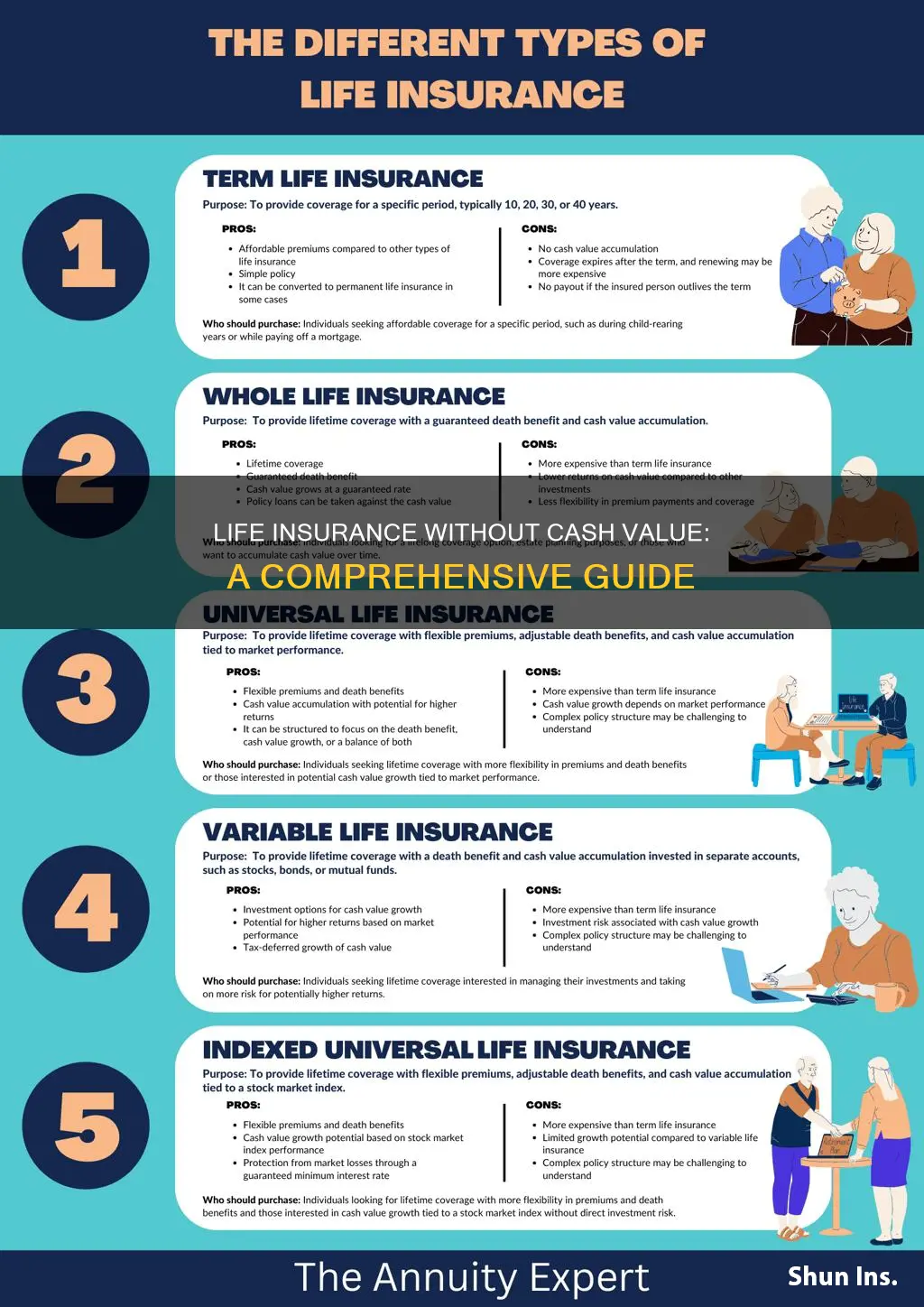

Life insurance is a crucial financial tool that provides financial security and peace of mind to individuals and their families. When considering life insurance options, it's important to understand the different types available. One type of life insurance that stands out is term life insurance, which offers pure coverage without any cash value accumulation. This type of policy provides a death benefit if the insured passes away during the specified term, but it does not build up any cash value that can be withdrawn or invested. Understanding the features and benefits of term life insurance can help individuals make informed decisions about their financial protection.

What You'll Learn

- Term Life Insurance: Pure protection with no investment component

- Whole Life Insurance: Permanent coverage, but no cash value accumulation

- Universal Life Insurance: Flexible premiums, no guaranteed cash value

- Variable Universal Life: Offers investment options, no fixed cash value

- Guaranteed Universal Life: Fixed premiums, no investment risk, no cash value

Term Life Insurance: Pure protection with no investment component

Term life insurance is a straightforward and effective way to provide financial protection for a specific period, offering pure coverage without any investment or savings component. This type of insurance is designed to offer a temporary safety net for your loved ones in the event of your untimely death during the policy term. It is a popular choice for those seeking affordable and focused coverage, as it directly addresses the need for financial security without the added complexity of investment features.

The beauty of term life insurance lies in its simplicity. When you purchase a term policy, you agree to pay a premium for a set period, often 10, 20, or 30 years. In return, the insurance company promises to pay a death benefit to your designated beneficiaries if you pass away during that term. This benefit is a lump sum payment that can be used to cover various expenses, such as mortgage payments, children's education, or any other financial obligations you may have left behind. The key advantage is that it provides a clear and defined period of coverage, ensuring your family's financial stability during a specific life stage.

One of the critical aspects of term life insurance is its affordability. Since it lacks an investment component, the premiums are typically lower compared to permanent life insurance policies. This makes it an attractive option for individuals who want comprehensive protection without the higher costs associated with building cash value. With term insurance, you can secure a substantial death benefit at a relatively low cost, ensuring that your loved ones are financially protected without the complexity of investment-related features.

Furthermore, term life insurance is highly customizable. You can choose the amount of coverage, the duration of the policy, and the premium payment options that best suit your needs. This flexibility allows you to tailor the policy to your specific circumstances, ensuring that the coverage aligns perfectly with your requirements. Whether you need coverage for a short period, like while your children are growing up, or a longer term, term life insurance provides the adaptability to meet various life situations.

In summary, term life insurance offers pure protection without the investment aspect, making it an ideal choice for those seeking affordable and focused coverage. Its simplicity, affordability, and customization options make it a powerful tool for providing financial security to your loved ones during the specific period you choose. By understanding the benefits of term life insurance, individuals can make informed decisions to protect their families effectively.

Factors Affecting Sum Assured in Life Insurance Calculation

You may want to see also

Whole Life Insurance: Permanent coverage, but no cash value accumulation

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, whole life insurance is designed to be a long-term financial commitment. One of the key features of whole life insurance is that it provides guaranteed level death benefits, meaning the insurance company will pay out a predetermined amount upon the insured's death, regardless of when it occurs. This aspect of whole life insurance makes it a reliable and secure choice for those seeking permanent coverage.

However, it's important to note that whole life insurance does not offer cash value accumulation. Cash value is the portion of the premium that is invested and grows over time, providing a tax-deferred savings component. In traditional whole life insurance, the premiums paid are used entirely to cover the death benefit and the associated expenses, with no portion allocated for investment or savings. This means that the policyholder does not build up any cash value that can be borrowed against or withdrawn.

The lack of cash value accumulation in whole life insurance can be a significant factor for those seeking investment opportunities or a means to build a financial nest egg. Unlike other types of life insurance, such as universal life insurance, which allows for some flexibility in premium payments and investment options, whole life insurance is more straightforward and predictable. Policyholders can expect consistent premiums and a fixed death benefit, but they won't benefit from the potential growth of cash value.

Despite the absence of cash value, whole life insurance still offers several advantages. It provides lifelong coverage, ensuring that the insured's beneficiaries will receive the promised death benefit. Additionally, whole life insurance policies typically have fixed premiums, which remain the same throughout the policy's duration, providing long-term financial planning stability. This predictability can be especially valuable for those who want a permanent insurance solution without the complexities of investment-based policies.

In summary, whole life insurance offers permanent coverage with guaranteed death benefits, making it a reliable choice for long-term financial protection. While it lacks the cash value accumulation feature, it provides consistent and predictable premiums, ensuring that the insured's beneficiaries receive the intended financial support. Understanding the differences between various life insurance types is crucial in making an informed decision based on individual financial goals and needs.

Does AARP's Guaranteed Life Insurance Offer Cash Value?

You may want to see also

Universal Life Insurance: Flexible premiums, no guaranteed cash value

Universal life insurance is a type of permanent life insurance that offers a unique blend of flexibility and potential financial benefits. Unlike traditional whole life insurance, which provides a guaranteed death benefit and a fixed cash value accumulation, universal life insurance allows policyholders to customize their coverage and investment strategy. This flexibility is particularly appealing to those seeking a more adaptable insurance solution.

One of the key features of universal life insurance is the ability to adjust premiums. Policyholders can typically choose to pay a fixed premium, a variable premium, or a combination of both. This flexibility is advantageous as it allows individuals to tailor their payments to their current financial situation and future needs. For instance, during periods of financial stability, one might opt for higher premiums to build up more cash value, while in times of economic uncertainty, lower premiums can be maintained to ensure continued coverage.

The lack of a guaranteed cash value in universal life insurance is a defining characteristic. Unlike whole life insurance, where a portion of each premium contributes to a fixed cash value that grows over time, universal life insurance invests premiums in a separate account. This investment account can be customized by the policyholder, allowing them to choose from various investment options offered by the insurance company. While this approach provides flexibility, it also means that the cash value accumulation is not guaranteed and can fluctuate based on market performance.

This type of insurance also offers a unique death benefit. The death benefit is typically equal to the cash value plus any additional amounts paid into the policy. This means that the death benefit can grow over time, providing a potentially higher payout to beneficiaries. However, it's important to note that the death benefit is not guaranteed and can be affected by market conditions and the performance of the investment account.

In summary, universal life insurance provides a flexible and customizable approach to life insurance. With the ability to adjust premiums and the lack of a guaranteed cash value, it offers policyholders the freedom to manage their insurance strategy according to their changing needs and financial goals. While this flexibility comes with potential risks, it also presents opportunities for those seeking a more tailored and adaptable insurance solution.

Unlocking Life Insurance Rates: Your Guide to Finding the Best Deal

You may want to see also

Variable Universal Life: Offers investment options, no fixed cash value

Variable Universal Life (VUL) is a type of life insurance policy that offers a unique combination of features, making it an attractive option for those seeking both insurance protection and investment opportunities. Unlike traditional life insurance policies with fixed cash values, VUL provides a flexible approach to insurance and investment.

One of the key advantages of VUL is its investment component. Policyholders can choose from a variety of investment options, allowing them to potentially grow their money over time. These investment accounts are typically separate from the insurance portion, providing a way to build wealth while also ensuring a death benefit for the insured's beneficiaries. The investment options in VUL policies can vary, often including stocks, bonds, and mutual funds, which are professionally managed to help grow the policy's value. This investment aspect is particularly appealing to those who want to actively manage their investments and potentially benefit from market performance.

In contrast to permanent life insurance policies like whole life, VUL does not have a fixed cash value that accumulates over time. Instead, the policy's value fluctuates based on the performance of the underlying investments. This means that the cash value in VUL is not guaranteed and can increase or decrease, depending on market conditions. For those who prefer a more dynamic and market-driven approach to their insurance and savings, this feature can be advantageous.

The flexibility of VUL is another significant benefit. Policyholders can adjust their contributions and investment allocations as their financial situation changes. This adaptability is especially useful for individuals who want to optimize their insurance coverage and investment strategy over time. Additionally, VUL policies often allow for loan features, enabling policyholders to access a portion of their policy's cash value as a loan, which can be useful in times of financial need.

In summary, Variable Universal Life insurance offers a unique blend of insurance and investment opportunities. With its investment options, VUL provides a way to potentially grow wealth while also ensuring financial protection. The lack of a fixed cash value means that the policy's value is tied to market performance, offering a dynamic approach to life insurance. This type of policy is well-suited for individuals who want to actively manage their investments and adapt their insurance strategy as their financial goals evolve.

Life Insurance Policy: Locating Your Coverage

You may want to see also

Guaranteed Universal Life: Fixed premiums, no investment risk, no cash value

Guaranteed Universal Life (GUL) is a type of permanent life insurance that offers a unique set of features, primarily catering to those seeking a straightforward and predictable insurance solution. Unlike traditional life insurance policies, GUL provides a fixed death benefit and fixed premiums, ensuring stability and predictability for the policyholder. One of its key advantages is the absence of investment risk, making it an attractive option for those who prefer a more conservative approach to life insurance.

In a GUL policy, the insurance company guarantees the death benefit, which is the amount paid to the policyholder's beneficiaries upon the insured's passing. This guarantee is a significant feature, as it provides certainty and peace of mind, knowing that the policy will pay out as promised, regardless of market fluctuations or the performance of underlying investments. The fixed premiums associated with GUL ensure that the cost of the policy remains consistent over the entire term, providing long-term financial planning with predictable expenses.

The absence of investment risk in GUL is a critical aspect that sets it apart from other life insurance products. Unlike some permanent life insurance policies that tie the death benefit to investment accounts, GUL does not expose policyholders to market volatility. The insurance company uses the premiums to fund the policy's death benefit and other expenses, ensuring that the policy's value remains stable and predictable. This feature is particularly appealing to those who want a guaranteed payout without the potential risks associated with investment-based policies.

Furthermore, GUL does not accumulate cash value, which is another distinguishing factor. Cash value is the investment component of certain life insurance policies, where a portion of the premium contributes to a savings account. In GUL, the focus is solely on providing a fixed death benefit and fixed premiums, without the accumulation of cash value. This means that the policy does not grow a savings component over time, making it a more straightforward and transparent insurance product.

For individuals seeking a life insurance policy with fixed premiums, a guaranteed death benefit, and no exposure to investment risks, GUL offers a compelling solution. Its simplicity and predictability make it an excellent choice for those who prefer a conservative approach to financial planning. By understanding the unique features of GUL, individuals can make informed decisions about their life insurance needs, ensuring they have the right coverage to protect their loved ones.

Life Insurance: Me Bank's Guide to Peace of Mind

You may want to see also

Frequently asked questions

Term life insurance is a pure protection policy that provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit if the insured person passes away during the term, but it does not accumulate cash value. On the other hand, whole life insurance is a permanent policy that provides lifelong coverage. It includes a death benefit and an investment component, where a portion of the premium contributes to a cash value account that grows over time.

A life insurance policy without cash value, often referred to as a term life policy, is designed to provide coverage for a specified period. The primary purpose is to offer financial protection to the policyholder's family or beneficiaries in the event of the insured's death. The premiums are paid solely to provide the death benefit, and there is no investment or savings component.

Yes, there are several benefits. Firstly, term life insurance is generally more affordable than permanent policies with cash value because it doesn't have the additional costs associated with building a cash reserve. It provides pure coverage, making it an excellent choice for those seeking temporary protection, especially if they have specific needs for a defined period, such as covering mortgage payments or children's education.

Yes, many insurance companies offer conversion options. If you decide you want the long-term financial security of a policy with cash value, you can typically convert your term life insurance into a whole life or universal life policy. This process may involve a medical examination and additional paperwork, and the conversion rate may vary based on the insurance company's policies.