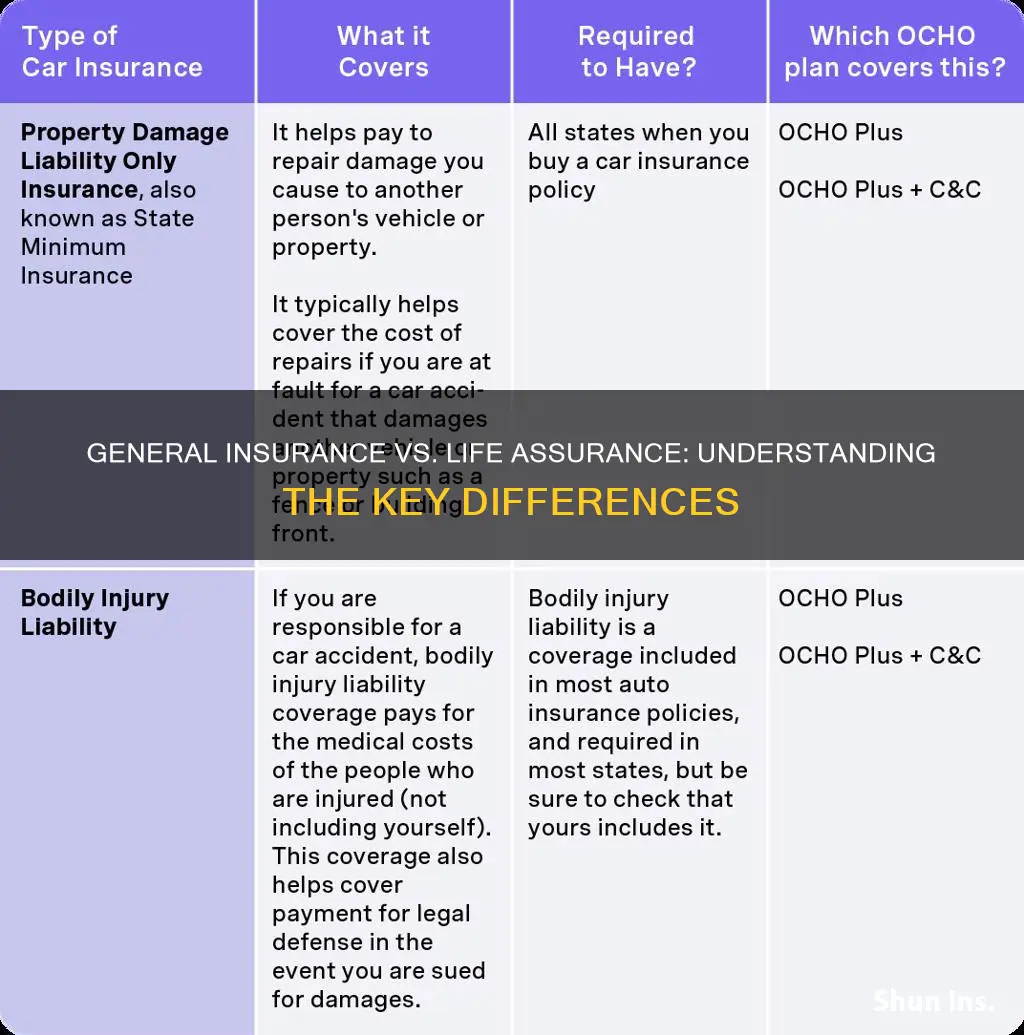

General insurance and life assurance are two distinct types of insurance policies that offer different levels of coverage and protection. General insurance, also known as non-life insurance, typically covers risks associated with property, vehicles, health, and liability. It includes policies like home insurance, car insurance, and health insurance, which provide financial protection against various losses and damages. On the other hand, life assurance, or life insurance, is designed to provide financial security for the policyholder's beneficiaries in the event of their death. It offers a payout or death benefit to the designated recipients, ensuring financial stability and peace of mind for the family or dependents. Understanding the differences between these two types of insurance is essential for individuals to choose the right coverage based on their specific needs and circumstances.

General Insurance vs. Life Assurance: Key Differences

| Characteristics | Values |

|---|---|

| Definition | General insurance covers financial losses from various risks, such as property damage, liability, and health issues. Life assurance provides financial protection in the event of the insured person's death. |

| Focus | General insurance focuses on protecting against unforeseen events and losses. Life assurance is centered around providing financial security for beneficiaries upon the insured individual's passing. |

| Risk Types | Includes property, liability, auto, health, disability, and professional liability insurance. Life assurance primarily covers accidental death, natural death, and terminal illness. |

| Payouts | Payouts are typically made when a covered event occurs, such as a car accident or property damage. Life assurance payouts are made upon the insured person's death or diagnosis of a terminal illness. |

| Term | General insurance policies can be short-term (e.g., one year) or long-term. Life assurance is often a long-term commitment, with policies lasting for decades or until the insured person reaches a certain age. |

| Benefits | Offers financial protection, risk mitigation, and peace of mind. Life assurance provides financial support to dependents, covers funeral expenses, and ensures financial goals are met. |

| Premiums | Premiums are generally paid monthly, quarterly, or annually. Life assurance premiums are typically higher due to the longer coverage period and the certainty of a payout. |

| Regulation | Regulated by insurance authorities to ensure fair practices and consumer protection. Life assurance is heavily regulated to protect policyholders and beneficiaries. |

| Tax Implications | Premiums are often tax-deductible for the insured. Payouts may be taxable depending on the jurisdiction and policy type. |

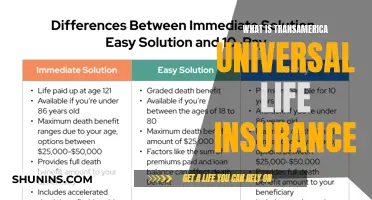

| Examples | Auto insurance, home insurance, health insurance, travel insurance. Term life insurance, whole life insurance, universal life insurance. |

What You'll Learn

- Coverage: General insurance covers property, liability, health, and auto, while life assurance covers death, critical illness, and disability

- Focus: Life assurance focuses on financial security for dependents, whereas general insurance addresses risks in daily life

- Term: General insurance is typically for a specific period, while life assurance is usually for a lifetime or a defined term

- Premiums: Premiums for general insurance are often paid annually, while life assurance premiums are paid monthly or annually

- Benefits: Life assurance offers tax-free death benefits, whereas general insurance provides compensation for losses and damages

Coverage: General insurance covers property, liability, health, and auto, while life assurance covers death, critical illness, and disability

General insurance and life assurance are two distinct types of insurance policies that provide different levels of coverage and protection. Understanding the coverage offered by each can help individuals choose the right insurance for their needs.

General Insurance Coverage:

General insurance, also known as non-life insurance, typically covers a wide range of risks and perils. It is designed to protect individuals and businesses from financial losses due to various events. The primary areas of coverage in general insurance include:

- Property Insurance: This type of insurance safeguards your assets, such as your home, building, or valuable items, against perils like fire, theft, natural disasters, or damage. It provides financial protection to repair or replace the damaged property.

- Liability Insurance: Liability coverage is essential to protect against legal claims and financial losses arising from accidents or injuries caused to others. It includes public liability, product liability, and employer's liability insurance, ensuring that you are financially protected in case of third-party claims.

- Health Insurance: Health insurance is crucial for covering medical expenses, treatments, and hospital stays. It provides financial assistance for medical bills, surgeries, medications, and other healthcare services, ensuring that individuals can access necessary medical care without incurring significant debt.

- Auto Insurance: Also known as motor insurance, this coverage protects vehicle owners and drivers from financial losses resulting from accidents, theft, or damage to their vehicles. It includes liability coverage for third-party claims, collision coverage, comprehensive coverage, and personal injury protection.

Life Assurance Coverage:

Life assurance, on the other hand, is a type of insurance that provides financial protection and peace of mind for individuals and their loved ones. It focuses on covering specific risks related to death, critical illness, and disability. Here's how it differs:

- Death Coverage: Life assurance policies offer death benefit coverage, which provides a financial payout to the policyholder's beneficiaries in the event of the insured individual's death. This financial support can help cover funeral expenses, outstanding debts, or provide financial security for dependents.

- Critical Illness Coverage: This aspect of life assurance provides financial assistance when the insured individual is diagnosed with a critical illness, such as cancer, heart attack, or stroke. It offers a lump sum payment or regular income to cover medical expenses, rehabilitation, and loss of income during the recovery period.

- Disability Coverage: Disability insurance under life assurance protects individuals from financial losses due to disabilities that prevent them from working. It provides income replacement benefits, ensuring that policyholders can maintain their standard of living and cover living expenses while they are unable to work.

In summary, general insurance offers a broad spectrum of coverage for various risks, including property, liability, health, and auto-related incidents. In contrast, life assurance is tailored to provide financial protection and support during critical life events, such as death, critical illness, and disability. Understanding these differences is essential for individuals to select the appropriate insurance policies that align with their specific needs and provide comprehensive coverage.

Whole Life Insurance: Is It Right for You?

You may want to see also

Focus: Life assurance focuses on financial security for dependents, whereas general insurance addresses risks in daily life

Life assurance and general insurance serve distinct purposes in the realm of financial protection. Life assurance, also known as life insurance, is a financial product designed to provide financial security and peace of mind for individuals' dependents. It is a contract between an individual and an insurance company, where the insurer promises to pay a specified sum of money to the policyholder's beneficiaries upon the insured individual's death. The primary purpose of life assurance is to ensure that the financial obligations and future needs of the dependents are met, even if the primary breadwinner is no longer present. This can include covering expenses such as mortgage payments, education fees, or simply providing an income replacement for the family. For instance, if a parent with young children purchases a life assurance policy, the proceeds can be used to ensure the children's upbringing and education, even if the parent were to pass away prematurely.

In contrast, general insurance is a broader category of insurance that covers various risks and perils associated with daily life. It provides protection against unforeseen events and accidents that can lead to financial loss. General insurance policies typically include coverage for property damage, liability, health, and motor vehicle-related risks. For example, a homeowner's insurance policy would protect against financial losses due to property damage caused by natural disasters or theft. Similarly, a car insurance policy safeguards against the financial burden of vehicle repairs or medical expenses resulting from an accident. General insurance is more about mitigating the impact of specific, identifiable risks and ensuring that individuals are financially protected against potential losses.

The key difference lies in the scope and purpose of these insurance types. Life assurance is specifically tailored to provide financial support to dependents, ensuring their well-being and security during challenging times. It is a long-term commitment that offers peace of mind, knowing that loved ones will be taken care of even in the event of the insured's death. On the other hand, general insurance is more comprehensive and covers a wide range of potential risks and liabilities that individuals might encounter in their daily lives. It provides a safety net for various financial losses, ensuring that individuals can recover from unforeseen events and continue their lives with reduced financial strain.

When considering insurance options, it is essential to understand the specific needs and priorities of the individual or family. Life assurance is ideal for those who have dependents and want to ensure their long-term financial stability. It provides a sense of security and allows individuals to focus on their daily lives without constantly worrying about the financial impact of their passing. General insurance, however, is more versatile and can be customized to fit various lifestyles and risk profiles. It offers protection against multiple perils, ensuring that individuals can manage financial risks effectively.

In summary, life assurance and general insurance serve different purposes. Life assurance is a dedicated financial tool to secure the future of dependents, while general insurance provides a comprehensive safety net against various daily risks. Understanding these differences is crucial in making informed decisions about insurance coverage, ensuring that individuals and families can adequately protect themselves and their loved ones.

Voluntary Term Life Insurance: Worth the Cost?

You may want to see also

Term: General insurance is typically for a specific period, while life assurance is usually for a lifetime or a defined term

When it comes to insurance, understanding the difference between general insurance and life assurance is crucial for making informed decisions about your coverage. One key aspect that sets these two types of insurance apart is the duration of their coverage.

General insurance, as the name suggests, provides coverage for a wide range of risks and events. It is designed to protect individuals and businesses from various perils, such as property damage, liability claims, vehicle accidents, and professional misconduct. This type of insurance is typically tailored to meet specific needs and is often taken out for a particular period, which can vary from a few months to several years. For example, you might purchase a home insurance policy that covers your property for a 5-year term or a car insurance policy that lasts for 3 years. The beauty of general insurance lies in its flexibility, allowing you to choose the duration that best suits your requirements.

On the other hand, life assurance, also known as life insurance, provides financial protection for the insured individual's beneficiaries in the event of their death. It is a long-term commitment, offering coverage for the entire lifetime of the insured person or for a defined term, such as 20 or 30 years. The primary purpose of life assurance is to provide financial security to loved ones, ensuring they have the necessary funds to cover expenses, repay debts, or achieve their financial goals after the insured individual's passing. Unlike general insurance, life assurance policies are not typically canceled or renewed frequently, as they are designed to provide lifelong coverage.

The key difference in terms of duration is that general insurance is often short-term and adaptable, allowing policyholders to adjust their coverage as needed. It provides protection for specific periods, ensuring that you are covered during the time when the risk is most relevant. In contrast, life assurance is a long-term commitment, offering peace of mind and financial security for the future. It is a more permanent solution, ensuring that your loved ones are protected even if your circumstances change over time.

Understanding the term and duration of these insurance policies is essential for making the right choice. General insurance provides flexibility and tailored coverage for specific risks, while life assurance offers lifelong protection and financial security for your beneficiaries. By grasping these differences, you can make informed decisions about your insurance needs and ensure that you have the appropriate coverage in place.

Battling for My Mother's Life Insurance: A Fight for Justice

You may want to see also

Premiums: Premiums for general insurance are often paid annually, while life assurance premiums are paid monthly or annually

When it comes to insurance, understanding the payment structures can be crucial for managing your finances effectively. One key aspect to consider is the frequency of premium payments, which can vary significantly between general insurance and life assurance policies.

General insurance, which covers a wide range of risks such as property damage, liability, and health issues, often requires annual premium payments. This means that policyholders typically pay the entire annual cost upfront or in installments throughout the year. For instance, if you take out a home insurance policy, you might pay the annual premium in three or six monthly installments. This annual payment structure can be beneficial for those who prefer a structured, long-term financial plan and can help in budgeting for insurance costs.

On the other hand, life assurance, or life insurance, usually involves more flexible premium payment options. Life assurance policies are designed to provide financial protection in the event of the insured's death. Premiums for these policies are often paid monthly or annually. Monthly payments provide a more regular and predictable expense for policyholders, which can be advantageous for those who prefer smaller, consistent payments throughout the year. Annual payments, similar to general insurance, can also be a suitable option for those who prefer a one-time payment for the entire year.

The choice between annual and monthly/annual premium payments depends on individual preferences and financial situations. Annual payments might be more appealing to those who prefer a simplified financial plan, while the flexibility of monthly payments can suit those who need more frequent, smaller payments. It's essential to consider your financial capabilities and the importance of insurance coverage when deciding on a premium payment schedule.

In summary, the payment structure is a significant differentiator between general insurance and life assurance. General insurance often requires annual premiums, providing a structured approach to insurance costs, while life assurance offers more flexibility with monthly or annual payments, catering to various financial preferences. Understanding these payment differences can help individuals make informed decisions when choosing the right insurance coverage for their needs.

Canceling Life Insurance: Understanding Your Time Limit

You may want to see also

Benefits: Life assurance offers tax-free death benefits, whereas general insurance provides compensation for losses and damages

Life assurance, also known as life insurance, is a financial product designed to provide financial security and peace of mind to individuals and their loved ones. One of its key benefits is the provision of tax-free death benefits. When an insured individual passes away, the life assurance policy pays out a lump sum or regular income to the designated beneficiaries. This amount is typically tax-free, ensuring that the entire sum reaches the intended recipients without any deductions. This feature is particularly advantageous as it provides a substantial financial cushion to the family, helping them cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even the daily living expenses of dependents. The tax-free nature of these benefits ensures that the money is utilized efficiently and according to the policyholder's wishes.

On the other hand, general insurance serves a different purpose and offers a distinct set of advantages. It provides coverage for various risks and perils, offering compensation for losses and damages incurred. General insurance policies can cover a wide range of events, including property damage, liability claims, health issues, and more. When an insured event occurs, the insurance company provides financial reimbursement to the policyholder, helping them recover from financial losses. For example, if a person's home is damaged by a natural disaster, general insurance can cover the repair or replacement costs, ensuring that the individual is not left financially devastated by the event. This aspect of insurance is crucial for managing risks and providing financial protection against unforeseen circumstances.

The primary distinction between life assurance and general insurance lies in their focus and the nature of the benefits provided. Life assurance is specifically designed to offer financial security and support to the policyholder's family in the event of their death. It provides a safety net, ensuring that loved ones are financially protected during challenging times. In contrast, general insurance is more comprehensive and covers a broad spectrum of risks, offering compensation for various losses and damages. It is a versatile tool for risk management, allowing individuals to safeguard themselves against multiple potential pitfalls.

In summary, life assurance provides tax-free death benefits, which are crucial for the financial well-being of beneficiaries. This feature ensures that the intended recipients receive the full amount without any tax implications. On the other hand, general insurance offers compensation for losses and damages, providing individuals with financial protection against a wide array of risks. Understanding these differences is essential for individuals to make informed decisions when choosing insurance products that align with their specific needs and priorities.

Term Life Insurance: Decreasing Cover, Explained

You may want to see also

Frequently asked questions

General insurance, also known as non-life insurance, covers a wide range of risks and perils that can affect your assets, liabilities, and daily life. This includes insurance for property, vehicles, health, liability, and various other risks. Life assurance, on the other hand, is a type of insurance that provides financial protection for an individual's family or beneficiaries in the event of their death. It ensures that the insured person's dependents receive a lump sum payment or an income stream.

General insurance policies typically involve an insurance company agreeing to compensate the policyholder (or a third party) for specific losses or damages in exchange for a premium. The policyholder pays a regular fee to the insurance company, and in return, the company promises to provide financial protection against various risks. For example, in health insurance, the company agrees to cover medical expenses, while in property insurance, it protects against damage to the insured asset.

Life assurance offers several advantages, including financial security for loved ones, tax advantages, and potential investment opportunities. Upon the insured individual's death, the policy pays out a death benefit, which can be used to cover funeral expenses, provide income replacement, or fund a child's education. Additionally, some life assurance policies offer investment components, allowing policyholders to grow their money over time.

Absolutely! Many individuals choose to have both types of insurance to ensure comprehensive coverage. For instance, you might have general insurance policies for your home, car, and health, while also opting for a life assurance policy to provide financial security for your family. Combining these can offer a robust risk management strategy and peace of mind.