Life Farmers Insurance is a comprehensive solution designed to protect your loved ones and assets in the event of unforeseen circumstances. It offers a range of benefits, including coverage for critical illnesses, accidental injuries, and natural disasters, ensuring that you and your family are financially secure. With customizable plans, you can tailor the insurance to fit your specific needs, providing peace of mind and long-term financial stability. This insurance is a valuable tool for anyone looking to safeguard their future and the well-being of their loved ones.

What You'll Learn

- Financial Security: Protecting your assets and providing financial stability for your loved ones

- Customized Coverage: Tailoring policies to meet individual needs and budgets

- Local Expertise: Accessing knowledgeable agents who understand your community's unique risks

- Community Support: Giving back through initiatives that strengthen local communities

- Peace of Mind: Knowing you're protected against life's unexpected events

Financial Security: Protecting your assets and providing financial stability for your loved ones

Life insurance, particularly from providers like Farmers Insurance, is a crucial tool for ensuring financial security and stability for your loved ones. It provides a safety net that can help protect your family's financial future in the event of your untimely death. Here's how it can be a valuable asset:

Asset Protection: One of the primary benefits of life insurance is its ability to safeguard your assets. When you purchase a life insurance policy, you essentially create a financial reserve that can be used to cover various expenses and obligations. This includes mortgage payments, car loans, credit card debts, and even the cost of raising your children. By having this financial cushion, you ensure that your loved ones won't be burdened with these financial responsibilities during a difficult time. For instance, if you pass away, the death benefit from your life insurance policy can be used to pay off debts, leaving your family with a more secure financial position.

Financial Stability for Dependents: If you have dependents, such as a spouse or children, life insurance becomes even more critical. It provides the means to maintain their standard of living and cover their daily needs. This financial stability can include funding their education, covering living expenses, and ensuring they have the resources to build their own financial future. For example, a life insurance policy can provide a steady income stream to cover household expenses, allowing your spouse to focus on raising the family and making important life decisions without the added stress of financial worries.

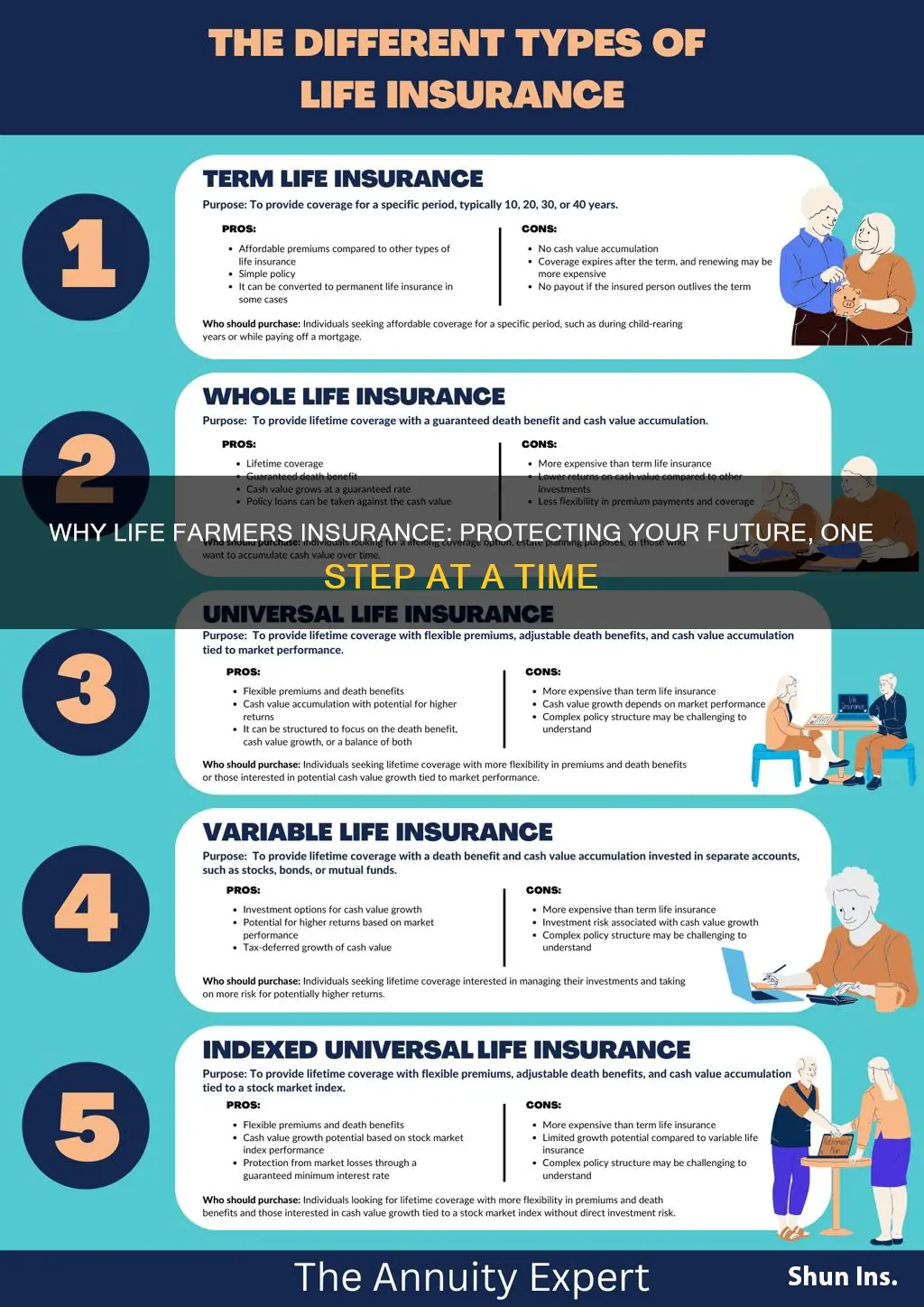

Long-Term Financial Planning: Life insurance also plays a vital role in long-term financial planning. It can be used as a tool to build wealth over time. Certain types of life insurance policies, such as whole life insurance, offer a guaranteed death benefit and accumulate cash value, which can be borrowed against or withdrawn as needed. This feature can be utilized to invest in other financial goals, such as purchasing a home, starting a business, or funding retirement. By integrating life insurance into your financial strategy, you can ensure that your loved ones' financial future is secure and that your hard-earned assets are protected.

Peace of Mind: Perhaps the most valuable aspect of life insurance is the peace of mind it provides. Knowing that your family is financially protected in the event of your death can significantly reduce stress and anxiety. It allows you to focus on the present and make the most of your time with your loved ones. Additionally, life insurance can provide financial security during unexpected life events, such as critical illnesses or disabilities, ensuring that your family's financial stability remains intact.

In summary, life insurance from Farmers Insurance is a powerful tool for achieving financial security and stability. It protects your assets, provides for your dependents, facilitates long-term financial planning, and offers peace of mind. By carefully considering your family's needs and choosing the right life insurance policy, you can ensure that your loved ones are taken care of, even when you're not around.

Life Insurance: Is It Legally Compulsory?

You may want to see also

Customized Coverage: Tailoring policies to meet individual needs and budgets

When it comes to life insurance, Farmers Insurance understands that every individual and family has unique needs and circumstances. That's why they offer a range of customized coverage options to ensure you get the protection that suits your specific requirements and budget. This tailored approach allows you to build a policy that aligns perfectly with your goals and financial situation.

The process begins with a comprehensive assessment of your personal and financial situation. Farmers Insurance agents will work closely with you to understand your current and future needs, including your income, assets, dependents, and long-term financial goals. By gathering this information, they can design a policy that provides the necessary coverage while also being affordable and sustainable. For instance, if you have a large family and want to ensure their financial security in the event of your passing, a term life insurance policy could be recommended. This type of coverage offers a fixed amount of protection for a specified period, allowing you to provide for your loved ones without the long-term financial burden.

Customized coverage also takes into account various factors that may influence your insurance needs. For example, your age, health, and lifestyle choices can impact the cost and type of coverage. Younger individuals may opt for more extensive coverage to secure their family's future, while older adults might focus on ensuring their estate is protected. Farmers Insurance agents can provide expert advice on how to navigate these decisions and offer solutions that cater to your specific circumstances.

One of the key benefits of tailored policies is the flexibility they offer. Farmers Insurance allows you to choose the level of coverage, the duration of the policy, and even the payment options that suit your preferences. This level of customization ensures that you only pay for the protection you need, making it an affordable and efficient way to secure your loved ones' financial future. Moreover, with the option to adjust your policy over time, you can adapt it as your life changes, ensuring that your coverage remains relevant and effective.

In summary, Farmers Insurance's approach to customized coverage empowers individuals to take control of their financial security. By offering personalized policies, they ensure that life insurance is accessible and beneficial to everyone, regardless of their unique circumstances. This level of tailoring not only provides peace of mind but also allows you to make the most of your insurance investment.

Life Insurance Annuity: What Happens When It Matures?

You may want to see also

Local Expertise: Accessing knowledgeable agents who understand your community's unique risks

When it comes to choosing an insurance provider, local expertise can be a game-changer, especially for those in rural or specific community-oriented areas. Farmers Insurance, with its deep-rooted presence in local communities, offers a unique advantage that sets it apart from other insurance companies. Here's why local expertise is a key factor in making Farmers Insurance a top choice:

Community Understanding: Farmers Insurance agents are not just representatives but integral parts of the communities they serve. They possess an intimate knowledge of the local area, including its unique risks and challenges. For instance, in rural communities, agents understand the specific perils associated with farming, such as crop damage, livestock loss, or equipment breakdowns. This local insight allows them to tailor insurance policies to meet the exact needs of farmers, ensuring comprehensive coverage for their unique risks.

Personalized Service: The local expertise of Farmers Insurance agents enables them to provide personalized service. They take the time to understand their clients' individual circumstances, including their lifestyle, occupation, and specific risks. For example, a local agent can assess the potential risks associated with a farmer's livelihood, such as machinery accidents or natural disasters specific to the region. This personalized approach ensures that the insurance coverage is tailored to the client's needs, providing peace of mind and financial protection.

Efficient Claims Processing: In the event of a claim, local expertise becomes invaluable. Farmers Insurance agents can guide policyholders through the claims process, making it less stressful and more efficient. They understand the local regulations, laws, and procedures, ensuring that claims are handled swiftly and accurately. This efficiency is particularly important in rural areas where timely assistance can make a significant difference, especially after natural disasters or unexpected incidents.

Community Engagement: Farmers Insurance agents often actively participate in community events and initiatives, fostering a sense of trust and belonging. This engagement allows them to stay updated on local issues and trends, ensuring that their insurance solutions remain relevant and beneficial to the community. By being involved, these agents can quickly identify and address the evolving needs of their clients, providing ongoing support and expertise.

In summary, local expertise is a powerful advantage of Farmers Insurance. It enables agents to offer tailored solutions, efficient service, and a deep understanding of the community's unique risks. This personalized approach to insurance ensures that policyholders receive the protection they need, making Farmers Insurance a trusted and reliable choice for individuals and businesses in local communities.

Life Insurance: Is It Worth the Hassle?

You may want to see also

Community Support: Giving back through initiatives that strengthen local communities

Life Farmers Insurance is committed to fostering a culture of community support and giving back, recognizing that strong communities are the foundation of a resilient and thriving society. Through various initiatives, the company aims to strengthen local communities and create a positive impact on the lives of its members and the wider population.

One of the key ways Life Farmers Insurance demonstrates its dedication to community support is by organizing and participating in local events and programs. These initiatives often focus on areas such as education, healthcare, and environmental sustainability. For instance, the company might sponsor a community health fair, providing free health screenings and educational workshops to raise awareness about wellness. By engaging directly with community members, Life Farmers Insurance can identify specific needs and tailor its support accordingly. This approach ensures that the assistance provided is meaningful and aligned with the community's priorities.

In addition to direct engagement, Life Farmers Insurance encourages its employees to become active volunteers within their communities. The company promotes a culture of corporate social responsibility, where employees are empowered to give back through their time and skills. This could involve mentoring youth, organizing food drives, or participating in community clean-up projects. By involving its workforce, Life Farmers Insurance not only strengthens community bonds but also fosters a sense of shared responsibility and purpose among its employees.

Furthermore, Life Farmers Insurance may establish long-term partnerships with local non-profit organizations and charities. These partnerships can take the form of financial donations, in-kind contributions, or collaborative projects. For example, the company might partner with a local food bank to provide financial support for their operations or organize fundraising campaigns to address specific community needs. Such partnerships ensure a more sustained and impactful approach to community support, allowing Life Farmers Insurance to contribute to the long-term development and well-being of the communities it serves.

The impact of these community support initiatives is far-reaching. By strengthening local communities, Life Farmers Insurance contributes to the overall resilience and prosperity of the region. Improved access to healthcare, education, and other essential services can lead to better health outcomes, increased educational attainment, and a more engaged and empowered citizenry. Ultimately, the company's commitment to community support not only benefits the immediate recipients of its initiatives but also creates a positive ripple effect, making the community a better place for everyone.

Sibling Rivalry: Can They Steal My Life Insurance?

You may want to see also

Peace of Mind: Knowing you're protected against life's unexpected events

When it comes to life insurance, having peace of mind is invaluable. Life Farmers Insurance understands this and aims to provide comprehensive coverage to ensure you're protected against life's unexpected twists and turns. This peace of mind is a powerful benefit that can significantly impact your overall well-being and financial security.

The primary purpose of life insurance is to safeguard your loved ones and provide financial support in the event of your untimely demise. It offers a safety net, knowing that your family will be taken care of even if you're no longer around. With Life Farmers Insurance, you can rest assured that your beneficiaries will receive the intended payout, allowing them to cover essential expenses, such as mortgage payments, education costs, or daily living expenses. This financial security can alleviate the stress and anxiety often associated with the uncertainty of the future.

One of the key advantages of Life Farmers Insurance is its ability to adapt to your changing needs. Life circumstances can evolve over time, and your insurance policy should reflect these changes. Whether it's a new addition to the family, a career change, or a significant financial milestone, the insurance provider can adjust your coverage accordingly. This flexibility ensures that your protection remains relevant and effective throughout your life's journey.

Moreover, Life Farmers Insurance offers a range of policy options to cater to diverse preferences and budgets. From term life insurance, which provides coverage for a specified period, to permanent life insurance that offers lifelong protection, there's a policy to suit various needs. Additionally, riders and add-ons can be incorporated into your policy to enhance coverage, such as critical illness coverage or accidental death benefits. This customization empowers you to create a tailored plan that aligns perfectly with your unique requirements.

In summary, Life Farmers Insurance provides peace of mind by offering comprehensive protection against life's uncertainties. With their adaptable policies, you can ensure that your loved ones are financially secure, even in the face of unexpected events. By choosing Life Farmers Insurance, you're making a wise investment in your future and the well-being of your family.

Life Insurance After Military Service: What's Covered?

You may want to see also

Frequently asked questions

Life Farmers Insurance is a type of insurance policy designed to provide financial protection and peace of mind to individuals and their families. It offers coverage for various life events, including death, disability, critical illness, and long-term care.

Life Farmers Insurance policies typically involve a contract between the policyholder and the insurance company. The policyholder pays regular premiums, and in return, the insurance company provides benefits and financial support during specified life events or if the insured individual passes away.

The advantages of Life Farmers Insurance include financial security for loved ones, coverage for medical expenses, income replacement in case of disability, and assistance with long-term care costs. It can also help with funeral expenses and provide a financial safety net for beneficiaries.

Life Farmers Insurance is available to individuals of various ages and health conditions. The eligibility criteria may vary depending on the specific policy and insurance provider. Generally, it is recommended to assess your health, lifestyle, and financial goals to determine the most suitable coverage.

Selecting the appropriate Life Farmers Insurance policy involves considering your specific needs, budget, and long-term financial objectives. It is advisable to research different insurance providers, compare policies, and seek professional advice to ensure you make an informed decision.