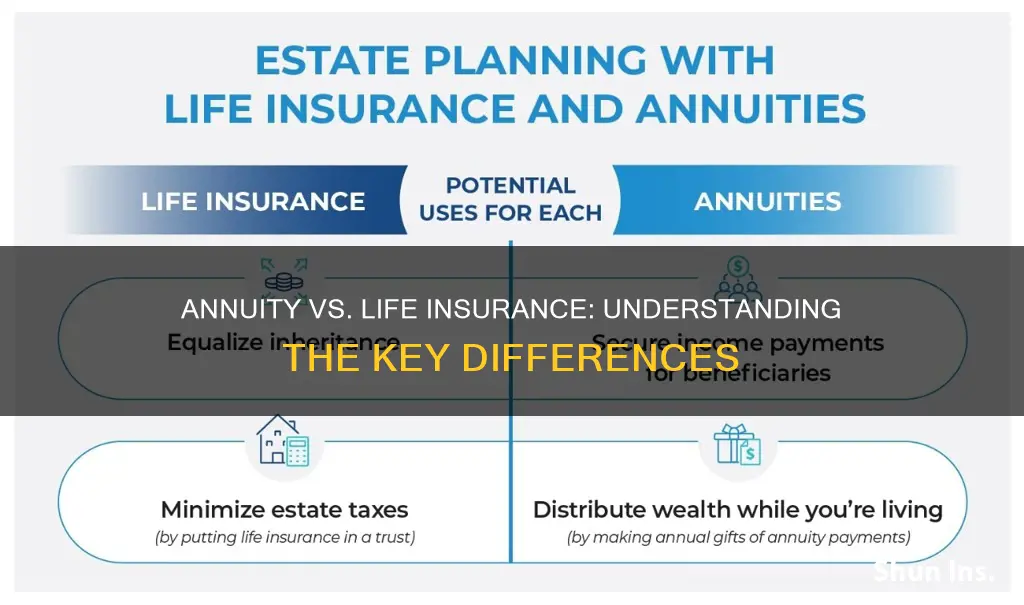

Annuities and life insurance are both financial products designed to provide financial security, but they serve different purposes and offer distinct benefits. Annuities are long-term investment vehicles that offer a steady stream of income over a specified period or for the annuitant's lifetime. They are typically purchased with a lump sum or regular payments and can be used for various financial goals, such as retirement planning or wealth accumulation. On the other hand, life insurance is a contract between an individual and an insurance company, where the insurer promises to pay a designated beneficiary a death benefit upon the insured's passing. This benefit can provide financial support to loved ones, cover funeral expenses, pay off debts, or achieve specific financial objectives. Understanding the differences between these two financial instruments is essential for individuals to make informed decisions about their financial planning and ensure they choose the right product to meet their unique needs.

What You'll Learn

- Annuity: A contract to make regular payments in exchange for a lump sum or periodic contributions

- Life Insurance: Provides financial protection for beneficiaries upon the insured's death

- Payouts: Annuities offer guaranteed income, while life insurance pays a lump sum

- Term: Life insurance is typically for a specific period, while annuities are long-term

- Taxes: Annuities may be taxed differently than life insurance proceeds

Annuity: A contract to make regular payments in exchange for a lump sum or periodic contributions

An annuity is a financial product that provides a steady stream of income over a specified period, typically in exchange for a lump sum or regular contributions. It is a contract between an individual (the annuitant) and an insurance company, where the insurer agrees to make regular payments to the annuitant, either for a fixed term or for the annuitant's lifetime. This arrangement offers a structured way to generate income, ensuring a consistent financial flow for the annuitant.

When you purchase an annuity, you essentially make an investment in your future income. The process begins with an initial payment, known as the "lump sum" or "premium," which is then used by the insurance company to invest in various assets. These investments can include stocks, bonds, or other securities, and the returns generated from these investments are used to fund the regular payments. The beauty of an annuity lies in its ability to provide a guaranteed income stream, offering financial security and peace of mind.

The payments made by the insurance company can be structured in two primary ways. Firstly, there are fixed annuities, where the payments remain consistent over the agreed-upon period. This type of annuity provides a steady and predictable income, making it an attractive option for those seeking financial stability. Secondly, there are variable annuities, which offer more flexibility in terms of investment options and potential returns. With variable annuities, the payments can fluctuate based on the performance of the underlying investments, providing an opportunity for higher returns but also carrying more risk.

Annuities are often used as a retirement planning tool, allowing individuals to secure a regular income during their retirement years. By purchasing an annuity, retirees can ensure a consistent financial flow, providing financial security and the freedom to enjoy their later years without the worry of running out of funds. Additionally, annuities can be an effective way to pass on wealth to beneficiaries, as the contract may include provisions for paying out benefits to designated heirs upon the annuitant's death.

In summary, an annuity is a financial contract that offers a structured and guaranteed income stream in exchange for an initial investment. It provides individuals with a reliable source of income, whether for a fixed term or for life, making it a valuable tool for retirement planning and wealth management. Understanding the different types of annuities and their investment options can help individuals make informed decisions to suit their financial needs and goals.

AAA Life Insurance: Is It Worth the Hype?

You may want to see also

Life Insurance: Provides financial protection for beneficiaries upon the insured's death

Life insurance is a financial product designed to provide a monetary benefit to designated individuals (the beneficiaries) when the insured individual passes away. It is a contract between the insurance company and the policyholder, where the insurance company promises to pay out a specified sum of money upon the death of the insured. This payout is intended to offer financial security and support to the beneficiaries, ensuring they have the necessary resources to cover expenses, maintain their standard of living, or achieve specific financial goals.

The primary purpose of life insurance is to protect the financial interests of the beneficiaries. It serves as a safety net, especially for those who rely on the income or support of the insured individual. For example, if a primary breadwinner in a family dies, life insurance can provide the funds needed to cover daily living expenses, mortgage payments, children's education, or other long-term financial commitments. This financial protection can alleviate the burden on beneficiaries and ensure their well-being during a difficult time.

There are various types of life insurance policies available, each with its own features and benefits. Term life insurance is a popular choice, offering coverage for a specified period, such as 10, 20, or 30 years. During this term, the policy provides a death benefit if the insured dies. Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component that can accumulate over time. This type of policy offers both an insurance benefit and an investment opportunity.

When purchasing life insurance, policyholders must consider several factors. These include the desired coverage amount, which should be sufficient to meet the beneficiaries' financial needs, the duration of coverage (term length), and the type of policy that best suits their goals. Additionally, understanding the various policy options, such as term conversion rights, riders, and additional benefits, is essential to making an informed decision.

In summary, life insurance is a vital tool for providing financial security and peace of mind. It ensures that beneficiaries are protected financially during the insured's passing, allowing them to maintain their lifestyle and achieve their financial objectives. With various policy types and customization options available, individuals can tailor their life insurance coverage to meet their unique needs and provide long-term financial protection for their loved ones.

Gerber Life Insurance: Whole or Term?

You may want to see also

Payouts: Annuities offer guaranteed income, while life insurance pays a lump sum

When it comes to payouts, the primary difference between annuities and life insurance lies in the nature of the payments they provide. Annuities are financial products designed to provide a steady stream of income over a specified period, offering a guaranteed payout structure. This means that once you start receiving payments from an annuity, you can expect a consistent and predictable income stream for the rest of the term agreed upon. Annuities are particularly attractive to individuals seeking a reliable and secure source of income, especially for retirement planning, as they provide a sense of financial security and stability.

On the other hand, life insurance is a contract between an individual and an insurance company, where the insurer promises to pay a designated beneficiary a lump sum amount upon the insured person's death. This lump-sum payment is typically a one-time benefit and can be used for various purposes, such as covering funeral expenses, paying off debts, or providing financial support to loved ones. Life insurance is often chosen for its flexibility in terms of payout options, allowing the policyholder to select how and when the proceeds are distributed.

The key advantage of annuities in terms of payouts is the guarantee. With an annuity, you can rest assured that your income will continue as long as the annuity contract remains in force. This is particularly beneficial for those who want a steady income stream, especially in retirement, as it provides a reliable source of funds. Annuities can be structured in various ways, including fixed, variable, or indexed annuities, each offering different levels of risk and potential returns.

In contrast, life insurance provides a financial safety net for your loved ones after your passing. The lump sum payment from a life insurance policy can be a significant financial resource, allowing the beneficiary to make important decisions regarding the funds. This flexibility is a significant advantage for those who want to ensure their family's financial security in the event of their untimely death.

In summary, the choice between an annuity and life insurance for payouts depends on individual financial goals and priorities. Annuities offer guaranteed income, making them ideal for those seeking a steady stream of payments, while life insurance provides a lump sum, offering flexibility and financial support to beneficiaries. Understanding these payout structures is essential in making informed decisions about financial planning and security.

Finding Life Insurance: Locating Your Provider and Coverage

You may want to see also

Term: Life insurance is typically for a specific period, while annuities are long-term

Life insurance and annuities are both financial products designed to provide financial security and support to individuals and their beneficiaries. However, they serve different purposes and have distinct characteristics that set them apart. One of the key differences lies in their term or duration.

Life insurance is generally designed to provide coverage for a specific period, often referred to as the "term" of the policy. This term can vary, ranging from a few years to several decades. During this term, the insurance company promises to pay out a death benefit to the policyholder's beneficiaries if the insured individual passes away. The primary purpose is to offer financial protection and peace of mind during a defined period, ensuring that loved ones are financially secure in the event of the policyholder's death. For example, a 10-year term life insurance policy will provide coverage for exactly 10 years, and if the insured person dies within this period, the beneficiaries receive the death benefit.

On the other hand, annuities are long-term financial products designed to provide income and financial security over an extended period. Annuities are typically purchased with a lump sum or regular contributions and are intended to generate a steady stream of payments to the annuitant (the person who purchases the annuity) for the rest of their life. This long-term commitment ensures that the annuitant receives regular income, providing financial stability and security. Annuities can be immediate, where payments start right away, or deferred, where payments begin at a later date. The primary focus of annuities is to offer a reliable income stream and financial protection for the annuitant during their retirement years or for life.

In summary, the term aspect of life insurance and annuities highlights their contrasting durations. Life insurance is tailored for a specific period, offering coverage and financial protection during that time, while annuities are long-term commitments, providing income and security for the annuitant's entire life. Understanding these differences is crucial for individuals to make informed decisions when choosing between these financial instruments to meet their specific needs and goals.

Calculating Group Term Life Insurance: Economic Benefits Explained

You may want to see also

Taxes: Annuities may be taxed differently than life insurance proceeds

When it comes to taxes, understanding the differences between annuities and life insurance is crucial for financial planning. Annuities and life insurance are both financial products that provide income or a lump sum payment, but they are taxed differently, which can significantly impact the overall value of the policy.

Annuities are considered a form of deferred income, meaning the money paid into the annuity is not immediately taxable. Instead, the earnings grow tax-deferred within the annuity until they are withdrawn. This tax-deferred growth can be advantageous for long-term savings goals, as it allows the funds to accumulate without being subject to annual income taxes. When you start receiving payments from the annuity, the distributions are typically taxed as ordinary income, which means they are taxed at your regular income tax rate. This can be a significant consideration for retirees or those in a higher tax bracket, as it may impact their overall tax liability.

On the other hand, life insurance proceeds are generally not taxable. When a policyholder passes away, the death benefit paid out to the beneficiaries is typically free from income tax. This is because life insurance is designed to provide financial protection and support to beneficiaries, and the proceeds are often used for various purposes, such as covering funeral expenses, paying off debts, or providing financial security for loved ones. The tax-free nature of life insurance proceeds can be a significant advantage, especially for larger policy values.

The key difference in taxation lies in the timing and nature of the payments. Annuities provide a steady stream of income over time, and the tax treatment focuses on the growth and eventual distribution. In contrast, life insurance offers a lump sum payment upon the insured individual's death, and the tax treatment is more straightforward, as the proceeds are generally not taxable.

It's important for individuals to consider their tax situation and financial goals when deciding between an annuity and life insurance. Consulting with a financial advisor or tax professional can provide personalized guidance, ensuring that the chosen financial product aligns with one's specific needs and objectives. Understanding these tax implications is essential to making informed decisions regarding retirement planning and wealth management.

Hashimoto's Thyroiditis: Life Insurance Considerations and Impacts

You may want to see also

Frequently asked questions

An annuity is a financial product that provides a regular income stream over a specified period or for the annuitant's lifetime, while life insurance is a contract that provides a death benefit to the beneficiary upon the insured individual's passing.

Annuities generate income through premium payments and investment growth. The annuitant or their designated beneficiary receives regular payments, which can be immediate or deferred, depending on the annuity type.

Life insurance offers financial security to the beneficiary by providing a lump sum payment or income replacement in the event of the insured's death. It helps cover expenses, pay off debts, or provide for loved ones' financial needs.

Yes, some annuities offer conversion options, allowing annuitants to convert their annuity into a life insurance policy, providing additional death benefit coverage.

Both products can offer tax advantages. Annuities may provide tax-deferred growth, and certain types of annuities can be tax-free. Life insurance policies can also offer tax benefits, especially when used strategically for estate planning or business ownership.