Life insurance is a crucial financial tool that provides a safety net for individuals and their loved ones. When it comes to defining the best way to approach life insurance replacement, it's essential to understand the various options available. This paragraph will explore the different methods and strategies that can help individuals find the most suitable replacement plan for their unique circumstances, ensuring financial security and peace of mind.

What You'll Learn

- Cost of Living: Life insurance should cover expenses to maintain a similar standard of living

- Debt Management: Replacing income to pay off debts and financial obligations

- Income Replacement: Provides financial support to replace lost wages due to death

- Long-Term Care: Covers costs for extended medical care and assisted living

- Legacy Planning: Life insurance can be used to leave a financial legacy for beneficiaries

Cost of Living: Life insurance should cover expenses to maintain a similar standard of living

The concept of life insurance replacement is often misunderstood, and one of the most critical aspects to consider is the cost of living and its impact on financial security. When determining the appropriate amount of life insurance coverage, it is essential to ensure that the policy adequately replaces the financial impact of the insured's death, taking into account the unique circumstances of their life and the needs of their loved ones. One of the primary purposes of life insurance is to provide financial support to beneficiaries in the event of the insured's passing. This support should ideally cover the expenses associated with maintaining a similar standard of living for the family or individual who relied on the insured's income.

To achieve this, it is crucial to calculate the cost of living for the specific family or individual. This involves considering various factors such as housing, transportation, utilities, food, healthcare, education, and other essential expenses. For instance, if the insured is the primary breadwinner in a family, the life insurance policy should aim to replace their income to cover the family's daily expenses and long-term financial goals. This might include funding children's education, paying off a mortgage, or covering other significant financial commitments.

The process of determining the cost of living can be complex and may require professional assistance. Financial advisors or insurance specialists can help families and individuals assess their unique financial situation and identify the necessary expenses to maintain their desired standard of living. By doing so, they can ensure that the life insurance policy provides a comprehensive financial safety net.

It is worth noting that the cost of living can vary significantly depending on geographical location, lifestyle choices, and personal circumstances. For example, the expenses for a family in a rural area might differ from those in an urban center, and the cost of raising children or supporting elderly parents can also impact the overall financial needs. Therefore, a personalized approach to calculating the cost of living is essential to ensure that the life insurance replacement accurately reflects the insured's contribution to their family's well-being.

In summary, life insurance replacement should be designed to cover the expenses that maintain a similar standard of living for the insured's beneficiaries. This requires a thorough understanding of the family's or individual's financial needs and a comprehensive assessment of the cost of living. By taking these factors into account, life insurance policies can provide the necessary financial security and peace of mind for those who rely on the insured's income.

Life Insurance Classes: How Many Are There?

You may want to see also

Debt Management: Replacing income to pay off debts and financial obligations

When it comes to debt management, replacing income to cover financial obligations is a crucial strategy for individuals facing financial challenges. This approach involves generating an alternative source of income to ensure that debts are paid off efficiently and effectively. Here's a detailed breakdown of this process:

Understanding the Need for Income Replacement: In many cases, individuals may experience a reduction in their primary income due to various circumstances, such as job loss, illness, or other unforeseen events. During these times, having a backup plan to replace income becomes essential. The primary goal is to maintain a steady cash flow to meet immediate financial responsibilities, including debt repayment.

Exploring Income Replacement Options: There are several strategies to consider when replacing income for debt management:

- Side Hustles or Freelancing: Many people turn to their skills and hobbies to generate extra income. This could involve freelancing in your field of expertise, offering consulting services, or even starting a small business. For example, a graphic designer might take on additional design projects or teach online courses to earn extra money.

- Part-time Employment: Taking on a part-time job can provide a consistent income stream. This could be a temporary position or a long-term arrangement, depending on the individual's skills and the local job market.

- Rental Income: For those with extra space, renting out a room, property, or even parking spaces can generate a steady income. This can be a lucrative way to replace lost income and contribute to debt repayment.

- Pension or Retirement Savings: Accessing pension funds or retirement savings (with proper planning and consideration of tax implications) can provide a financial cushion during difficult times.

Creating a Structured Plan: When implementing income replacement strategies, it's crucial to create a structured plan:

- Assess Your Skills and Resources: Evaluate your skills, experience, and available resources to determine the most suitable income-generating activities.

- Set Realistic Goals: Define short-term and long-term financial goals, including the amount needed to repay debts and the timeline for achieving these goals.

- Prioritize Debt Repayment: Allocate a significant portion of your new income towards debt repayment. Prioritize high-interest debts first to minimize long-term costs.

- Budgeting and Expense Management: Create a detailed budget to track expenses and ensure that your income replacement covers essential costs and debt repayment.

Long-term Financial Planning: Replacing income is just one aspect of effective debt management. It's essential to consider long-term financial planning to prevent future financial crises:

- Financial Education: Invest time in learning about personal finance, budgeting, and debt management to make informed financial decisions.

- Emergency Funds: Build an emergency fund to cover unexpected expenses, reducing the reliance on income replacement during financial hardships.

- Regular Review: Periodically review and adjust your financial plan to adapt to changing circumstances and ensure that your income replacement strategies remain effective.

By implementing these strategies, individuals can take control of their financial situation, replace lost income, and effectively manage their debts. It empowers them to make informed choices, ensuring a more secure and stable financial future.

Transamerica's E-App for Life Insurance: A Digital Revolution

You may want to see also

Income Replacement: Provides financial support to replace lost wages due to death

Income replacement is a fundamental concept in life insurance, offering a crucial financial safety net for individuals and their families. When an individual's life is tragically cut short, this type of insurance ensures that their loved ones are provided for and can maintain their standard of living. The primary purpose is to replace the income that the deceased would have contributed, thereby alleviating the financial burden on the surviving family members.

In the event of a policyholder's death, the insurance company pays out a lump sum or regular payments to the beneficiaries. These payments are designed to mimic the income the deceased would have earned, covering essential expenses such as mortgage or rent, utility bills, groceries, and other daily costs. By providing this financial support, income replacement insurance ensures that the family can continue to meet their financial obligations and maintain their lifestyle without the immediate worry of financial instability.

The amount of income replacement provided is typically calculated based on the policyholder's earnings, taking into account factors such as age, occupation, and overall health. This calculation ensures that the insurance payout is sufficient to cover the deceased's expected future earnings, providing a comprehensive financial safety net. For example, if a family's primary breadwinner passes away, the income replacement benefit could cover their entire household income, ensuring that the family can afford their current standard of living.

One of the key advantages of income replacement is its ability to provide long-term financial security. Unlike a one-time payout, which may be quickly depleted, regular income replacement payments can sustain the family for an extended period. This is particularly important for families with children, as it ensures that the children's needs are met and their education and future prospects are secured. Moreover, the financial support can also help cover funeral expenses and other immediate costs associated with the death, providing immediate relief during a difficult time.

In summary, income replacement in life insurance is a vital mechanism for providing financial stability and peace of mind to families. It ensures that the deceased's income is replaced, allowing the surviving loved ones to maintain their lifestyle and meet their financial obligations without the added stress of sudden financial hardship. This type of insurance is a powerful tool for individuals and families to plan for the future and protect their financial well-being.

HDFCLife Insurance: Comprehensive Overview and Key Features

You may want to see also

Long-Term Care: Covers costs for extended medical care and assisted living

Long-term care insurance is a crucial component of a comprehensive financial plan, especially for individuals who want to ensure they have the necessary support during their later years. This type of insurance is designed to cover the costs associated with extended periods of medical care and assisted living, which can be financially burdensome without proper coverage. As people age, the likelihood of requiring long-term care services increases, and having a dedicated insurance policy can provide peace of mind and financial security.

The primary purpose of long-term care insurance is to assist individuals in managing the expenses related to extended medical treatment and daily living assistance. This coverage is particularly important as it can help individuals maintain their financial independence and avoid depleting their savings or assets. Long-term care services often include a range of needs, such as skilled nursing care, rehabilitation, and assistance with activities of daily living (ADLs) like bathing, dressing, and eating. These services can be provided in various settings, including nursing homes, assisted living facilities, or even at home.

When considering long-term care insurance, it is essential to understand the potential costs involved. The expenses can vary significantly depending on the level of care required and the location of the services. On average, long-term care costs can range from a few thousand dollars per month for in-home care to tens of thousands of dollars per month for specialized nursing facilities. Without insurance, these costs can quickly accumulate and have a significant impact on an individual's financial well-being.

A long-term care insurance policy typically covers a portion of these expenses, providing financial relief to the policyholder and their families. The coverage can include both skilled and unskilled care, ensuring that individuals receive the necessary assistance with medical needs and daily activities. Additionally, some policies offer benefits for cognitive care, which is essential for those with Alzheimer's or other forms of dementia. The goal is to ensure that individuals can age with dignity and comfort, knowing that their financial future is protected.

Obtaining long-term care insurance is a strategic decision that can significantly impact one's retirement planning. It allows individuals to focus on enjoying their later years without the constant worry of financial strain. When choosing a policy, it is advisable to consider factors such as the coverage amount, duration of benefits, and any waiting periods. Customizing the policy to fit individual needs and preferences ensures that long-term care insurance becomes a valuable asset in the overall financial strategy.

Pregnant and Life Insurance: When to Apply?

You may want to see also

Legacy Planning: Life insurance can be used to leave a financial legacy for beneficiaries

Life insurance is a powerful tool for legacy planning, allowing individuals to ensure their loved ones are financially secure even after their passing. When considering the concept of 'life insurance replacement,' it's important to understand how this financial product can be utilized to create a lasting impact. Here's an exploration of this idea:

In the context of legacy planning, life insurance serves as a strategic asset. It provides a means to transfer wealth to beneficiaries, ensuring that the insured individual's financial goals and values are upheld. The primary purpose of life insurance is to provide financial security, and in the context of legacy, it becomes a tool to achieve specific objectives. For instance, a person might purchase a life insurance policy to secure their family's future, covering expenses like mortgage payments, education costs, or daily living expenses. This immediate financial support can be a significant legacy in itself, ensuring the well-being of loved ones.

The beauty of life insurance in legacy planning lies in its flexibility. Policyholders can customize their insurance plans to align with their unique wishes. This includes deciding on the coverage amount, which directly impacts the financial legacy. A higher coverage amount can provide a substantial financial cushion, allowing beneficiaries to maintain their standard of living and achieve long-term financial goals. Additionally, individuals can choose the type of policy, such as term life insurance for temporary coverage or permanent life insurance for long-term financial security.

Furthermore, life insurance can be structured to accommodate specific legacy goals. For example, a person might opt for a policy that includes a cash value component, which can accumulate over time and be borrowed against or withdrawn. This feature enables policyholders to access funds during their lifetime, providing financial flexibility and the ability to adapt to changing circumstances. By utilizing the cash value, individuals can ensure that their legacy plan remains dynamic and responsive to their evolving needs.

In summary, life insurance is a versatile tool for legacy planning, offering both immediate and long-term financial security. It empowers individuals to leave a lasting impact by providing for their beneficiaries' present and future needs. Whether it's covering essential expenses, funding education, or supporting a family's lifestyle, life insurance can be tailored to create a meaningful financial legacy. This approach to legacy planning ensures that the insured individual's wishes are respected and that their loved ones are provided for in a way that aligns with their values and goals.

Life Insurance and Credit: Any Connection?

You may want to see also

Frequently asked questions

Life insurance replacement is a financial strategy designed to provide financial security and peace of mind for individuals and their loved ones. It aims to ensure that the financial obligations and future needs of the policyholder's family are met in the event of their passing.

When you purchase a life insurance policy, you agree to pay regular premiums in exchange for a death benefit. Upon the insured individual's death, the insurance company pays out the death benefit to the designated beneficiaries, who can then use it to cover various expenses, such as mortgage payments, children's education, funeral costs, and daily living expenses.

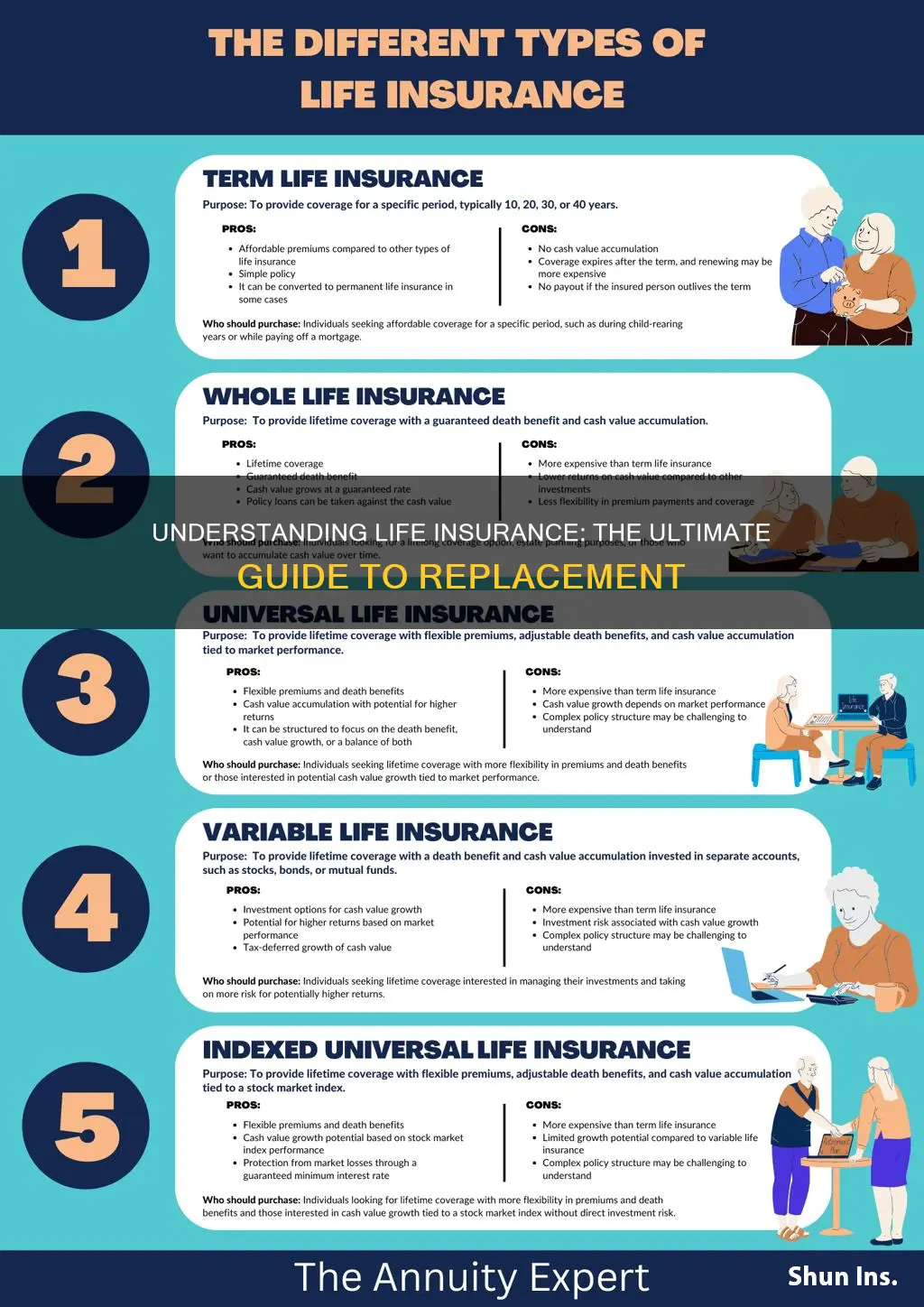

There are several types of life insurance policies that can serve as replacement coverage:

- Term Life Insurance: Provides coverage for a specified term, such as 10, 20, or 30 years. It offers a death benefit if the insured dies during the term.

- Permanent Life Insurance: Offers lifelong coverage and includes an investment component. It provides a death benefit and can accumulate cash value over time.

- Universal Life Insurance: Provides flexible coverage with adjustable premiums and a potential for cash value accumulation.

Life insurance replacement is crucial for several reasons:

- Financial Security: It ensures that your family has the financial resources to maintain their standard of living and cover essential expenses after your passing.

- Debt Management: It can help pay off debts, such as mortgages or loans, preventing financial burden on your loved ones.

- Children's Future: It provides for your children's future needs, including education, healthcare, and other expenses.

- Peace of Mind: Knowing that your family is protected financially can offer significant peace of mind.

Selecting the best life insurance policy involves several factors:

- Assess Your Needs: Determine the financial needs of your family and the duration of coverage required.

- Compare Policies: Research and compare different life insurance options, considering factors like coverage amount, premiums, policy terms, and additional benefits.

- Seek Professional Advice: Consult with a financial advisor or insurance specialist who can provide personalized recommendations based on your circumstances.