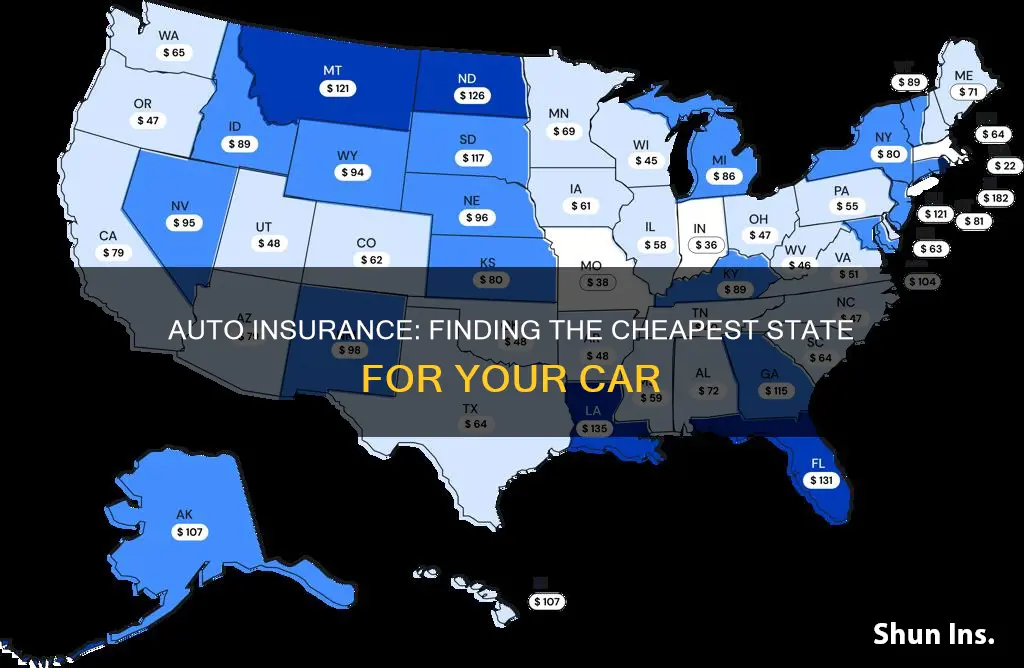

The cost of car insurance varies across the United States, with some states offering cheaper rates than others. Maine is the cheapest state for car insurance, with an average annual premium of $1,175. Other states with low insurance costs include New Hampshire, Vermont, Ohio and Idaho. On the other hand, Louisiana is the most expensive state for car insurance, with an average annual premium of $2,883. Florida, California, Colorado and South Dakota are also among the most expensive states for car insurance.

| Characteristics | Values |

|---|---|

| Cheapest State for Auto Insurance | Maine |

| Average Annual Rate | $1,175 |

| Average Monthly Rate | $97 |

What You'll Learn

Maine: The cheapest state for car insurance at $1,175 annually

Maine is the cheapest state for car insurance, with an average auto insurance premium of $1,175 for a full coverage policy. This is 38% less than the national average of $1,895.

Maine's low insurance losses, competitive auto insurance market, and low population density all contribute to its cheap car insurance. The state has a low number of car insurance claims due to its low population density, which ranks 42nd in the country. This means fewer accidents and claims compared to more populated states.

The next cheapest states for car insurance after Maine are:

- New Hampshire: $1,265 annually

- Vermont: $1,319 annually

- Ohio: $1,417 annually

- Idaho: $1,428 annually

In comparison to the most expensive state for car insurance, Louisiana, Maine's rates are significantly lower. Louisiana has an average annual premium of $2,883 for full coverage, a difference of $1,708.

While Maine has the cheapest rates for car insurance on average, rates can still vary within the state depending on various factors. These factors include your age, gender, driving record, credit score, and the type of vehicle you drive.

To get the best rates in Maine, maintain a clean driving record, improve your credit score, and compare quotes from multiple insurance companies.

Auto Insurance Rates: Why the Spike?

You may want to see also

Low population density and a competitive insurance market

Population density is the number of people per unit of area, usually transcribed as "per square kilometer" or "square mile". It is a key geographical term, and a critical factor in determining auto insurance rates.

States with low population density tend to have lower insurance rates. This is because urban areas, with their higher population densities, tend to have higher congestion, leading to more crashes and higher rates of car break-ins, theft, and vandalism.

For example, Idaho, which has one of the lowest population densities in the country, also has one of the cheapest average car insurance rates in the country. The average annual rate for car insurance coverage in Idaho is $992, which is $551 lower than the national average of $1,543. Similarly, Maine, which has the lowest auto insurance rates in the nation, also has a low population density.

In addition to low population density, a competitive insurance market can also drive down insurance rates. When there are many insurance companies competing for customers in a state, it can lead to lower annual average car insurance rates.

For instance, Vermont has one of the lowest crime rates in the country, relatively few fatal crashes, and a low number of licensed drivers. These factors contribute to cheaper average car insurance costs in the state. Vermont's average annual rate for car insurance is $1,053, which is $490 less than the national average.

Another example is Ohio, which is one of the cheapest states for full coverage car insurance, with drivers paying an average of $1,497 per year. Ohio has a mix of rural and suburban roads, which helps break up traffic congestion. This, coupled with a competitive insurance market, leads to lower insurance rates for consumers.

In summary, low population density and a competitive insurance market can result in lower auto insurance rates for consumers. States with these characteristics tend to have cheaper insurance rates, as the number of claims and accidents is typically lower, and there is more competition to drive down prices.

Tower Hill Auto Insurance: What You Need to Know

You may want to see also

The average premium in the Pine Tree State is $1,175

The Pine Tree State, Maine, has an average premium of $1,175. This is the cheapest rate in the US, with the next cheapest state, Idaho, averaging $992 annually.

Maine's low insurance rates can be attributed to several factors. Firstly, the state has a low population density, with approximately half of its area being forested or unclaimed land. This means there are fewer drivers on the roads, reducing the risk of accidents and claims. Additionally, Maine does not have a history of severe weather conditions that can cause vehicle damage. The state also has a relatively low number of uninsured drivers, which can help keep insurance rates low.

Furthermore, Maine's geography and climate contribute to its low insurance rates. The state's rugged climate and terrain, including its rocky coastline and mountainous interior, may deter drivers from taking unnecessary risks. The state's cold, snowy winters may also result in reduced traffic and slower driving speeds, which can lower the likelihood of accidents.

However, it is important to note that insurance rates can vary within the state. Factors such as age, driving history, and vehicle type can also impact insurance premiums. Additionally, urban areas, such as Portland, the state's most populous city, may have higher insurance rates than rural areas.

To find the cheapest insurance rates in Maine, it is recommended to compare quotes from multiple companies and choose a policy that offers the best coverage at the most affordable price.

Switching Auto Insurance Mid-Year: What You Need to Know

You may want to see also

Maine has the lowest auto insurance rates in the nation

According to US News, Maine has the lowest auto insurance rates in the US, with an average annual rate of $949, which is $594 less than the national average of $1,543. The next cheapest state, Idaho, has an average annual rate of $992.

Maine has a low population density and one of the smallest percentages of uninsured drivers in the country. This helps to keep insurance premiums affordable.

The average auto insurance premium in Maine is $79 per month. The average annual rate for car insurance is $949, while full coverage costs an average of $1,460 per year. This is 46% cheaper than the national average of $2,681. Minimum-liability coverage averages about $456 per year, which is well below the national average of $869.

According to our research, Maine is the cheapest state in the country for full coverage, considering its annual cost of $1,460. It's also one of the cheapest for minimum coverage.

How to Get Cheaper Auto Coverage in Maine

- Shop around: Compare quotes from several providers to find the best rate.

- Look for discounts: Ask about discounts that may be available, such as for safe driving, bundling policies, or having certain safety features in your vehicle.

- Raise your deductible: Increasing your deductible will lower your monthly premium, but make sure you can afford the higher deductible if you need to file a claim.

Creating Fake Auto Insurance Cards: A How-To Guide

You may want to see also

Maine residents have the cheapest average annual rate: $949 per year

Maine residents enjoy the cheapest car insurance rates in the US, paying an average of $949 per year. This is $594 less than the national average of $1,543. Auto-Owners Insurance offers the cheapest rate in the state, at $620 per year.

Maine's low insurance costs are due to its low population density, which results in fewer accidents and claims. The state also has a competitive insurance market, with insurers vying to offer the best rates.

The next cheapest states for car insurance are Idaho ($992), Vermont ($1,053), and Ohio ($1,083).

In contrast, the most expensive state for car insurance is Louisiana, where drivers pay an average of $2,734 per year. This is almost three times the average rate in Maine.

Credit Freeze Conundrum: Unraveling the Myth of Auto Insurance Premiums

You may want to see also

Frequently asked questions

Maine is the cheapest state for auto insurance, with an average annual premium of $1,175.

The cheapest states for auto insurance are Maine, New Hampshire, Vermont, Ohio, and Idaho.

The most expensive states for auto insurance are Louisiana, Florida, California, Colorado, and South Dakota.