Rebates in the life insurance industry can be a complex and often misunderstood aspect of the business. When selling life insurance, it's important to understand the various ways in which commissions and rebates can be structured. The dollar amount for rebates can vary significantly depending on the insurance company, the type of policy, and the specific terms and conditions. This guide will explore the different types of rebates, how they are calculated, and what factors can influence the final rebate amount.

What You'll Learn

- Rebate Calculation Methods: Different approaches to determine the dollar amount of rebates for life insurance sales

- Regulatory Guidelines: Rules and regulations governing the calculation and disclosure of life insurance rebates

- Customer Incentives: Strategies to attract customers with attractive rebate offers for life insurance policies

- Commission Structures: How rebates impact commission rates and overall compensation for life insurance agents

- Market Trends: Recent trends in rebate amounts and practices in the life insurance industry

Rebate Calculation Methods: Different approaches to determine the dollar amount of rebates for life insurance sales

When it comes to calculating rebates for life insurance sales, there are several methods and approaches that can be employed to determine the dollar amount of these incentives. The choice of method often depends on the specific insurance company's policies, the type of policy sold, and the regulatory environment. Here, we'll explore some of the common rebate calculation methods:

Percentage-Based Rebates: One of the most straightforward approaches is to calculate the rebate as a percentage of the total premium paid by the policyholder. For instance, an insurance company might offer a 5% rebate on the first year's premium for a term life insurance policy. This method is simple to understand and calculate, as the rebate amount is directly proportional to the premium. The formula here is straightforward: Rebate = (Percentage) * (Total Premium).

Fixed Dollar Amount per Policy: In some cases, the rebate is a fixed amount per policy, regardless of the premium or other factors. This method is often used for simplified life insurance products or when the rebate is a promotional incentive. For example, an insurance provider might offer a $100 rebate for every new policy sold during a specific campaign period. This approach is easy to communicate and understand for both the sales team and the customers.

Performance-Based Rebates: These rebates are tied to the performance or success of the insurance policy. For instance, a company might offer a rebate based on the policyholder's survival rate or the policy's claim experience. In this method, the rebate amount is calculated as a percentage of the total premiums collected if certain performance criteria are met. This approach incentivizes both the insurer and the sales team to focus on policy quality and customer satisfaction.

Commission-Based Rebates: Here, the rebate is calculated as a percentage of the sales commission earned by the insurance agent or broker. This method is common in the industry and ensures that the rebate structure aligns with the sales team's efforts. The formula could be: Rebate = (Commission Percentage) * (Total Sales Commission). This approach provides a direct link between the rebate and the sales performance.

Regulatory and Compliance Considerations: It's essential to note that rebate calculation methods must adhere to regulatory guidelines and industry standards. Insurance regulators often have specific rules regarding the transparency and fairness of rebate structures. Companies must ensure that their rebate calculation methods comply with these regulations to avoid legal and ethical issues.

Each of these methods has its advantages and is chosen based on the specific needs of the insurance company, the sales team, and the target market. Understanding these calculation methods is crucial for insurance professionals to effectively communicate the value proposition of life insurance policies to potential customers.

Life Insurance Benefits: Marital Property in Pennsylvania?

You may want to see also

Regulatory Guidelines: Rules and regulations governing the calculation and disclosure of life insurance rebates

The regulatory landscape surrounding life insurance rebates is intricate and varies by jurisdiction. Here's an overview of the rules and guidelines governing the calculation and disclosure of these rebates:

Regulatory Bodies and Their Roles:

Different countries and regions have dedicated regulatory bodies overseeing the insurance industry. For instance, in the United States, the National Association of Insurance Commissioners (NAIC) sets standards and guidelines for insurance practices, including rebate calculations. Similarly, in the European Union, the European Insurance and Occupational Pensions Authority (EIOPA) plays a crucial role in establishing regulatory frameworks. These bodies often provide guidelines on how insurance companies should calculate and disclose rebates to policyholders.

Rebate Calculation Methods:

Regulatory guidelines dictate the methods insurance companies must use to calculate rebates. These methods typically involve assessing the performance of the insurance policy against predetermined metrics. For example, a company might calculate rebates based on the policy's investment returns, policyholder satisfaction scores, or the number of claims filed. The specific metrics and weights assigned to each factor can vary depending on the regulatory requirements and the insurance company's policies.

Transparency and Disclosure:

Regulators emphasize the importance of transparency in rebate calculations and disclosure. Insurance companies are required to provide policyholders with clear and understandable information about the rebate process. This includes explaining the factors considered in rebate calculations, the frequency of rebate adjustments, and how policyholders can access their rebate information. Annual reports, policy documents, or dedicated sections on the company's website are common channels for disclosing rebate-related details.

Compliance and Reporting:

Insurance companies must ensure compliance with regulatory guidelines throughout the rebate process. This involves maintaining accurate records, implementing robust internal controls, and providing regular reports to regulatory authorities. In some cases, companies may need to obtain prior approval from regulators for specific rebate calculation methods or significant changes in rebate practices.

Policyholder Rights and Protections:

Regulatory guidelines also aim to protect policyholders' rights. Companies are obligated to ensure that rebates are calculated and disclosed fairly and accurately. Policyholders have the right to understand how their premiums contribute to the rebate system and how they can benefit from it. Regulators may also mandate that companies provide dispute resolution mechanisms for policyholders who have concerns about the rebate calculations or disclosures.

Life Insurance Options for Diabetics: What You Need to Know

You may want to see also

Customer Incentives: Strategies to attract customers with attractive rebate offers for life insurance policies

Attracting customers to life insurance policies can be challenging, but offering rebate incentives can be a powerful strategy to capture their attention and encourage sign-ups. The concept of rebates is simple: customers receive a portion of their premium back as a refund after a certain period. This approach not only benefits the customer financially but also creates a sense of loyalty and trust in the insurance provider.

When designing rebate programs, it's essential to consider the following: First, determine the rebate percentage or amount. A higher rebate might attract more customers initially, but it's crucial to ensure the offer is sustainable and doesn't compromise the insurer's financial stability. Striking a balance between customer appeal and long-term viability is key. For instance, offering a 5% rebate on the first year's premium could be an attractive incentive without being overly generous.

Secondly, set clear terms and conditions for the rebate. Define the duration of the rebate period, whether it's a one-time offer or a recurring benefit for long-term policies. Communicate the conditions transparently to avoid customer confusion. For instance, you could offer a 3% rebate for the first two years, provided the policy remains active and the customer meets certain eligibility criteria.

Additionally, consider personalizing the rebate experience. Customers appreciate tailored incentives. You could introduce a loyalty program where customers earn points for policy renewals, and these points can be redeemed for rebates or other rewards. This strategy not only provides an incentive but also fosters a sense of exclusivity and appreciation.

Lastly, promote the rebate offers effectively. Utilize various marketing channels to reach your target audience. Social media campaigns, email newsletters, and even print advertisements can be powerful tools to showcase the benefits of your rebate programs. Emphasize the long-term savings and the added value of the policy, ensuring customers understand the potential financial gains.

By implementing these strategies, insurance providers can effectively attract customers and create a win-win situation. Customers benefit from financial incentives, and the insurer gains a satisfied client base, potentially leading to long-term policy retention.

American Life Insurance: Scam or Legit?

You may want to see also

Commission Structures: How rebates impact commission rates and overall compensation for life insurance agents

The concept of rebates in the life insurance industry is an intriguing aspect of commission structures, offering both incentives and complexities for agents. When an insurance agent sells a policy, they typically earn a commission based on a percentage of the premium. However, the introduction of rebates can significantly influence the overall compensation structure. Rebates are essentially a portion of the commission that the insurance company returns to the agent after a certain period, often as an incentive for continued performance.

In the context of life insurance sales, rebates can be a powerful tool to motivate agents. For instance, an insurance company might offer a rebate of 5% of the first year's premium if an agent meets a specific sales target. This means that for every policy sold, the agent receives an additional 5% of the premium as a rebate, which can accumulate over time. The impact of this structure is twofold: it provides an immediate financial boost to the agent, encouraging them to focus on short-term sales, and it also creates a long-term incentive to maintain and grow the policyholder base.

The calculation of commission rates becomes more intricate with rebates. When an agent earns a commission, a portion of it is set aside as a rebate, which is then returned to them at a later date. This process can be repeated for multiple years, with the rebate amount increasing as the policy ages and the agent's performance is evaluated. For example, if an agent sells a $10,000 policy with a 10% commission rate, they would initially earn $1,000 in commission. However, if a 5% rebate is offered, the agent would receive $950 in the first year, with the remaining $50 set aside for the rebate period.

Over time, the impact of rebates on overall compensation can be substantial. As policies mature, the rebate amounts can grow, providing agents with a significant portion of their total earnings. This structure encourages agents to focus on long-term customer relationships, as the success of a policy over its lifetime directly influences their compensation. Additionally, it fosters a culture of continuous improvement, as agents strive to meet and exceed sales targets to maximize their rebate potential.

However, the complexity of rebate structures also presents challenges. Agents must carefully manage their expectations and understand the long-term commitment required to maximize rebates. It requires a strategic approach to sales and a deep understanding of the policy's lifecycle. Moreover, the rebate system can create a performance-based hierarchy, where top-performing agents benefit more significantly, potentially leading to a more competitive and dynamic insurance sales environment.

Life Insurance Lab Tests: Alcohol Detection and Implications

You may want to see also

Market Trends: Recent trends in rebate amounts and practices in the life insurance industry

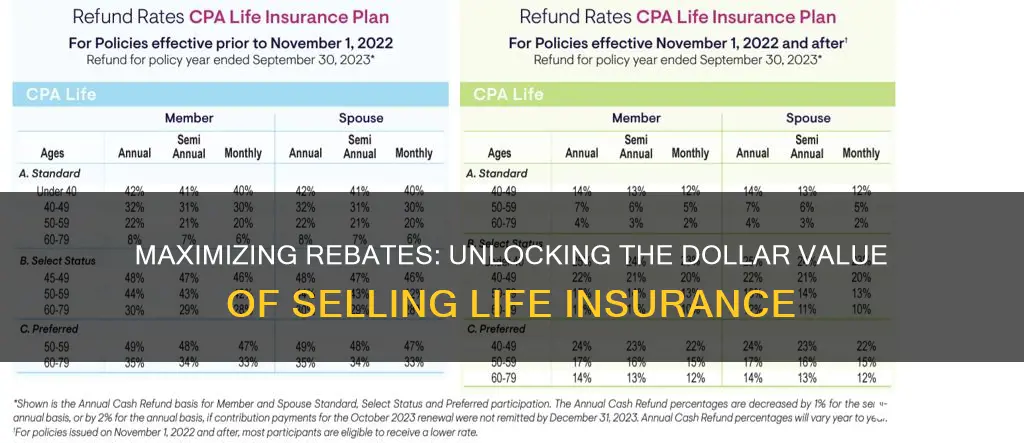

The life insurance industry has witnessed a significant shift in recent years, with a growing emphasis on transparency and customer-centric practices. One of the most notable trends is the evolution of rebate structures within life insurance policies. Rebates, which are essentially a portion of the premium returned to the policyholder, have become a key differentiator in a highly competitive market.

In the past, rebate amounts were often a closely guarded secret, with insurance companies offering vague terms and conditions without providing specific dollar figures. However, market trends indicate a move towards greater transparency. Insurers are now more inclined to disclose the exact rebate amounts, allowing customers to make more informed decisions. This shift is particularly evident in the term life insurance segment, where customers are increasingly comparing policies based on the actual rebate they will receive over the policy term.

The trend towards transparency is further fueled by regulatory changes and customer expectations. Insurance regulators in several countries have introduced guidelines that encourage companies to provide clear and detailed information about rebate structures. As a result, insurers are adapting their practices to ensure compliance and build trust with their customers. For instance, some companies now offer guaranteed minimum rebate percentages, providing policyholders with a clear understanding of their potential savings.

Another emerging trend is the customization of rebate structures. Insurers are offering policyholders the flexibility to choose their preferred rebate options. This includes the ability to select between different rebate schedules, such as a higher initial rebate with lower subsequent amounts or a more gradual increase in rebates over time. Such customization allows customers to align the policy with their financial goals and risk tolerance.

Additionally, the life insurance industry is witnessing a trend towards longer-term rebate commitments. Some insurers are now offering policies with extended rebate periods, providing policyholders with a more substantial financial benefit over a more extended period. This approach not only attracts customers but also fosters long-term loyalty and encourages policyholders to view the insurance company as a trusted financial partner.

In conclusion, the life insurance industry is experiencing a transformation in rebate practices, driven by a desire for transparency, regulatory compliance, and customer-centricity. The market is moving towards more detailed and specific rebate disclosures, allowing customers to make informed choices. Customization and longer-term rebate commitments are also gaining popularity, ensuring that insurance companies remain competitive and meet the evolving needs of their policyholders. This shift in trends is likely to continue shaping the industry, fostering a more customer-friendly and transparent environment.

Insurability Evidence: Life Insurance Lapse Requirements

You may want to see also

Frequently asked questions

The dollar amount of rebates for selling life insurance can vary significantly depending on several factors. These factors include the insurance company, the type of policy, the age and health of the insured individual, and the distribution channel through which the policy is sold. Typically, rebates are a percentage of the policy's premium, and they are designed to incentivize agents and brokers to promote and sell the policy.

Rebate structures can be complex and are often subject to regulatory oversight. Insurance regulators often set guidelines to ensure fair practices and protect consumers. These guidelines may include maximum rebate limits, restrictions on the timing of rebates, and requirements for transparent communication with policyholders. It's essential to review the specific policies and regulations in your jurisdiction to understand the legal and ethical boundaries of rebate offerings.

Negotiating rebate amounts is possible, but it depends on the insurance company's policies and your relationship with them. Some insurance providers offer flexible rebate structures, allowing for customization based on the agent's performance and the policy's characteristics. However, others may have standardized rebate schedules that are non-negotiable. It's advisable to discuss rebate options with your insurance provider or broker to understand the potential for negotiation and any associated benefits or trade-offs.