The average insurance payout for loss of life can vary significantly depending on several factors, including the type of insurance policy, the age and health of the individual, and the specific circumstances of the death. Life insurance policies, for instance, typically offer a lump-sum payment to the policyholder's beneficiaries upon the insured's death. These payouts can range from a few thousand to several hundred thousand dollars, with the average payout often being around $50,000 to $100,000. However, term life insurance, which is usually more affordable, may have lower average payouts compared to permanent life insurance policies. Additionally, the payout can be influenced by the policy's coverage amount, which is determined by the insured's needs and financial goals. Understanding these averages and variations is crucial for individuals and families to plan for financial security in the event of a loved one's passing.

What You'll Learn

- Payout Variations: Payouts vary based on insurance type, policy details, and individual circumstances

- Statistical Data: Average payouts are influenced by statistical data on mortality rates and demographics

- Policy Terms: Policy terms, coverage limits, and exclusions impact the payout amount

- Death Cause: The cause of death can affect the payout, with some policies offering higher amounts for specific circumstances

- Legal Considerations: Legal factors, such as jurisdiction and insurance company policies, influence the payout process

Payout Variations: Payouts vary based on insurance type, policy details, and individual circumstances

The average insurance payout for loss of life can vary significantly depending on several factors, including the type of insurance policy, the specific terms and conditions of the policy, and the individual circumstances surrounding the claim. Understanding these variations is crucial for anyone seeking financial protection in the event of a loved one's passing.

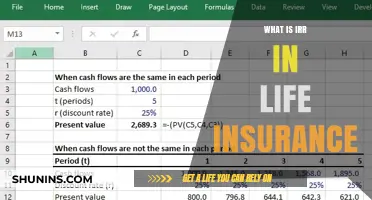

Insurance Type: Different types of insurance policies offer varying levels of coverage and benefits. For instance, life insurance policies can be categorized into two main types: term life insurance and permanent life insurance (e.g., whole life or universal life). Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and offers a fixed death benefit if the insured individual passes away during that term. On the other hand, permanent life insurance provides lifelong coverage and often includes an investment component, allowing the policyholder to build cash value over time. The average payout for term life insurance is generally lower compared to permanent life insurance, as the latter offers more comprehensive benefits and longer coverage.

Policy Details: The specific terms and conditions of a life insurance policy play a pivotal role in determining the payout amount. These details include the policy's death benefit, which is the amount the insurance company agrees to pay out upon the insured individual's death. Factors such as the policy's term, the insured's age, health, and lifestyle can influence the death benefit. For example, a younger, healthier individual with a 20-year term life insurance policy might receive a higher death benefit compared to an older individual with pre-existing health conditions and a 10-year term policy. Additionally, some policies may offer additional benefits like accelerated death benefits, allowing the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness, thus providing financial support during their final days.

Individual Circumstances: The unique circumstances of the insured individual and their family can also impact the insurance payout. Insurance companies often consider factors such as the number of dependents, the financial needs of the family, and the insured's role in providing financial support. For instance, a primary breadwinner with a large family and significant financial obligations may receive a higher payout to ensure the family's financial security. Moreover, the cause of death can influence the payout, as some policies may have specific exclusions or limitations based on the circumstances of the death.

In summary, the average insurance payout for loss of life is not a fixed amount but rather a dynamic figure that depends on various factors. By understanding the nuances of insurance types, policy details, and individual circumstances, individuals can make informed decisions when selecting life insurance coverage, ensuring that their loved ones receive the financial support they need during challenging times. It is essential to carefully review and compare different policies to find the best fit for one's specific needs and circumstances.

Life Insurance Wrappers: Maximizing Your Policy Benefits

You may want to see also

Statistical Data: Average payouts are influenced by statistical data on mortality rates and demographics

The average insurance payout for the loss of life is a complex figure that is heavily influenced by statistical data and various factors. When determining the payout, insurance companies rely on extensive research and analysis of mortality rates, demographics, and other relevant statistics. This data-driven approach ensures that the compensation provided is fair and aligned with the potential risks and probabilities associated with the insured individual's life.

Mortality rates play a crucial role in this calculation. Insurance providers analyze historical and current mortality data to assess the likelihood of an individual's death within a specific period. These rates consider factors such as age, gender, and overall health. For instance, older individuals generally face higher mortality risks, which may result in higher payout amounts to account for the reduced life expectancy. Conversely, younger individuals might have lower payout values due to their longer expected lifespan.

Demographics also significantly impact average payouts. Insurance companies consider factors such as occupation, lifestyle, and geographic location. Certain professions, such as those in high-risk industries like construction or emergency services, may lead to higher payout amounts due to the increased likelihood of accidents or injuries. Similarly, individuals living in areas with higher crime rates or natural disaster risks might receive higher compensation to reflect the potential challenges they face.

Additionally, statistical data on life expectancy and health trends is essential. Insurance companies study trends in life expectancy, chronic disease prevalence, and overall population health. This information helps them understand the likelihood of an individual's survival beyond a certain age or the potential impact of health conditions on their lifespan. By incorporating these factors, insurance providers can offer more accurate and personalized payout amounts.

In summary, the average insurance payout for loss of life is a result of meticulous statistical analysis. Insurance companies use mortality rates, demographics, and other relevant data to determine fair compensation. This approach ensures that the payout reflects the unique circumstances and risks associated with the insured individual, providing financial security for their beneficiaries.

Great-West Life Insurance: Orthotics Coverage and Your Benefits

You may want to see also

Policy Terms: Policy terms, coverage limits, and exclusions impact the payout amount

When it comes to life insurance, the payout amount can vary significantly depending on the specific policy terms and conditions. Understanding these policy terms is crucial for both the insured and the beneficiary, as they directly influence the financial support provided in the event of a covered loss.

Policy Terms and Their Impact:

The terms and conditions of a life insurance policy are the foundation of the agreement between the insurance company and the policyholder. These terms include the policy duration, premium payments, and the specific events covered under the policy. For instance, a term life insurance policy provides coverage for a specified period, such as 10, 20, or 30 years, and the payout is typically a fixed amount if the insured individual passes away during this term. On the other hand, a whole life insurance policy offers lifelong coverage, with premiums often increasing over time, and the death benefit can accumulate value, providing a higher payout.

Coverage Limits:

Coverage limits, also known as the death benefit, are a critical aspect of life insurance policies. This limit represents the maximum amount the insurance company will pay out upon the insured's death. Higher coverage limits generally result in larger payouts, ensuring that the beneficiary receives a substantial financial sum. For example, if a policy has a $500,000 coverage limit and the insured individual's death is deemed a covered event, the beneficiary will receive this full amount. However, it's essential to strike a balance between desired coverage and affordable premiums, as increasing coverage limits often leads to higher insurance costs.

Exclusions and Their Effect:

Life insurance policies also include exclusions, which are specific events or circumstances that are not covered under the policy. These exclusions can significantly impact the payout amount. For instance, pre-existing medical conditions, certain high-risk activities, or acts of war might be excluded from coverage. If the cause of death falls under any of these exclusions, the insurance company may not provide a payout, or the amount paid out could be reduced. It is the responsibility of the policyholder to carefully review and understand these exclusions to ensure they are aware of any potential gaps in coverage.

In summary, the average insurance payout for loss of life is influenced by the intricate details of the policy. Policy terms, coverage limits, and exclusions all play a pivotal role in determining the financial support provided to the beneficiary. Policyholders should thoroughly review their policies, seek professional advice if needed, and ensure they have adequate coverage to meet their financial obligations and provide security for their loved ones. Understanding these policy aspects is essential to making informed decisions regarding life insurance.

Beneficiary Rights: Assigning Life Insurance Policies

You may want to see also

Death Cause: The cause of death can affect the payout, with some policies offering higher amounts for specific circumstances

The average insurance payout for the loss of life can vary significantly depending on the cause of death and the specific insurance policy in place. This is because different insurance companies and policies have their own guidelines and rates for different death causes, often influenced by statistical data and risk assessments. For instance, life insurance policies typically have higher payout amounts for accidental deaths compared to natural causes, as accidents are often considered more unpredictable and sudden.

In the event of an accidental death, insurance companies may offer a higher payout due to the element of surprise and the potential for financial impact on the bereaved. This could include scenarios like road accidents, industrial accidents, or sudden medical emergencies. For example, a life insurance policy might provide a higher sum if the insured individual dies in a tragic accident, such as a plane crash or a natural disaster, as these events are often deemed more unforeseen and impactful.

On the other hand, natural causes of death, such as old age, chronic illnesses, or terminal diseases, may result in lower payout amounts. Insurance companies often consider these causes more predictable and aligned with the natural progression of life. Policies might have specific clauses or rates for such deaths, which could be lower than those for accidental causes. For instance, a life insurance policy might have a lower payout if the insured person passes away due to a long-term illness or age-related complications.

Additionally, some insurance policies offer enhanced benefits or higher payouts for specific death causes. For example, certain policies provide increased coverage for deaths caused by terrorism, extreme sports, or other high-risk activities. These policies recognize the unique risks associated with these activities and offer additional financial protection to the policyholder's beneficiaries.

It is essential for individuals to carefully review their insurance policies and understand the terms and conditions, especially regarding the cause of death and the associated payout amounts. This knowledge can help ensure that the beneficiaries receive the appropriate financial support in the event of the insured person's passing.

Felons Selling Life Insurance: Is It Possible?

You may want to see also

Legal Considerations: Legal factors, such as jurisdiction and insurance company policies, influence the payout process

The legal framework surrounding insurance payouts for loss of life is a complex and multifaceted issue, with several key considerations that can significantly impact the process. One of the primary factors is jurisdiction, which refers to the specific geographic area or legal territory where the insurance policy was issued and the event occurred. Each jurisdiction has its own set of laws, regulations, and guidelines that govern insurance practices, including the handling of death claims. These laws can vary widely, and they often dictate the procedures for filing a claim, the evidence required, and the timeline for processing the payout. For instance, some jurisdictions may have strict time limits for notifying the insurance company about a death, while others might require specific documentation, such as a death certificate and proof of relationship.

Insurance companies also play a crucial role in the payout process and have their own set of policies and procedures. These policies can include coverage limits, exclusions, and specific conditions that must be met to receive a payout. For example, some policies may have a maximum payout amount for accidental deaths, while others might exclude certain causes of death, such as suicide or pre-existing medical conditions. The insurance company's internal processes, including their investigation and verification methods, can also affect the payout timeline. They may require additional documentation or evidence to support the claim, and their decision-making process can vary, potentially leading to delays or rejections.

The legal considerations extend beyond the immediate jurisdiction and insurance company policies. In some cases, international law and treaties may come into play, especially when the deceased individual held dual citizenship or was involved in international travel or business. These legal complexities can introduce additional layers of bureaucracy and require the involvement of legal professionals to navigate the process effectively. Furthermore, the presence of a will or trust can significantly impact the distribution of the insurance payout. If the deceased had a will, the insurance proceeds may need to be distributed according to the legal procedures outlined in the will, which could involve court proceedings.

Another critical aspect is the determination of the cause of death and its legal implications. Insurance companies often require a thorough investigation to establish the circumstances surrounding the death. This may include an autopsy or a detailed report from the coroner or medical examiner. The findings can influence the decision to pay the policy or not, especially in cases of suspicious or unnatural deaths. Legal factors also come into play when disputes arise between the insured individual's beneficiaries or heirs. In such cases, the insurance company may be required to intervene and facilitate a resolution, which could involve legal proceedings to determine the rightful recipients of the payout.

Understanding these legal considerations is essential for individuals and families navigating the aftermath of a loved one's death. It is advisable to seek legal counsel or consult with insurance professionals who can provide guidance tailored to the specific circumstances. They can help navigate the complex web of laws, policies, and procedures, ensuring that the payout process is handled efficiently and in compliance with all relevant legal requirements. Being aware of these legal factors can also empower individuals to make informed decisions and take appropriate actions during this challenging time.

Life Insurance for Unborn Children: What You Need to Know

You may want to see also

Frequently asked questions

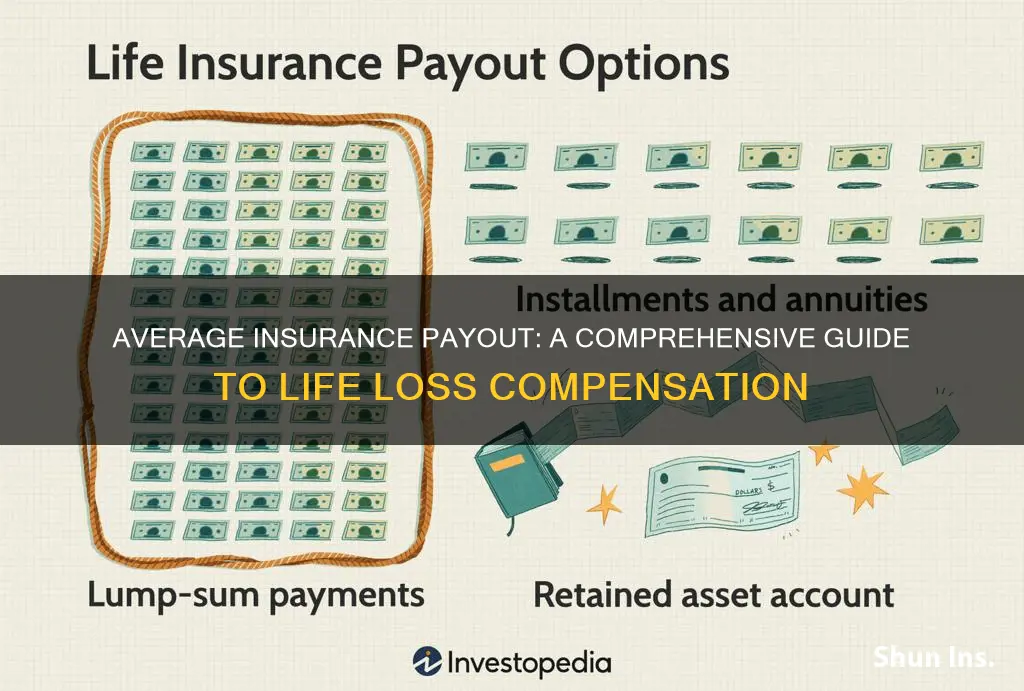

The average insurance payout for a loss of life claim can vary significantly depending on several factors, including the type of insurance policy, the age and health of the deceased, and the jurisdiction. Generally, life insurance policies provide a financial benefit to the policyholder or beneficiaries in the event of the insured's death. The payout amount is typically determined by the policy's terms and conditions, which can range from a few thousand to several hundred thousand dollars or more.

The calculation of the payout amount in a life insurance policy is based on the policy's coverage and the insured's details. For term life insurance, the payout is usually a fixed amount for a specified period. In contrast, whole life or permanent life insurance policies may have a cash value component, and the death benefit can be adjusted based on the policy's investment performance. The insurance company assesses the insured's health, lifestyle, and other risk factors to determine the premium and coverage amount.

Yes, life insurance payouts may have certain limitations and exclusions. Some policies might exclude coverage for deaths resulting from specific causes, such as suicide, criminal activity, or pre-existing medical conditions. Additionally, the payout amount may be reduced or denied if the insured's death is found to be fraudulent or if the policyholder failed to disclose relevant information during the application process. It's essential to review the policy terms and conditions to understand the specific coverage and any potential limitations.

The process of receiving the insurance payout varies depending on the policy type and the insurance company's procedures. Typically, the beneficiaries named in the policy must provide the insurance company with proof of death, such as a death certificate, and complete any necessary claim forms. The insurance company will then review the claim, verify the information, and disburse the payout according to the policy's terms. In some cases, the payout may be paid directly to the beneficiaries, while in others, it might be paid to the policyholder or a designated trust.