The face amount in life insurance is a crucial component of any life insurance policy. It refers to the death benefit or the amount of money that the insurance company will pay out to the policyholder's beneficiaries upon the insured individual's death. This amount is typically predetermined and agreed upon when the policy is purchased, and it serves as a financial safety net for the policyholder's loved ones in the event of their passing. Understanding the face amount is essential for individuals to choose the right insurance coverage that aligns with their financial goals and provides adequate protection for their family's future needs.

What You'll Learn

- Definition: The face amount is the death benefit amount in a life insurance policy

- Determination: It's based on factors like age, health, and policy type

- Impact: The face amount affects premium costs and policy value

- Customization: Policyholders can choose different face amounts

- Tax Implications: Face amount may have tax consequences upon payout

Definition: The face amount is the death benefit amount in a life insurance policy

The face amount, also known as the death benefit, is a crucial component of a life insurance policy. It represents the monetary value that the insurance company agrees to pay out to the policyholder's beneficiaries upon the insured individual's death. This amount is predetermined and specified in the policy contract, ensuring that the beneficiaries receive a specific financial sum when the insured person passes away.

In essence, the face amount serves as a financial safety net for the policyholder's loved ones, providing them with the necessary resources to cover various expenses and maintain their standard of living after the insured individual's death. It is a fixed sum that the insurance company promises to pay, and it can be a significant financial asset for the beneficiaries.

When purchasing a life insurance policy, the face amount is a critical factor in determining the policy's value and the level of coverage provided. It is the primary reason why the policy is considered a valuable financial tool for risk management and wealth transfer. The face amount is typically set at a higher value to ensure that the beneficiaries can adequately support themselves and their families during a challenging time.

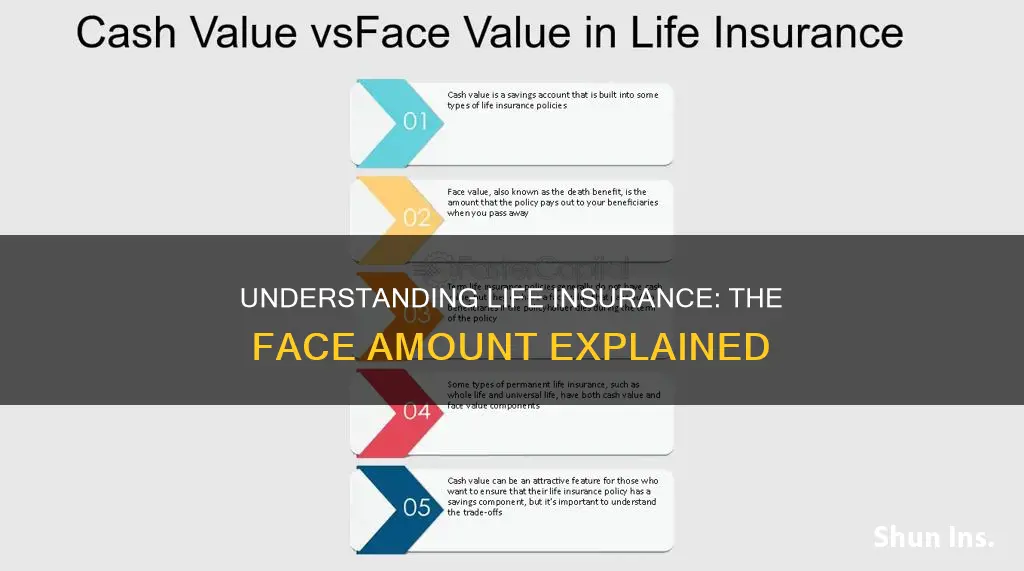

The concept of the face amount is straightforward: it is the amount the insurance company will pay out when the insured event (death) occurs. This amount is often referred to as the "death benefit" and is a key feature of term life insurance policies, which provide coverage for a specified period. The face amount is also a critical element in permanent life insurance policies, where it can accumulate cash value over time.

Understanding the face amount is essential for anyone considering life insurance. It ensures that the policyholder and their beneficiaries are aware of the financial security provided by the insurance policy. By knowing the face amount, individuals can make informed decisions about their insurance coverage, ensuring that their loved ones are protected financially in the event of their passing.

Unlocking the Cash Value: Understanding Life Insurance Payouts

You may want to see also

Determination: It's based on factors like age, health, and policy type

The face amount in life insurance is a crucial component of the policy, representing the death benefit or the payout that the insurance company will provide to the policyholder's beneficiaries upon the insured individual's death. This amount is predetermined and agreed upon when the policy is taken out, and it serves as a financial safety net for the insured's loved ones. The determination of the face amount is a complex process that takes into account various factors, ensuring that the policy provides adequate coverage for the individual's needs.

One of the primary factors influencing the face amount is the age of the insured person. Younger individuals typically qualify for higher face amounts because they have a longer life expectancy, reducing the insurance company's risk. As age increases, the face amount may decrease due to the higher likelihood of health issues and potential long-term care needs. For instance, a 30-year-old might secure a substantial face amount, while an elderly individual may have a lower coverage amount due to their advanced age.

Health and medical history play a significant role in determining the face amount as well. Insurance companies assess the insured's overall health, including any pre-existing conditions, chronic illnesses, or lifestyle factors like smoking or excessive alcohol consumption. A person with a history of serious health issues may be offered a lower face amount due to the increased risk of early death or the potential need for frequent medical interventions. Conversely, a healthy individual with no significant medical history may be eligible for a higher coverage amount.

The type of life insurance policy also impacts the face amount. Term life insurance, which provides coverage for a specified period, often has a higher face amount compared to permanent life insurance. Term policies are designed for specific needs and durations, and the face amount is determined based on the term length and the insured's circumstances. On the other hand, permanent life insurance, such as whole life or universal life, offers lifelong coverage and may have a lower face amount, as it provides a combination of death benefit and investment components.

In summary, the face amount in life insurance is determined by considering multiple factors, including age, health, and the specific policy type. These considerations ensure that the insurance company can accurately assess the risk and provide appropriate coverage. Understanding these factors is essential for individuals to make informed decisions when selecting a life insurance policy that meets their financial and personal needs.

Life Insurance: An Investment or a Safety Net?

You may want to see also

Impact: The face amount affects premium costs and policy value

The face amount, also known as the death benefit, is a crucial component of a life insurance policy. It represents the monetary value paid to the policyholder's beneficiaries upon the insured individual's death. This amount is predetermined and agreed upon when the policy is taken out. The face amount has a significant impact on both the premium costs and the overall value of the policy.

When it comes to premium costs, the face amount directly influences the price of the insurance policy. Insurance companies calculate premiums based on various factors, including the insured individual's age, health, and the chosen face amount. A higher face amount typically results in higher premium payments. This is because the insurer takes on a larger risk by guaranteeing a substantial payout in the event of the insured's death. As the face amount increases, the insurer's liability grows, and they may require higher premiums to ensure they can fulfill their financial obligations.

On the other hand, the face amount also affects the policy's value. The value of a life insurance policy is not solely determined by the face amount but also by the policy's cash value, which accumulates over time. The cash value is essentially the investment component of the policy, and it grows through regular premium payments and interest earned. As the face amount increases, the policy's overall value may also rise, providing the policyholder with a more substantial financial asset. This is particularly important for those who want to build a substantial savings component within their insurance policy.

Additionally, the impact of the face amount on premium costs and policy value can vary depending on the type of life insurance policy. Term life insurance, for example, typically offers a higher face-to-premium ratio compared to permanent life insurance. In term life, the face amount is guaranteed for a specific period, and the premiums are often lower during the initial years. As the policy term progresses, the premiums may increase, but the face amount remains the same. In contrast, permanent life insurance provides lifelong coverage and includes a savings component, which can result in higher premiums but also a growing policy value.

In summary, the face amount in life insurance plays a critical role in determining the financial implications of a policy. It influences premium costs, with higher face amounts generally leading to increased premiums, and it also affects the policy's value, potentially providing a more substantial financial asset for the policyholder. Understanding the impact of the face amount is essential for individuals to make informed decisions when selecting a life insurance policy that aligns with their financial goals and risk tolerance.

Whole Life Insurance and Cash Value: What's the Difference?

You may want to see also

Customization: Policyholders can choose different face amounts

The face amount, also known as the death benefit, is a crucial component of a life insurance policy. It represents the monetary value paid to the policyholder's beneficiaries upon the insured individual's death. This amount is predetermined and agreed upon when the policy is initially taken out. One of the key advantages of life insurance is the flexibility it offers in terms of customization, allowing policyholders to tailor the policy to their specific needs and preferences.

One of the most significant aspects of customization in life insurance is the ability for policyholders to choose different face amounts. This feature provides a high level of control over the financial security provided by the policy. When selecting the face amount, policyholders can decide how much financial support they want to provide to their loved ones in the event of their passing. This choice is entirely dependent on the individual's circumstances, financial obligations, and the level of coverage they deem necessary.

For instance, a policyholder might opt for a higher face amount if they have a large family to support, significant financial responsibilities, or specific long-term goals that require substantial funds. On the other hand, someone with fewer financial commitments and a smaller family might choose a lower face amount, ensuring that the policy remains affordable while still providing a safety net for their loved ones. This customization option ensures that the life insurance policy is tailored to the unique situation of each individual.

The process of selecting the face amount involves careful consideration and often requires input from financial advisors or insurance professionals. These experts can guide policyholders through the decision-making process, helping them understand the implications of different face amounts on their premiums and the overall policy structure. By offering this level of customization, life insurance companies empower individuals to make informed choices that align with their personal financial goals and the needs of their beneficiaries.

In summary, the face amount in life insurance is a customizable feature that allows policyholders to decide the monetary value of the death benefit. This flexibility enables individuals to create policies that are tailored to their specific circumstances, ensuring that their loved ones receive the necessary financial support when they need it most. With this level of customization, life insurance becomes a powerful tool for managing risk and providing peace of mind.

Life Insurance: Money Pit or Smart Investment?

You may want to see also

Tax Implications: Face amount may have tax consequences upon payout

The face amount, also known as the death benefit, is a crucial component of a life insurance policy. It represents the monetary value paid out to the policyholder's beneficiaries upon the insured individual's death. This amount is predetermined and agreed upon when the policy is taken out, and it serves as the basis for the insurance company's obligations under the contract. Understanding the tax implications of the face amount is essential for policyholders to make informed financial decisions.

When a life insurance policy is paid out, the face amount is generally considered a death benefit and is typically exempt from income tax. This means that the proceeds received by the beneficiaries are not subject to taxation as regular income. However, there are certain tax considerations that policyholders should be aware of. Firstly, if the policy is a term life insurance, the payout is generally tax-free. Term life insurance is designed to provide coverage for a specific period, and the face amount is paid out as a lump sum upon the insured's death.

In contrast, permanent life insurance policies, such as whole life or universal life, may have different tax implications. These policies accumulate cash value over time, and the face amount can be significantly larger than the initial premium payments. When the insured dies, the policy's cash value plus the face amount is paid out. Here, the tax treatment can vary depending on the policy's structure and the beneficiary's relationship to the insured.

For policies with a large face amount, the payout may be subject to estate taxes. Estate taxes are levied on the transfer of assets after an individual's death. If the face amount exceeds the estate tax exemption, it could trigger a tax liability for the beneficiaries. Additionally, if the policy is owned by an individual and the face amount is paid out to a non-spouse beneficiary, it may be considered a taxable event for the recipient. This is because the payout could be treated as ordinary income for the beneficiary, subject to income tax.

To minimize tax consequences, policyholders can consider various strategies. One approach is to structure the policy in a way that maximizes the tax-free status of the payout. For example, taking out a term life insurance policy with a substantial face amount can provide coverage without the immediate tax implications associated with cash value accumulation. Additionally, consulting with tax professionals and financial advisors can help individuals navigate the complex tax laws surrounding life insurance payouts and make informed decisions regarding their insurance policies.

Life Insurance: Age Limits and What Comes After

You may want to see also

Frequently asked questions

The face amount, also known as the death benefit, is the predetermined sum of money that is paid out to the policyholder's beneficiaries upon the insured individual's death. It is a key component of a life insurance policy and represents the financial value of the policy.

The face amount is typically set when the policy is initially purchased and can vary depending on the type of life insurance policy. For term life insurance, the face amount is usually a fixed sum for a specific period, such as 10, 20, or 30 years. In contrast, permanent life insurance policies, like whole life or universal life, may have a face amount that increases over time, often with an investment component.

Yes, in some cases, the face amount can be adjusted. For term life insurance, if you want to increase the coverage, you may need to apply for a new policy with the higher face amount. With permanent life insurance, the face amount can often be increased or decreased by paying additional premiums or making surrenders, depending on the policy's terms and conditions.