Car insurance is a legal requirement in Maryland, and the average cost of car insurance in the state is $1,305 per year, which is 15% lower than the national average. However, the cost of car insurance in Maryland varies depending on factors such as age, location, and driving history. For example, the average cost of car insurance for a 35-year-old driver with a clean driving record in Maryland is $1,433 per year, while the average cost for an 18-year-old driver with a speeding ticket is $300 per month.

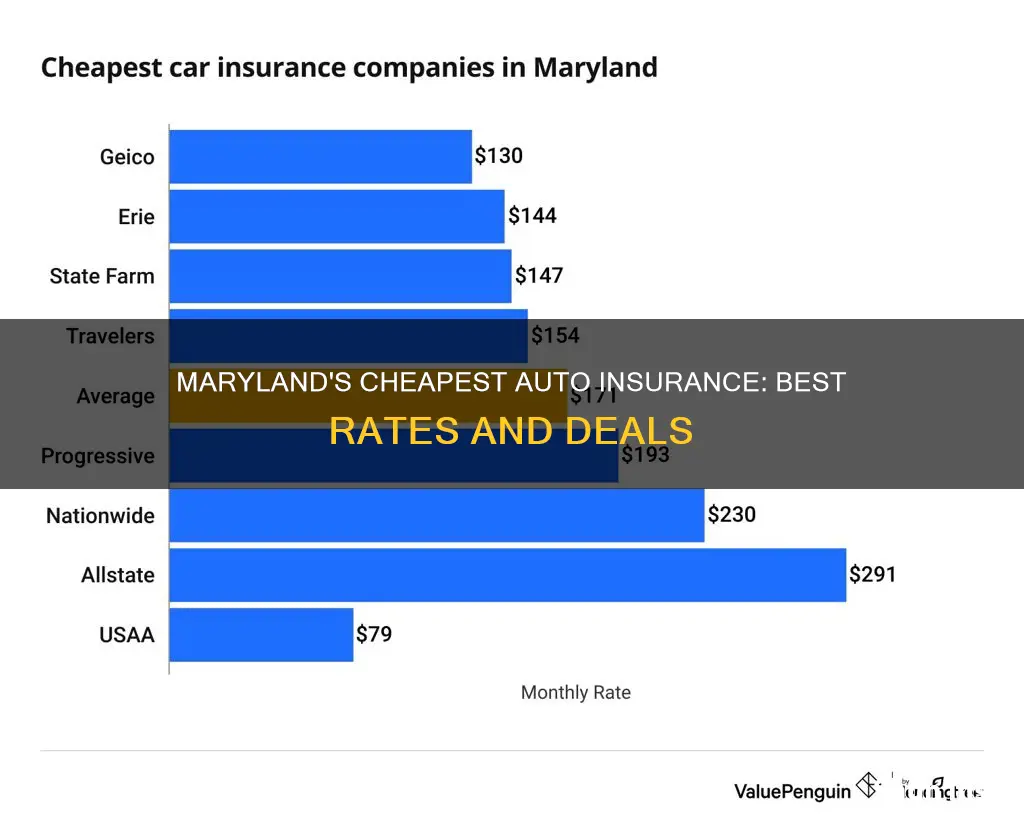

When it comes to finding the cheapest car insurance in Maryland, there are several companies that offer competitive rates. According to recent analyses, Geico, USAA, and Nationwide offer some of the lowest prices for car insurance in the state. For example, Geico's full-coverage policy costs only $130 per month, while USAA's minimum-coverage policy starts at $37 per month. It's important to note that USAA's policies are exclusive to military members, veterans, and their families.

In addition to the cost, it's also important to consider the quality of customer service and the convenience of the insurance company. Erie, for instance, is known for its dependable customer service and affordable quotes, making it a great option for those seeking a balance between cost and service.

| Characteristics | Values |

|---|---|

| Cheapest car insurance in Maryland | USAA |

| Cheapest car insurance in Maryland for minimum coverage | USAA |

| Cheapest car insurance in Maryland for full coverage | Nationwide |

| Cheapest car insurance in Maryland for drivers with prior incidents | USAA and Geico |

| Cheapest car insurance for young drivers in Maryland | USAA and Encompass |

What You'll Learn

Cheapest car insurance for young drivers in Maryland

Car insurance for young drivers is usually much more expensive than for older drivers. An 18-year-old driver in Maryland pays three times as much for minimum-coverage car insurance as a 30-year-old driver. This is due to young drivers' lack of experience and the likelihood of engaging in risky behaviour behind the wheel, both of which make them more likely to be in an accident.

According to ValuePenguin, Erie offers the best cheap quotes for 18-year-old drivers in Maryland. Erie offers minimum coverage for just $155 per month. That's 48% cheaper than the state average for teen drivers. Erie is also the cheapest option for full coverage, at $308 per month.

The Zebra, on the other hand, found that the cheapest major car insurance company in Maryland is Travelers.

USAA is another good option for young drivers, but it is only available to current and former military members and their families.

Other ways to save on car insurance in Maryland

Applying discounts is another way you might be able to get Maryland car insurance savings. Here are some of the most common discounts:

- Young driver discounts: Although insuring young drivers can be expensive, there are ways to save. Young drivers with a B or above GPA could get a good student discount. Taking advantage of telematics programs to demonstrate safe driving habits is another way teens could save on Maryland car insurance.

- Safe driver discounts: A safe driving discount is typically available for drivers with a clean driving record. The longer you go without a ticket or at-fault accident, the more you could save.

- Bundling discounts: Bundling your home and auto insurance typically offers a significant discount on car insurance. Some carriers offer discounts for bundling other policies with auto insurance, too, like renters or pet insurance.

- Affiliation discounts: Another way to save on car insurance in Maryland is through affiliation discounts. This could mean being a member of a professional organization, a credit union or even working in a certain industry or for a specific employer.

Electric Vehicle Insurance: Cheaper?

You may want to see also

Cheapest car insurance for drivers with a DUI in Maryland

In Maryland, drivers with a DUI on their record pay an average of $2,095 per year for car insurance. The cheapest company for this group of drivers is Geico, with an average annual rate of $1,230.

The cheapest car insurance in Maryland is offered by USAA, but membership is limited to military members, veterans, and their families. For those who don't qualify for USAA, the next-cheapest is Geico, which has an annual average rate of $982.

In Maryland, the average rate for a 35-year-old married woman's auto insurance is $1,433 per year, with USAA the cheapest option at $762 per year, on average. Geico is the second-cheapest at $898.

The average rate for a 35-year-old married man is $1,426 per year, with USAA the cheapest option on average at $749 per year, and Geico next-cheapest at $939.

Insuring Your Vehicle: When is it Mandatory?

You may want to see also

Cheapest car insurance for drivers with an at-fault accident in Maryland

In Maryland, the average rate for car insurance after an accident is $2,200 per year. The cheapest option for drivers after an accident is USAA, with an average annual rate of $1,278, and Geico is the next cheapest at $1,528 per year.

USAA is the cheapest option for drivers with an at-fault accident in Maryland. However, USAA is only available to military members, veterans, and their families. For those who don't qualify for USAA, Geico is the next best option.

MetLife Auto Insurance: Understanding Their Roadside Assistance Offerings

You may want to see also

Cheapest car insurance for drivers with a ticket in Maryland

The cost of car insurance in Maryland is about 10% higher than the national average. The average cost of full-coverage car insurance in Maryland is $1,958 per year, or $163 per month. The cheapest car insurance company in Maryland is Geico, with an average rate of $883 per year according to NerdWallet's September 2024 analysis.

For drivers with a speeding ticket, the cheapest car insurance company in Maryland is USAA, with an average annual rate of $931. For those who don’t qualify for USAA, the next-cheapest is Geico, at $1,110 per year on average.

For drivers with an accident on their record, the cheapest option for drivers after an accident is USAA, with an average annual rate of $1,278, and Geico is next-cheapest at $1,528 per year.

For drivers with a DUI on their record, the cheapest company for this group of drivers is Geico, with an average annual rate of $1,230.

For drivers with poor credit, Geico offers the lowest average annual rate of $1,269.

Maryland drivers should get car insurance quotes from several companies to find the lowest rate possible.

Uber's Commercial Auto Insurance Costs

You may want to see also

Cheapest car insurance for military families in Maryland

If you're a military family in Maryland, you may be eligible for USAA car insurance, which is the cheapest option in the state. USAA policies are only available to military members, veterans, and their families. The company offers a discount of up to 15% for those who store their cars on base.

Other cheap options for military families in Maryland include:

- Geico: Up to 15% discount for military members, up to 25% for those deployed to imminent danger zones.

- Armed Forces Insurance: Offers policies to veterans, active-duty service members, and their families, as well as employees of the Department of Defense, the National Oceanic and Atmospheric Administration, and the U.S. Public Health Service.

- Farmers: Offers a 10% discount for former and current military personnel.

- Nationwide: Offers a pay-per-mile program that can save low-mileage drivers up to 20%.

State Farm Auto Insurance: Unveiling Rodent Damage Coverage

You may want to see also

Frequently asked questions

The cheapest auto insurance in Maryland is offered by USAA, with an average rate of $790 per year. However, USAA is only available to military members, veterans, and their families. For those who don't qualify for USAA, Geico is the next cheapest option, with an average annual rate of $982.

The average cost of car insurance in Maryland is $1,305 per year, which is 15% lower than the national average.

In Maryland, drivers are required to have car insurance coverage for bodily injury to others ($30,000 per person and $60,000 per accident) and property damage liability ($15,000 per accident).