Term and permanent life insurance are two types of life insurance policies that provide financial protection for your loved ones in the event of your death. The main difference between the two is that term life insurance offers temporary coverage for a specific period, while permanent life insurance provides lifelong coverage as long as the policyholder continues to pay the premiums. Term life insurance is generally more affordable, with lower premiums, but it does not offer the same long-term protection as permanent life insurance. On the other hand, permanent life insurance tends to be more expensive but offers the advantage of building cash value over time, which can be accessed by the policyholder. Ultimately, the choice between term and permanent life insurance depends on an individual's needs, budget, and financial goals.

What You'll Learn

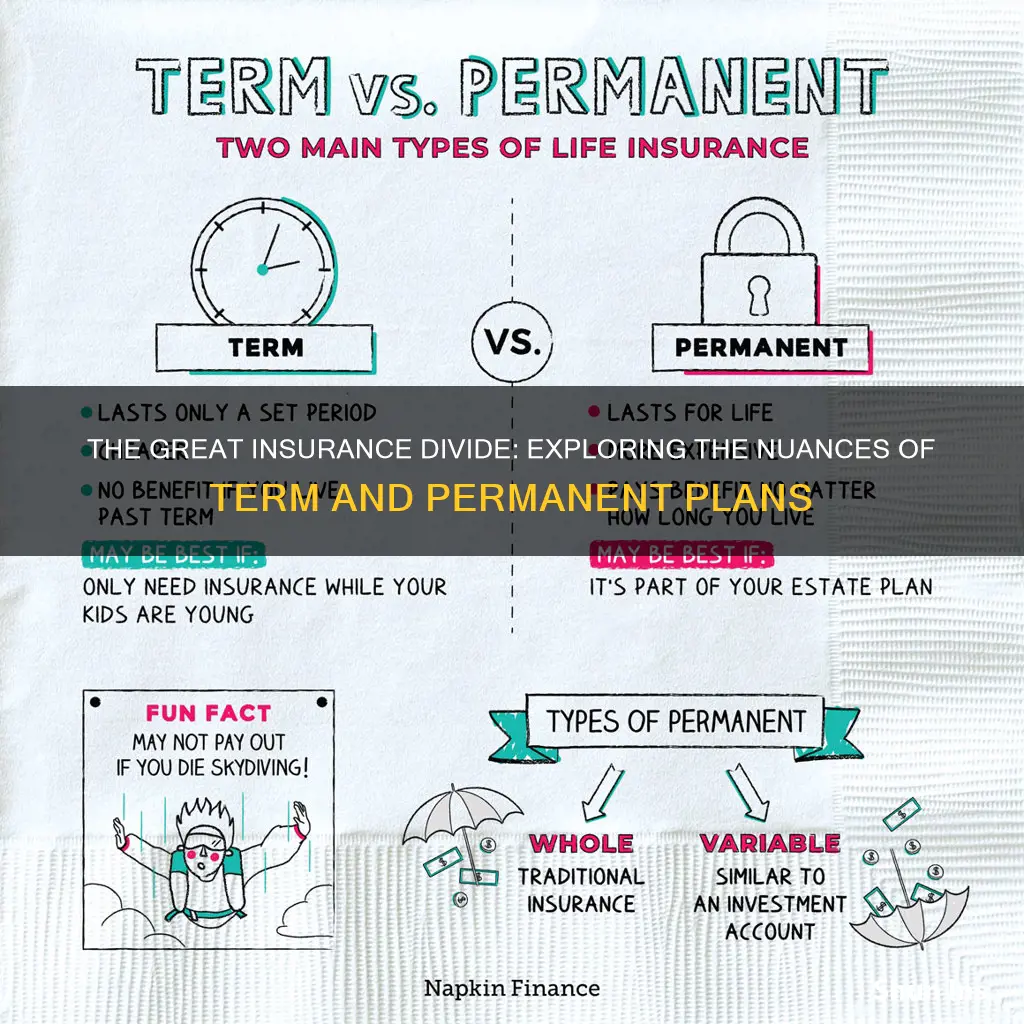

- Term life insurance is temporary, lasting a specific amount of time, whereas permanent life insurance is lifelong

- Term life insurance is generally more affordable, especially initially, but permanent life insurance may be more efficient in the long run

- Term life insurance does not offer cash value accumulation, but permanent life insurance does

- Term life insurance can be renewed, but premiums will increase

- Term life insurance is ideal for those who want affordable premiums and coverage for a specific period

Term life insurance is temporary, lasting a specific amount of time, whereas permanent life insurance is lifelong

Term life insurance and permanent life insurance are two types of life insurance policies that cater to different needs. Term life insurance is temporary and lasts for a specific period, known as the "term". This can range from one to thirty years, or until a particular age. On the other hand, permanent life insurance, as the name suggests, provides coverage for the full lifetime of the insured person.

Term life insurance is designed for those who require coverage for a specific duration. For example, young parents might opt for a twenty-year term policy to ensure financial security until their child becomes financially independent. Additionally, term life insurance is more affordable than permanent life insurance, making it a good option for those on a budget or those who are just starting out. The premiums for term life insurance are typically level, meaning they remain unchanged during the policy period. However, if the policy is renewed, the premiums will increase. Term life insurance policies do not carry a cash value, so there is no opportunity for savings or investment growth over time.

In contrast, permanent life insurance offers lifelong coverage as long as the premiums are paid. This type of insurance is ideal for those who want long-term financial protection and the opportunity to build cash value. Permanent life insurance policies combine a death benefit with a savings component, allowing the policyholder to access funds for emergencies or milestone expenses like college tuition or retirement. The savings component, known as the cash value, grows over time and can be withdrawn or borrowed against. However, doing so may decrease the amount of the policy's death benefit if the funds are not repaid. While permanent life insurance offers more features and flexibility, it comes at a higher cost. The premiums are significantly more expensive than those for term life insurance.

In summary, the main difference between term and permanent life insurance lies in the duration of coverage and the presence of a cash value component. Term life insurance is temporary and does not accumulate cash value, making it a more affordable option. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component that grows over time, resulting in higher premiums. The choice between the two depends on an individual's financial situation, long-term goals, and the level of protection desired.

Universal Truths: Unraveling the Similarities Between Universal and Term Life Insurance

You may want to see also

Term life insurance is generally more affordable, especially initially, but permanent life insurance may be more efficient in the long run

Term life insurance is generally more affordable than permanent life insurance, especially initially. However, permanent life insurance may be more efficient in the long run.

Term life insurance is a good option for those who want affordable premiums and coverage when their financial obligations are at their highest. It is also ideal for people who want coverage for a specific period of time, such as when raising children or paying off a mortgage. Term life insurance is also a good option for those who are just starting out or are on a budget.

Permanent life insurance, on the other hand, is best for those who want lifetime coverage, access to cash value, and can afford the higher premiums. It is also a good option for those who want to create an inheritance for their heirs and those who want a tax-advantaged way to save for future expenses.

While term life insurance is typically cheaper than permanent life insurance, there are some cases where it may be more cost-effective to choose permanent life insurance. For example, if you have a lifelong dependent, such as a child with special needs, permanent life insurance can provide coverage for your entire lifetime. Additionally, permanent life insurance offers a savings component that grows over time, which can be useful for future needs.

In summary, term life insurance is generally more affordable initially, but permanent life insurance may be a more efficient option in the long run, depending on your individual needs and circumstances.

The Intricacies of Insurance Rebating: Unraveling the Practice and Its Implications

You may want to see also

Term life insurance does not offer cash value accumulation, but permanent life insurance does

Term life insurance and permanent life insurance are two distinct types of life insurance policies, each with its own unique features and benefits. While both types of policies provide financial protection for loved ones in the event of the policyholder's death, they differ in terms of duration, cost, and the presence or absence of cash value accumulation.

Term life insurance is designed to provide temporary coverage for a specific period, often ranging from 1 to 30 years. It offers short-term death benefit protection, and premiums are typically locked in for the selected coverage period. Term life insurance does not offer cash value accumulation, meaning there is no savings component within the policy. As a result, term life insurance policies tend to be more affordable, especially for younger individuals. However, the coverage needs to be renewed periodically, and the premiums usually increase with each renewal.

On the other hand, permanent life insurance, including whole life and universal life, is designed to provide lifelong coverage as long as the policyholder continues to pay the premiums. One of the key features of permanent life insurance is the presence of a cash value component. This means that a portion of the premiums paid goes towards building up a cash value account that earns interest over time. Policyholders can access this cash value in various ways, such as borrowing against it, withdrawing funds, or using it to pay premiums. The cash value aspect of permanent life insurance makes it a more expensive option compared to term life insurance.

The decision between choosing term or permanent life insurance depends on an individual's specific needs and financial situation. Term life insurance is suitable for those seeking short-term coverage, affordability, and flexibility. On the other hand, permanent life insurance is ideal for those who want lifelong coverage, desire the ability to accumulate cash value, and can afford the higher premiums associated with this type of policy.

Understanding Loss Payees: Protecting Lenders and Borrowers Alike

You may want to see also

Term life insurance can be renewed, but premiums will increase

Term life insurance is a policy that lasts a certain number of years. It is a more affordable option than permanent life insurance, but it does not build up cash value over time. When the term ends, the policyholder can either choose to end their coverage or renew their policy, usually at a higher rate.

When you buy term life insurance, you lock in your rate for the level term period, which is typically 10, 15, 20, or 30 years. The premiums remain the same throughout the term, but if you renew the policy, the premiums will increase. The cost of renewal is much higher than what you paid during the initial term, and it can quickly become unaffordable. The increase in premiums is due to the higher risk of the insurance company having to pay out a death benefit as the policyholder ages.

Term life insurance renewal is an option offered by many policies. When you buy a term life policy with a renewal option, the policy outlines the future renewal rates. For example, if you buy a 20-year term life policy, the documents will show a premium for the first 20 years and a higher renewal rate starting at year 21.

While the renewal rates may be shocking, they are outlined in the policy and should not come as a surprise. It is important to carefully consider your timeframe and select a term length that fits your needs and budget. If you anticipate needing coverage for longer, it may be more cost-effective to shop for a new life insurance policy or convert your term policy to a permanent one.

In summary, term life insurance can be renewed, but the premiums will increase significantly. This is because the risk of a payout increases as the policyholder ages, and the insurance company compensates for this by raising the premiums. It is important to understand the renewal process and consider the potential costs before deciding to renew a term life insurance policy.

Understanding Decreasing Term Insurance and PPI: Unraveling the Complexities

You may want to see also

Term life insurance is ideal for those who want affordable premiums and coverage for a specific period

Term life insurance is a popular choice for those seeking life insurance, thanks to its lower premiums compared to permanent life insurance. Term life insurance provides coverage for a specific period, typically ranging from 1 to 30 years, and offers flexible features to meet diverse needs. It is an excellent option for individuals who want to ensure their loved ones are financially protected during critical years, such as the duration of a mortgage or their children's education.

One of the key advantages of term life insurance is its affordability. The premiums for term life insurance are generally lower than those for permanent life insurance, especially when purchased at a younger age. This makes it a budget-friendly option for individuals and families who want comprehensive coverage without breaking the bank. The low premiums also allow individuals to allocate their funds to other financial goals, such as investments or savings for college.

Term life insurance is particularly well-suited for those who need coverage for a specific period. For example, young parents might opt for a 20-year policy to ensure financial security during their children's dependent years. Additionally, term life insurance can be renewed, providing extended protection if needed. However, it's important to note that renewal premiums tend to increase annually.

Another benefit of term life insurance is the flexibility it offers. Some term life insurance policies include features that allow beneficiaries to access benefits early if the insured person becomes terminally ill or needs assistance with premium payments due to disability. This adaptability ensures that policyholders can tailor their coverage to their unique circumstances.

Furthermore, term life insurance policies often include an option to convert to permanent life insurance. This feature is especially appealing to individuals with medical issues, as it allows them to transition to permanent coverage without undergoing additional medical exams or meeting qualification standards. The ability to convert policies provides peace of mind and flexibility, ensuring that individuals can adapt their insurance plans as their needs and circumstances change.

In summary, term life insurance is a cost-effective solution for individuals seeking coverage for a defined period. It offers flexibility, affordable premiums, and the option to convert to permanent coverage. Term life insurance is an excellent choice for those who want to balance their financial obligations with comprehensive protection for their loved ones.

The Evolution of P2P Insurance: A New Era of Risk Sharing and Community Trust

You may want to see also

Frequently asked questions

Term life insurance is temporary and covers you for a specific period, typically between one and 30 years. Permanent life insurance, on the other hand, lasts your entire lifetime as long as you continue paying premiums.

No, term life insurance does not build cash value. It also does not offer any savings component or investment opportunities.

Term life insurance is generally more affordable, especially when purchased at a younger age. Permanent life insurance costs more because it provides lifelong coverage and includes a cash value component that grows over time.

Term life insurance offers affordable premiums and provides coverage when your financial obligations are at their highest. It is ideal for those who want coverage for a specific period, such as during their working years or when raising children.

Permanent life insurance offers lifelong coverage and access to cash value. It is suitable for those who want coverage for their entire lives, including those with lifelong dependents, and who can afford the higher premiums.