Life insurance is a crucial financial tool that provides coverage and peace of mind to individuals and their families. When considering life insurance, it's essential to understand the different types of policies available. Two common types are level and decreasing life insurance. Level life insurance, also known as whole life or permanent insurance, offers a consistent death benefit throughout the policy's term, providing a fixed amount of coverage that remains the same over time. On the other hand, decreasing life insurance, often referred to as term life insurance, has a death benefit that reduces over time, typically aligning with the insured individual's decreasing financial obligations as they age. Understanding the differences between these two types of policies can help individuals make informed decisions about their insurance needs and ensure they have adequate coverage to protect their loved ones.

What You'll Learn

- Definition: Level-term insurance maintains the same coverage amount for a set period

- Decreasing Term: Coverage decreases over time, often aligning with financial milestones

- Cost: Level policies typically have consistent premiums, while decreasing terms may lower over time

- Flexibility: Decreasing life insurance offers adjustable coverage, allowing for changes as needed

- Longevity: Level insurance provides coverage for a specific duration, while decreasing terms can last a lifetime

Definition: Level-term insurance maintains the same coverage amount for a set period

Level-term insurance, also known as level-term life insurance, is a type of life insurance policy that provides a fixed amount of coverage for a predetermined period. This type of insurance is designed to offer a consistent level of financial protection during the term of the policy, ensuring that the insured individual and their beneficiaries receive the same amount of coverage throughout the specified duration.

When you purchase level-term insurance, you agree to pay a set premium for a particular number of years, often ranging from 10 to 30 years. During this term, the policyholder's life is insured for the agreed-upon amount. For example, if you take out a $500,000 level-term policy for 20 years, your beneficiaries will receive the full $500,000 if you pass away during that period. The key advantage of this type of insurance is the stability and predictability it offers. Policyholders can plan their finances with confidence, knowing their loved ones will have a consistent financial safety net.

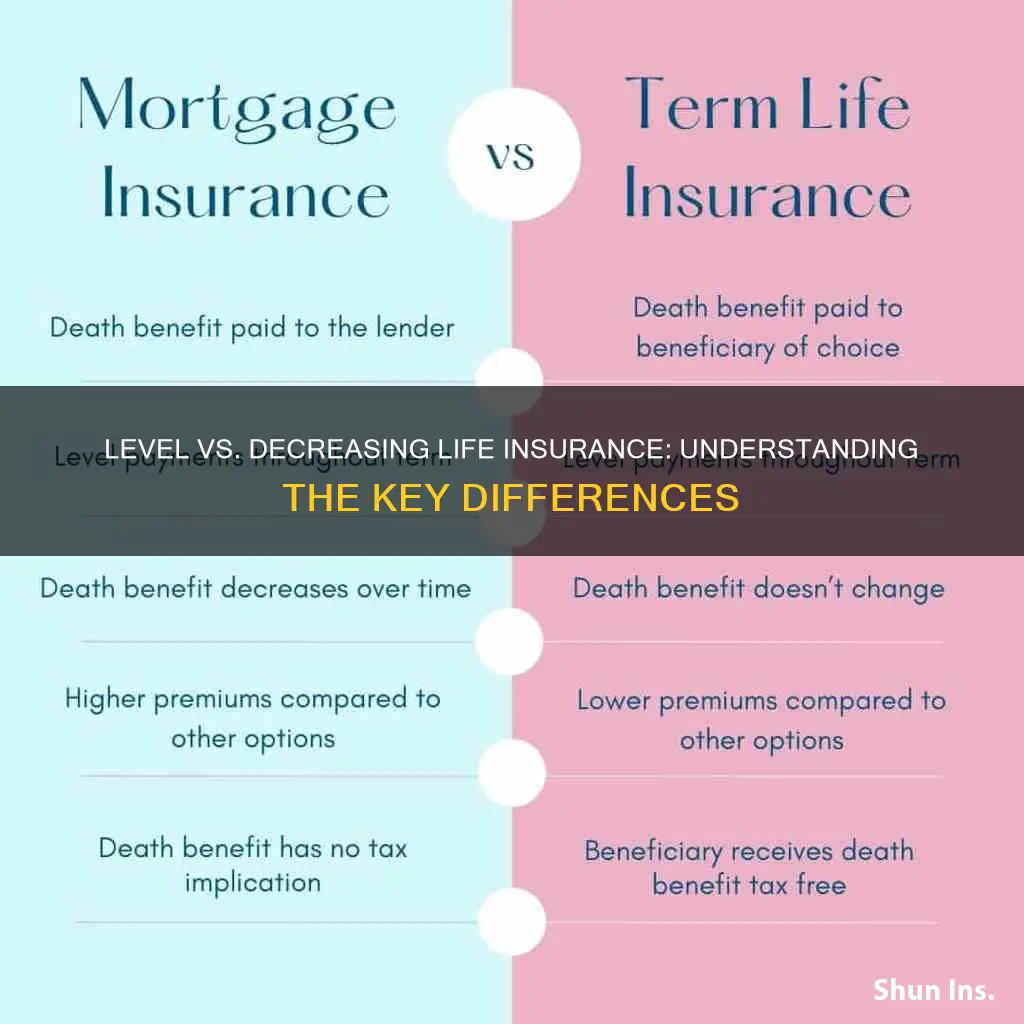

One of the primary differences between level-term and decreasing life insurance is the coverage amount. In a decreasing life insurance policy, the death benefit typically decreases over time, often in line with the policyholder's decreasing needs or financial obligations. For instance, a borrower taking out a mortgage might opt for a decreasing policy, as the loan amount reduces over time. In contrast, level-term insurance maintains a constant coverage amount, providing a fixed level of protection throughout the term.

Level-term insurance is particularly useful for individuals who want to ensure a specific level of financial security for a set period, such as covering mortgage payments, providing for children's education, or funding retirement plans. It offers a straightforward and transparent approach to life insurance, making it easier for policyholders to understand and manage their coverage.

In summary, level-term insurance is a valuable tool for those seeking consistent financial protection over a defined period. Its fixed coverage amount and predictable premiums make it an attractive option for individuals and families who want to secure their financial future with a reliable and stable insurance product.

Life Insurance Evolution: Adapting to Changing Times

You may want to see also

Decreasing Term: Coverage decreases over time, often aligning with financial milestones

When considering life insurance, it's important to understand the different types of coverage available to ensure you choose the right option for your needs. One such type is decreasing term life insurance, which offers a unique approach to financial protection. This type of policy is designed to provide a higher level of coverage during the initial years, typically aligning with significant financial milestones in your life.

Decreasing term life insurance, as the name suggests, decreases the amount of coverage over time. This is in contrast to level term life insurance, where the coverage amount remains constant throughout the policy term. The decreasing coverage is often structured to match the changing financial needs and responsibilities as you progress through life. For example, when you start a family or purchase a home, you might require a substantial amount of insurance to cover potential financial losses. As you pay off the mortgage, raise your children, and your financial situation stabilizes, the need for extensive coverage may diminish.

The beauty of decreasing term life insurance lies in its flexibility and cost-effectiveness. By starting with a higher coverage amount, you can ensure that your loved ones are adequately protected during the most critical periods. As time passes and your financial obligations reduce, the policy adjusts accordingly, providing a more tailored and efficient solution. This type of insurance is particularly beneficial for those who want to maximize their coverage when it matters the most while also considering long-term financial planning.

When deciding on a decreasing term life insurance policy, it's essential to consider your current and future financial goals. You'll need to determine the initial coverage amount, the duration of the policy, and how often the coverage will decrease. Some policies offer annual or even monthly adjustments, allowing for precise control over the coverage. Additionally, understanding the factors that influence the policy's cost, such as age, health, and lifestyle, will help you make an informed decision.

In summary, decreasing term life insurance offers a strategic approach to financial protection, providing higher coverage during the most critical life stages and gradually decreasing as your financial needs evolve. This type of policy is a valuable tool for individuals seeking a flexible and efficient way to secure their family's financial future. By carefully evaluating your circumstances and choosing the right policy, you can ensure that your loved ones are protected when it matters the most.

Group Life Insurance: Non-Waiver of Premium Benefits Explained

You may want to see also

Cost: Level policies typically have consistent premiums, while decreasing terms may lower over time

When considering life insurance, understanding the cost structure is crucial for making informed decisions. One key aspect to compare is the cost of level term life insurance versus decreasing term life insurance.

Level term life insurance, as the name suggests, offers a consistent and fixed premium throughout the entire term of the policy. This means that the cost of coverage remains the same from the start to the end of the chosen term, typically 10, 15, or 20 years. For example, if you purchase a $500,000 level term policy with a 20-year term, your annual premium will be the same for the entire 20 years, providing a predictable and stable cost for the duration of the policy. This predictability can be advantageous for budgeting, especially for those who want long-term financial security without the worry of increasing premiums.

On the other hand, decreasing term life insurance has premiums that start high and then gradually decrease over time. This type of policy is often more affordable in the early years of the policy but becomes more expensive as the term progresses. For instance, if you opt for a $500,000 decreasing term policy with a 20-year term, your initial annual premium might be higher compared to a level term policy, but it will decrease by a certain percentage each year. This structure is particularly beneficial for individuals who want lower insurance costs in the early years of their policy, which can be more aligned with their financial situation during those years.

The cost advantage of decreasing term life insurance becomes more apparent as the policy term progresses. As the premiums decrease, the overall cost of coverage becomes more manageable, especially for those who want to ensure their loved ones are protected without the burden of high premiums in the long term. This flexibility in cost can be an attractive feature for those who may experience changes in their financial status or need for insurance coverage over time.

In summary, when it comes to cost, level term life insurance offers consistent premiums, providing a stable financial commitment. In contrast, decreasing term life insurance provides lower premiums in the early years, allowing for more flexibility and potentially better affordability as your financial situation evolves. Understanding these cost differences can help individuals choose the most suitable life insurance policy based on their specific needs and financial goals.

Life Insurance: Does It Expire or End?

You may want to see also

Flexibility: Decreasing life insurance offers adjustable coverage, allowing for changes as needed

Decreasing life insurance is a type of policy that provides a flexible and adaptable approach to financial protection. Unlike traditional level term life insurance, which offers a fixed amount of coverage for a specified period, decreasing life insurance is designed to decrease over time, aligning with the changing needs of the policyholder. This type of insurance is particularly beneficial for those who want to ensure their loved ones are financially secure during the initial years of their children's upbringing or for any other long-term financial commitments.

The flexibility of decreasing life insurance is a key advantage. As the name suggests, the coverage amount decreases annually, typically in line with the policyholder's age and changing circumstances. For instance, a policyholder might start with a higher coverage amount when they first take out the policy, ensuring their family is protected during the early years of their children's education. Over time, as the children grow and the financial obligations may change, the policyholder can adjust the coverage downward, potentially saving on premiums and ensuring the insurance remains relevant.

This adjustable nature allows individuals to make changes to their policy as their life circumstances evolve. For example, a policyholder might increase the coverage during significant life events like getting married or starting a business, providing extra financial security during these times. Conversely, they can decrease the coverage when their children become financially independent or when they no longer have substantial financial commitments. This flexibility ensures that the insurance remains a practical and cost-effective solution throughout the policyholder's life.

Furthermore, decreasing life insurance can be a strategic choice for those who want to optimize their financial resources. By adjusting the coverage, policyholders can ensure they are not overpaying for insurance that they no longer need. This adaptability also allows for better financial planning, as individuals can allocate their resources more efficiently, either by reducing the insurance premium or by investing the saved amount elsewhere.

In summary, decreasing life insurance offers a unique and flexible approach to financial planning. Its adjustable coverage allows policyholders to adapt to changing life events and financial goals, ensuring that the insurance remains a relevant and practical solution. This type of policy provides a tailored and efficient way to manage financial risks and commitments, making it an attractive option for those seeking long-term financial security.

Term Life Insurance: Cashing Out and Claiming Benefits

You may want to see also

Longevity: Level insurance provides coverage for a specific duration, while decreasing terms can last a lifetime

When it comes to life insurance, understanding the differences between various policy types is crucial for making informed financial decisions. Two common types of life insurance policies are level term insurance and decreasing term insurance, each with distinct characteristics regarding longevity and coverage.

Level term insurance, as the name suggests, provides a fixed level of coverage for a predetermined period. This means that the policyholder receives a set amount of financial protection for a specific duration, such as 10, 20, or 30 years. Once the term ends, the coverage typically expires unless the policy is renewed or converted. This type of insurance is ideal for individuals who want a straightforward, temporary solution to cover specific financial obligations, such as mortgage payments or children's education expenses. The simplicity of level term insurance lies in its predictability; the premium remains consistent throughout the term, making it easier to budget and plan.

On the other hand, decreasing term insurance offers a unique approach to longevity and coverage. This policy type provides a higher level of coverage at the beginning of the term and gradually decreases over time. For instance, if you choose a 20-year decreasing term policy, your coverage will start at a higher amount and then reduce by a predetermined percentage each year. This feature is particularly useful for those who want to ensure that their loved ones are protected during the most critical financial periods, such as when a mortgage is being paid off or when children are growing up. As the policy decreases, the premium also reduces, providing a cost-effective solution for long-term financial planning.

The key difference in longevity between these two types of insurance is that level term insurance is time-bound, offering coverage for a specific period, while decreasing term insurance is designed to last a lifetime. With decreasing term insurance, the coverage amount adjusts over time, ensuring that the policy remains relevant and valuable even as the insured individual's needs change. This flexibility can be advantageous for those who want a more dynamic and adaptable insurance strategy.

In summary, when considering life insurance, it is essential to evaluate your long-term financial goals and obligations. Level term insurance provides a straightforward solution for specific durations, while decreasing term insurance offers a more comprehensive approach, adapting to your changing needs over time. Understanding these differences will enable you to make an informed choice, ensuring that your loved ones are adequately protected throughout their lives.

BDO Life Insurance: Application Process Simplified

You may want to see also

Frequently asked questions

The main distinction lies in the death benefit amount over time. Level term life insurance provides a fixed death benefit for a specified term, typically 10, 20, or 30 years, and the benefit remains the same throughout the policy period. On the other hand, decreasing life insurance, also known as term life insurance, offers a death benefit that reduces over time, aligning with the insured's changing needs and financial obligations.

Generally, decreasing term life insurance is more affordable than level term life insurance, especially for longer coverage periods. This is because the death benefit decreases over time, and insurance companies calculate premiums based on the remaining benefit. As a result, the cost per year of coverage tends to be lower for decreasing term policies.

Yes, decreasing life insurance can be advantageous for those with specific financial goals. For instance, if you're financing a large purchase like a house, the decreasing benefit can ensure that your family is protected with a higher amount of coverage when the loan is more significant, and the benefit reduces as the loan balance decreases.

Yes, many insurance companies offer conversion options, allowing policyholders to convert their decreasing term life insurance to a level term policy. This can be beneficial if your financial needs change, and you require a consistent death benefit. However, conversion may be subject to certain conditions and medical underwriting, and there might be additional costs involved.