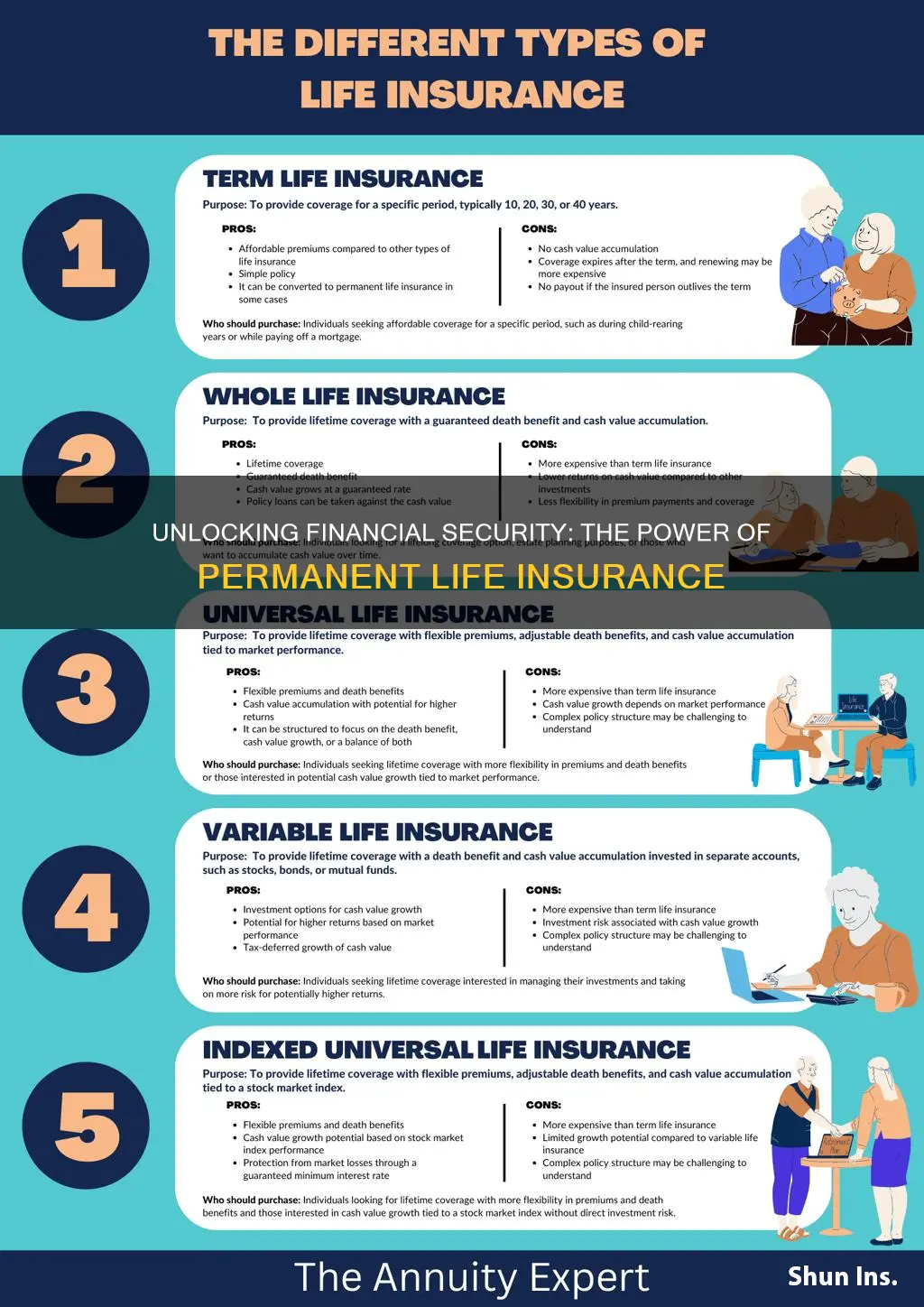

Permanent life insurance offers a range of benefits that make it a valuable financial tool. One of its key advantages is the ability to build cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Additionally, permanent life insurance provides lifelong coverage, ensuring that your loved ones are protected even in the event of your passing. This type of insurance also offers a guaranteed death benefit, meaning the amount paid out upon your death is fixed, providing financial security for your family. Furthermore, permanent life insurance can be a valuable investment vehicle, allowing you to accumulate wealth over time through its investment components.

What You'll Learn

- Long-Term Financial Security: Provides consistent coverage for a lifetime, ensuring financial stability for beneficiaries

- Death Benefit: Offers a lump sum payout, covering final expenses and providing financial support to loved ones

- Tax Advantages: Premiums are often tax-deductible, and death benefits are tax-free, offering financial benefits to policyholders

- Flexible Premiums: Policyholders can choose payment plans, allowing customization based on individual financial situations and needs

- Build Cash Value: Some policies accumulate cash value, which can be borrowed against or used for investment, offering financial growth

Long-Term Financial Security: Provides consistent coverage for a lifetime, ensuring financial stability for beneficiaries

Permanent life insurance is a powerful financial tool that offers long-term financial security and provides consistent coverage for a lifetime. This type of insurance is designed to offer a sense of financial stability and peace of mind, knowing that your loved ones will be taken care of, no matter what life throws their way. One of the key benefits of permanent life insurance is its ability to provide a guaranteed death benefit, which means that the insurance company will pay out a specified amount upon your passing. This financial safety net ensures that your beneficiaries can rely on a steady stream of income to cover essential expenses, such as mortgage payments, education costs, or daily living expenses.

The long-term nature of permanent life insurance is particularly advantageous as it allows for the accumulation of cash value over time. As premiums are paid, a portion of the money goes towards building a cash reserve, which can be borrowed against or withdrawn if needed. This feature provides financial flexibility and can be a valuable asset for various financial goals. For example, policyholders can access the cash value to fund education expenses, start a business, or even provide a loan to help with a major purchase without having to surrender the policy or disrupt their long-term coverage.

In addition to the financial benefits, permanent life insurance also offers a sense of security and reassurance. Knowing that your family's financial future is protected can reduce stress and provide a sense of control over life's uncertainties. This type of insurance is especially valuable for those with long-term financial commitments or responsibilities, as it ensures that these obligations will be met, even in the event of the insured's untimely death.

Furthermore, permanent life insurance can be a valuable tool for wealth accumulation and transfer. The cash value accumulation can grow tax-deferred, allowing it to potentially grow significantly over time. This growth can be utilized to build a substantial financial legacy, ensuring that your beneficiaries receive a substantial inheritance. The policy can also be used to secure loans, providing access to funds without selling the policy or disrupting the coverage.

In summary, permanent life insurance is an excellent choice for those seeking long-term financial security. It provides consistent coverage, ensuring that your loved ones are protected and financially stable. With its ability to offer a guaranteed death benefit, accumulate cash value, and provide financial flexibility, permanent life insurance is a valuable asset for anyone looking to secure their family's financial future and leave a lasting legacy.

Life Insurance: Haven's Affiliate Program Explained

You may want to see also

Death Benefit: Offers a lump sum payout, covering final expenses and providing financial support to loved ones

The death benefit is a crucial aspect of permanent life insurance, providing a financial safety net for your loved ones in the event of your passing. This benefit offers a lump sum payout, which can be a significant financial cushion for your family during a difficult time. The primary purpose of this payout is to cover various final expenses, such as funeral costs, burial or cremation arrangements, and outstanding debts. These expenses can often be overwhelming for grieving families, and having a dedicated financial resource to cover them can provide immense relief.

Moreover, the death benefit serves as a vital source of financial support for your loved ones' long-term needs. It can help cover essential living expenses, such as mortgage or rent payments, utility bills, and daily living costs, ensuring that your family's standard of living is maintained even after your passing. This financial support can be especially crucial if the primary breadwinner in the family is no longer present. By providing a lump sum amount, permanent life insurance ensures that the financial burden of maintaining a household doesn't fall solely on the remaining family members.

One of the key advantages of the death benefit is its ability to provide financial security and peace of mind. Knowing that your family has a guaranteed financial resource in place can reduce stress and anxiety during challenging times. It allows your loved ones to focus on grieving and healing rather than worrying about financial matters. This aspect of permanent life insurance is particularly valuable, as it ensures that your family's financial well-being is protected even when you are no longer around to provide for them.

In addition, the death benefit can be tailored to meet specific financial goals and requirements. You can choose the amount of the payout based on your family's needs and future expenses. This customization ensures that the financial support provided is adequate and aligned with your loved ones' long-term plans. Whether it's covering educational expenses for children, paying off a mortgage, or funding a business venture, the death benefit can be structured to accommodate various financial objectives.

In summary, the death benefit of permanent life insurance is a powerful tool for providing financial security and support to your loved ones. It offers a lump sum payout that covers final expenses and ensures your family's financial stability in the long term. By addressing the practical and emotional challenges associated with the loss of a primary income earner, permanent life insurance empowers individuals to leave a lasting legacy of financial protection for their cherished ones.

Whole Life Insurance for Seniors: Is It Worth It?

You may want to see also

Tax Advantages: Premiums are often tax-deductible, and death benefits are tax-free, offering financial benefits to policyholders

When it comes to permanent life insurance, one of the key advantages is the tax benefits it provides. Firstly, the premiums paid for this type of insurance can often be tax-deductible, which means that the cost of your insurance policy can be reduced from your taxable income. This is particularly beneficial for individuals who are in higher tax brackets, as it can result in significant tax savings. By deducting the premiums, you can lower your overall tax liability, which is a substantial financial benefit.

Secondly, the death benefits associated with permanent life insurance are tax-free. When a policyholder passes away, the death benefit amount is paid out to the designated beneficiaries. Unlike other forms of insurance payouts, this amount is not subject to income tax. This tax-free status ensures that the entire death benefit can be used to cover funeral expenses, provide financial support to loved ones, or be invested to grow over time. It offers a seamless and efficient way to provide financial security to your family without the burden of taxes.

The tax advantages of permanent life insurance can be particularly appealing for long-term financial planning. As the premiums are often tax-deductible, you can build up a substantial amount of savings over time, which can be used for various financial goals. Additionally, the tax-free nature of the death benefit ensures that the entire amount received by the beneficiaries remains intact, providing a more substantial financial cushion. This aspect is especially valuable for those who want to ensure their family's financial well-being in the event of their passing.

Furthermore, the tax benefits of permanent life insurance can be a strategic advantage for business owners. By deducting the premiums, business owners can reduce their taxable income, which can lead to lower tax payments and increased cash flow. This can be crucial for business operations and growth. Moreover, the tax-free death benefit can be an essential part of an estate plan, allowing business owners to provide for their heirs while minimizing the tax impact on their estate.

In summary, permanent life insurance offers valuable tax advantages that can significantly benefit policyholders. The tax-deductible premiums and tax-free death benefits provide financial relief, flexibility, and security. Understanding these tax benefits is essential for individuals and business owners alike, as it can contribute to a more comprehensive financial strategy and ensure a more prosperous future for their loved ones.

Lawyers: Life Insurance Agents? Exploring Dual Careers

You may want to see also

Flexible Premiums: Policyholders can choose payment plans, allowing customization based on individual financial situations and needs

When it comes to permanent life insurance, one of the key advantages is the flexibility it offers in terms of premium payments. This feature allows policyholders to tailor their insurance plans according to their unique financial circumstances and requirements. By offering customizable payment plans, permanent life insurance provides individuals with the ability to make informed decisions about their insurance coverage.

The concept of flexible premiums is particularly beneficial for those who may experience fluctuations in their income or financial obligations over time. For instance, a young professional might opt for a higher monthly payment to ensure comprehensive coverage during their initial years of earning. As their career progresses and income increases, they can adjust the premium payments accordingly, potentially reducing the monthly outlay. This flexibility enables individuals to manage their insurance costs effectively, ensuring they remain financially stable while maintaining adequate protection.

Furthermore, this customization aspect caters to various life stages and personal goals. For example, a policyholder may choose to increase the premium during their child's formative years to provide a robust financial safety net for their family. Alternatively, someone approaching retirement might prefer a more conservative payment plan, ensuring the insurance remains affordable without compromising the coverage. The ability to adapt the premium structure allows individuals to align their insurance policy with their evolving life goals and financial priorities.

In addition, flexible premium options can be advantageous for those who prefer a more proactive approach to financial planning. By regularly reviewing and adjusting their payment plans, policyholders can ensure that their insurance coverage remains relevant and appropriate as their life circumstances change. This level of control empowers individuals to make proactive decisions, ensuring their permanent life insurance policy remains a valuable asset throughout their lifetime.

In summary, the flexibility of premium payments in permanent life insurance is a significant benefit, offering policyholders the freedom to customize their coverage. This feature enables individuals to make informed choices, adapt to changing financial situations, and align their insurance plans with their personal goals. By providing such flexibility, permanent life insurance becomes a versatile tool, catering to the diverse needs of policyholders at different stages of life.

Universal Life Insurance: What You Need to Know

You may want to see also

Build Cash Value: Some policies accumulate cash value, which can be borrowed against or used for investment, offering financial growth

Permanent life insurance, often referred to as whole life insurance, offers a range of benefits that set it apart from other insurance products. One of its key advantages is the ability to build cash value over time. This feature is particularly valuable for those seeking long-term financial security and growth.

When you purchase a permanent life insurance policy, a portion of your premium goes towards building cash value. This cash value grows tax-deferred, meaning it can accumulate without being subject to annual taxes. Over time, this value can become substantial, providing a financial cushion that can be utilized in various ways. One of the primary benefits is the ability to borrow against this cash value. Policyholders can take out loans against their policy, allowing them to access funds without selling the policy or disrupting their insurance coverage. These loans typically have favorable interest rates, often lower than those of traditional bank loans, making them an attractive option for various financial needs.

The cash value built up in permanent life insurance can also be used for investment purposes. Policyholders have the flexibility to allocate a portion of the cash value towards investment options offered by the insurance company. These investments can vary, including stocks, bonds, or other financial instruments. By investing in these options, policyholders can potentially earn higher returns compared to traditional savings accounts, thus growing their financial assets. This feature is especially beneficial for those who want to take control of their investments and potentially benefit from the power of compounding over time.

Furthermore, the cash value in permanent life insurance can provide financial security and peace of mind. It serves as a valuable asset that can be used to cover various expenses, such as education costs, business ventures, or even retirement planning. The ability to build and access cash value allows individuals to create a financial safety net, ensuring that their loved ones are protected even in their absence. This aspect is particularly crucial for those who want to ensure long-term financial stability and leave a legacy for their beneficiaries.

In summary, permanent life insurance with its cash value accumulation offers a unique advantage in the financial market. It provides policyholders with the opportunity to build a valuable asset, access funds through loans, and invest for potential growth. This feature not only ensures long-term financial security but also empowers individuals to take control of their financial future, making permanent life insurance a comprehensive and attractive choice for those seeking both insurance coverage and financial growth.

Life Insurance and Pre-Existing Conditions: What They Can Discover?

You may want to see also

Frequently asked questions

Permanent life insurance, also known as whole life insurance, is a type of long-term coverage that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, permanent life insurance offers coverage that cannot be canceled, regardless of changes in health or age. This means the policyholder will always have coverage as long as they pay the premiums.

This type of insurance provides several financial advantages. Firstly, it offers a guaranteed death benefit, ensuring a fixed payout to your beneficiaries when you pass away. Secondly, it includes an investment component, allowing your premiums to grow tax-deferred within an internal investment account. Over time, this can accumulate cash value, which can be borrowed against or withdrawn, providing financial flexibility. Additionally, permanent life insurance can be a valuable tool for wealth accumulation and can be used to secure long-term financial goals.

Yes, there are tax benefits associated with permanent life insurance. The cash value accumulation within the policy grows tax-deferred, meaning it can accumulate without being taxed each year. Additionally, policyholders can make tax-deductible premium payments, and the death benefit received by beneficiaries is generally tax-free. These features can provide significant tax advantages over time, making it a tax-efficient way to secure your family's financial future.

Absolutely. One of the key advantages of permanent life insurance is the ability to access the cash value built up within the policy. Policyholders can borrow against this cash value or make withdrawals, providing financial flexibility. This can be particularly useful for various purposes, such as funding education expenses, starting a business, or covering unexpected costs. The cash value also grows over time, ensuring that your investment remains intact even if you need to access funds.