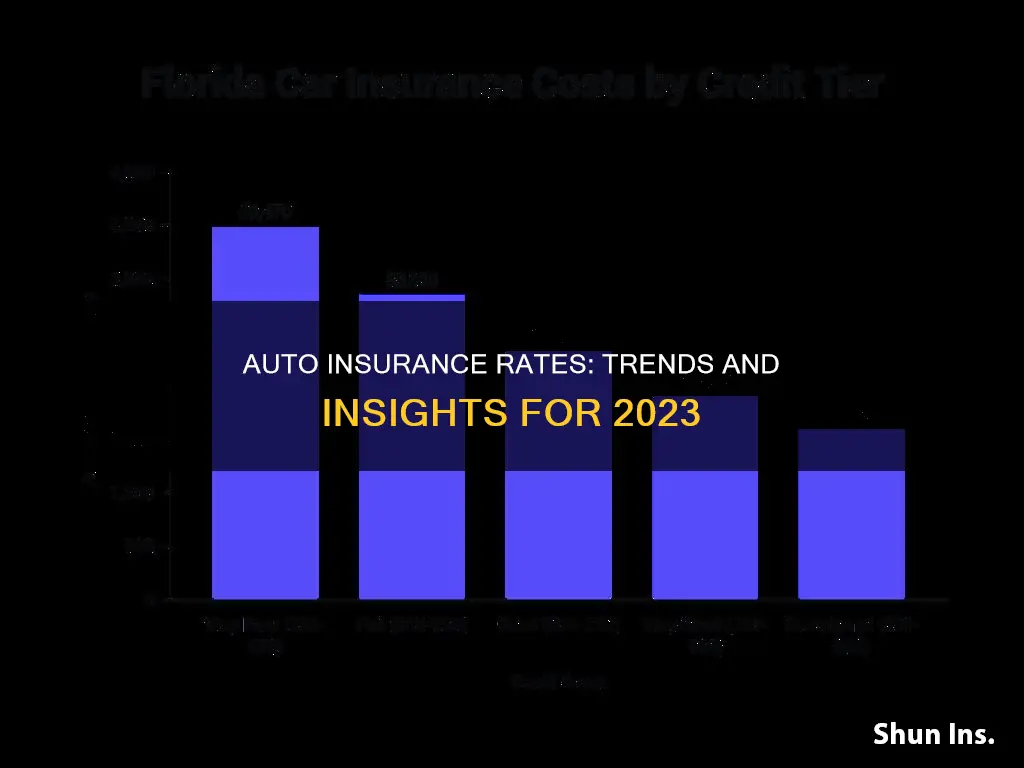

Auto insurance rates are currently trending upwards, with US drivers facing higher premiums and an increasingly challenging economic environment. From July 2023 to July 2024, car insurance premiums rose by 18.6%, with the average annual full-coverage premium now costing $2,329. This increase is attributed to various factors, including inflation, supply chain issues, rising car repair costs, an increase in accidents, and severe weather events. The rise in insurance rates is expected to continue, with drivers facing higher costs and potentially having to make difficult choices to maintain coverage.

| Characteristics | Values |

|---|---|

| Premium insurance rates | Continue to increase, up 14% in 2024 |

| Rate increases by state | Vary significantly, with Nevada seeing the highest increase at 28.3% in 2023 |

| Average annual full-coverage premium | $2,329 |

| Cheapest U.S. states for car insurance | North Carolina |

| Factors influencing rates | Driving record, credit score, vehicle model, location, population density, cost of living |

| Rate of increase | 18.6% from July 2023 to July 2024 |

| Inflation impact | Inflation and supply shortages, costlier claims, and roadway fatalities contribute to rising rates |

| Car repair costs | Up 6.7% for the year, with more expensive auto parts and higher wages for mechanics |

| Accident severity | Increased number of accidents and higher severity, with riskier driving behaviours and distracted driving contributing factors |

| Weather impact | Increase in weather catastrophes, such as wildfires, floods, and tropical cyclones, leading to higher claims |

| Inflation rate comparison | Car insurance rate increases outpacing the current inflation rate of 3.5% |

What You'll Learn

Rising car repair costs

Supply Chain Issues and Parts Shortages

The ongoing supply chain disruptions that began during the pandemic have resulted in shortages of various car parts, making it challenging to replace components during repairs. These shortages have led to increased prices for car parts, contributing to higher repair costs.

Technological Advancements in Vehicles

The integration of advanced technology in modern vehicles has significantly added to the cost of repairs. Cars today are equipped with sophisticated features such as advanced driver-assistance systems, parking sensors, lane-keeping assist, and cross-traffic alert systems. While these technologies enhance safety, they also require precision and specialised knowledge to repair. The cost of repairing or replacing these high-tech components is considerably higher than traditional mechanical repairs.

Older Vehicles Requiring More Repairs

The average age of vehicles on the road has been increasing. Older vehicles are more likely to require major repairs, and the availability of older car parts may be more limited, driving up repair costs.

Labour Shortages and Higher Labour Costs

There is a notable shortage of automotive technicians and mechanics, leading to higher labour costs. The demand for skilled labour in the auto repair industry exceeds the supply, as there are not enough trained professionals to meet the growing need for vehicle repairs.

Complexity of Repairs and Repair Times

The increasing complexity of repairs, due in part to the advanced technology in vehicles, has resulted in longer repair times. This extends the time a policyholder needs a rental car, adding to the overall cost of an insurance claim.

High-Tech Service Appointments

Some repair shops, particularly dealerships, have adopted the practice of sharing photos and videos of potential issues with customers, similar to telehealth appointments. While this enhances transparency, it also increases the average repair cost, as customers are more likely to approve repairs when they can visually assess the problem.

The combination of these factors has resulted in a significant rise in car repair costs, which, in turn, contributes to the upward trend in auto insurance rates. As repair costs continue to climb, insurance providers pass on these increased costs to their customers in the form of higher premiums.

Gap Insurance: When to Notify Your Provider

You may want to see also

Inflation

The rise in insurance rates is also linked to the increase in car repair costs. According to CPI data, repair costs have gone up by 6.7% in the last year. This is due to more expensive auto parts and wage increases for mechanics due to labour shortages. The use of new technology, such as parking sensors and lane-departure warnings, has also contributed to the rising cost of repairs.

In addition to repair costs, insurance rates have been affected by the rise in car theft. The National Insurance Crime Bureau reported that vehicle thefts topped 1 million in 2022 for the second consecutive year, driving up claims and insurance rates.

Overall, inflation has played a significant role in the upward trend of auto insurance rates, with the increased costs of vehicles, repairs, and labour contributing to higher premiums.

Auto Insurance and Rust Repair: What You Need to Know

You may want to see also

Increase in accidents

Auto insurance rates are increasing, and one of the primary reasons for this is the increase in accidents.

During the global pandemic that started in 2020, there was a notable decrease in the number of cars on the road, with many employees working from home and schools conducting virtual classes. This resulted in a decrease in accidents and, consequently, insurance rates. However, in the post-pandemic era, roads are bustling again, with people returning to offices and schools. This change has led to a significant increase in car accidents and injuries, causing insurance rates to soar.

Several factors contribute to the rise in accidents. Firstly, bad driving habits acquired during the pandemic, such as speeding, have persisted. With more vehicles on the road and higher speeds, the likelihood of collisions increases. Additionally, distracted driving plays a significant role in the surge of accidents. Texting while driving, watching or recording videos, and even voice-activated car commands can divert attention and increase the risk of accidents, especially among teenagers. According to a State Farm® survey, 67% of drivers found reading or sending texts while driving to be distracting, and over 70% reported that watching or recording videos was distracting.

The increase in accidents has led to higher insurance rates as insurance companies price their policies according to risk factors. At-fault accidents on a driving record indicate a higher risk of future accidents, and insurance companies will adjust their rates accordingly. Even accidents that are not the driver's fault can result in increased rates, as insurers possess data suggesting that some drivers are more prone to not-at-fault accidents.

The rise in accidents has also impacted insurance rates due to the associated costs. The cost of repairing vehicles has increased due to supply chain disruptions, labour issues, and new technology in vehicles. These factors have led to longer repair times and higher rental car costs for policyholders waiting for their vehicles to be fixed. As a result, insurance companies are facing costlier claims, which they pass on to their customers in the form of higher premiums.

The increase in accidents, coupled with other factors, has contributed to the overall upward trend in auto insurance rates. As the frequency of accidents rises, insurance companies adjust their rates to mitigate the financial risk associated with claims.

Choosing the Right Home and Auto Insurance: Tips and Tricks

You may want to see also

Post-pandemic driving habits

However, this return to pre-pandemic driving habits has also resulted in an increase in car accidents and injuries, which has contributed to rising car insurance rates. Post-pandemic driving habits have also been described as "getting more dangerous". This is due to an increase in distracted driving, with technology use, stress, and emotional strain affecting how drivers manoeuvre their vehicles. According to the 2023 Travelers Risk Index, 30% of Canadian participants admitted to having been in an accident due to their distractions, a 50% increase from 2022. In the US, 70% of respondents believe distracted driving is a bigger problem now than in previous years, with a National Safety Council study finding that deaths from preventable traffic crashes in 2022 increased by 18% compared to pre-pandemic levels.

Work-related distractions have also impacted safer driving habits, with 44% of Americans surveyed saying they responded to work emergencies while driving, and 43% feeling the need to always be available for work obligations. This trend is particularly prominent among younger generations, with 60% of millennials resuming their daily commutes, compared to 52% of Gen X and 45% of Gen Z.

The increase in driving post-pandemic has also been influenced by a return to office life, social obligations, and travel. In 2024, there has been a record year for travel, with near-record or record travel during holidays such as Memorial Day and the Fourth of July. This has resulted in more people on the roads, including those who may be unfamiliar with the roadways, leading to traffic congestion and safety concerns.

Overall, post-pandemic driving habits have seen a return to pre-pandemic behaviours, but with an increase in distracted driving and accidents, contributing to rising car insurance rates and safety concerns on the roads.

Does BECU Offer Auto Insurance? Here's What You Need to Know

You may want to see also

Electric vehicles

On average, it costs about 20% more to insure an EV than a gas-powered vehicle. The cheapest EV to insure is the Volkswagen ID.4, while Teslas are among the most expensive. However, this trend may change as EVs become more common. As the technology becomes more efficient and affordable, and as more repair shops become equipped to handle EVs, the cost of insurance is expected to decrease.

Currently, some insurance companies offer discounts for driving an EV, such as Geico, Nationwide, State Farm, and USAA, which offer a discount of up to 10%. Additionally, EVs may be eligible for rebates and tax credits at the local, state, and federal levels, which can help offset the higher insurance costs.

When insuring an EV, it is important to consider the make and model, as this can significantly impact the cost of insurance. The availability of specialised labour and replacement parts for specific EV models can also affect insurance rates. Overall, while EVs may currently be more expensive to insure, the gap is expected to close as they become more commonplace.

Auto Insurance for Young Adults

You may want to see also

Frequently asked questions

Auto insurance rates are currently on an upward trend.

There are several reasons why auto insurance rates are increasing. Firstly, inflation and supply shortages have led to increased costs for vehicles, repairs, and labour, which in turn affects insurance rates. Secondly, there has been an increase in the number of claims due to rising car accidents and severe weather events. Thirdly, advancements in vehicle technology have made repairs more expensive.

According to the Consumer Price Index, auto insurance rates have increased by 18.6% from July 2023 to July 2024. However, the increase varies across states, with Nevada experiencing a 38% jump, while North Carolina saw a smaller increase of 5.5%.

Auto insurance rates are influenced by various factors, including your driving record, credit score, vehicle model, and location. The number of claims in an area, population density, and cost of living can also impact the overall rate.

To manage the increase in auto insurance rates, you can shop around for the best rates, take advantage of discounts, increase your deductibles, and improve your credit score. Additionally, comparing quotes from different companies and discussing potential discounts can help you save on auto insurance.