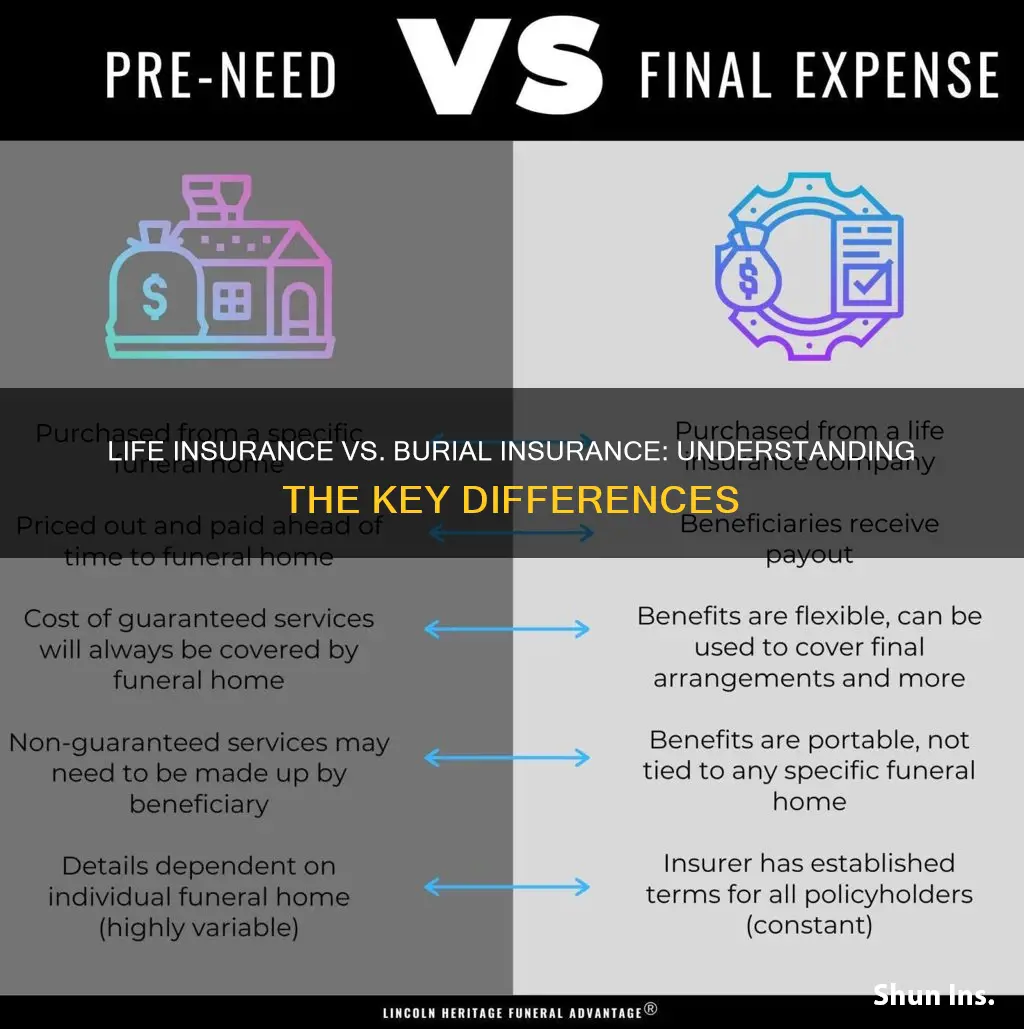

Life insurance and burial insurance are two distinct types of coverage that provide financial protection for individuals and their families. While life insurance offers a safety net for various life events, such as death, illness, or disability, burial insurance specifically focuses on covering the costs associated with funeral and burial expenses. The key difference lies in their purpose and coverage: life insurance provides a financial benefit to beneficiaries upon the insured's death, ensuring financial security for loved ones, whereas burial insurance is designed to cover the final expenses, including funeral services, casket, and cemetery fees, providing peace of mind and financial relief during a difficult time.

What You'll Learn

- Coverage Duration: Burial insurance provides a one-time payout, while life insurance offers ongoing financial support

- Purpose: Life insurance replaces income and covers expenses, whereas burial insurance funds final arrangements

- Tax Implications: Life insurance death benefits are generally tax-free, unlike burial insurance, which may be taxable

- Flexibility: Life insurance policies can be tailored to specific needs, while burial insurance is standardized

- Cost: Burial insurance is typically more affordable upfront, with higher costs over time, compared to life insurance

Coverage Duration: Burial insurance provides a one-time payout, while life insurance offers ongoing financial support

When it comes to insurance, understanding the differences between various types of coverage is essential for making informed financial decisions. Two common types of insurance that often cause confusion are life insurance and burial insurance. While both serve important purposes, they differ significantly in their coverage duration and the way they provide financial support.

Life insurance is a comprehensive financial tool designed to provide financial security for the beneficiary(ies) during the insured's lifetime. It offers ongoing financial support to the policyholder's loved ones, ensuring that they can maintain their standard of living and cover essential expenses even after the insured's passing. This type of insurance typically has a long-term coverage period, which can last for several years or even the entire lifetime of the insured individual. The primary purpose of life insurance is to provide financial stability and peace of mind, knowing that the policyholder's family will be taken care of in the event of their death.

On the other hand, burial insurance, also known as final expense insurance, is specifically tailored to cover the costs associated with funeral and burial expenses. This type of insurance provides a one-time payout to the beneficiary, which is used to cover the final arrangements and burial costs. Burial insurance is designed to alleviate the financial burden on the family during a difficult time, ensuring that the insured's wishes are honored without causing additional stress. The coverage duration of burial insurance is typically much shorter, often lasting only a few years, and it is intended to provide immediate financial relief for the specific purpose of funeral and burial expenses.

The key difference lies in the timing and nature of the financial support. Life insurance offers long-term financial security, ensuring that the insured's family can maintain their lifestyle and cover various expenses over an extended period. It provides a steady income to the beneficiaries, allowing them to make important financial decisions and plan for the future. In contrast, burial insurance provides a one-time payment, which is crucial for covering the immediate and often substantial costs associated with funeral and burial services. This type of insurance is particularly valuable for individuals who want to ensure that their final wishes are respected without leaving a financial burden on their loved ones.

Understanding these differences is essential for individuals to choose the right insurance coverage based on their specific needs and financial goals. While life insurance offers ongoing support and financial stability, burial insurance provides a dedicated safety net for the final expenses, ensuring that the insured's wishes are honored with dignity and respect.

Understanding Comprehensive Life Insurance Coverage

You may want to see also

Purpose: Life insurance replaces income and covers expenses, whereas burial insurance funds final arrangements

Life insurance and burial insurance serve distinct purposes and cater to different needs, primarily due to their unique focuses. Life insurance is a financial tool designed to provide financial security and support for the beneficiaries of the policyholder. Its primary purpose is to replace the income that would have been contributed by the deceased individual, ensuring that their loved ones can maintain their standard of living and cover essential expenses. This type of insurance offers a financial safety net, allowing beneficiaries to manage daily costs, such as mortgage payments, rent, utilities, and other living expenses, without the immediate financial burden of replacing the deceased's income.

The coverage provided by life insurance policies can vary, but it typically includes a death benefit, which is a lump sum payment made to the designated beneficiaries upon the insured individual's passing. This benefit can be used to cover various expenses, including funeral and burial costs, outstanding debts, education fees, and even long-term care or medical expenses. By providing this financial support, life insurance ensures that the family's financial stability is maintained, and the policyholder's legacy is honored.

On the other hand, burial insurance, also known as final expense insurance, is specifically tailored to cover the costs associated with funeral and burial arrangements. This type of insurance is designed to provide peace of mind and financial security during a difficult time. Burial insurance policies typically offer a guaranteed death benefit, which is used exclusively for funeral and burial expenses. This includes costs such as the casket, funeral home services, grave marker, and other related fees.

The key difference lies in the timing and purpose of the payments. Life insurance is intended to provide long-term financial security and support for the beneficiaries' future needs, ensuring that the family can maintain their lifestyle and cover various expenses over an extended period. In contrast, burial insurance focuses on the immediate and specific costs associated with funeral and burial arrangements, providing a one-time payment to cover these essential expenses. This distinction highlights the unique roles each type of insurance plays in financial planning and estate management.

Life Insurance: Who Has It and Who Doesn't?

You may want to see also

Tax Implications: Life insurance death benefits are generally tax-free, unlike burial insurance, which may be taxable

When it comes to tax implications, understanding the differences between life insurance and burial insurance is crucial. Life insurance death benefits are typically exempt from taxation, which means the proceeds paid out upon the insured individual's death are not subject to income tax. This is a significant advantage, as it ensures that the beneficiaries receive the full amount without any tax liabilities. The tax-free nature of life insurance death benefits is a result of the insurance being considered a form of protection and not an investment, which is why it is treated differently from other financial instruments.

On the other hand, burial insurance, also known as final expense insurance, may have different tax considerations. Burial insurance is designed to cover the costs associated with funeral and burial expenses, providing financial assistance to the insured's beneficiaries. While the proceeds from burial insurance can be tax-free in some cases, there are instances where they may be taxable. This is because burial insurance policies can be structured in various ways, and the tax treatment depends on the specific terms and conditions of the policy. In some cases, if the burial insurance is considered a form of investment or savings, it may be subject to income tax when the proceeds are received.

The key difference lies in the purpose and structure of the policies. Life insurance is primarily designed to provide financial security to beneficiaries in the event of the insured's death, and its tax treatment reflects this. Burial insurance, however, focuses on covering specific expenses, and its tax implications can vary depending on the policy's structure and the tax laws applicable in the jurisdiction. It is essential for individuals and their financial advisors to carefully review the policy documents and seek professional advice to understand the tax consequences specific to their situation.

For individuals and families, this distinction is crucial when planning for the future and making insurance decisions. Understanding that life insurance death benefits are generally tax-free can encourage individuals to utilize this tool effectively for estate planning and providing financial security to their loved ones. In contrast, burial insurance may be more suitable for covering specific funeral and burial costs, and individuals should be aware of the potential tax implications associated with this type of insurance.

In summary, the tax treatment of life insurance and burial insurance differs significantly. Life insurance death benefits are generally tax-free, ensuring that beneficiaries receive the full amount without any tax burdens. Burial insurance, while often tax-free, may have varying tax consequences depending on its structure and the tax laws in the relevant jurisdiction. Being aware of these differences is essential for making informed financial decisions and ensuring that insurance policies align with an individual's specific needs and goals.

Life-Altering Events: Understanding Health Insurance Changes

You may want to see also

Flexibility: Life insurance policies can be tailored to specific needs, while burial insurance is standardized

When it comes to insurance, understanding the differences between various types of coverage is essential for making informed decisions about your financial security and that of your loved ones. Two common types of insurance that often cause confusion are life insurance and burial insurance. While both serve important purposes, they differ significantly in terms of flexibility and customization.

Life insurance is a versatile financial tool that provides a safety net for your beneficiaries in the event of your death. One of its key strengths is the ability to customize the policy to meet specific needs. Life insurance policies can be tailored to include various coverage amounts, payment terms, and riders (optional benefits) to ensure that the policyholder's family is adequately protected. For example, a person with a large family and significant financial responsibilities might opt for a higher coverage amount and choose a term life insurance policy, which provides coverage for a specific period, ensuring that their family is taken care of during that time. Alternatively, someone looking for long-term financial security might prefer a whole life insurance policy, which offers lifelong coverage and potential cash value accumulation.

On the other hand, burial insurance, also known as final expense insurance, is designed to cover the costs associated with funeral and burial expenses. This type of insurance is standardized, meaning it typically provides a fixed amount of coverage for a predetermined period, usually one year. Burial insurance policies are often sold as a way to ensure that the financial burden of funeral arrangements does not fall on the surviving family members. While it provides a sense of security, the lack of customization can be a drawback. Standardized burial insurance policies may not offer the flexibility to adapt to changing circumstances or individual preferences, making it less suitable for those seeking a more personalized insurance solution.

The flexibility of life insurance allows individuals to create a policy that aligns with their unique circumstances and goals. This customization can include adjusting the coverage amount based on the number of dependents, income, and future financial obligations. For instance, a young professional with no children might opt for a lower coverage amount, while an older individual with a mortgage and a growing family might choose a higher policy limit. Life insurance policies can also be adjusted over time as one's financial situation changes, ensuring that the coverage remains appropriate.

In contrast, burial insurance is designed to provide a straightforward solution for a specific need. It is often marketed as a simple way to ensure that funeral expenses are covered, providing peace of mind to those who purchase it. However, the standardized nature of burial insurance means that it may not be suitable for individuals seeking more comprehensive financial protection. This type of insurance is best suited for those who want a basic level of coverage for funeral expenses without the complexity and flexibility of a life insurance policy.

In summary, the key difference in flexibility lies in the customization options available. Life insurance policies offer a wide range of choices, allowing individuals to tailor coverage to their specific needs and financial goals. In contrast, burial insurance is standardized, providing a fixed level of coverage for funeral expenses, which may not be adjustable to fit individual preferences or changing circumstances. Understanding these differences is crucial for making an informed decision when it comes to protecting yourself and your loved ones.

How to Modify an Irrevocable Life Insurance Trust

You may want to see also

Cost: Burial insurance is typically more affordable upfront, with higher costs over time, compared to life insurance

When considering the financial aspects of insurance, it's important to understand the cost implications of different policies, especially when comparing life insurance and burial insurance. Burial insurance, also known as final expense insurance, is designed to cover the costs associated with funeral and burial expenses. One of the key differences in cost between the two types of insurance is the upfront affordability of burial insurance.

Burial insurance policies often have lower initial premiums compared to life insurance. This is because the primary purpose of burial insurance is to provide a specific benefit, which is to cover funeral and burial costs. As a result, the insurance company calculates the premiums based on the expected expenses, making it more cost-effective for the policyholder. For individuals who are concerned about the financial burden on their loved ones or want to ensure that their final wishes are honored without causing a significant financial strain, burial insurance can be an attractive option.

However, it's important to note that the lower upfront cost of burial insurance can come with higher long-term expenses. Burial insurance policies typically have higher annual premiums as the policyholder ages, and the risk of claiming the policy increases. This is in contrast to life insurance, where premiums may remain relatively stable or even decrease over time as the policyholder ages and the risk profile improves. Life insurance is designed to provide a financial benefit to the policyholder's beneficiaries, and the cost is structured to cover this long-term liability.

In summary, burial insurance offers a more affordable initial cost, making it accessible to a wider range of individuals. However, the trade-off is that the costs can escalate over time, especially as the policyholder ages. On the other hand, life insurance provides a comprehensive financial safety net with potentially more stable long-term costs, ensuring that the policyholder's beneficiaries receive the intended financial support. Understanding these cost differences is crucial in making an informed decision about the type of insurance that best suits one's needs and financial goals.

Voya's Index Universal Life Insurance: Features Locked In?

You may want to see also

Frequently asked questions

Life insurance is a financial product designed to provide monetary benefits to the beneficiaries upon the insured individual's death. It offers coverage for various life events and can be used to secure financial goals like mortgage payments, children's education, or retirement savings. Burial insurance, also known as final expense insurance, is specifically tailored to cover the costs associated with funeral expenses and burial or cremation. It ensures that the insured's loved ones are financially supported during a difficult time.

Life insurance policies typically offer a death benefit, which can be a lump sum or an income stream, depending on the policy type. This benefit can be used for various purposes, such as paying off debts, providing financial security to dependents, or funding long-term care. Burial insurance, on the other hand, provides a fixed benefit to cover funeral and burial expenses, which are often a significant financial burden for families. The benefit amount is predetermined and ensures that the insured's final wishes are honored without causing financial strain on loved ones.

The face amount, or death benefit, is the amount of money that the insurance company agrees to pay out upon the insured's death. In life insurance, the face amount can vary widely depending on factors like the insured's age, health, lifestyle, and the type of policy chosen (term life, whole life, etc.). Burial insurance often has a fixed face amount, which is determined when the policy is issued and remains the same throughout the policy's duration. This fixed benefit ensures that the insured's burial expenses are covered, regardless of changes in the cost of living over time.

Life insurance policies, especially those with an investment component (like whole life or universal life), offer potential tax advantages. The cash value accumulation within these policies can grow tax-deferred, and policyholders can borrow against this value. Burial insurance, being a pure death benefit policy, does not typically have investment features. However, some burial insurance policies may offer an optional riders or add-ons that provide additional benefits, such as accelerated death benefits or critical illness coverage, which can have tax implications depending on the specific policy and jurisdiction.