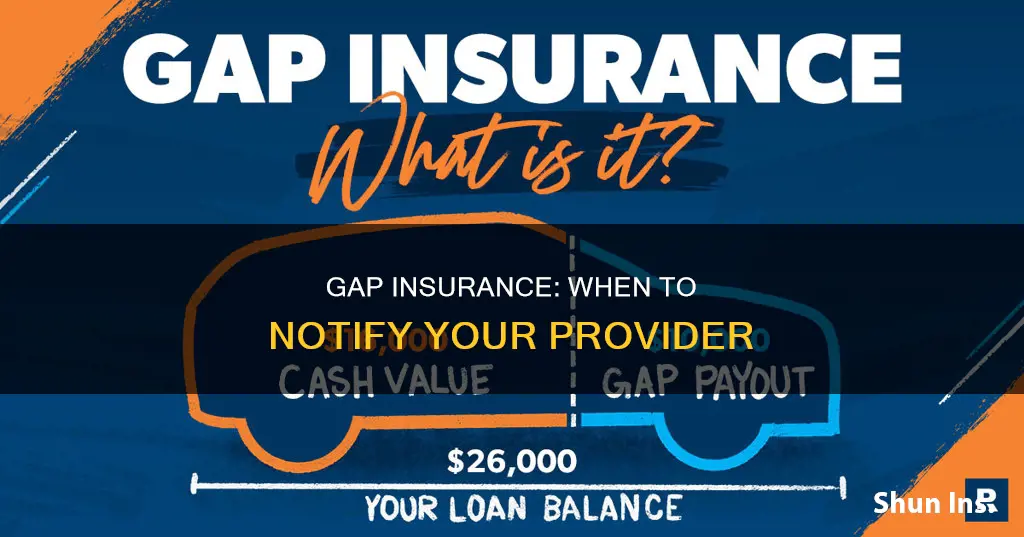

GAP insurance, or guaranteed auto protection, is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. You can check your current car insurance policy or the terms of your lease or loan to see if you have gap insurance. This type of coverage is usually offered as optional coverage by insurers or as an extra add-on by dealers.

| Characteristics | Values |

|---|---|

| When to notify gap insurance | When your car is stolen or deemed a total loss |

| When to buy gap insurance | When you buy a new or used car |

| How to check if you have gap insurance | Check your current car insurance policy or the terms of your lease or loan |

What You'll Learn

If you buy a new or used car

When you buy a new or used car, the dealer will likely offer you gap insurance when you discuss your financing options. However, it is usually more expensive to buy gap insurance from a dealer than from an insurance company, as the cost of the coverage is bundled into your loan amount, which means you will pay interest on your gap coverage.

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. If you already have car insurance, check with your current insurer to determine how much it would cost to add gap coverage to your existing policy. Note that you need comprehensive and collision coverage to add gap coverage to a car insurance policy.

If you are buying a new or used car, you can also get gap insurance from your auto insurance company. Gap insurance is usually optional if you're financing a purchase, but it might be required if you're leasing a vehicle.

In general, most new car buyers benefit from gap coverage while the vehicle is less than three model years old. You only need gap insurance until the remainder of your loan drops below the value of the vehicle, which is typically in the first couple of years of the loan. You can cancel the policy when you owe less than your vehicle is worth.

Insurance Coverage: Any Vehicle?

You may want to see also

If your car is stolen

You will then want to file a claim with your gap insurance provider and submit all requested documentation. While you are waiting for a determination on your claims, you should continue to make your loan payments so your credit is not negatively impacted.

Gap insurance helps pay your auto loan balance if your car is stolen. It covers the difference between your loan and the car's market value. It is important to note that gap insurance won't cover it if you leave your car unlocked.

The gap insurance claim process is slightly different from a typical auto insurance claim. The first thing you'll need is for your auto insurance provider to declare your car a total loss. Before accepting a claim payout and once it has been verified, you should contact your gap insurance provider. You can usually find a deadline in your gap policy documentation for when you should get in touch with them.

Gap Insurance: Monthly Payment or One-Time Fee?

You may want to see also

If your car is deemed a total loss

If your car is damaged in an accident that was not your fault, the other driver's insurance policy should cover the cost. If you are at fault, or if the other driver is uninsured or flees the scene, you will need to file a claim under your own coverage.

Your insurance provider will reimburse you for the actual cash value (ACV) of your car. This is the current market value of your vehicle, calculated by taking the amount you paid for the car minus depreciation. You can research your car's make and model to get an estimate of its ACV.

If you owe more on your car loan than the ACV, you will need GAP insurance to cover the difference. GAP insurance is not automatically included in your policy, so check your coverage. If you have GAP insurance, it will cover the difference between the ACV and the remaining amount on your loan or lease.

Once your car has been deemed a total loss, you will need to sign the title over and cancel the license plates. You should update your insurance agent on these changes, as they are usually not notified by the carrier that your vehicle has been totaled. They can help you cancel your plates and remove the vehicle from your policy so that you are no longer paying for an inoperable car.

If you have comprehensive or collision coverage, your insurance company will pay the ACV of your vehicle minus your deductible. If you are not happy with their offer, you can try to negotiate for a higher payout by providing evidence that your car is worth more.

Autonomous Vehicles: Insurable Future?

You may want to see also

If you have a lease agreement

When reviewing your lease agreement, carefully look for any mention of gap insurance or similar coverage. Some lease agreements may already include gap insurance as part of the monthly lease payments, while others may require you to purchase it separately. It's crucial to determine whether gap insurance is mandatory or optional in your specific lease agreement. If it's not explicitly mentioned, don't hesitate to contact the leasing company for clarification.

Even if gap insurance is not required, consider the benefits of purchasing it for your own financial protection. Leasing a car without gap insurance exposes you to potential financial risks. If your leased car is in an accident, stolen, or declared a total loss, you may be liable for paying the difference between the market value and the retail value of the car. This can result in significant out-of-pocket expenses.

To make an informed decision, evaluate factors such as the length of your lease term, the amount of your down payment, and the potential depreciation of the vehicle. If you have a long lease term, a low down payment, or are leasing a car that is likely to depreciate quickly, gap insurance can provide valuable coverage. It's better to be prepared for unexpected events that may result in a total loss of the vehicle.

Additionally, when considering gap insurance, shop around for quotes from different insurance providers to find the best coverage and price. You can add gap insurance to your existing auto insurance policy or purchase it separately. By comparing rates and coverage options, you can ensure that you're getting the most suitable protection at a competitive price. Remember, gap insurance provides financial peace of mind during the lease term, knowing that you're covered in case of any unforeseen events involving your leased vehicle.

Vehicles with Lower Insurance Rates

You may want to see also

If you have a loan rollover

The cost of gap insurance varies, but it is generally much cheaper to purchase it through a car insurance company than a car dealership. Adding it to your car loan through a dealer can result in you paying loan interest on the gap insurance cost. Additionally, if the gap insurance cost is rolled into your car loan, you may lose the flexibility to cancel it since it is tied to your loan. Thus, you might end up paying for something that is no longer useful.

You can typically buy gap insurance from car insurance companies, banks, and credit unions. It is worth noting that not every car insurance company sells gap insurance, and it may not be available in every state. For example, Geico and Farmers do not sell gap insurance.

Before purchasing gap insurance, it is important to check if you already have it. Gap insurance is usually offered as optional coverage by insurers or as an extra add-on by dealers. You can check your current car insurance policy or the terms of your lease or loan to see if you have it. If you are unsure, you can call your agent or insurance company to find out.

In summary, if you have a loan rollover, gap insurance can provide valuable protection by covering the difference between what you owe on your car loan and the car's value. However, it is important to consider the costs and availability of gap insurance before making a decision.

Autonomous Cars: Motor Insurance's Future

You may want to see also

Frequently asked questions

You should notify your gap insurance provider as soon as you've bought your new car.

You should notify your gap insurance provider as soon as possible after your car has been in an accident.

You should notify your gap insurance provider immediately if your car has been stolen.

You should notify your gap insurance provider as soon as you've paid off your loan, as you may no longer need gap coverage.