Term life insurance is a type of life insurance that provides coverage for a specific period, or term, typically ranging from 10 to 30 years. While the primary purpose of term life insurance is to offer financial protection to beneficiaries in the event of the insured's death during the term, it also has an additional feature known as cash value. Cash value is the accumulation of a portion of the premiums paid into a savings component within the policy. This cash value can grow over time, and policyholders can access it through policy loans or surrender the policy for its cash value. Understanding the concept of cash value is essential for those considering term life insurance, as it can provide a financial safety net and even act as a long-term savings tool.

What You'll Learn

- Definition: Term life insurance with cash value is a type of permanent life insurance that builds cash value over time

- How it Works: It combines death benefit and investment features, allowing policyholders to borrow against or withdraw funds?

- Benefits: Offers guaranteed death benefit, potential investment returns, and flexibility to build wealth

- Comparison: Unlike term life, it provides long-term financial security and investment opportunities

- Tax Advantages: Cash value can grow tax-deferred, providing tax benefits when withdrawn or borrowed against

Definition: Term life insurance with cash value is a type of permanent life insurance that builds cash value over time

Term life insurance with cash value is a unique and valuable form of permanent life insurance. It offers both the essential protection of term life insurance and the long-term savings potential of a cash value component. This type of insurance is designed to provide financial security and peace of mind for individuals and their families.

As a permanent life insurance policy, it remains in force for the entire duration of the term, typically 10, 20, or 30 years, or even for the insured's lifetime. During this period, the policyholder pays regular premiums, which are invested by the insurance company. The key feature is the accumulation of cash value, which grows over time through interest and investment returns. This cash value can be borrowed against or withdrawn, providing a source of funds for various financial needs.

The cash value component of the policy is a type of investment account within the insurance policy. It allows the policyholder to build a savings account that can grow tax-deferred. As the policy earns interest and investment returns, the cash value increases, providing a financial asset that can be utilized or passed on to beneficiaries. This aspect sets term life insurance with cash value apart from traditional term life insurance, as it offers a way to build wealth alongside providing coverage.

One of the advantages of this type of insurance is the flexibility it offers. Policyholders can choose the amount of coverage and the term length that best suits their needs. Additionally, the cash value can be used to pay for future premiums, ensuring the policy remains in force even if the primary source of funding changes. This flexibility is particularly beneficial for those who want both insurance protection and a long-term savings strategy.

In summary, term life insurance with cash value is a powerful financial tool that combines the security of term life insurance with the potential for long-term savings. It provides individuals with a way to protect their loved ones while also building a valuable asset. Understanding this concept is essential for anyone considering permanent life insurance as part of their financial planning strategy.

Contacting AIG Life Insurance: A Step-by-Step Guide

You may want to see also

How it Works: It combines death benefit and investment features, allowing policyholders to borrow against or withdraw funds

Term life insurance with cash value is a unique financial product that offers both a death benefit and investment opportunities, providing policyholders with a versatile and potentially valuable tool for their financial planning. This type of insurance is designed to provide coverage for a specific period, known as the "term," during which the policyholder pays regular premiums. The key feature here is the accumulation of cash value, which is a significant aspect that sets it apart from traditional term life insurance.

As the policyholder makes premium payments, a portion of the premium goes towards building up the cash value. This value grows over time, often at a guaranteed rate of interest, and it can be used for various purposes. One of the primary benefits is the ability to borrow against this cash value. Policyholders can take out loans, allowing them to access funds without having to surrender the policy or disrupt their financial plans. These loans typically have favorable terms, with interest rates that are usually lower than those of personal loans or credit cards.

The process of borrowing against the cash value is straightforward. Policyholders can request a loan from the insurance company, and upon approval, they receive the funds, which they can use for various financial needs. The loan is then repaid with interest, and the policy's death benefit remains intact, ensuring that the intended beneficiaries receive the full amount upon the policyholder's passing. This feature provides a safety net and financial flexibility, especially during challenging economic times or unexpected events.

In addition to borrowing, policyholders can also withdraw funds from the cash value. This option allows for a more flexible approach to utilizing the policy's value. Withdrawals can be made when needed, providing access to the accumulated funds without the need for a loan. The policyholder can decide how much to withdraw, ensuring they have the financial resources available when required. This flexibility is particularly useful for those who want to access their money for specific goals or investments while still maintaining the death benefit coverage.

The combination of death benefit and investment features in term life insurance with cash value offers a comprehensive solution for individuals seeking both protection and financial growth. It provides a safety net for loved ones in the event of the policyholder's passing while also allowing for financial flexibility and control. Understanding how this works can empower individuals to make informed decisions about their insurance and financial strategies, ensuring they have the necessary tools to achieve their short-term and long-term financial objectives.

Ameritas vs New York Life: Which Insurance is Better?

You may want to see also

Benefits: Offers guaranteed death benefit, potential investment returns, and flexibility to build wealth

Term life insurance with cash value is a financial product that provides both protection and an opportunity to build wealth over time. One of its primary benefits is the guaranteed death benefit, which ensures that your beneficiaries receive a specified amount of money upon your passing. This guarantee is a significant advantage, especially for those who want to provide financial security for their loved ones in the event of an untimely death. The cash value component of this insurance type allows the policyholder to accumulate a savings component within the policy, which can grow tax-deferred.

The potential for investment returns is a key feature that sets term life insurance with cash value apart. As the policyholder, you can choose to allocate a portion of your premium payments into an investment account associated with the policy. This investment account can offer various investment options, such as stocks, bonds, or mutual funds, allowing your money to grow over time. The returns generated from these investments can be used to enhance the cash value of the policy, providing an additional source of financial growth.

Flexibility is another advantage of this insurance type. Policyholders can customize their coverage to fit their specific needs. You can adjust the death benefit, premium payments, and investment allocations to align with your financial goals and changing circumstances. For instance, if your financial situation improves, you might choose to increase the death benefit to provide more comprehensive coverage. Conversely, if you wish to reduce your premiums, you can explore options to decrease the coverage amount while still maintaining the guaranteed death benefit.

Over time, the cash value in the policy can accumulate and be borrowed against or withdrawn, providing access to funds without surrendering the policy. This flexibility enables policyholders to utilize the cash value for various purposes, such as funding education expenses, starting a business, or investing in other opportunities. Additionally, the policy can be converted to a permanent life insurance policy, ensuring long-term coverage and continued accumulation of cash value.

In summary, term life insurance with cash value offers a comprehensive solution for those seeking both financial protection and wealth-building opportunities. The guaranteed death benefit provides peace of mind, while the potential investment returns and flexibility in policy customization allow individuals to tailor their coverage to their unique needs and financial objectives. This type of insurance is a valuable tool for individuals who want to secure their family's future and simultaneously grow their financial assets.

Life Insurance Options Post-Prostate Cancer Treatment

You may want to see also

Comparison: Unlike term life, it provides long-term financial security and investment opportunities

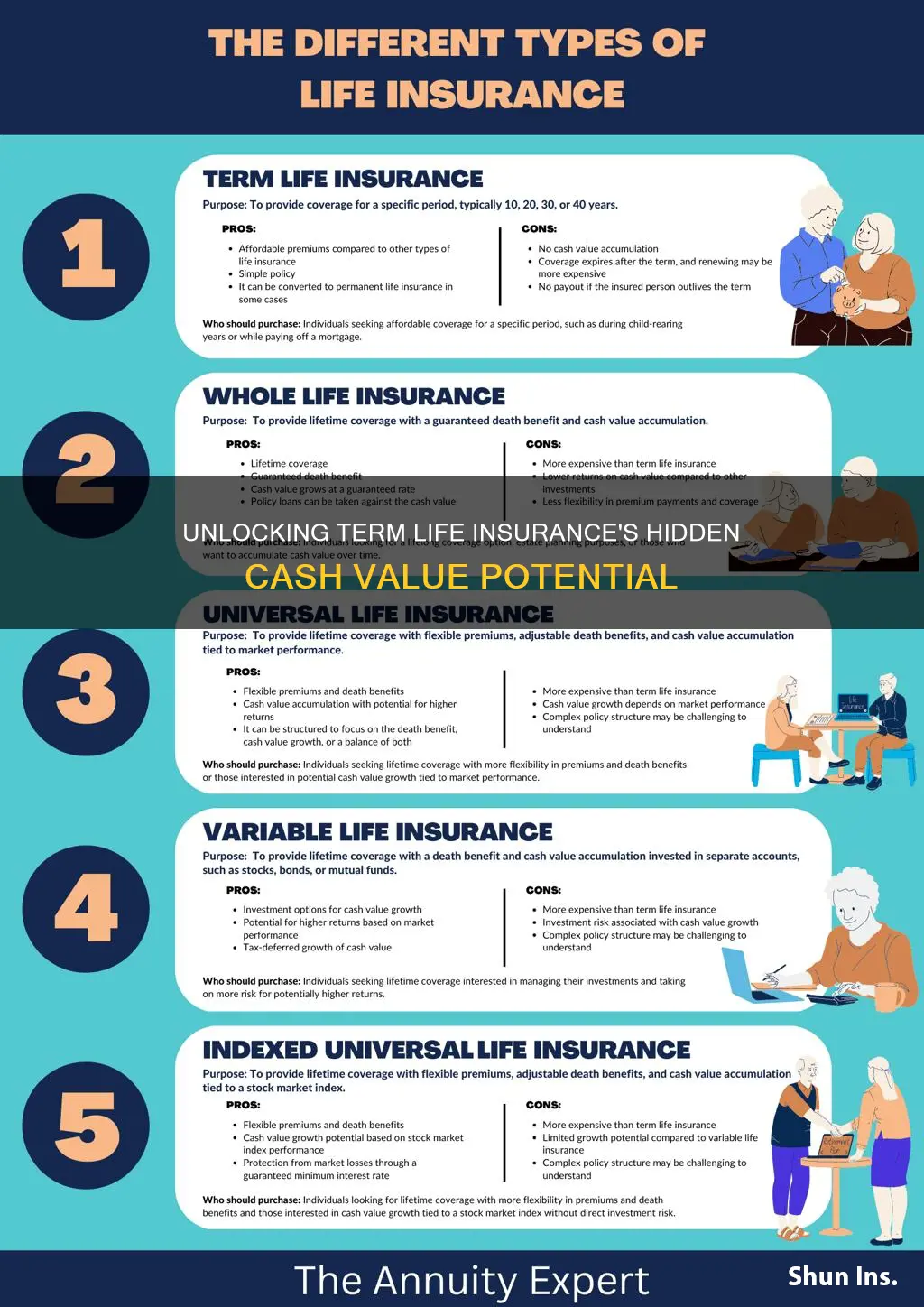

Term life insurance is a straightforward and cost-effective way to provide financial protection for a specific period, typically 10, 20, or 30 years. It offers a death benefit to the policyholder's beneficiaries if the insured individual passes away during the term. However, unlike permanent life insurance, term life insurance does not accumulate cash value, which means there is no investment component to the policy. This is a key difference that sets term life insurance apart from other types of life insurance.

On the other hand, permanent life insurance, including whole life and universal life, offers a unique advantage: it provides long-term financial security and investment opportunities. When you purchase a permanent life insurance policy, a portion of your premium goes towards building cash value, which grows over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. One of the primary benefits of this feature is that it ensures long-term financial security for the policyholder and their beneficiaries.

The investment aspect of permanent life insurance allows policyholders to benefit from potential earnings on their premiums. These earnings can accumulate and grow tax-deferred, providing a substantial sum over time. This is particularly advantageous for those seeking to build a financial cushion or invest in a long-term strategy. For example, the cash value in a whole life policy can be used to pay for college tuition, start a business, or provide a financial safety net for retirement.

In contrast, term life insurance is ideal for those who need coverage for a specific period, such as when they have a mortgage or young children. It provides a simple and affordable solution without the investment component. However, if long-term financial security and the potential for investment growth are important considerations, permanent life insurance is the better choice. It offers a comprehensive approach to life insurance, combining protection with the opportunity to build wealth over time.

Understanding the difference between term life and permanent life insurance is crucial for making an informed decision. While term life is suitable for short-term needs, permanent life insurance provides a more comprehensive solution, offering both financial protection and the potential for investment growth. This comparison highlights the importance of considering your long-term financial goals and the specific features of different insurance products to make the right choice for your situation.

Life Insurance Options with Hypothyroidism

You may want to see also

Tax Advantages: Cash value can grow tax-deferred, providing tax benefits when withdrawn or borrowed against

Term life insurance with cash value is a financial product that offers both death benefit protection and an investment component. The cash value aspect refers to the accumulation of a monetary reserve within the policy, which can be utilized in various ways. One of the key advantages of this feature is the tax-deferred growth of the cash value.

When the cash value in a term life insurance policy grows, it is not subject to income tax as long as it remains within the policy. This means that the policyholder can benefit from tax-free growth over time. The cash value can accumulate and grow, providing a potential source of funds that can be used for various financial needs.

Tax advantages become particularly relevant when the policyholder decides to access the cash value. When the cash value is withdrawn or borrowed against, it is generally not taxed as income. This allows the policyholder to utilize the funds for various purposes, such as paying for education, starting a business, or covering unexpected expenses, without incurring additional tax liabilities.

Furthermore, the tax-deferred nature of cash value growth can be advantageous in the long term. As the cash value grows, it can be used to build a substantial reserve. When the policyholder needs to access this money, the tax-deferred growth ensures that a larger portion of the original investment remains intact, providing more financial flexibility. This can be especially beneficial for individuals who want to build a financial safety net or have specific financial goals that require tax-efficient growth.

In summary, the tax advantages of term life insurance with cash value are significant. The tax-deferred growth allows the policyholder to build a valuable asset without incurring immediate tax consequences. When the cash value is withdrawn or borrowed against, the tax benefits continue, providing a flexible and efficient way to access funds while preserving the policy's overall value. Understanding these tax advantages can be crucial for individuals seeking to optimize their financial strategies and protect their assets.

Understanding Flexible Adjustable Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." While the primary purpose of term life insurance is to offer financial protection to beneficiaries in the event of the insured's death during the term, it does not accumulate cash value. Cash value is a feature typically found in permanent life insurance policies, such as whole life or universal life insurance.

Term life insurance is straightforward; it provides a death benefit to the policyholder's beneficiaries if the insured person passes away during the specified term. The policyholder pays a premium to the insurance company, and in return, the insurer promises to pay out a predetermined amount if the insured dies within the term. Once the term ends, the policy typically expires unless the policyholder chooses to renew it or convert it to a permanent policy.

Term life insurance is primarily designed to provide financial security to loved ones in the event of the insured's untimely death. It does not offer any investment or savings component, unlike permanent life insurance policies. However, term life insurance is often more affordable and can be a cost-effective way to secure coverage for a specific period, especially for those who need insurance for a particular duration, such as to cover a mortgage or provide for children's education.

Yes, many term life insurance policies offer the option to convert them into a permanent life insurance policy, such as whole life or universal life, at the end of the term. This conversion allows policyholders to continue their coverage beyond the initial term and build up cash value over time. It can be a convenient way to ensure long-term financial protection without the need to reapply for insurance.

Term life insurance itself does not have cash value, but the concept of cash value is associated with permanent life insurance policies. Permanent life insurance builds up cash value, which can be borrowed against or withdrawn. This feature allows policyholders to access funds for various purposes, such as paying for college tuition, starting a business, or supplementing retirement income. However, it's important to note that accessing cash value may impact the death benefit and policy coverage.