When it comes to choosing the best life insurance in the UK, it's important to understand that best can mean different things to different people. Some may prioritize coverage amount, while others might focus on affordability, customer service, or specific policy features. The ideal life insurance policy will depend on your unique financial situation, health, and personal goals. This guide will explore the various types of life insurance available in the UK, their pros and cons, and key factors to consider when making your decision, helping you find a policy that suits your needs.

What You'll Learn

- Cost Comparison: Understand how different policies compare in terms of price and coverage

- Policy Types: Explore term, whole life, and universal life insurance options in the UK

- Provider Reviews: Research customer satisfaction and financial stability of insurance companies

- Medical Requirements: Learn about health assessments and their impact on insurance eligibility

- Tax Benefits: Discover how life insurance can provide tax advantages for policyholders

Cost Comparison: Understand how different policies compare in terms of price and coverage

When considering life insurance in the UK, understanding the cost comparison between different policies is crucial to making an informed decision. The price of life insurance can vary significantly depending on several factors, including your age, health, lifestyle, and the level of coverage you require. Here's a breakdown of how to compare costs and what to look for:

Age and Health: One of the most significant factors affecting the cost of life insurance is your age and overall health. Younger and healthier individuals typically pay lower premiums as they pose less risk to insurance providers. As you age, especially if you have pre-existing health conditions, the cost of insurance may increase. It's essential to be transparent about your health history when applying for a policy to ensure accurate pricing.

Coverage Amount: The amount of coverage you choose directly impacts the premium. Higher coverage amounts mean a larger payout in the event of your passing, which usually results in higher premiums. It's a delicate balance between ensuring sufficient coverage and keeping costs manageable. Many insurers offer a range of coverage options, allowing you to customize your policy to fit your needs and budget.

Policy Type: There are various types of life insurance policies available in the UK, including term life insurance, whole life insurance, and decreasing term life insurance. Term life insurance is generally more affordable for shorter-term coverage, while whole life insurance provides long-term coverage and may have an investment component. Deciding on the policy type that aligns with your goals and financial situation is essential for cost-effective coverage.

Lifestyle and Risk Factors: Insurers consider factors like smoking status, occupation, hobbies, and travel plans. For instance, a non-smoker with a sedentary lifestyle and no plans for extreme sports may pay less for life insurance compared to a smoker with a high-risk job and frequent international travel. These factors influence the perceived risk to the insurer and can significantly impact premium costs.

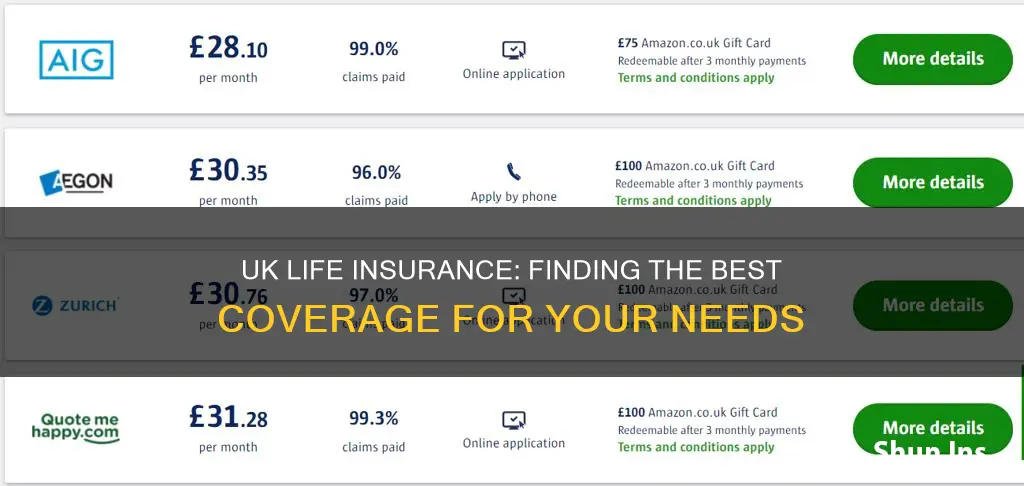

Comparing Quotes: To get a comprehensive cost comparison, obtain quotes from multiple insurance providers. Ensure that the quotes include similar coverage amounts and terms. Review the policy details carefully, as some insurers may offer lower premiums but with fewer benefits or exclusions. Online comparison tools can also help you quickly assess the prices and features of various policies.

In summary, comparing the costs of different life insurance policies in the UK involves considering your age, health, desired coverage, and lifestyle factors. By understanding these elements, you can make an informed decision and choose a policy that provides adequate protection without breaking the bank. Remember, the goal is to find a balance between coverage and affordability to suit your individual circumstances.

Borrowing from Your Unum Life Insurance: Is It Possible?

You may want to see also

Policy Types: Explore term, whole life, and universal life insurance options in the UK

When considering life insurance in the UK, it's essential to understand the different policy types available to ensure you choose the right coverage for your needs. Here's an overview of the three primary policy types: term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance: This is a straightforward and cost-effective option, providing coverage for a specified period, typically 10, 20, or 30 years. It offers a death benefit if the insured individual passes away during the term. Term life insurance is ideal for those seeking temporary coverage, often used to protect against financial burdens like mortgage payments or to provide for dependents. The premiums are generally lower compared to other types, making it an attractive choice for those on a budget. However, it's important to note that term life insurance does not accumulate cash value, and the coverage ends once the term is over, requiring the need to renew or purchase a new policy if desired.

Whole Life Insurance: In contrast, whole life insurance offers lifelong coverage, providing a death benefit and an accumulation of cash value over time. This policy type is more expensive than term life but offers long-term financial security. With whole life insurance, the premiums are typically higher, but they remain consistent throughout the policy's duration. The cash value component allows the policyholder to build equity, which can be borrowed against or withdrawn. This type of insurance is suitable for those seeking permanent coverage and a financial asset that can grow over time. It provides peace of mind, knowing that your loved ones will be financially protected regardless of when you pass away.

Universal Life Insurance: This policy offers flexibility and adaptability, allowing policyholders to adjust their coverage and premiums over time. Universal life insurance provides a death benefit and a cash value component, similar to whole life insurance. However, the premiums can vary, and policyholders have the option to increase or decrease the death benefit based on their financial goals and changing circumstances. This type of insurance is suitable for those who want control over their policy and the ability to adapt it as their life changes. It offers a combination of coverage and investment opportunities, making it a versatile choice.

Understanding these policy types is crucial when evaluating the best life insurance options in the UK. Each type has its advantages and considerations, and the choice depends on individual financial goals, risk tolerance, and long-term plans. It is recommended to consult with a financial advisor or insurance specialist to determine the most suitable policy based on personal circumstances.

Understanding Taxable Life Insurance Dividends: A Guide

You may want to see also

Provider Reviews: Research customer satisfaction and financial stability of insurance companies

When considering the best life insurance provider in the UK, it's crucial to delve into customer satisfaction and financial stability, as these factors significantly influence the overall quality of the service. Researching customer reviews and ratings can provide valuable insights into the experiences of policyholders. Many independent review platforms and financial rating agencies offer comprehensive overviews of various insurance companies. These reviews often highlight common trends in customer satisfaction, such as the ease of claims processing, the responsiveness of customer service, and the overall value for money. For instance, a quick search might reveal that Company X has consistently received high ratings for its straightforward claims process, while Company Y is praised for its competitive premiums and comprehensive coverage options.

Financial stability is another critical aspect to consider. A financially strong insurance provider is more likely to honor its commitments to policyholders, especially in the event of a claim. Financial ratings from agencies like A.M. Best, Moody's, and Standard & Poor's can provide an in-depth assessment of a company's financial health. These ratings consider factors such as capital strength, liquidity, and financial performance over time. For instance, a 'A' rating from A.M. Best indicates an excellent financial strength, suggesting that the company is well-equipped to meet its obligations to policyholders.

To conduct a thorough provider review, start by identifying the top-rated insurance companies based on customer satisfaction and financial stability. Look for companies that have received multiple positive reviews and high financial ratings. Then, delve deeper into the specific aspects that make these companies stand out. For example, some companies might offer exceptional customer service, with quick response times and efficient claim handling. Others might provide a wide range of policy options tailored to diverse needs, ensuring that customers can find a plan that suits their requirements.

Additionally, consider the transparency and communication practices of the insurance providers. Transparent companies often provide clear and detailed information about their policies, fees, and coverage options. They should also offer regular updates and notifications to policyholders, ensuring that everyone is well-informed about their coverage. Financial stability is also about ensuring that the company can adapt to changing market conditions and economic shifts, which is especially important in the face of unforeseen events like the global pandemic, which has significantly impacted the insurance industry.

In summary, researching customer satisfaction and financial stability is essential when evaluating life insurance providers in the UK. By combining customer reviews with financial ratings, you can make an informed decision, ensuring that you choose a provider that offers both excellent service and a strong financial foundation to support its commitments to policyholders. This approach will help you navigate the complex world of life insurance and find the best fit for your needs.

Government Life Insurance: Taxable or Not?

You may want to see also

Medical Requirements: Learn about health assessments and their impact on insurance eligibility

When considering life insurance in the UK, understanding the medical requirements and health assessments is crucial. These processes are designed to evaluate an individual's health and assess the risk associated with providing insurance coverage. Here's an overview of how health assessments influence insurance eligibility:

Health Assessments and Insurance:

Life insurance companies in the UK often require applicants to undergo a health assessment or medical screening process. This assessment is a comprehensive evaluation of an individual's medical history, current health status, and lifestyle factors. The primary purpose is to determine the risk of developing health issues that could lead to insurance claims. During the assessment, insurers may ask for detailed medical records, including any previous illnesses, surgeries, medications, and lifestyle choices like smoking or drinking habits. This information helps them gauge the likelihood of future health problems and set appropriate insurance premiums.

Impact on Eligibility:

The outcome of a health assessment can significantly impact your insurance eligibility and premium costs. Here's how:

- Eligibility for Coverage: Insurers may offer coverage, but the terms and conditions might vary based on the assessment results. For instance, they might provide a standard policy with certain exclusions or limitations if pre-existing conditions are identified. Alternatively, they may offer a more comprehensive policy with lower premiums if your health is deemed favorable.

- Premium Adjustments: Health assessments directly influence the premium rates. A good health assessment with no significant findings can lead to lower premiums, as you are considered a lower-risk candidate. Conversely, existing health issues or chronic conditions may result in higher premiums or even denial of coverage, depending on the severity.

- Exclusions and Restrictions: In some cases, specific medical conditions or health factors may lead to exclusions or restrictions in the policy. For example, pre-existing heart disease might require a waiting period before coverage begins or may exclude certain activities like extreme sports.

Preparing for the Assessment:

To ensure a smooth process, it's advisable to gather your medical records and be prepared to provide detailed information. Here are some tips:

- Obtain your medical records from previous doctors and hospitals, ensuring you have a comprehensive history.

- Be honest and accurate when providing information about your health. Inaccurate details can lead to issues during claims.

- Consider consulting a healthcare professional for a pre-assessment check-up to identify any potential concerns.

Understanding the medical requirements and health assessments is essential for making informed decisions about life insurance. It empowers individuals to take control of their insurance journey, ensuring they receive appropriate coverage while being aware of any potential limitations or adjustments needed due to health factors.

Trustage Life Insurance: Is It Worth the Hype?

You may want to see also

Tax Benefits: Discover how life insurance can provide tax advantages for policyholders

Life insurance in the UK offers a range of benefits, and one of the most significant advantages is the potential for tax relief. When considering the best life insurance policies, understanding these tax benefits can be crucial for making an informed decision. Here's an overview of how life insurance can provide valuable tax advantages for policyholders:

Tax Relief on Premiums: One of the primary tax benefits of life insurance is the ability to claim tax relief on the premiums paid. When you take out a life insurance policy, a portion of your annual premium payments can be claimed as an income tax relief. This means that a percentage of the premium amount is deducted from your taxable income, effectively reducing the overall tax liability. For example, if you pay an annual premium of £1,000 and are in the higher rate tax bracket (40%), you could claim up to £400 of that premium as tax relief, thus lowering your taxable income. This benefit is particularly advantageous for high-income earners who may be in a higher tax bracket.

Tax-Free Payouts: In the event of a policyholder's death, life insurance policies typically provide a tax-free payout to the beneficiaries. This means that the death benefit received by the beneficiaries is not subject to inheritance tax or other taxes. The tax-free nature of these payouts ensures that the intended beneficiaries receive the full value of the policy without any tax implications. This is a significant advantage, especially for larger insurance policies, as it allows the policyholder's family to receive a substantial sum without incurring additional tax costs.

Long-Term Savings and Investment: Certain types of life insurance policies, such as whole life insurance, offer a combination of insurance coverage and long-term savings. These policies accumulate cash value over time, which can be borrowed against or withdrawn tax-free. This feature provides policyholders with a potential source of tax-efficient savings. By investing in these policies, individuals can build a financial asset that grows over the long term, offering tax advantages compared to traditional savings accounts or investments.

Business Owners' Advantage: For business owners, life insurance can be a valuable tool for tax planning. By taking out a business-owned life insurance policy, owners can make regular premium payments, which are tax-deductible business expenses. This allows them to manage their cash flow and potentially reduce their taxable income. Additionally, the death benefit can be used to provide financial security for the business or to settle any outstanding business debts, ensuring a smooth transition for the business in the event of the owner's passing.

Understanding the tax benefits of life insurance is essential for UK residents, as it can significantly impact their financial planning and overall savings strategy. When evaluating different life insurance policies, considering these tax advantages can help individuals choose the best coverage to meet their financial goals while optimizing their tax position.

Understanding Life Insurance Premiums: Your Monthly Cost Breakdown

You may want to see also

Frequently asked questions

The best type of life insurance depends on your individual needs and circumstances. Term life insurance is a popular choice as it provides coverage for a specific period, offering a lump sum payment if you pass away during that time. Permanent life insurance, also known as whole life insurance, offers lifelong coverage and includes a savings component, allowing your beneficiaries to receive a tax-free cash value upon your death. It's essential to assess your financial goals, risk tolerance, and the level of coverage required to determine the most suitable option.

The amount of life insurance you need is typically based on several factors, including your income, family's financial obligations, outstanding debts, mortgage or rent payments, future expenses (e.g., children's education), and the number of dependents you have. A common rule of thumb is to purchase a policy that would provide 10-15 times your annual income. However, it's advisable to consult with a financial advisor to determine a realistic and adequate coverage amount tailored to your specific situation.

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It is generally more affordable and offers a straightforward death benefit. If you pass away during the term, your beneficiaries receive the payout. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component known as cash value. This policy builds up cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Permanent life insurance is more expensive but offers long-term security.

Yes, it is possible to obtain life insurance with pre-existing health conditions, but the process and terms may vary. Insurers often consider factors such as the severity and stability of your health condition, recent medical history, and lifestyle choices. Some companies offer specialized policies for individuals with specific health concerns, while others may require a medical exam and may have higher premiums or exclusions based on the condition. It's best to disclose all relevant health information to get an accurate assessment and quotes from multiple insurers.

Life insurance needs can change over time due to various life events, such as marriage, the birth of a child, purchasing a home, or significant financial changes. It is recommended to review your life insurance policy at least once a year or whenever you experience a major life event. Regular reviews ensure that your coverage remains adequate and aligned with your current circumstances. Additionally, policy terms may have periodic reviews or adjustments, so staying informed about these changes is essential.