Term life insurance is a type of life insurance that provides coverage for a specific period, or term, typically ranging from 10 to 30 years. In India, it is a popular and affordable way to protect your loved ones financially in the event of your untimely death. This insurance offers a death benefit to the policyholder's beneficiaries if the insured person passes away during the term. It is known for its simplicity, with no investment or savings component, making it a straightforward and cost-effective solution for those seeking basic life coverage.

What You'll Learn

- Definition: Term life insurance is a temporary policy offering coverage for a specific period

- Benefits: It provides financial protection for dependents during the policyholder's working years

- Cost: Premiums are typically lower than permanent life insurance

- Flexibility: Policies can be tailored to individual needs and often renewable

- Tax Advantages: In India, term life insurance can offer tax benefits under certain conditions

Definition: Term life insurance is a temporary policy offering coverage for a specific period

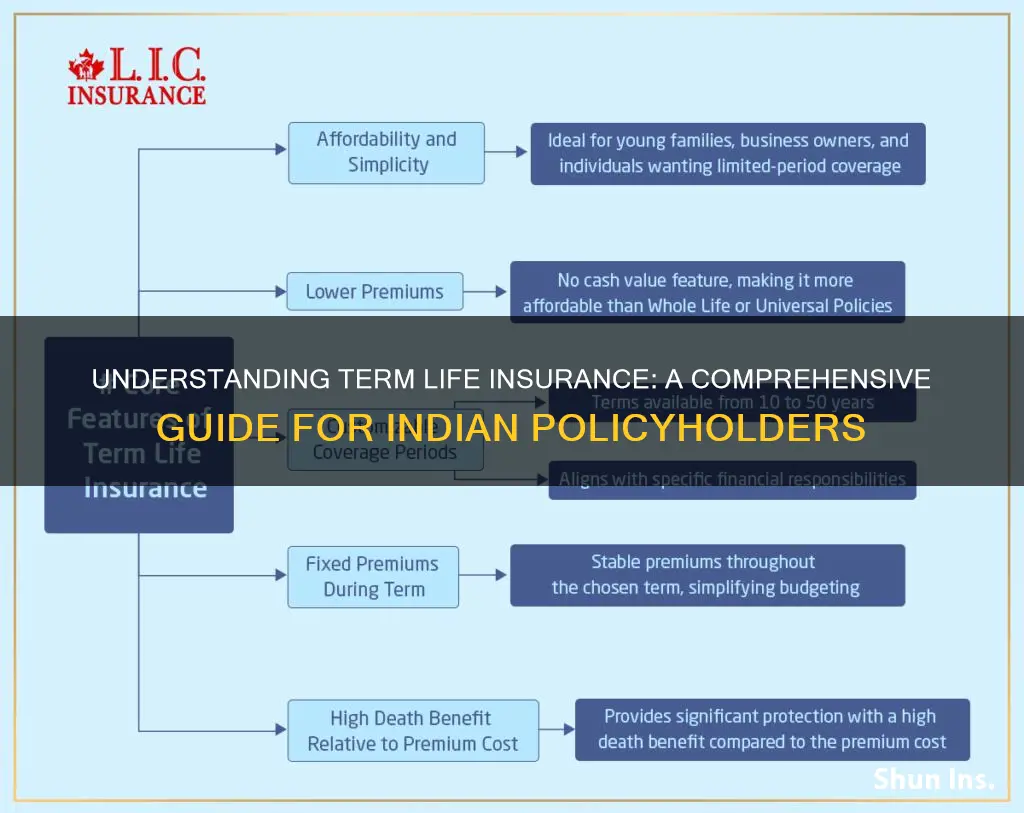

Term life insurance is a type of life insurance that provides coverage for a specific period, often ranging from 10 to 30 years. It is a pure insurance product, meaning it offers financial protection to the policyholder's beneficiaries in the event of the insured's death during the term. This type of insurance is designed to be a cost-effective way to secure financial stability for a family or individual during a particular period.

The key feature of term life insurance is its temporary nature. Unlike permanent life insurance, which provides coverage for the entire life of the insured, term insurance is specifically tailored to meet the needs of a particular time frame. This could be a period associated with significant financial commitments, such as a mortgage, children's education, or business expansion. By choosing a term duration that aligns with these obligations, individuals can ensure that their loved ones are financially protected during the most critical years.

In India, term life insurance has gained popularity due to its simplicity and affordability. It is often seen as a more straightforward and cost-effective alternative to other life insurance products. The policyholder pays a fixed premium for the chosen term, and in return, the insurance company promises to pay a death benefit to the designated beneficiaries if the insured dies during that period. This benefit can help cover various expenses, such as outstanding debts, funeral costs, or daily living expenses, providing financial security to the family.

The flexibility of term life insurance allows individuals to customize their coverage based on their specific needs. Policyholders can select the term length, death benefit amount, and premium payment options that best suit their circumstances. This adaptability makes it an attractive choice for those seeking a tailored insurance solution. Moreover, term insurance often has lower premiums compared to permanent policies, making it an accessible option for a wide range of individuals.

In summary, term life insurance in India is a temporary policy that offers a focused and affordable approach to life coverage. Its temporary nature allows individuals to address specific financial needs during critical periods, providing peace of mind and financial security to their beneficiaries. With its simplicity and customization options, term insurance has become a popular choice for those seeking effective protection without long-term commitments.

Life Insurance Benefits: Taxable in California?

You may want to see also

Benefits: It provides financial protection for dependents during the policyholder's working years

Term life insurance in India is a type of life insurance that offers coverage for a specific period, typically ranging from 10 to 30 years. It is a straightforward and cost-effective way to secure financial protection for your loved ones, especially during the most productive years of your life when you are earning a steady income. This type of insurance is designed to provide a financial safety net for your dependents, such as your spouse, children, or other family members who rely on your income.

The primary benefit of term life insurance is its ability to ensure financial stability for your family in the event of your untimely demise. During the policy term, if the insured individual passes away, the insurance company pays out a lump sum death benefit to the policyholder's beneficiaries. This financial payout can help cover various expenses and provide for the well-being of your dependents, ensuring they have the necessary resources to maintain their standard of living and cover essential costs.

For example, the death benefit can be utilized to pay for daily living expenses, such as mortgage or rent, utility bills, groceries, and other household costs. It can also provide for the education of children, cover medical expenses, and even contribute to the long-term financial goals of your family. By having this financial protection in place, you can rest assured that your loved ones will be taken care of, even if you are no longer around to provide directly.

Furthermore, term life insurance offers a level of flexibility and affordability that makes it an attractive option for many individuals. The premiums are typically lower compared to permanent life insurance policies, making it more accessible to a broader range of people. This affordability allows you to secure a substantial death benefit without straining your budget, ensuring that you can provide for your family's needs without compromising your financial goals.

In summary, term life insurance in India is a valuable tool for those seeking to protect their family's financial future. It offers a straightforward and cost-effective solution to ensure that your dependents are financially secure during the policy term. By providing a lump sum death benefit, this insurance product empowers you to take care of your loved ones' essential needs and maintain their standard of living, even in your absence.

Get a Life Insurance License: Connecticut Requirements

You may want to see also

Cost: Premiums are typically lower than permanent life insurance

Term life insurance in India is a type of life insurance that provides coverage for a specific period, or 'term', typically ranging from 10 to 40 years. This form of insurance is designed to offer financial protection to the policyholder's beneficiaries during a defined period. One of the key advantages of term life insurance is its cost-effectiveness compared to permanent or whole life insurance policies.

The lower premiums of term life insurance are primarily due to the nature of the coverage. Term insurance focuses solely on providing coverage for a specific duration, ensuring that the policyholder's beneficiaries receive a death benefit if the insured individual passes away during the term. This targeted approach allows insurers to offer more competitive rates since the risk of paying out a death benefit is concentrated within the defined period. In contrast, permanent life insurance provides coverage for the entire lifetime of the insured individual, which comes with a higher risk and, consequently, higher premiums.

When considering the cost, term life insurance is an attractive option for those seeking affordable life insurance coverage. The lower premiums make it more accessible to a broader range of individuals, allowing them to secure their loved ones' financial future without incurring significant expenses. This is particularly beneficial for young families, individuals starting their careers, or those on a tight budget, as it provides essential protection without straining their financial resources.

The affordability of term life insurance is a significant factor in its popularity. It allows individuals to allocate their financial resources more efficiently, ensuring that they can meet their short-term financial obligations and goals while still providing for their long-term needs. Moreover, the flexibility of term insurance allows policyholders to adjust their coverage as their circumstances change, ensuring that the insurance remains relevant and cost-effective over time.

In summary, term life insurance in India offers a cost-effective solution for individuals seeking temporary financial protection. Its lower premiums, compared to permanent life insurance, make it an accessible and affordable option for a wide range of policyholders. By understanding the cost implications, individuals can make informed decisions about their life insurance needs, ensuring that they receive the necessary coverage without compromising their financial well-being.

Life Insurance Options with Cardiomyopathy

You may want to see also

Flexibility: Policies can be tailored to individual needs and often renewable

Term life insurance in India offers a unique level of flexibility, allowing individuals to customize their coverage to fit their specific needs. This type of policy is designed to provide a temporary safety net, typically for a set period, such as 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the designated beneficiary if the insured individual passes away within the specified period. The beauty of term life insurance lies in its adaptability.

One of the key advantages is the ability to tailor the policy to individual circumstances. Policyholders can choose the coverage amount based on their financial obligations and goals. For instance, a young professional with a mortgage, children's education expenses, and other financial commitments might opt for a higher coverage amount to ensure their family's financial security in the event of their untimely demise. Conversely, someone with fewer financial dependents might choose a lower coverage amount, keeping premiums more affordable. This flexibility ensures that the insurance policy aligns perfectly with the policyholder's current and future needs.

Moreover, term life insurance policies are often renewable, providing long-term peace of mind. After the initial term expires, the policyholder has the option to renew the policy, typically at the same or a similar premium rate. This renewability is particularly beneficial for those who want to maintain coverage as their life circumstances change over time. For example, a policyholder might renew the policy to cover the cost of their child's higher education or to secure financial stability during a specific life stage. The renewability feature ensures that the insurance coverage remains relevant and effective throughout the policyholder's life.

The flexibility and renewability of term life insurance policies empower individuals to make informed decisions about their financial security. It allows them to adapt the coverage as their life progresses, ensuring that they are always protected during the most critical periods. Whether it's providing for a family's future, securing a mortgage, or covering unexpected expenses, term life insurance offers a customizable and reliable solution. With the ability to choose the term length and coverage amount, individuals can create a policy that suits their unique requirements, making it an essential tool for long-term financial planning in India.

Life Insurance: Avoiding Capital Gains Tax?

You may want to see also

Tax Advantages: In India, term life insurance can offer tax benefits under certain conditions

Term life insurance in India is a popular and cost-effective way to secure financial protection for your loved ones. It provides coverage for a specific period, known as the 'term', during which the insurer promises to pay out a lump sum or regular income if the insured individual passes away. This type of insurance is particularly attractive due to its simplicity and the potential tax advantages it offers.

Under the Income Tax Act of India, term life insurance can provide tax benefits, which can significantly reduce the overall cost of the policy. The key advantage lies in the fact that the premiums paid for term life insurance can be claimed as a deduction under Section 80D of the Act. This section allows individuals to reduce their taxable income by the amount of premium paid for certain types of insurance, including term life insurance. By availing of this deduction, policyholders can lower their tax liability, effectively making the insurance more affordable.

To be eligible for this tax benefit, the term life insurance policy must meet specific criteria. Firstly, the insurance must be taken out for the benefit of a dependent family member, such as a spouse, child, or parent. Secondly, the policy should be for a minimum term of one year, and the coverage amount should be substantial enough to provide financial security. It is important to note that the tax benefit is available only for the premiums paid and not for any other expenses associated with the policy.

Additionally, the tax advantage extends beyond the individual policyholder. In the case of a death claim, the entire sum assured is paid out as a tax-free income to the beneficiary(ies) of the policy. This means that the entire amount received by the family is not subject to income tax, providing immediate financial relief during a difficult time.

In summary, term life insurance in India offers a valuable tax advantage, allowing policyholders to claim deductions on their premiums and providing tax-free benefits in the event of a claim. This makes it an attractive financial tool for those seeking to secure their family's financial future while also managing their tax obligations effectively. Understanding these tax benefits can encourage individuals to consider term life insurance as a prudent financial decision.

Life Insurance and ITINs: What You Need to Know

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It offers financial protection to the policyholder's beneficiaries if the insured individual passes away during this term. The policy is renewable, but it may not be guaranteed for the entire life of the insured person.

In India, term life insurance policies typically offer coverage for a fixed period, ranging from 10 to 40 years. The policyholder pays regular premiums to the insurance company. If the insured person dies during the term, the beneficiaries receive a death benefit, which is usually the sum assured chosen by the policyholder. The policy ends at the end of the term, and the coverage is not guaranteed beyond that point.

Term life insurance in India offers several advantages:

- Simplicity: It is a straightforward and cost-effective way to secure financial protection for your loved ones.

- Affordability: Term plans are generally more affordable compared to permanent life insurance, making it accessible to a wider range of individuals.

- Flexibility: Policyholders can choose the term length, sum assured, and other features to suit their needs.

- Tax Benefits: In India, the premiums paid for term life insurance may be eligible for tax deductions under certain conditions.

Term life insurance is suitable for individuals who want to provide financial security to their family during a specific period, especially if they have financial responsibilities like mortgage payments, children's education, or other long-term commitments. It is often considered a more practical choice for those who want coverage for a defined period without the long-term financial commitment of permanent insurance.

While term life insurance offers valuable coverage, there are a few considerations:

- Limited Coverage: The policy provides coverage only for the specified term, so if the insured person outlives the term, the coverage ends.

- No Cash Value: Unlike permanent life insurance, term plans do not accumulate cash value, which means there is no investment component.

- Renewal: After the initial term, the policy may need to be renewed, and the cost could increase, especially if the insured person's health has changed.