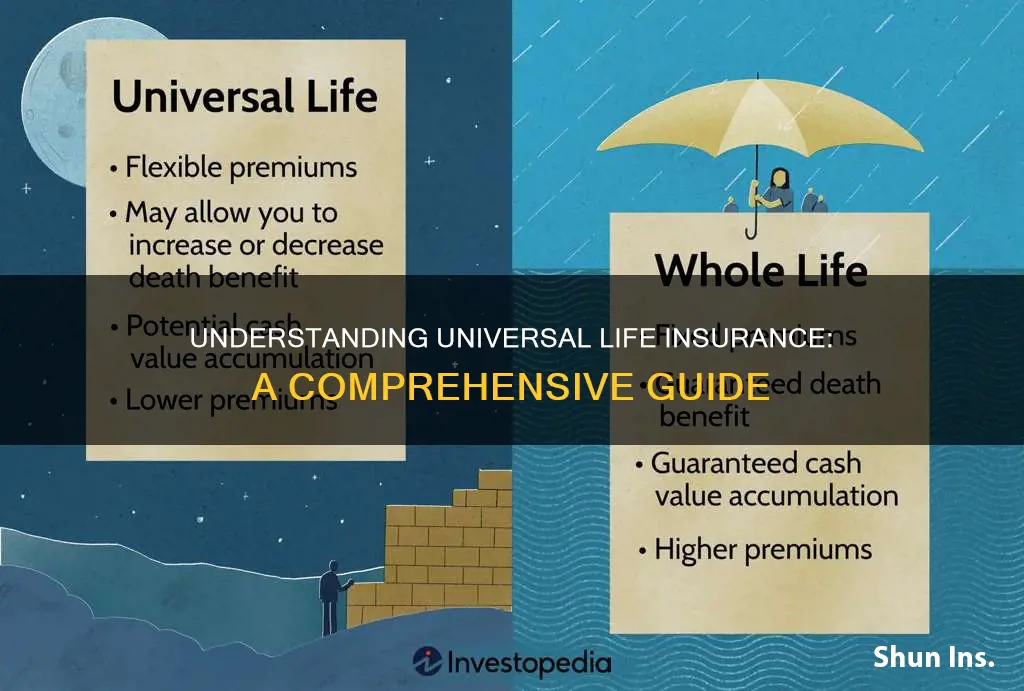

Universal life insurance is a type of permanent life insurance that offers a flexible approach to coverage. Unlike traditional term life insurance, which provides coverage for a specific period, universal life insurance combines a death benefit with an investment component. This means that a portion of the premium paid goes towards building cash value, which can be used to pay for future premiums or withdrawn as needed. The policyholder has the freedom to adjust their coverage amount and premium payments, making it a customizable and long-term financial planning tool. Understanding the features and benefits of universal life insurance is essential for individuals seeking a comprehensive and adaptable life insurance solution.

What You'll Learn

- Universal Life Insurance: A permanent life insurance policy with flexible premiums and a cash value component

- Premiums: Adjustable payments based on the policyholder's needs and financial situation

- Cash Value: Accumulated savings that can be borrowed against or withdrawn

- Death Benefit: A fixed amount paid to beneficiaries upon the insured's death

- Investment Options: Policyholders can allocate a portion of cash value to investment accounts

Universal Life Insurance: A permanent life insurance policy with flexible premiums and a cash value component

Universal Life Insurance is a type of permanent life insurance that offers a unique blend of flexibility and security. It is designed to provide long-term coverage with the added benefit of a cash value component, allowing policyholders to build a savings element within their insurance policy. This type of insurance is a permanent solution, meaning it remains in force for the policyholder's entire life, providing coverage regardless of age or health changes.

One of the key features of Universal Life Insurance is its flexibility. Policyholders have the freedom to choose their premium payments, which can be adjusted over time. This flexibility allows individuals to customize their insurance plan according to their financial situation and needs. For example, during their earning years, individuals might opt for higher premiums to maximize coverage, and later, they can reduce payments if their financial circumstances change. This adaptability is particularly useful for those who want to ensure they have adequate insurance coverage without the strict payment schedules of term life insurance.

The cash value aspect of Universal Life Insurance is a significant advantage. As the policyholder pays premiums, a portion of each payment goes towards building a cash value, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing policyholders with a source of funds that can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. Additionally, the cash value can also be used to pay for future premiums, ensuring that the policy remains in force even if the policyholder encounters financial difficulties.

Another advantage of Universal Life Insurance is its potential to accumulate significant cash value over time. With consistent premium payments, the cash value can grow substantially, providing a substantial financial asset for the policyholder. This feature is especially beneficial for those who want to build a substantial savings component within their insurance policy, which can be passed on to beneficiaries or used for personal financial goals.

In summary, Universal Life Insurance offers a permanent and flexible solution for individuals seeking long-term coverage with a savings component. Its ability to adapt to changing financial circumstances, combined with the potential for significant cash value accumulation, makes it an attractive option for those who want both insurance protection and a financial asset. This type of insurance provides a comprehensive approach to financial planning, ensuring that individuals can meet their insurance needs while also building a secure financial future.

Selling Life Insurance After Bankruptcy: What You Need to Know

You may want to see also

Premiums: Adjustable payments based on the policyholder's needs and financial situation

Universal life insurance is a type of permanent life insurance that offers flexibility and adaptability to policyholders. One of its key features is the ability to adjust premiums, which sets it apart from traditional life insurance policies. This adjustability is a significant advantage, allowing policyholders to tailor their insurance coverage to their evolving needs and financial circumstances.

Premiums in universal life insurance are not set in stone; they can be modified over time. This flexibility is particularly beneficial for individuals who may experience changes in their financial situation or life goals. For instance, a young professional might opt for a higher premium to ensure comprehensive coverage during their initial years of earning. As their career progresses and financial stability increases, they can adjust the premium downward, potentially saving money while still maintaining adequate insurance coverage. This adjustability is a unique aspect of universal life insurance, providing policyholders with a sense of control and customization.

The adjustment process typically involves regular reviews of the policy, where the insurance company and the policyholder collaborate to assess the current financial situation and determine if any changes are necessary. This review can be an annual or biannual event, ensuring that the policy remains aligned with the policyholder's evolving needs. During these reviews, the policyholder can decide to increase or decrease the premium, ensuring that the insurance coverage remains appropriate.

This adjustable premium structure is a significant advantage for those who want to optimize their insurance coverage without the constraints of a fixed-rate policy. It allows individuals to make informed decisions based on their current financial health and future projections. For example, a policyholder might choose to increase the premium during periods of financial surplus, ensuring that the policy remains robust when needed. Conversely, during lean financial times, they can opt for a lower premium, thus reducing overall costs.

In summary, universal life insurance offers a dynamic approach to life insurance, where premiums are not static but rather adaptable to the policyholder's circumstances. This feature provides individuals with the freedom to manage their insurance coverage effectively, ensuring that it remains relevant and beneficial throughout their lives. It is a powerful tool for those seeking a personalized and flexible insurance solution.

Understanding Sul Life Insurance: A Comprehensive Guide

You may want to see also

Cash Value: Accumulated savings that can be borrowed against or withdrawn

Universal life insurance is a type of permanent life insurance that offers a unique combination of coverage and investment opportunities. One of its key features is the concept of cash value, which is an essential aspect of this insurance policy. Cash value refers to the accumulated savings that grow within the policy over time. As the policyholder, you can access this cash value in several ways, providing financial flexibility and security.

When you purchase a universal life insurance policy, a portion of your premium payments goes towards building this cash value. This value grows through interest earned on the policy's investment, typically in a separate investment account. The growth of cash value is often tax-deferred, allowing it to accumulate steadily. Over time, this can result in a substantial amount of savings, which can be utilized in various ways.

One of the primary benefits of cash value is the ability to borrow against it. Policyholders can take out loans against the accumulated cash value, providing immediate access to funds. These loans are typically interest-free, as they are secured by the policy itself. Borrowing against cash value can be advantageous when you need quick access to money for significant expenses, such as education fees, home improvements, or business ventures.

Additionally, the cash value can be withdrawn as needed. Withdrawals are made by the policyholder and are typically tax-free, provided they are taken out of the policy's cash value account. This feature allows you to access your savings without permanently reducing the insurance coverage. Withdrawals can be particularly useful during financial emergencies or when you require funds for other financial goals.

Universal life insurance with cash value provides a safety net and a financial tool. It offers the advantage of having insurance coverage for life, while also allowing you to build a substantial savings portfolio. The cash value component ensures that your investment grows over time, providing financial security and the potential for long-term wealth accumulation. Understanding how cash value works is crucial to making informed decisions about your insurance and financial planning.

High-Income Earners: Is Whole Life Insurance a Smart Choice?

You may want to see also

Death Benefit: A fixed amount paid to beneficiaries upon the insured's death

Universal life insurance is a type of permanent life insurance that offers a unique combination of flexibility and long-term coverage. One of its key features is the death benefit, which is a fixed amount that the insurance company promises to pay to the designated beneficiaries when the insured individual passes away. This death benefit is a critical aspect of universal life insurance, providing financial security and peace of mind to the policyholder's loved ones.

When purchasing universal life insurance, the policyholder typically pays a set premium, which can vary depending on factors such as age, health, and the desired coverage amount. The death benefit is a fixed sum that the insurance company agrees to pay out upon the insured's death, ensuring that the beneficiaries receive the intended financial support. This benefit is often a significant selling point for individuals seeking long-term financial protection for their families.

The beauty of the death benefit in universal life insurance lies in its flexibility. Policyholders can choose the amount of coverage they desire, and this choice directly impacts the premium they pay. Over time, as the insured individual's needs or financial situation changes, the policy can be adjusted to maintain the desired death benefit. This adaptability is a significant advantage, allowing individuals to tailor their insurance plan to their evolving circumstances.

Upon the insured's death, the beneficiaries will receive the predetermined death benefit, which can be a substantial financial cushion. This amount can be used to cover various expenses, such as funeral costs, outstanding debts, or the day-to-day living expenses of the beneficiaries. The death benefit ensures that the insured's loved ones are financially protected, even in the event of their passing.

In summary, the death benefit is a cornerstone of universal life insurance, offering a fixed and reliable financial safety net for the insured's beneficiaries. It provides individuals with the freedom to customize their coverage and ensures that their loved ones are financially secure during challenging times. Understanding the death benefit is essential for anyone considering universal life insurance as a means of long-term financial protection.

Adjustable Target Life Insurance: How Does It Work?

You may want to see also

Investment Options: Policyholders can allocate a portion of cash value to investment accounts

Universal life insurance is a type of permanent life insurance that offers a unique combination of coverage and investment opportunities. One of its key features is the ability for policyholders to allocate a portion of the cash value accumulated in their policy towards various investment options. This investment aspect sets universal life insurance apart from traditional term life insurance, providing policyholders with a way to potentially grow their money over time.

When it comes to investment options, universal life insurance policies typically offer a range of choices to suit different risk appetites and financial goals. Policyholders can allocate a portion of the cash value, which is the accumulated savings within the policy, into investment accounts. These investment accounts are often provided by the insurance company and may include various investment vehicles such as stocks, bonds, mutual funds, or even real estate investment trusts (REITs). The specific investment options available can vary depending on the insurance provider and the policy's terms.

The investment strategy within a universal life insurance policy is flexible, allowing policyholders to adjust their allocations as needed. They can choose to allocate more funds to aggressive investment options for potential higher returns or opt for more conservative investments to minimize risk. This flexibility is a significant advantage, as it enables individuals to tailor their investment strategy to their financial objectives and risk tolerance.

By allocating cash value to investment accounts, policyholders can benefit from the potential growth of their money. The investment performance can contribute to increasing the overall value of the policy, which, in turn, can provide additional death benefits or policy value. This feature is particularly attractive to those seeking long-term financial planning and the potential for wealth accumulation.

It is important to note that investing in universal life insurance carries risks, and the performance of investment options is not guaranteed. Policyholders should carefully review the investment options available, understand the associated risks, and consider their financial goals before making any allocations. Consulting with a financial advisor can also provide valuable guidance in navigating the investment aspects of universal life insurance.

Prudential Term Life Insurance: Digging for Policy Details

You may want to see also

Frequently asked questions

Universal life insurance is a type of permanent life insurance that offers a flexible premium and a guaranteed death benefit. It provides lifelong coverage and allows policyholders to build cash value over time, which can be borrowed against or withdrawn. This type of insurance is designed to provide financial security and a sense of peace of mind, ensuring that your loved ones are protected even if your circumstances change.

With universal life insurance, you pay a fixed or adjustable premium to the insurance company. The policy has a death benefit, which is a guaranteed amount that will be paid out upon your death. A portion of your premium goes towards covering the cost of insurance and the remaining amount is invested to build cash value. This cash value can accumulate and can be used for various purposes, such as increasing the death benefit, taking loans, or making additional payments to accelerate the growth of the policy.

One of the key advantages is its flexibility. Policyholders can adjust their premium payments and death benefits according to their changing financial situations. It also offers a higher potential for cash value accumulation compared to term life insurance. Additionally, universal life insurance provides permanent coverage, ensuring that your beneficiaries receive the death benefit regardless of market fluctuations.

Yes, one of the unique features of universal life insurance is the ability to access the cash value built up over time. Policyholders can take loans against the cash value or make withdrawals, provided there is sufficient cash value in the policy. These withdrawals can be used for various financial needs, such as funding education, starting a business, or covering unexpected expenses. However, it's important to note that withdrawals may impact the policy's death benefit and overall cash value growth.