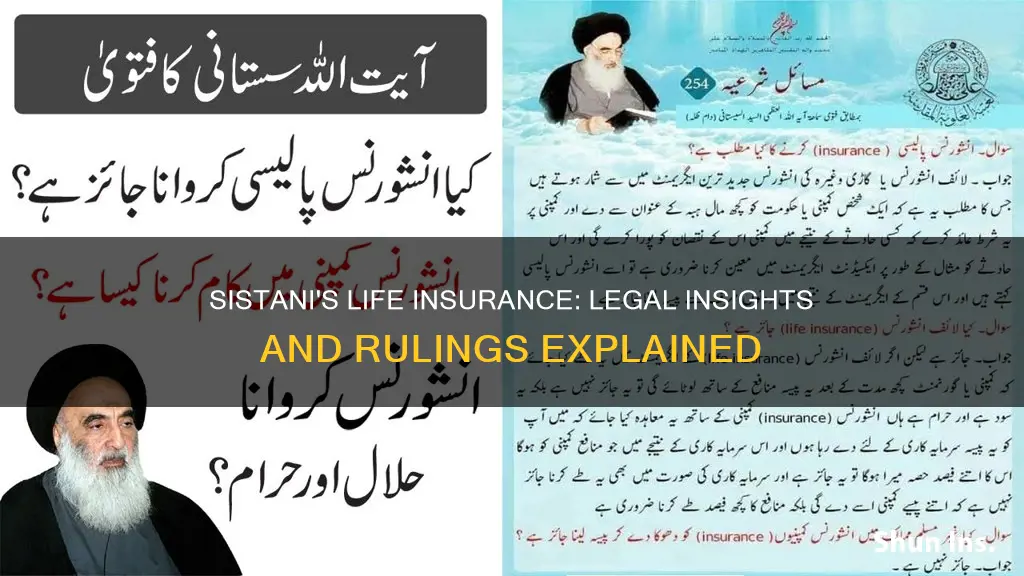

Sistani Life Insurance is a unique and complex topic within Islamic finance and insurance. It involves the concept of life insurance, which is a form of risk management in Islam, and the rulings on it are derived from Islamic law, particularly from the teachings of the Prophet Muhammad and the interpretation of Islamic scholars. The topic of Sistani Life Insurance focuses on the legal and ethical considerations of life insurance policies, especially those associated with the renowned Twelver Shi'a cleric, Ayatollah Sistani. His rulings on financial matters, including insurance, have significant influence in the Islamic legal community. This paragraph introduces the discussion by highlighting the importance of understanding the Islamic perspective on life insurance and the specific rulings related to Ayatollah Sistani's interpretation of Islamic law.

What You'll Learn

- Legal Basis: Understanding the religious and legal principles behind Sistan's life insurance rulings

- Fatwa Process: How Sistan's fatwas are issued and the process behind them

- Financial Implications: The financial impact of Sistan's rulings on life insurance policies

- Cultural Context: Exploring the cultural and societal factors influencing Sistan's views on life insurance

- Comparative Analysis: Comparing Sistan's rulings with other Islamic scholars' perspectives on life insurance

Legal Basis: Understanding the religious and legal principles behind Sistan's life insurance rulings

The rulings on life insurance in the context of Sistan, a region in Iran, are rooted in a combination of religious and legal principles that reflect the unique cultural and religious dynamics of the area. These rulings are particularly significant as they address the complex relationship between Islamic law and modern financial practices.

Sistan's life insurance rulings are heavily influenced by Islamic jurisprudence, which emphasizes the importance of fairness, justice, and ethical conduct in financial matters. One of the key principles is the concept of 'Mahrumah' or 'Haram,' which refers to actions or transactions that are considered unlawful or prohibited in Islam. In the context of life insurance, this often translates to ensuring that the insurance contract does not involve any form of speculation or gambling, which is strictly forbidden in Islamic finance.

The rulings also take into account the concept of 'Zakat,' which is one of the five pillars of Islam and involves the distribution of a fixed percentage of one's wealth to the needy. In life insurance, this could mean that a portion of the insurance proceeds might be designated for charitable purposes, aligning with the Islamic principle of giving back to the community.

Additionally, the legal framework in Sistan considers the social and economic impact of these rulings. It aims to protect the interests of both the insured and the insurer while ensuring that the insurance contract adheres to the principles of Islamic law. This includes considerations such as transparency, fairness in premium calculations, and the avoidance of any form of exploitation.

Understanding these religious and legal principles is crucial for anyone involved in the insurance industry operating in or serving the Sistan region. It ensures compliance with the local laws and religious beliefs, fostering a responsible and ethical approach to life insurance practices.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

Fatwa Process: How Sistan's fatwas are issued and the process behind them

The process of issuing fatwas, or religious rulings, in the context of Sistan, a region in Iran and Afghanistan, is a complex and structured system. This process is guided by the principles of Islamic jurisprudence and the teachings of the Twelvers, a branch of Shia Islam. Here is an overview of how these fatwas are issued:

The process begins with a request for a fatwa, which can be initiated by individuals, scholars, or even government authorities. These requests are then directed to the relevant scholars or experts in Islamic law, who are often part of the Sistan religious establishment. These scholars are well-versed in the various schools of Islamic thought, including the Jafari (Twelver) jurisprudence, which is prevalent in Sistan. The scholars carefully study the specific issue and its context, ensuring that they consider all relevant Islamic texts and legal principles.

Once the scholars receive the request, they engage in a thorough examination of the matter. This involves researching and analyzing the relevant Islamic texts, such as the Quran, the Hadith (sayings and actions of Prophet Muhammad), and the works of Islamic scholars. They also consider the specific circumstances and the potential outcomes of the ruling. The process is meticulous, requiring a deep understanding of Islamic law and its application to various scenarios.

After the initial research and analysis, the scholars engage in a discussion, often in a council setting, to reach a consensus. This consensus is crucial as it ensures the fatwa's authenticity and authority. The scholars consider different perspectives and interpretations, ensuring that the ruling is based on a comprehensive understanding of the issue. The process may involve multiple rounds of debate and revision until a final agreement is reached.

Finally, the fatwa is issued, and the ruling is made public. This fatwa then becomes a guiding principle for Muslims in Sistan and potentially beyond, depending on the authority of the issuing scholars. The process is designed to maintain the integrity of Islamic law and provide clear guidance to the community. It is a structured approach that ensures the fatwa's legitimacy and its ability to address complex religious matters.

This process highlights the importance of Islamic jurisprudence in providing guidance and solutions to various issues within the Sistan community. The fatwas issued through this method are considered reliable and influential, shaping the religious and legal landscape of the region.

Life Insurance Trusts: Grantor Trust Status Explained

You may want to see also

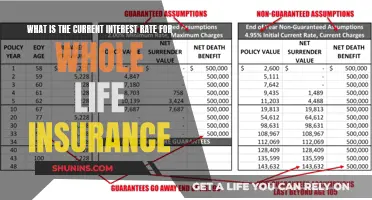

Financial Implications: The financial impact of Sistan's rulings on life insurance policies

The rulings of Grand Ayatollah Sistani regarding life insurance policies have significant financial implications for both insurers and policyholders. These rulings, which have been influential in Islamic jurisprudence, have a direct impact on the structure and pricing of life insurance products in Islamic financial markets.

One of the key financial implications is the requirement for life insurance policies to be based on shared risk and benefit among participants. This means that instead of a traditional premium-based model, where the insurer collects premiums and invests them to pay out claims, Islamic life insurance policies often utilize a profit-sharing mechanism. In this model, the insurer and policyholders share the profits and losses of the investment, ensuring a more equitable distribution of financial outcomes. This approach can lead to more stable and predictable returns for policyholders, especially in the long term.

The rulings also emphasize the importance of transparency and fairness in the pricing of life insurance. Insurers are required to provide clear and detailed explanations of the factors influencing the premium rates, ensuring that policyholders understand the costs associated with their coverage. This transparency can help build trust between insurers and policyholders, which is crucial in the Islamic financial sector, where ethical and moral considerations are paramount.

From a financial perspective, the profit-sharing model can result in lower initial premiums for policyholders, as the insurer's profits are shared with the participants. However, this model may also lead to more volatile returns, especially in the short term, as the performance of the investment pool directly impacts the policyholder's benefits. Insurers must carefully manage these risks to ensure the long-term sustainability of the product.

Additionally, the rulings encourage the development of alternative investment strategies within life insurance policies. This includes exploring options like investment accounts, where policyholders can choose specific investment portfolios, allowing for more personalized financial planning. Such strategies can provide policyholders with greater control over their financial outcomes and potentially attract a wider range of customers.

In summary, the financial implications of Ayatollah Sistani's rulings on life insurance policies are far-reaching. They promote a more equitable and transparent approach to insurance, potentially leading to lower initial costs for policyholders and the development of innovative investment strategies. However, insurers must carefully navigate the shared risk and profit-sharing models to ensure the financial stability and trustworthiness of these products in the Islamic financial ecosystem.

Skydiving: Is Your Life Insurance Policy Still Valid?

You may want to see also

Cultural Context: Exploring the cultural and societal factors influencing Sistan's views on life insurance

The cultural and societal landscape of Sistan, a region with a rich history and diverse population, significantly influences its residents' perspectives on life insurance. Understanding these factors is crucial in comprehending the unique stance on life insurance within this context.

One of the primary cultural influences is rooted in the region's Islamic heritage. Sistan, being a predominantly Muslim area, adheres to Islamic principles in various aspects of life, including financial matters. In Islamic jurisprudence, the concept of 'Zakat' (charity) and 'Awqaf' (endowments) plays a vital role in wealth distribution and social welfare. Life insurance, in its traditional form, may not align with these principles as it involves speculative investments and potential gains, which could be seen as a form of gambling. This perspective often leads to a more cautious approach towards life insurance among the local population.

The traditional values and customs of Sistan also contribute to the cultural context. In many traditional societies, the extended family system is prevalent, where family members rely on each other for support and financial stability. This close-knit family structure may reduce the perceived need for life insurance, as family members can provide financial assistance in times of need. Additionally, the region's historical experiences, including periods of conflict and economic instability, might have shaped a more conservative attitude towards financial planning, making life insurance a less prioritized concern.

Furthermore, the availability and accessibility of financial services in Sistan can impact the adoption of life insurance. The region's infrastructure and economic development may limit the presence of insurance companies and financial institutions, making it challenging for residents to access and understand life insurance products. This lack of accessibility could further reinforce traditional practices and alternative financial safety nets, such as community-based support systems.

In recent times, there has been a growing interest in modern financial services, including insurance, as Sistan experiences economic growth and increased exposure to global markets. However, the cultural and religious considerations remain significant factors in shaping the local perception of life insurance. Balancing traditional values with the need for financial security is a delicate task, and understanding these cultural influences is essential for providing appropriate financial solutions that respect the community's beliefs while addressing their needs.

Life Insurance in Mexico: What You Need to Know

You may want to see also

Comparative Analysis: Comparing Sistan's rulings with other Islamic scholars' perspectives on life insurance

The concept of life insurance in Islamic finance has been a subject of extensive debate and interpretation among scholars, with various perspectives emerging over the years. One prominent figure in this discourse is Grand Ayatollah Sistani, whose rulings on life insurance have gained significant attention within the Islamic legal tradition. This comparative analysis aims to explore how Ayatollah Sistani's views on life insurance compare to those of other Islamic scholars.

Ayatollah Sistani's ruling on life insurance is based on a strict interpretation of Islamic law, emphasizing the principles of fairness and prohibition of speculative transactions (gharar). He argues that life insurance, in its traditional form, involves an uncertain risk (gharar) as it is based on the uncertain event of death. According to Sistani, this uncertainty makes the contract invalid, and he suggests that the concept of insurance in Islam should be re-evaluated to align with the principles of Islamic finance. Sistani's approach is rooted in the traditional Hanafi school of thought, which is known for its conservative stance on financial matters.

In contrast, other Islamic scholars have offered different perspectives on life insurance. Some scholars, like Professor Muhammad Akram, propose a modified form of life insurance that avoids the speculative element. Akram suggests that a contract based on a fixed premium and a guaranteed payout can be considered acceptable under certain conditions, provided it is free from gharar. This view allows for a more flexible interpretation of Islamic law, accommodating modern financial instruments while maintaining the core principles of fairness.

Another perspective is presented by Ayatollah Ali al-Sistani, who, while sharing similar concerns about gharar, suggests that life insurance can be structured in a way that avoids speculative elements. He proposes a 'profit-sharing' model, where the insurer and the policyholder share the profits and losses based on a predetermined formula. This approach, according to al-Sistani, ensures that the contract is free from gharar and aligns with Islamic principles.

The differing views among Islamic scholars highlight the complexity of the issue. While Ayatollah Sistani's ruling emphasizes the prohibition of gharar, other scholars propose more nuanced interpretations that aim to reconcile traditional Islamic principles with modern financial needs. The debate continues, as scholars strive to find a balanced approach that respects the religious teachings while providing practical solutions for financial security in the context of Islamic finance.

In conclusion, this comparative analysis reveals the diversity of opinions among Islamic scholars regarding life insurance. While Ayatollah Sistani's ruling is based on a strict interpretation, other scholars offer modified perspectives that aim to address the practical needs of Muslims in the modern financial landscape. The ongoing dialogue and exploration of this topic contribute to the development of Islamic finance, ensuring its relevance and adaptability in a rapidly changing world.

Aviators: Why You Need Whole Life Insurance Coverage

You may want to see also

Frequently asked questions

The life insurance policy of Ayatollah Sistani, a prominent religious leader, is considered a personal financial arrangement and is generally permissible in Islam. However, the specific ruling may vary depending on the terms and conditions of the policy, as well as the intentions of the insured party. It is advisable to consult with Islamic scholars or financial experts who can provide guidance based on the individual circumstances.

Yes, there are certain considerations and potential restrictions. Firstly, the insurance should not be taken out with the primary intention of gaining financial profit, as this could be deemed speculative. The policy should also not involve any prohibited activities or transactions, such as gambling or uncertain investments. Additionally, the insurance amount and coverage should be fair and not excessive, ensuring that it does not cause harm or injustice to others.

The distribution of the insurance payout is generally considered a personal matter and is subject to the insured individual's wishes. The beneficiary should be someone who is eligible and has a valid claim, such as a family member or a designated representative. The payout can be used for the beneficiary's benefit, but it should be managed in a way that aligns with Islamic principles of fairness and justice. It is recommended to seek legal and religious advice to ensure compliance with the specific requirements of the Islamic legal system.