Universal life insurance is a type of permanent life insurance that offers flexibility and long-term coverage. In Canada, it provides policyholders with the ability to adjust their premiums and death benefits over time, allowing them to tailor the policy to their changing needs. This insurance type is designed to provide coverage for the entire life of the insured individual, offering a range of benefits such as a guaranteed death benefit and the potential for cash value accumulation. It is a popular choice for those seeking a more adaptable and personalized insurance solution, ensuring financial security for the future.

What You'll Learn

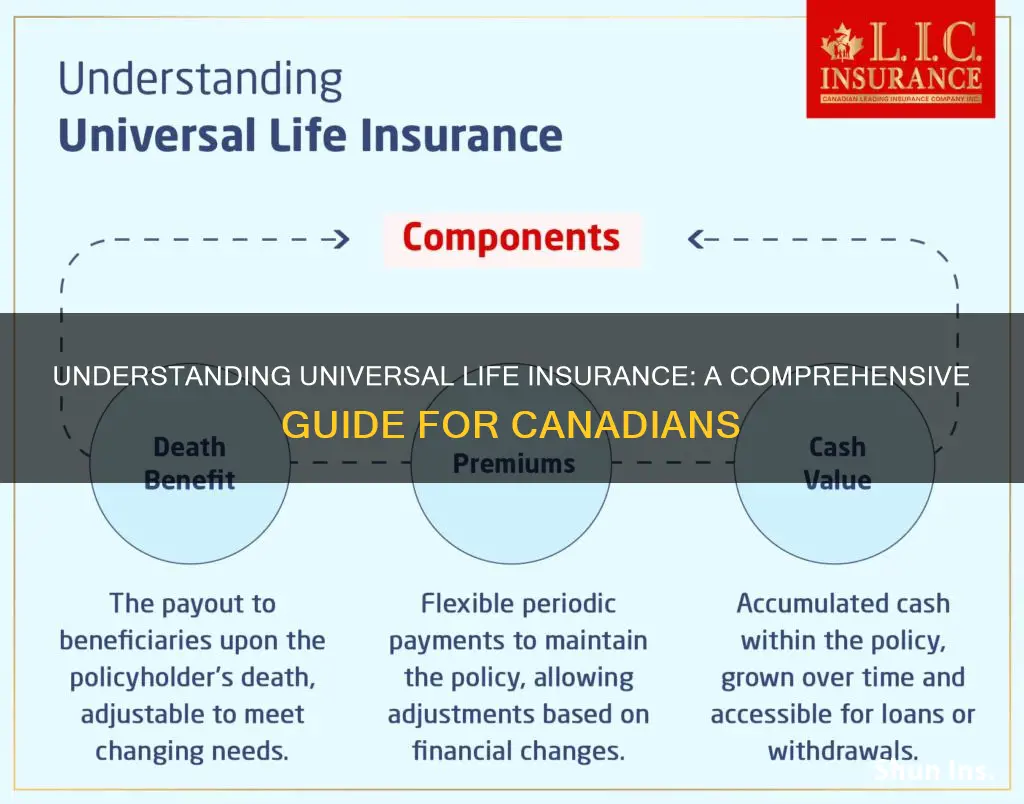

- Definition: Universal life insurance in Canada offers flexible coverage with a permanent death benefit

- Premiums: Premiums are typically adjustable, allowing policyholders to manage costs

- Death Benefit: The death benefit is guaranteed and can grow tax-deferred over time

- Investment Options: Policyholders can allocate a portion of premiums to investment accounts

- Flexibility: Universal life provides flexibility in premium payments and death benefit amounts

Definition: Universal life insurance in Canada offers flexible coverage with a permanent death benefit

Universal life insurance is a type of permanent life insurance policy available in Canada, offering a unique blend of flexibility and security. This insurance product provides a death benefit that remains in force for the entire life of the insured individual, ensuring financial protection for beneficiaries. One of its key advantages is the adaptability it offers to policyholders. Unlike traditional term life insurance, universal life insurance allows policyholders to adjust their coverage over time, making it a versatile financial tool.

The flexibility begins with the initial premium payment, where policyholders can choose to pay a fixed amount or a variable amount, depending on their financial situation and goals. This adaptability continues as the policy progresses, allowing for adjustments to the death benefit and premium payments. Policyholders can increase their coverage during periods of financial stability and decrease it when needed, ensuring that the insurance remains tailored to their evolving circumstances.

A permanent death benefit is a cornerstone of universal life insurance. This means that as long as the policy premiums are paid, the death benefit will remain in effect, providing a financial safety net for the insured's beneficiaries. The death benefit is typically tax-free, offering a significant financial advantage to the policyholder's estate. This permanent coverage is particularly valuable for those seeking long-term financial security and a reliable way to provide for their loved ones.

In Canada, universal life insurance policies are designed to offer a competitive interest rate on the cash value of the policy. This cash value grows over time, providing a substantial financial asset that can be borrowed against or withdrawn, offering policyholders additional financial flexibility. The policy's adaptability and the potential for cash value accumulation make universal life insurance a comprehensive solution for individuals seeking both financial protection and investment opportunities.

When considering universal life insurance in Canada, it is essential to understand the policy's features and how they align with your financial goals. Consulting with a financial advisor can provide valuable insights into how this insurance product can be tailored to meet your specific needs, ensuring you have the right level of coverage and flexibility to secure your financial future.

Life Insurance Industry: Stability and Future Outlook

You may want to see also

Premiums: Premiums are typically adjustable, allowing policyholders to manage costs

Universal life insurance is a type of permanent life insurance that offers a flexible approach to coverage, particularly when it comes to premium payments. Unlike traditional term life insurance, where premiums are set for a specific period, universal life insurance provides policyholders with the ability to adjust their premiums over time. This flexibility is a key feature that sets universal life insurance apart and can be highly beneficial for those seeking long-term financial protection.

In Canada, universal life insurance policies often come with adjustable premiums, which means the policyholder can choose to pay more or less at various points during the policy's duration. This adjustability is a significant advantage, especially for individuals who may experience changes in their financial situation or income levels. For instance, during periods of financial prosperity, a policyholder might opt to pay higher premiums to build up more cash value in the policy, which can be borrowed against or used to increase the death benefit. Conversely, when finances are tighter, they can reduce the premium payments, ensuring the policy remains affordable.

The adjustability of premiums in universal life insurance allows policyholders to tailor their coverage to their specific needs and financial goals. This level of control is particularly appealing to those who want to ensure their insurance policy remains relevant and effective throughout their lives. By making premium adjustments, individuals can optimize the policy's performance, ensuring it provides adequate financial protection without unnecessary costs.

It's important to note that while the adjustability of premiums offers flexibility, it also requires careful consideration and planning. Policyholders should be mindful of the potential impact of premium changes on the overall cost of the policy over time. Striking a balance between managing costs and maintaining sufficient coverage is essential to ensure the policy's long-term viability.

In summary, the adjustable premium structure of universal life insurance in Canada empowers policyholders to take control of their insurance costs. This feature enables individuals to adapt their coverage as their financial circumstances evolve, ensuring they receive the right level of protection at the right price. Understanding and effectively utilizing this flexibility can lead to a more customized and cost-effective insurance solution.

Life Insurance Drug Tests: How Strict Are They?

You may want to see also

Death Benefit: The death benefit is guaranteed and can grow tax-deferred over time

Universal life insurance is a type of permanent life insurance that offers a unique combination of flexibility and security. One of its key features is the death benefit, which is a critical aspect of the policy and provides financial protection for your loved ones. When you purchase universal life insurance, you are essentially agreeing to a contract with an insurance company, where the death benefit is a guaranteed amount that will be paid out to your beneficiaries upon your passing. This guarantee is a significant advantage, ensuring that your family receives the intended financial support regardless of market fluctuations or changes in the insurance company's financial status.

The death benefit in universal life insurance is designed to grow over time, providing a potential increase in the value of the policy. This growth is often referred to as "cash value" or "accumulation value." As you make regular premium payments, a portion of each payment goes towards building this cash value, which can grow tax-deferred. Tax-deferred growth means that the cash value can accumulate without being taxed each year, allowing it to grow faster over time. This feature is particularly beneficial for long-term financial planning, as the cash value can be used for various purposes, such as funding education expenses, starting a business, or providing additional retirement savings.

The tax-deferred nature of the death benefit's growth is a significant advantage, especially in Canada, where tax laws can impact investment growth. By allowing the cash value to grow tax-free, universal life insurance provides a more efficient way to build wealth and secure financial goals. This growth can be particularly valuable for those who want to maximize their savings and ensure that their money works harder for them over time. Additionally, the flexibility of universal life insurance allows policyholders to adjust their death benefit amount as their financial needs change, providing a customizable solution for different life stages.

In Canada, universal life insurance offers individuals a way to secure their family's financial future while also providing an opportunity to build wealth. The guaranteed death benefit ensures that beneficiaries receive the intended financial support, while the tax-deferred growth of the cash value allows policyholders to benefit from compound interest and potential tax advantages. This type of insurance provides a sense of security and financial planning, making it an attractive option for those seeking long-term financial protection and growth.

When considering universal life insurance, it is essential to understand the specific features and benefits offered by different insurance providers. The death benefit is a core component, but other aspects, such as premium flexibility, investment options, and rider benefits, can also impact the overall value of the policy. Consulting with a financial advisor or insurance specialist can help individuals navigate the options and choose a universal life insurance policy that best aligns with their financial goals and risk tolerance.

Does Your Job's Life Insurance Policy Require Drug Testing?

You may want to see also

Investment Options: Policyholders can allocate a portion of premiums to investment accounts

Universal life insurance in Canada offers a unique and flexible approach to life coverage, providing policyholders with a range of investment opportunities. This type of insurance allows individuals to allocate a portion of their premiums into investment accounts, offering a way to potentially grow their money over time. Here's a detailed look at how this investment aspect works:

When you purchase a universal life insurance policy, you typically have the option to allocate a certain percentage of your monthly or annual premium payments into an investment account. This investment component is a key feature that sets universal life insurance apart from traditional term or whole life insurance. The investment portion of the policy is designed to provide an opportunity for policyholders to benefit from market performance while still having the security of life insurance coverage.

The investment accounts within a universal life insurance policy can be customized to suit the policyholder's financial goals and risk tolerance. Policyholders can choose from various investment options, often including stocks, bonds, and mutual funds. These investments are typically managed by the insurance company or an external financial institution, ensuring a level of professional oversight. The idea is to provide a diversified and potentially lucrative investment vehicle while also ensuring the policy's long-term viability.

One of the advantages of this investment strategy is the potential for higher returns compared to traditional savings accounts. Over time, the accumulated investment growth can contribute to the policy's cash value, which is a key component of universal life insurance. This cash value can be used to pay future premiums, providing financial security and flexibility. Additionally, policyholders can access this cash value through loans or withdrawals, allowing them to utilize their investment for various financial needs.

It's important to note that while investment accounts within universal life insurance policies offer potential growth, they also come with risks. Market volatility can impact investment performance, and policyholders should carefully consider their risk tolerance before making investment decisions. Regular reviews and adjustments to the investment strategy may be necessary to ensure the policy remains aligned with the policyholder's financial objectives.

Getting Your Life Insurance License in Nevada

You may want to see also

Flexibility: Universal life provides flexibility in premium payments and death benefit amounts

Universal life insurance is a type of permanent life insurance that offers a unique level of flexibility to policyholders in Canada. One of its key advantages is the ability to customize both premium payments and the death benefit, providing policyholders with a tailored insurance solution.

In terms of premium payments, universal life insurance allows policyholders to choose their own payment schedule. This means you can opt for higher monthly payments to build up cash value faster, or lower payments over a more extended period. This flexibility is particularly beneficial for those who prefer a more flexible approach to budgeting and want to ensure that their insurance premiums align with their financial capabilities at any given time. For instance, during periods of higher income, you might choose to increase your premium payments to accumulate more cash value, which can be borrowed against in the future. Conversely, if you experience a financial downturn, you can adjust your payments to a more manageable level without losing coverage.

The death benefit is another area where universal life insurance shines in terms of flexibility. Policyholders can adjust the death benefit amount to match their changing needs and financial goals. For example, if you start a family or purchase a new home, you might want to increase the death benefit to ensure your loved ones are adequately protected. Similarly, if you pay off a mortgage or your children become financially independent, you may choose to decrease the death benefit to avoid over-insuring. This adaptability ensures that your universal life insurance policy remains relevant and valuable throughout your life's different stages.

This flexibility is a significant advantage over traditional term life insurance, where the death benefit and premium payments are fixed for the policy's duration. With universal life, you have the power to make these decisions based on your life's circumstances, providing peace of mind and financial security.

In summary, universal life insurance in Canada offers a flexible approach to life insurance, allowing policyholders to customize their premium payments and death benefit. This adaptability ensures that the policy remains a valuable financial tool, providing coverage when needed and the freedom to adjust as your life and financial goals evolve.

Cheap Life Insurance: Smart Ways to Save on Coverage

You may want to see also

Frequently asked questions

Universal Life Insurance is a type of permanent life insurance that offers flexibility and long-term coverage. It provides a death benefit to your beneficiaries and also includes an investment component. This means your policy's cash value can grow over time, allowing you to borrow against it or use it as a source of funds.

In Canada, Universal Life Insurance policies typically have a guaranteed death benefit and an adjustable premium. The policyholder can choose to pay a fixed premium or a variable one, which may increase or decrease based on market performance. The cash value of the policy accumulates with interest, and you can access it through withdrawals or loans.

This type of insurance offers several advantages. Firstly, it provides coverage for a lifetime, ensuring financial security for your loved ones. Secondly, the investment aspect allows your money to grow, potentially outpacing the traditional savings accounts. Additionally, you can customize the policy to fit your needs, and the flexibility to increase or decrease coverage as your circumstances change.