Life insurance is a way to help your family cope financially when you die. It is intended to provide support to your loved ones when they can no longer rely on your income. The payout can be used to clear debts, pay off a mortgage, cover everyday expenses, or even pay for your funeral. While there is no legal requirement to take out life insurance, it is worth considering if you have people who depend on your income and may struggle to cope financially without you.

| Characteristics | Values |

|---|---|

| Purpose | Help your family cope financially when you die |

| Who needs it? | Those with a partner or family who may struggle to cope financially without your income |

| Who doesn't need it? | Single people with no one depending on their income |

| Types | Term life insurance, whole-of-life insurance, family income benefit, mortgage life insurance, over-50s life insurance, joint life insurance |

| Payout | A lump sum or regular income |

| Cost | Depends on age, occupation, lifestyle, health, type of policy, etc. |

| Add-ons | Critical illness cover, terminal illness cover, waiver of premium |

| Considerations | Whether you have dependants, existing life insurance, health conditions, age, smoking status, etc. |

| Alternatives | Income protection insurance, mortgage protection insurance |

| Tax implications | Proceeds are free from income and capital gains tax but are liable for inheritance tax unless the policy is written in trust |

| Exclusions | Suicide, alcohol or drug-related death, dangerous sports or hobbies, pre-existing conditions (sometimes) |

| Advice | Shop around, buy as early as possible, improve health, quit smoking |

| Broker types | Advisory broker, discount broker |

What You'll Learn

Peace of mind for loved ones

Life insurance is a way to ensure that your family is financially secure when you are no longer around to provide for them. It is intended to provide help to your loved ones when they can no longer rely on your salary or income. The pay-out from a life insurance policy can be used to clear debts, pay off the mortgage, cover everyday expenses, or even pay for your funeral.

If you are single with no one depending on your income, you may not need life insurance. However, if you have a partner or family who may struggle financially without your support, then life insurance could offer them the help they need during a very difficult time.

- Mortgage Protection: Life insurance can help your loved ones continue to meet mortgage repayments, so they don't have to worry about losing their home on top of dealing with the grief of losing you.

- Education and Childcare Expenses: If you have children, life insurance can ensure that your partner or guardian will have the financial means to cover their education and childcare expenses.

- Final Expenses: Funerals and medical expenses can be costly. Life insurance can help cover these final expenses, so your loved ones don't have to worry about finances during their time of grief.

- Income Replacement: Life insurance can provide a lump-sum payment or regular income to replace the income you were providing, helping your loved ones maintain their current standard of living.

- Business Protection: If you are in a partnership or have financial responsibilities with a business partner, life insurance can ensure that your share of the business is covered, making it easier for your partner to buy your share of the business from your beneficiaries.

- Peace of Mind: Knowing that your loved ones will be financially secure can give you peace of mind and allow you to live your life more fully, without constantly worrying about what will happen to them if you are no longer around.

While life insurance is not a legal requirement, it can be a valuable safety net for your loved ones. It ensures that they have the financial resources to cope with the loss of your income and can help them maintain their standard of living.

When considering life insurance, it is important to shop around, compare policies, and seek advice from independent financial advisors or insurance brokers to find the best option for your specific circumstances.

Life Insurance and Doctor Visits: What's the Connection?

You may want to see also

Employer-provided life insurance

While employer-provided life insurance can be a good benefit, especially if you have no other life insurance in place, it is important to consider whether the coverage offered is sufficient to meet your financial needs. The amount of coverage provided is typically determined using a multiple of an employee's annual salary or may be linked to their position in the company. Additionally, employer-provided life insurance usually only applies to the employee and not their spouse or children.

One of the main advantages of employer-provided life insurance is its convenience. Starting coverage is simple, as employees can often just opt in. It can also result in savings, as employers usually pay for all or most of the premiums, leaving employees with more money to spend on other needs. Most employee life insurance plans are also guaranteed, meaning you will be accepted regardless of any serious medical conditions. For those who are just starting out in their careers and may not have the funds needed for life insurance, employer-provided life insurance can provide a degree of financial security for those who depend on them.

However, it is important to keep in mind that employer-provided life insurance may not provide enough coverage, especially if you have dependents. While it can give you a false sense of security, it often pays to get additional coverage. Industry experts generally recommend having enough life insurance to cover between 5 and 10 times your annual salary. Additionally, employer-provided life insurance is usually tied to your employment, and you may lose coverage if you change jobs or are laid off. Therefore, it is worth considering purchasing an individual policy in addition to your employer-provided life insurance to ensure you have sufficient coverage.

New York Life Insurance: Converting Term Policies

You may want to see also

Whole-of-life insurance

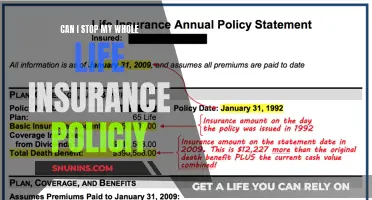

The cost of whole-of-life insurance is typically higher than term life insurance due to the guaranteed payout. The premium amount depends on various factors, including age, health, lifestyle, and occupation. It is important to note that whole-of-life insurance is usually linked to a specific investment, and poor performance may result in increased premiums to avoid losses for the insurer.

When considering whole-of-life insurance, it is essential to review the policy details, including any exclusions and the investment strategy. While it offers peace of mind and financial security for loved ones, it may not be necessary for individuals without financial dependents.

Fafsa and Life Insurance: What You Need to Know

You may want to see also

Pre-existing conditions

A pre-existing condition is a medical issue that has been diagnosed or treated before applying for life insurance. While health insurance companies can no longer refuse to cover treatment or raise rates for pre-existing conditions, no such law exists for life insurance carriers. This means that pre-existing health conditions such as asthma, diabetes, cancer, and heart disease could all negatively impact the premium and breadth of benefits available to prospective policyholders.

The impact a pre-existing condition has on your life insurance premium will mostly depend on its severity. In general, the more severe a condition is, the more you can expect it to impact your premium.

- Type of Condition: The type of pre-existing condition you have significantly impacts your approval chances. Insurers evaluate the risk the condition entails and its likelihood of causing recurring issues. For example, cancer, heart disease, and other severe chronic illnesses are considered higher risk and may lead to higher premiums or even disqualification from certain types of life insurance.

- Current Health Status: Even with a pre-existing condition, insurers evaluate how well you are managing it. If your condition is under control and you are otherwise healthy, you may have better approval chances and qualify for more favorable premiums. Demonstrating vigilant management of the condition, such as regular medical check-ups and medication adherence, can reduce the risk from the insurer's perspective.

- Age: Premiums can increase, and approval chances can decrease with age, given the same pre-existing condition. Younger individuals generally have a longer life expectancy, reducing the insurer's risk.

- Lifestyle Habits: Certain lifestyle habits can influence your approval chances. For example, smokers with pre-existing conditions may have lower approval odds. On the other hand, a healthy lifestyle, such as regular exercise and a balanced diet, can potentially increase your chances of approval.

- Time from Diagnosis: A longer time from diagnosis can increase the chance of complications or other issues. Insurers may scrutinize your application more closely if your diagnosis was made a long time ago.

If you have a pre-existing condition, there are still life insurance options available to you:

- Term Life Insurance: Term life insurance policies offer more favorable premiums and large death benefits, but coverage only lasts 10 to 30 years. This option may be suitable if you want the most coverage for your budget.

- Guaranteed Issue Life Insurance: Guaranteed issue life insurance policies never deny applicants. There are no medical questions or exams. These policies offer lower coverage amounts and favorable premiums, along with a cash value growth component that helps build wealth over time.

- Group Life Insurance: Group life insurance is a type of term life insurance that you can often obtain through your employer. While the death benefit is typically limited to a multiple of your annual salary, premiums can be favorable and easy to manage.

- Whole Life Insurance: People with pre-existing conditions may still qualify for whole life insurance, which offers lifelong coverage and a cash value growth component. However, premiums can be significantly higher.

If you have been denied life insurance due to pre-existing conditions, there are a few paths you can take:

- Re-apply after improving your condition: Waiting for your condition to improve and then re-applying can increase your chances of approval. During this time, focus on following your treatment plan and maintaining a healthy lifestyle. Document your health improvements and gather medical records to support your application.

- Appeal the denial: If there was an error or missing information in your initial application, you may be able to appeal the denial and provide additional evidence to support your case.

- Work with an insurance broker: Brokers specialize in helping clients find life insurance and can advocate on your behalf. They have access to multiple insurers and can guide you toward companies more likely to provide favorable rates for your specific condition.

- Explore guaranteed issue life insurance: Guaranteed issue life insurance approves all applicants, regardless of their health status. There are no medical exams or questions, making the application process simpler.

Life Insurance and Tax Returns: What's the Connection?

You may want to see also

Over-50s life insurance

Life insurance is a way of helping your family cope financially when you die. It is intended to provide help to your loved ones when they can no longer rely on your salary or income. The pay-out can be used to clear debts, pay off the mortgage or cover everyday expenses. It could even pay for your funeral if you haven’t set anything aside for that.

- A helping hand at a difficult time – the money could be used for costs or bills that remain unpaid.

- Support with funeral costs – some people plan their payout to go towards arranging their final send-off.

If you live a long time, you could end up paying more in premiums than the value of the policy that is paid out. As the lump sum is fixed, inflation could also reduce its value. Depending on how long you live, you could pay more in total premiums than the cover amount you’ll leave behind.

What to consider when choosing Over-50s life insurance

When choosing an Over-50s life insurance plan, it is important to consider the following:

- Cost of premiums: Premiums can vary from £5 to £100 a month.

- Payout amount: The payout amount depends on your age and whether you smoke.

- Inflation: As the payout amount is fixed, inflation will reduce its value over time.

- Length of cover: Cover lasts until you die, but you will only need to pay premiums for 30 years or until the policy anniversary after your 90th birthday, whichever comes first.

- No cash value: There is no cash value at any time and if you cancel the policy, you will not get anything back.

- Single cover only: This type of policy covers one person only, so you would need separate policies to cover two people.

Does Life Insurance Blood Test Check for Marijuana?

You may want to see also

Frequently asked questions

If you are single with no one depending on your income, you probably don't need life insurance. However, if you have a partner or family who may struggle to cope financially, life insurance could offer them help during a very difficult time.

Term life insurance provides cover for a set amount of time, typically anywhere from one to 50 years. Your beneficiaries will receive a payout if you pass away during the term, but there will be no refund on your premiums if you outlive the policy.

The amount of cover, or 'sum insured', depends on your personal circumstances. For example, a married couple with a large mortgage and four children will need more cover than a single parent living in a two-bedroom flat with one child. Most of the time, the recommended level of life insurance is 10 times your annual salary or income.

Many couples take out joint life insurance because it is convenient and cheaper. However, joint life insurance normally only pays out once, after which the surviving partner is left without insurance. When they then take out new insurance, the premiums are likely to be higher.