policy.

The process of conversion is straightforward. You notify your insurance company of your intention to convert, and they will guide you through the necessary steps. This may involve a medical examination to assess your current health and ensure the continued viability of the policy. Once converted, your new permanent policy will have a cash value component, which can accumulate over time, providing a financial benefit in addition to the death benefit.

In summary, conversion life insurance is a strategic tool for those seeking long-term financial security. It offers the advantage of flexibility, allowing individuals to start with a term policy and, when the time is right, transform it into a permanent solution. This ensures that your insurance coverage remains relevant and effective throughout your life, providing peace of mind and financial protection for your loved ones. Understanding this feature can be a game-changer in your financial planning journey.

Life Insurance: Medication's Impact on Eligibility

You may want to see also

Benefits: It offers flexibility and potential savings compared to term life

Term conversion life insurance is a valuable financial tool that provides individuals with a unique advantage in the life insurance market. One of its key benefits is the flexibility it offers policyholders. Unlike traditional term life insurance, which is designed for a specific period, conversion options allow policyholders to transform their term life insurance into a permanent policy without the need for a medical examination or additional underwriting. This flexibility is particularly advantageous for those who initially opt for term life insurance due to its affordability and simplicity but later realize the need for long-term coverage.

The ability to convert is especially beneficial for individuals who experience changes in their health or financial situation over time. For instance, a young professional might start with a 10-year term policy to cover their family during their initial years of earning. As their career progresses and they secure a more stable financial position, they can decide to convert their term policy into a permanent life insurance plan, ensuring their loved ones are protected for life without the hassle of reapplying for insurance. This flexibility is a significant advantage, especially for those who want to adapt their insurance coverage as their life circumstances evolve.

In addition to flexibility, term conversion life insurance can also lead to potential savings. Term life insurance is generally more affordable than permanent life insurance because it provides coverage for a specific period, typically 10, 20, or 30 years. By converting to a permanent policy, individuals can avoid the potential rate increases associated with permanent life insurance, especially if their health status has improved since the initial term policy was taken out. This can result in significant savings over the long term, as permanent policies often have higher premiums but offer lifelong coverage.

Furthermore, the conversion process can be seamless and straightforward, allowing individuals to continue their insurance coverage without interruption. This is particularly important for those who have already built a relationship with an insurance provider and are comfortable with their services. By converting, they can maintain the same level of trust and potentially benefit from any loyalty programs or discounts offered by the company. This continuity can provide peace of mind, knowing that one's insurance needs are being met efficiently and effectively.

In summary, term conversion life insurance offers a flexible and cost-effective solution for individuals seeking long-term protection. The ability to convert term policies into permanent coverage without additional medical requirements provides a valuable option for those who want to adapt their insurance as their life progresses. Additionally, the potential for savings by avoiding permanent policy rate increases and maintaining a seamless conversion process makes it an attractive choice for those looking to secure their loved ones' financial future.

Gender's Role in Life Insurance: A Complex Dynamic

You may want to see also

Cost: Premiums may be higher, but it provides long-term coverage

Term conversion life insurance is a financial product that offers a unique and valuable feature: the ability to convert a term life insurance policy into a permanent life insurance policy. This conversion option is a significant advantage for those seeking long-term financial protection and peace of mind. While it may come with a higher cost in the form of premiums, the long-term benefits it provides are substantial.

When considering term life insurance, it's essential to understand the time-bound nature of these policies. Term life insurance is designed to provide coverage for a specific period, often 10, 20, or 30 years. During this term, the policyholder pays regular premiums to the insurance company, and in return, the insurer promises to pay a death benefit to the policy's beneficiaries if the insured individual passes away within the specified period. However, once the term ends, the policy typically expires, and the coverage ceases unless the policyholder decides to convert it.

The conversion feature is a powerful tool for those who want to ensure their loved ones are protected for an extended period. By converting a term policy, you can transform it into a permanent life insurance policy, often referred to as whole life or universal life insurance. This conversion process allows the policy to continue providing coverage for the rest of the policyholder's life, offering long-term financial security. While the initial premiums for term life insurance might be lower, the conversion option ensures that the coverage remains in place, even if the policyholder's health or financial situation changes over time.

The cost of term conversion life insurance can be higher compared to standard term life policies, especially when considering the long-term commitment. However, this increased cost is justified by the extended coverage and the peace of mind it provides. As the policyholder ages, the likelihood of developing health issues that could affect insurance rates increases. By converting to a permanent policy, individuals can lock in their current rates, ensuring that their coverage remains affordable and comprehensive throughout their lives.

In summary, term conversion life insurance is a strategic financial decision for those seeking long-term protection. While the premiums may be higher initially, the conversion option allows individuals to secure coverage for their entire lives, providing a safety net for their families and loved ones. This feature is particularly beneficial for those who want to avoid the complexities of shopping for new insurance policies as they age or experience changes in their health or financial circumstances.

Trusts: The Best Life Insurance Beneficiary Option?

You may want to see also

Term vs. Permanent: Conversion allows you to switch from term to permanent insurance

Term life insurance is a type of coverage that provides protection for a specific period, typically 10, 20, or 30 years. It is a cost-effective way to secure financial protection for your loved ones during a defined period. When you purchase term life insurance, you agree to pay premiums for the duration of the policy, and in return, you receive a death benefit if you pass away during that term. This type of insurance is ideal for individuals who want to provide financial security for their families without the long-term commitment of a permanent policy.

On the other hand, permanent life insurance, also known as whole life or universal life, offers lifelong coverage. This means that once you purchase a permanent policy, you will have protection for as long as you remain insured, regardless of age or health changes. Permanent life insurance policies accumulate cash value over time, which can be borrowed against or withdrawn, providing a financial safety net. While permanent insurance is more expensive than term, it offers the advantage of long-term financial security and potential investment opportunities.

Now, let's talk about the concept of conversion. Conversion allows policyholders to switch from a term life insurance policy to a permanent one. This option is particularly beneficial for those who initially purchased term life insurance for a specific period, such as when they were young and healthy, and now want to ensure long-term coverage. By converting, you can lock in the current rates and benefits of a permanent policy, often at a lower cost compared to purchasing a new permanent policy. This process provides flexibility and allows you to adapt your insurance needs as your life circumstances change.

The conversion process typically involves notifying your insurance company of your intention to convert. You may need to provide updated health information and undergo a medical examination to ensure you qualify for the new permanent policy. Once approved, your term policy will be terminated, and a new permanent policy will be issued with the agreed-upon coverage and benefits. This transition can be advantageous as it ensures that you continue to have coverage without any gaps, especially if your health has changed since the initial term policy purchase.

Term-to-permanent conversion is a strategic move that allows individuals to start with a cost-effective term policy and then upgrade to a permanent one when their financial situation and insurance needs evolve. This approach provides a seamless transition, ensuring that you maintain coverage without the hassle of shopping for a new policy or undergoing a new medical evaluation. It is a smart financial decision for those who want to maximize their insurance benefits while managing their expenses effectively.

American General Life Insurance: Is It Part of AIG?

You may want to see also

Financial Planning: This type of insurance is a valuable tool for financial security

Term conversion life insurance is a financial strategy that offers a unique and powerful way to secure your family's financial future. It is a type of life insurance that provides coverage for a specific period, known as the "term," during which the insured individual's life is protected. This insurance is particularly valuable for those seeking a straightforward and cost-effective way to ensure their loved ones are financially protected.

In the context of financial planning, term conversion life insurance plays a crucial role in several ways. Firstly, it provides a safety net for your family in the event of your untimely passing. During the term, if the insured individual passes away, the policy pays out a death benefit to the designated beneficiaries, ensuring financial stability for the family. This is especially important for those with dependents, as it guarantees a steady income to cover essential expenses, such as mortgage payments, education costs, or daily living expenses.

The beauty of term conversion lies in its simplicity and flexibility. It is designed to be a temporary solution, allowing individuals to focus on other financial goals during the term. For example, a young professional might choose a 10-year term policy to cover their family while they build their career and save for the future. As the term ends, the policy can be converted into a permanent life insurance policy, providing lifelong coverage without the need for a new medical examination, ensuring continued financial security.

This type of insurance is an excellent tool for those who want to maximize their financial resources. By utilizing term conversion, individuals can allocate their funds efficiently, ensuring comprehensive coverage without breaking the bank. The cost of term life insurance is generally lower compared to permanent policies, making it an attractive option for those seeking affordable protection. Moreover, the conversion feature allows for a seamless transition, providing long-term peace of mind.

In summary, term conversion life insurance is a powerful financial planning tool. It offers a practical approach to securing your family's financial future by providing temporary coverage with the option to convert to permanent insurance. This strategy enables individuals to protect their loved ones and manage their finances effectively, ensuring a stable and secure environment for their family's well-being. By understanding the benefits of term conversion, individuals can make informed decisions to safeguard their financial interests.

COPD and Life Insurance: What's the Deal?

You may want to see also

Frequently asked questions

Term conversion life insurance is a type of life insurance policy that allows you to convert a term life insurance policy into a permanent life insurance policy, typically whole life or universal life, after a certain period. This option provides flexibility, allowing you to secure long-term coverage without the need for a new medical examination, as the conversion is based on the initial term policy's terms and rates.

Term conversion can be advantageous as it ensures that your loved ones are protected by a permanent insurance policy without the need for a new application process, which might be more complex and costly. It also allows you to lock in current rates, providing financial security and potentially saving money compared to purchasing a new permanent policy.

Yes, there are certain conditions to consider. The conversion privilege may only be available for a specific period, usually after the initial term policy's first year. Additionally, the insurance company might have specific requirements for the term policy's coverage amount and other terms to be eligible for conversion. It's essential to review the policy details and consult with an insurance advisor to understand the terms and limitations.

Absolutely. Term conversion typically offers the option to convert to various permanent life insurance policies, such as whole life or universal life. Each type has its own features and benefits, allowing you to choose the one that best suits your financial goals and long-term needs. This flexibility ensures that you can make the most suitable decision for your insurance coverage.