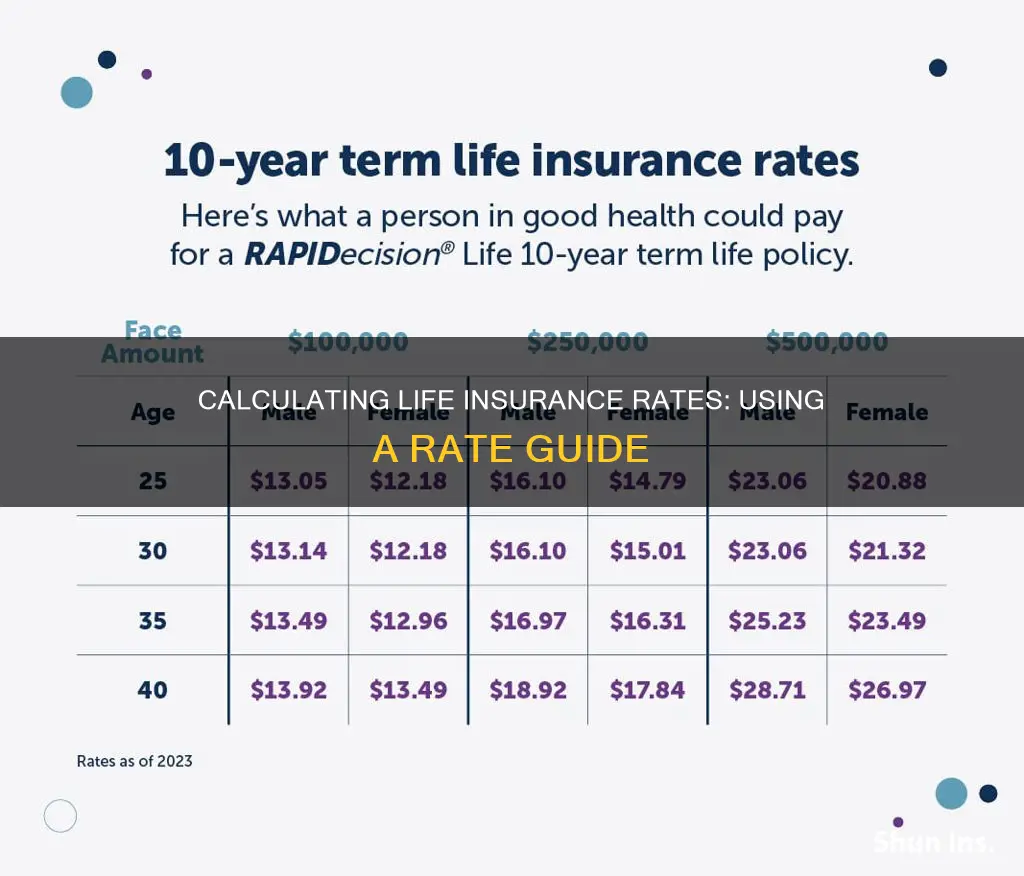

Life insurance rates can be calculated using a rate guide, factoring in considerations such as age, gender, health, and lifestyle choices. The younger and healthier an individual is, the cheaper the premiums tend to be. Additionally, women often pay less than men due to higher life expectancy. Lifestyle choices like smoking or engaging in risky activities can also impact rates. Calculators and tools are available to help estimate life insurance needs and costs, but consulting a licensed agent or financial planner is advisable to ensure coverage aligns with specific circumstances.

| Characteristics | Values |

|---|---|

| Policy type and limits | The amount of insurance you purchase and the type of policy you purchase will determine the cost. Term policies are more affordable than permanent types of insurance. |

| Age | The older you are, the more likely you are to pass away during the policy period, so the higher your rates will likely be. |

| Health | If you are generally healthy, you’ll probably get a cheaper life insurance premium. |

| Occupation | Having a career that puts your safety at risk could mean you’ll pay higher rates. |

| Hobbies | Having risky hobbies could mean you pay higher life insurance rates or that you’re denied coverage altogether. |

| Habits | Any habits, like smoking or drug use, that put you at a higher risk for health complications or death are likely to either increase premiums or possibly even exclude you from coverage. |

| Gender | Women have longer life expectancies than men and will almost always pay less than men of the same age and health. |

| Smoking status | Smokers are at a higher risk of developing health issues, so life insurance for smokers tends to be more expensive. |

What You'll Learn

Calculating rates for permanent whole life insurance

Permanent whole life insurance is a type of insurance that provides coverage for the policyholder's entire lifetime, as long as they continue to pay their premiums. It is designed to provide a death benefit rather than act as a conservative investment. Whole life insurance policies are significantly more expensive than term life insurance policies because they offer lifelong coverage and include a cash value component. The cash value of a whole life insurance policy grows tax-free over time and can be accessed by the policyholder through loans or partial withdrawals. The cost of whole life insurance depends on four main factors: age, health profile, gender, and the type of policy.

Age is a significant factor in determining the cost of whole life insurance. The younger the policyholder, the lower the cost of the policy, as the likelihood of the insurance company having to pay out the policy is reduced. Each year that passes without purchasing a life insurance policy, premiums increase by an average of 4.5% to 9%.

The health profile of the policyholder also plays a crucial role in calculating rates. Generally, the healthier the individual, the lower the cost of the policy. Pre-existing conditions, such as heart disease, diabetes, or cancer, can significantly impact premiums. Other conditions, like asthma, sleep apnea, or high blood pressure, usually have a lower impact.

Gender is another factor, with women paying lower rates than men due to their longer life expectancy.

Finally, the type of whole life insurance policy chosen will also affect the cost. There are three variations of permanent insurance: whole life, universal life, and variable life, each of which includes an investment component. The cost of the policy will depend on the specific features and coverage offered.

To calculate the rates for permanent whole life insurance, insurance companies consider various factors, including age, gender, health status, occupation, hobbies, and habits. By weighing these factors, insurance companies can assess the risk of insuring an individual and determine the appropriate premium amount.

Dialysis and Life Insurance: What's the Connection?

You may want to see also

How gender impacts rates

Life insurance rates are primarily based on life expectancy. Men and women have different life expectancies, with women generally living longer than men. As a result, women tend to pay lower life insurance premiums than men. According to 2020 data, the life expectancy for women in the US is around 80 years, while for men, it's around 74.5 years. This difference in life expectancy leads to a notable variation in male and female life insurance rates.

Actuarial tables, which determine an individual's chances of dying based on historical data, show that men usually die earlier than women. While more recent research suggests that life expectancy by gender may be more complex, there isn't currently enough data to change existing insurer guidelines.

In addition to life expectancy, other factors that contribute to the gender gap in life insurance rates include health factors, occupational hazards, and lifestyle choices. Men are generally more prone to certain health conditions, such as heart disease and hypertension, which increase the risk of mortality. They are also more likely to work in high-risk fields, such as construction or logging, which can increase the likelihood of accidents and fatalities. Furthermore, men tend to engage in riskier behaviors, such as smoking, heavy alcohol consumption, and extreme sports, which can impact their health and life expectancy.

It's important to note that gender-specific conditions can also impact life insurance rates for both men and women. For example, prostate or testicular cancer may affect men's rates, while ovarian or breast cancer, pregnancy, and hormonal conditions may influence women's rates.

While gender plays a role in life insurance rates, it's important to consider other factors as well. Age, family medical history, health history, lifestyle risks, policy benefits, and risky activities can all impact the cost of life insurance, regardless of gender.

Life Insurance Proceeds: Community Property or Separate Asset?

You may want to see also

How age affects rates

Age is one of the most influential factors affecting life insurance premiums. Insurers assess premiums based on multiple personal factors, but an emphasis is placed on mortality risk, and the probability of death rises steadily as we get older.

The older you are when you purchase a policy, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The older you are, the more likely you are to pass away during the policy period, so the higher your rates will likely be.

In general, the premium amount increases, on average, about 8% to 10% for every year of age; it can be as low as 5% annually if you're in your 40s, and as high as 12% annually if you’re over 50.

Life insurance rates usually increase as you get older because advanced age typically corresponds to health complications or a shorter lifespan. This means insurance companies can generally expect a claim payout will come sooner for an older person and will often charge a higher premium to offset that risk.

Young adults are often in good health and may only need a minimum amount of coverage, which might translate to lower rates. Many individuals will find that a term life insurance policy offers adequate coverage for their needs and budget, but the best policy for young adults might depend on their family situation. Young families often purchase term life insurance because it’s a more affordable option at a time when they’re typically the most financially vulnerable.

As people age, they often benefit from a term life insurance policy that is in effect until they hit retirement. For instance, instead of purchasing a 30-year policy, a middle-aged adult might purchase a 10-year policy if they’re only a decade out from retiring.

Older adults might have a harder time purchasing life insurance. In fact, many insurers stop issuing new life insurance policies to seniors over a certain age — usually around 80. Life insurance for seniors can often be cost-prohibitive depending on their health and the type of coverage they qualify for.

Of the life insurance products available, a guaranteed life insurance policy might be one of the only options a senior can qualify for. With guaranteed life insurance, no medical exam or health questionnaire is required, and approval is guaranteed. However, these policies can be expensive and usually have a death benefit cap of around $25,000.

Terrorists and Life Insurance: Who Benefits from Death?

You may want to see also

Using a calculator to estimate rates

- Your estimated burial expenses

- The number of income-earning years you want to replace for your beneficiary

- The net income of your survivors

- The values of your current investments and savings

- The number of children your survivor will need to support

- Any one-time expenses you want to account for, such as college expenses or charitable donations

It's important to note that these calculators provide an estimate of how much life insurance coverage you may need and are not meant to replace the expertise of a licensed agent or financial planner. Additionally, these calculators are death benefit calculators and won't show you the cost of life insurance. To get an accurate idea of the cost, you'll need to obtain a life insurance quote from a company that suits your specific needs.

- Understand your reason for purchasing life insurance. Whether it's to help a loved one pay off debt, replace lost income, or leave a financial gift, your reason will impact the amount of coverage you need.

- Decide on the type of policy you want. Different types of life insurance policies exist, such as term life insurance and whole life insurance, and understanding the differences can help you determine the appropriate coverage amount.

- Review your annual salary. If you're using life insurance to replace your income, you may want to multiply your annual salary by the number of years until retirement to ensure your loved ones receive a similar financial contribution.

- Consider your debts. If your life insurance is intended to pay off debts, you may only need enough coverage to cover the principal amount.

- Decide if you want to leave a financial gift. You can use life insurance to leave a financial gift to your beneficiaries, and the amount is entirely up to you.

- Assess your current assets. If you have significant savings or investment funds, you may not need as much life insurance coverage compared to someone with less wealth.

- Consult a professional. If you're unsure, working with a licensed agent or certified financial planner can help you assess your situation and determine the appropriate type and level of coverage.

Canceling Primerica Life Insurance: A Step-by-Step Guide

You may want to see also

How to calculate rates manually

To calculate life insurance rates manually, you can follow these steps:

Step 1: Identify your financial obligations

Calculate your annual salary and multiply it by the number of years you want to replace that income. Add to this your mortgage balance and any future costs such as college fees and funeral expenses. If applicable, also consider the cost of replacing services that a stay-at-home parent provides, such as childcare.

Step 2: Assess your assets

Calculate your total assets, including savings and existing college funds and current life insurance policies.

Step 3: Calculate your coverage

Subtract your total assets from your total financial obligations. The number you are left with is the amount of life insurance coverage you require.

Step 4: Calculate your premium

Your premium will depend on the type of insurance you choose. For example, the premium for a 20-Pay Permanent Whole Life Insurance policy can be calculated by finding your age and gender in a Life Insurance Rate Table, then multiplying the corresponding dollar value by the number of thousands of face value coverage.

You can also calculate your monthly premium by multiplying your annual premium by 0.09.

It is important to note that life insurance rates are based on life expectancy and other factors such as gender, age, health, and smoking status. Each insurer will have a different evaluation process, so it is a good idea to compare quotes from multiple insurers.

Life Insurance After a Suicide Attempt: What's the Wait Time?

You may want to see also

Frequently asked questions

Find your age in the Life Insurance Rate Table under the "Issue Age" column. Move across that row until you find your gender and nicotine use designation. Multiply the dollar value per $1,000 by the number of thousands of face value coverage. This will give you an estimate of your annual premium for a permanent life insurance policy.

Multiply the annual premium by 0.09.

Life insurance rates are primarily based on life expectancy. The younger and healthier you are, the cheaper your premiums will be. Other factors that affect rates include gender, smoking status, health, family medical history, driving record, occupation, and lifestyle.