Life insurance is a financial tool that provides coverage and peace of mind, but understanding when it becomes most profitable is crucial. The profitability of life insurance is often tied to the timing of policy purchases and the specific needs of the individual. Generally, purchasing life insurance when you are young and healthy can result in lower premiums and more favorable rates, as insurance companies consider you a lower risk. Additionally, the value of life insurance increases over time, especially with term life policies, which can provide a substantial payout to beneficiaries when the policy term ends. However, the profitability of life insurance is not solely about the initial purchase; it's also about understanding when to review and potentially adjust your policy to ensure it remains aligned with your changing life circumstances and financial goals.

What You'll Learn

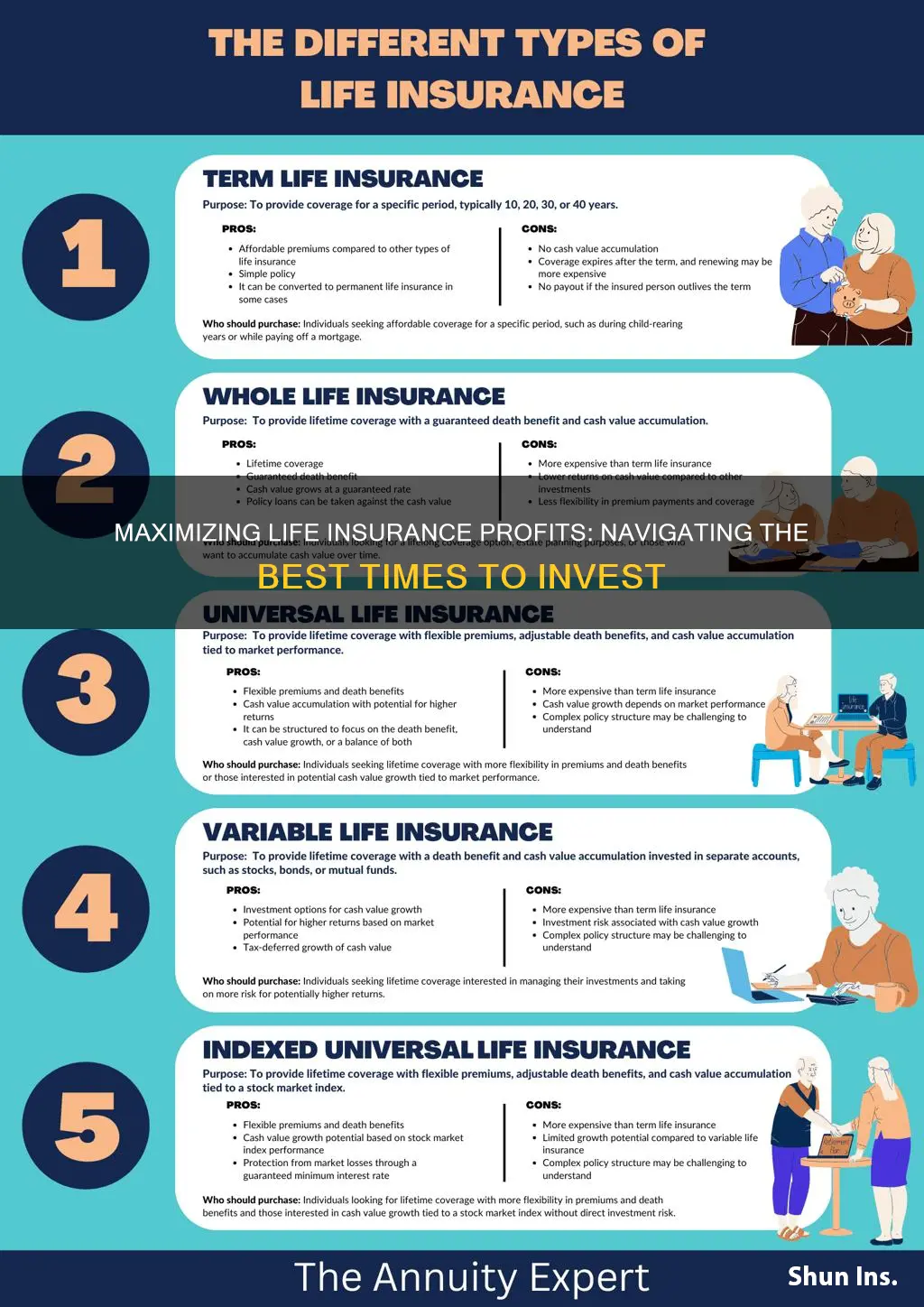

- Term Life vs. Permanent: Term life is cheaper and offers coverage for a specific period, while permanent life provides lifelong coverage and investment features

- Age and Health: Younger, healthier individuals often qualify for lower premiums and better rates due to reduced risk

- Income and Financial Goals: Higher income and larger families may require more coverage to secure financial stability

- Investment-Linked Policies: These policies offer potential investment growth, but fees and risks should be carefully considered

- Regular Review and Adjustments: Regularly reviewing and adjusting policies ensures coverage remains appropriate and cost-effective over time

Term Life vs. Permanent: Term life is cheaper and offers coverage for a specific period, while permanent life provides lifelong coverage and investment features

When considering life insurance, one of the fundamental decisions you'll face is choosing between term life and permanent life insurance. Both options have their unique advantages and can be valuable tools for financial planning, but understanding the differences is key to making the right choice.

Term life insurance is a straightforward and cost-effective solution. It provides coverage for a specific period, typically 10, 20, or 30 years. During this term, the policy offers a death benefit if the insured individual passes away. The beauty of term life is its affordability; it is generally more budget-friendly than permanent life insurance. This is because term policies are designed to cover a defined period, and the risk of death is lower compared to permanent plans, which offer lifelong coverage. As a result, insurance companies can offer lower premiums for term life, making it an attractive option for those seeking comprehensive protection without a long-term financial commitment.

On the other hand, permanent life insurance, also known as whole life or universal life, provides coverage for the entire lifetime of the insured individual. This type of policy offers a death benefit and also includes an investment component. With permanent life, a portion of your premium goes towards building cash value, which can be borrowed against or withdrawn. Over time, this cash value grows, providing a financial asset that can be used for various purposes, such as funding education expenses or starting a business. The lifelong coverage aspect of permanent life insurance ensures that your loved ones are protected even if you outlive your initial coverage period.

The choice between term and permanent life insurance depends on your specific needs and financial goals. If you prioritize affordability and have a defined coverage period in mind, term life is an excellent choice. It provides pure coverage without the additional investment features, keeping costs low. On the other hand, if you want lifelong protection and the potential for long-term financial benefits, permanent life insurance might be more suitable. It offers the security of knowing your loved ones will be taken care of, while also providing an investment opportunity that can grow over time.

In summary, term life insurance is ideal for those seeking temporary coverage at a lower cost, while permanent life insurance offers the advantage of lifelong protection and investment potential. Understanding these differences will enable you to make an informed decision when it comes to securing your family's financial future.

Can Unemployed People Get Life Insurance?

You may want to see also

Age and Health: Younger, healthier individuals often qualify for lower premiums and better rates due to reduced risk

Age and health are critical factors that significantly influence the cost and profitability of life insurance. Younger, healthier individuals often find themselves in a favorable position when it comes to securing life insurance coverage. This demographic group typically qualifies for lower premiums and more competitive rates due to their reduced risk profile.

As individuals age, the likelihood of developing health issues or facing medical complications increases. Older adults may have a higher prevalence of chronic diseases, such as heart disease, diabetes, or cancer, which can impact their overall health and longevity. Insurance companies often consider these health factors when determining the cost of life insurance policies. Younger individuals, on the other hand, are generally considered lower-risk prospects. Their age and good health suggest a longer life expectancy and a reduced likelihood of early mortality. As a result, insurance providers may offer them more attractive terms, including lower monthly premiums and potentially higher death benefits.

Maintaining a healthy lifestyle is crucial for younger individuals who want to optimize their life insurance rates. Engaging in regular physical exercise, eating a balanced diet, and avoiding harmful habits like smoking or excessive alcohol consumption can contribute to overall well-being. These healthy habits can lower blood pressure, improve cholesterol levels, and reduce the risk of various health conditions, making individuals more attractive to insurance companies.

Furthermore, younger adults often have the advantage of being breadwinners or primary earners in their families. Their financial stability and higher earning potential can also influence the cost of life insurance. Insurance providers may offer more competitive rates to individuals with stable careers and higher incomes, as they are considered less likely to require frequent claims.

In summary, younger and healthier individuals often benefit from more affordable and profitable life insurance options. Their reduced risk factors, combined with a healthy lifestyle and financial stability, make them ideal candidates for lower premiums and better coverage. It is essential for individuals in this demographic to understand the importance of maintaining good health and exploring their life insurance options to secure the most favorable terms.

Telco Life Insurance: What SC Telco Offers

You may want to see also

Income and Financial Goals: Higher income and larger families may require more coverage to secure financial stability

For individuals with higher incomes and larger families, life insurance can be an essential tool to ensure financial stability and security for their loved ones. As income increases, so do the responsibilities and expenses associated with supporting a larger household. This is where life insurance can step in and provide a crucial safety net.

When you have a higher income, you likely have more financial obligations and commitments. This could include mortgage payments, education costs for children, or even supporting extended family members. In the event of your untimely passing, a life insurance policy can provide a substantial financial cushion to cover these expenses and ensure that your family's standard of living is maintained. The payout from the insurance can help cover the remaining mortgage, fund your children's education, or even provide an inheritance for beneficiaries, ensuring that your family's financial future remains secure.

Additionally, larger families often require more resources and financial planning. With more mouths to feed and potential dependents, the impact of your death on the family's financial situation could be significant. Life insurance can help alleviate this concern by providing a lump sum or regular income to support the family's daily needs, including groceries, utilities, and other essential expenses. This financial support can be particularly crucial during the initial stages of grief, allowing the family to focus on healing and adjusting to life without you.

The amount of coverage needed will vary depending on individual circumstances. It is recommended to assess your family's unique situation and consider factors such as the number of dependents, existing savings, and future financial goals. Consulting with a financial advisor can help you determine the appropriate coverage amount to ensure that your family's financial stability is adequately protected. They can guide you in choosing the right policy, term length, and beneficiaries to meet your specific needs.

In summary, for those with higher incomes and larger families, life insurance is a valuable asset. It provides the means to secure financial stability, cover essential expenses, and ensure that your loved ones are taken care of during challenging times. By carefully evaluating your financial goals and obligations, you can make an informed decision about the type and extent of life insurance coverage that will benefit your family the most.

Whole Life Insurance: Interest or Not?

You may want to see also

Investment-Linked Policies: These policies offer potential investment growth, but fees and risks should be carefully considered

When considering life insurance, one type of policy that has gained popularity is the Investment-Linked Policy. These policies are designed to provide both a safety net in the event of death and the potential for investment growth. They are often marketed as a way to secure your family's financial future while also offering the opportunity to build wealth over time. However, it's crucial to understand the mechanics and potential pitfalls of these policies before making a decision.

Investment-Linked Policies combine life insurance with an investment component, typically a fund that invests in a diversified portfolio of assets. The policyholder's premiums are invested in this fund, and the performance of the investment can vary over time. The main advantage is that the policyholder can benefit from potential capital growth, which can be significant if the investment performs well. This type of policy can be an attractive option for those who want to take advantage of the stock market's potential while also having a guaranteed death benefit.

However, there are several factors to consider. Firstly, fees associated with these policies can be substantial. Investment fees, management fees, and other charges can eat into the potential returns, especially over the long term. It's important to carefully review the fee structure and understand how these costs impact your overall investment. Additionally, the investment performance is not guaranteed, and there is a risk that the value of your investment could decrease, potentially affecting the policy's overall value.

Another critical aspect is the tax implications. In many jurisdictions, the growth within investment-linked policies may be tax-deferred, meaning you won't pay tax on the investment gains until you withdraw the money. However, when you take a policy loan or surrender the policy, you may be subject to income tax on the accumulated value. Understanding the tax rules in your region is essential to make an informed decision.

Lastly, it's important to remember that while Investment-Linked Policies offer the potential for growth, they are still insurance products. The primary purpose is to provide financial security for your loved ones. It's crucial to assess your financial goals and risk tolerance before investing in these policies. While they can be a valuable tool in a comprehensive financial plan, they should not be the sole focus, and other investment options may be more suitable depending on your individual circumstances.

Borrowing Against Meritus Life Insurance: Is It Possible?

You may want to see also

Regular Review and Adjustments: Regularly reviewing and adjusting policies ensures coverage remains appropriate and cost-effective over time

Regularly reviewing and adjusting life insurance policies is a crucial aspect of ensuring that your coverage remains appropriate and cost-effective throughout your life's journey. Life insurance is a long-term commitment, and as your circumstances change, so should your policy. Here's why this practice is essential:

Life Changes and Policy Updates: Life is full of unexpected twists and turns. Major life events such as marriage, the birth of a child, purchasing a home, or significant career advancements can impact your insurance needs. For instance, starting a family might require increasing your coverage to provide for your loved ones in the event of your untimely demise. Similarly, a career change could lead to a different income level, affecting the amount of coverage you require. Regular reviews allow you to assess these changes and adjust your policy accordingly.

Age and Health Considerations: As you age, your health and medical needs may evolve. For example, older individuals might face increased health risks or require more specialized coverage. Regular policy reviews can help you stay on top of these changes and ensure that your insurance plan adapts to your evolving health status. This is particularly important as certain medical conditions or lifestyle choices can impact your insurance premiums.

Financial Goals and Milestones: Over time, your financial goals and milestones may shift. Perhaps you've paid off your mortgage, started saving for your children's education, or invested in a business. These financial achievements should be reflected in your insurance strategy. Regular adjustments can help you optimize your coverage to align with your current financial situation and goals, ensuring that your loved ones are adequately protected in the event of your passing.

Market and Rate Fluctuations: The insurance market is dynamic, with rates and policies changing over time. Regular reviews allow you to take advantage of potential savings or new policy options. Insurance providers often offer various coverage types and discounts, and staying informed about these changes can help you make more profitable decisions. By keeping your policy up-to-date, you can benefit from the most competitive rates and suitable coverage options available in the market.

Peace of Mind: Perhaps the most significant benefit of regular policy reviews is the peace of mind it provides. Knowing that your life insurance is tailored to your current needs and circumstances can offer reassurance. It ensures that you are adequately prepared for any eventuality, providing financial security for your loved ones. This proactive approach to insurance management can be a valuable part of your overall financial planning strategy.

In summary, regular review and adjustments of life insurance policies are essential to maintaining a suitable and cost-effective coverage plan. It allows you to adapt to life's changes, optimize financial goals, and stay informed about market offerings. By taking the time to review and update your policy, you can ensure that your life insurance remains a valuable asset, providing the necessary protection when it's needed most.

Family History: Life Insurance Impact

You may want to see also

Frequently asked questions

The ideal time to purchase life insurance is when you are in good health and have a stable financial situation. Young adults and middle-aged individuals often find themselves in this category, as they are less likely to have pre-existing health conditions that could impact insurance rates. Additionally, having a steady income and financial stability allows you to build a substantial cash value in your policy over time, which can be a significant profit for your beneficiaries.

While it is generally more affordable to get life insurance when you are younger and healthier, waiting until you are older might not always be the best financial decision. As you age, your health may deteriorate, and certain medical conditions could make you a higher risk for insurers. This can result in higher premiums or even denial of coverage. It's essential to consider your long-term financial goals and ensure that the insurance policy aligns with your needs and budget.

The cash value in a life insurance policy is a feature that allows the policy to accumulate a reserve of money over time. This reserve grows tax-free and can be borrowed against or withdrawn. The cash value increases as you make regular premium payments, and it can be a valuable asset, especially in whole life insurance policies. When you die, the cash value is used to pay your beneficiaries the death benefit, and any remaining cash value can be kept by the policyholder or borrowed against. This feature provides financial security and can be a significant profit, especially in long-term policies.

Yes, several strategies can help maximize the profitability of your life insurance. Firstly, consider choosing a whole life insurance policy, as it offers lifelong coverage and a guaranteed death benefit, ensuring a higher cash value accumulation. Secondly, opt for a higher death benefit amount that adequately covers your family's financial needs. Additionally, maintaining a healthy lifestyle can lead to lower premiums and better overall health, which is beneficial for both you and your insurance policy. Regularly reviewing and adjusting your policy as your life circumstances change is also essential to ensure it remains profitable and relevant.