The average cost of car insurance in the United States varies depending on factors such as age, gender, driving history, and location. According to a 2024 analysis by Bankrate, the monthly average cost of car insurance for drivers in the US is $196 for full coverage and $53 for minimum coverage. Forbes Advisor's 2024 analysis of full coverage rates places the national average cost at $169 per month, while NerdWallet's September 2024 rate analysis estimates the national average for full coverage to be around $147 per month.

The cost of car insurance also varies across different states. For example, Wyoming, Vermont, and New Hampshire are among the cheapest states for full coverage, while Florida, Louisiana, and Texas are the most expensive, according to NerdWallet. US News found that Maine and Idaho had the lowest average rates, while USAA, Erie, and Auto-Owners offered the cheapest average annual rates among insurance companies.

| Characteristics | Values |

|---|---|

| Average monthly cost of full auto insurance | $196 |

| Average annual cost of full auto insurance | $2,348 |

| Average monthly cost of minimum auto insurance | $53 |

| Average annual cost of minimum auto insurance | $639 |

What You'll Learn

Average car insurance costs for different driver profiles

The cost of car insurance varies depending on the driver's profile. Here is an overview of the average car insurance costs for different driver profiles:

Age

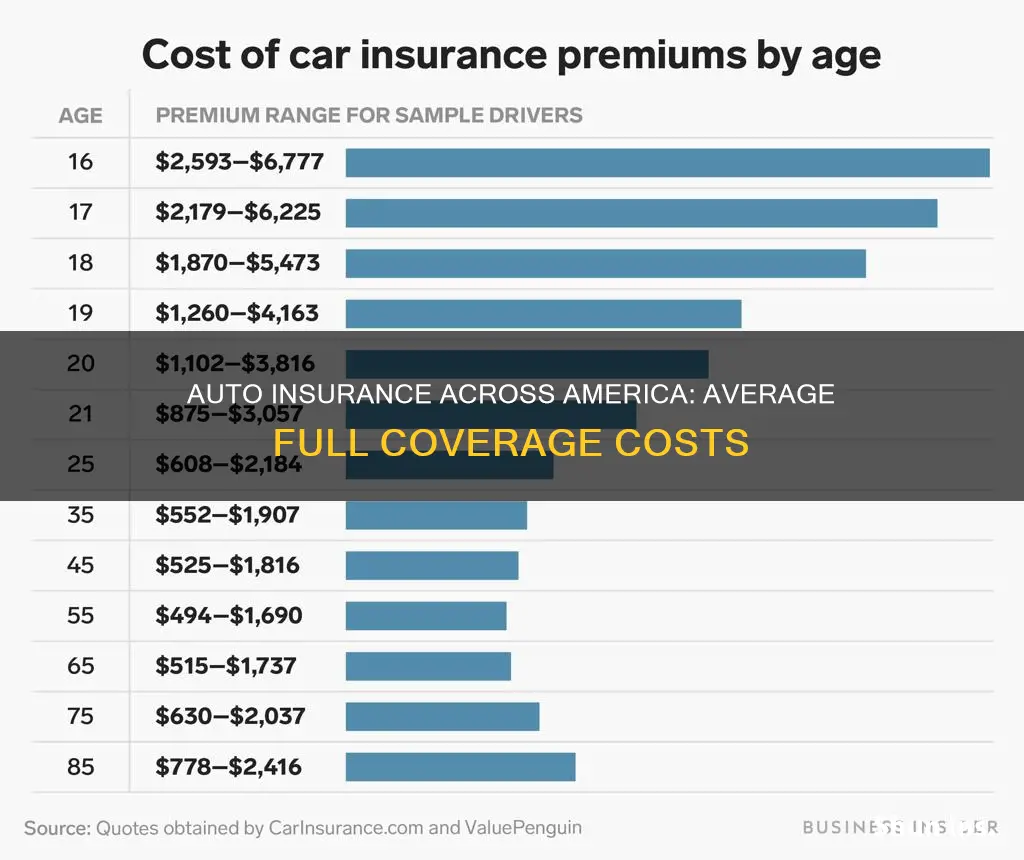

The cost of car insurance tends to be higher for younger and older drivers, as they are considered to be more risky. Drivers in their 20s can expect to pay around $3,653 for full coverage and $1,046 for minimum coverage. As drivers age, their rates tend to decrease, with drivers in their 40s paying around $1,766 for full coverage and $497 for minimum coverage. However, rates start to increase again for drivers in their 70s.

Gender

In states where gender-based pricing is allowed, men tend to pay more for car insurance than women, especially at younger ages. For example, at age 20, men pay about $626 more per year than women. This gap closes as drivers get older, with men paying only slightly more than women at ages 35 and above.

Driving Record

A clean driving record can help drivers obtain cheaper car insurance rates. On the other hand, a recent ding on a driving record, such as a speeding ticket or an at-fault accident, can cause rates to increase significantly. For example, a driver with an at-fault accident can expect to pay around $2,614 for full coverage and $744 for minimum coverage. A DUI conviction will result in even higher rates, with an average increase of about $1,467 per year for full coverage.

Credit Score

In most states, insurance companies use credit-based insurance scores to determine rates. Drivers with poor credit scores may pay significantly more for car insurance than those with good credit scores. On average, drivers with poor credit pay around $2,794 for full coverage and $771 for minimum coverage, which is about 58% higher than drivers with good credit.

Verify Auto Insurance: Active or Not?

You may want to see also

Car insurance cost by state

The cost of car insurance varies depending on the state in which one lives. Factors such as accident and claim frequency, the cost of labour and vehicle parts, vehicle theft frequency, and road conditions all play a role in determining insurance rates. The coverage levels chosen also have a significant impact on the cost. For example, drivers with leases or loans on their vehicles typically have comprehensive and collision coverage, as well as higher liability limits. On the other hand, drivers of older cars may only have liability-only coverage at the state-required minimums.

According to Bankrate, the cheapest states for full coverage car insurance in 2024 are Idaho, Vermont, Ohio, Maine, and Hawaii, with annual rates ranging from $1,162 to $1,548. In contrast, the most expensive states for full coverage are New York, Louisiana, Florida, Nevada, and Colorado, with annual rates ranging from $3,022 to $3,757.

The National Association of Insurance Commissioners reported that the countrywide average auto insurance expenditure increased by 1.4% from 2020 to 2021, with New York, Louisiana, and the District of Columbia having the highest average expenditures. However, NerdWallet's analysis found that Wyoming, Vermont, and New Hampshire had the cheapest full coverage rates, while Florida, Louisiana, and Texas were the most expensive.

In addition to state-specific factors, individual characteristics such as age, gender, credit score, and driving history can also influence insurance rates. For example, younger and less experienced drivers tend to pay higher premiums due to their higher risk profile. Similarly, drivers with a recent DUI or a poor credit score can expect to pay more for their insurance.

Dropping Vehicle Insurance: What You Need to Know

You may want to see also

Car insurance cost by company

The cost of car insurance varies depending on the company, the driver's age, gender, driving history, and location. Here is a breakdown of the average costs of car insurance by company:

USAA:

USAA offers some of the cheapest rates for full coverage car insurance, but it is only available to military personnel, veterans, and their families. Their annual rates for full coverage range from $1,300 to $2,800.

Erie:

Erie Insurance is another affordable option, with annual rates for full coverage ranging from $1,300 to $2,800.

Geico:

Geico is also known for its competitive rates, with annual full coverage policies ranging from $1,300 to $2,800.

Nationwide:

Nationwide offers full coverage policies starting from $1,300 up to $3,000 per year.

Travelers:

Travelers Insurance provides full coverage car insurance with annual premiums ranging from $1,300 to $3,000.

Auto-Owners:

Auto-Owners Insurance is another affordable option, with annual full coverage rates ranging from $1,300 to $2,800.

State Farm:

State Farm's annual rates for full coverage car insurance can vary, but they typically fall between $1,300 and $2,800.

Progressive:

Progressive Insurance offers a wide range of coverage options, with annual full coverage policies starting from $1,300 and going up to $3,000.

Allstate:

Allstate Insurance provides full coverage car insurance with annual premiums ranging from $1,600 to $3,200.

Farmers:

Farmers Insurance offers comprehensive car insurance policies, with annual full coverage rates starting from $1,600 and going up to $3,200.

It's important to note that these are average estimates, and the actual cost of car insurance can vary significantly based on individual factors and the specific coverage options chosen. Additionally, some companies may offer discounts or promotions that can further reduce the cost of car insurance.

Best Auto Insurance for Elderly Drivers: Safety and Savings

You may want to see also

How your driving record impacts your car insurance cost

A driving record is like a report card that reflects your behaviour behind the wheel. It includes your history of traffic violations, accidents, and other incidents involving your interaction with the road. This record is used by insurance companies to assess your risk profile, and it can have a significant impact on your car insurance cost. Here's how:

Minor Violations:

Infractions like speeding tickets, running a red light, or failure to use a turn signal are considered minor violations. While these are less severe, accumulating too many of them can still lead to higher insurance premiums. For example, a speeding ticket can bump up your rates by 20%.

Major Violations:

Serious offences like Driving Under the Influence (DUI), reckless driving, or hit-and-run incidents fall into the category of major violations. These offences have a substantial impact on insurance rates and often result in significant increases. For instance, a DUI or reckless driving charge can label you as a high-risk driver, pushing your premiums up by 30% to 300%.

At-Fault Accidents:

If you are deemed responsible for a car accident, it will likely affect your insurance rates. At-fault accidents indicate a higher risk of future claims, prompting insurers to adjust premiums accordingly. The increase in premiums can be quite significant, depending on the severity of the accident and the resulting damages.

No-Fault Accidents:

Even if you are not at fault in an accident, your insurance rates may still be impacted. Insurance companies consider the frequency of accidents, regardless of fault, when assessing risk. Multiple accidents, regardless of who is at fault, may lead to higher premiums as it suggests a higher risk of claims.

Frequency and Severity of Claims:

The number and cost of insurance claims you file within a specific period are also considered. Multiple claims may lead to higher premiums as they indicate a pattern of higher risk or careless driving behaviour. Additionally, if your claims involve significant damages, it is likely to result in higher premiums.

The Point System:

Many states use a point system to quantify and standardise driving offences. Each violation or incident carries a specific point value, and accumulating points can lead to penalties such as license suspension or increased insurance premiums. These points typically stay on your record for one to three years or more, depending on the severity of the violation.

Risk Assessment and Premium Adjustments:

Insurance companies use complex algorithms to determine your risk level based on your driving record. A clean driving record suggests responsible and low-risk behaviour, resulting in lower premiums. Conversely, a history of accidents or violations indicates a higher risk of future claims, leading insurers to classify you as a high-risk driver and increase your premiums. Each traffic violation or accident on your record can lead to premium adjustments, with more severe incidents resulting in larger increases.

In summary, your driving record plays a crucial role in determining your car insurance cost. Insurance companies use it to assess your risk profile, and any violations or accidents on your record can lead to higher premiums. The impact can be significant, especially for major violations or at-fault accidents. Therefore, maintaining a clean driving record is essential for keeping your car insurance costs down.

Auto Insurance and BBQ Trailers: What's the Coverage?

You may want to see also

Car insurance rates by driving history

The cost of car insurance is influenced by a variety of factors, including a person's driving history. A driver with a history of accidents, traffic violations, or DUI/DWI convictions is considered high-risk and will have to pay more for insurance. In general, car insurance companies look at a person's driving record for the past three to six years. The more recent the incident, the more it will impact the cost of insurance. For example, an at-fault accident can raise a person's insurance rate by about 44% on average, while a DUI conviction can increase the cost by about 94%.

The type of car also matters. Sports cars, luxury vehicles, and cars that are commonly stolen tend to be more expensive to insure because they are more likely to be involved in accidents or theft. Additionally, the age of the driver plays a significant role. Younger and less experienced drivers are considered high-risk and will pay higher insurance rates. Drivers between the ages of 16 and 19 are three times more likely to be involved in a fatal crash than older drivers. On the other hand, drivers with a clean driving record and good credit will typically pay lower insurance rates.

Auto Insurance Agent Salaries in BC: How Much?

You may want to see also

Frequently asked questions

The average cost of car insurance in the US varies depending on the type of coverage. The national average cost of car insurance is $2,026 per year or $169 per month for full coverage, and $638 per year or $53 per month for minimum coverage.

The average cost of car insurance is influenced by several factors, including age, gender, driving record, credit score, location, and the type of vehicle.

The average cost of car insurance varies by state, with Vermont having the cheapest full coverage rates and Florida having the most expensive.

The cost of car insurance also varies by company, with USAA, Erie, and Auto-Owners offering some of the lowest rates.

To save money on car insurance, consider shopping around for quotes, bundling policies, increasing your deductible, and taking advantage of discounts.