The initial benefit period for life insurance is a crucial aspect of understanding how this financial protection works. This period, often referred to as the term or duration, is the length of time during which the insurance policy provides financial benefits to the policyholder or their beneficiaries. It is a predetermined timeframe, typically ranging from a few years to several decades, during which the insurance company guarantees payments in the event of the insured individual's death. Knowing the initial benefit period is essential for individuals to choose the right coverage, ensuring they have adequate financial support for their loved ones during the most critical years of their lives.

What You'll Learn

- Definition: Initial benefit period is the time frame during which life insurance pays out benefits after a claim is made

- Policy Duration: This period is typically a set number of years, e.g., 10, 20, or 30 years

- Renewal Options: Some policies offer the option to renew the benefit period after the initial term

- Term Limits: The initial benefit period is limited to a specific age or a maximum age, e.g., 70 or 80

- Flexibility: Policyholders can choose the initial benefit period based on their financial goals and risk tolerance

Definition: Initial benefit period is the time frame during which life insurance pays out benefits after a claim is made

The initial benefit period is a crucial aspect of life insurance policies, as it defines the duration for which the insurance company is obligated to provide financial support to the policyholder's beneficiaries after a claim is made. This period is a predetermined timeframe, often ranging from a few months to a few years, during which the insurance provider ensures that the beneficiaries receive the agreed-upon death benefit. Once this initial period expires, the insurance company may adjust the payout structure, potentially reducing the amount or changing the terms of the benefit.

In the context of life insurance, the initial benefit period serves as a safety net for the policyholder's family or designated recipients. It ensures that the financial obligations and expenses associated with the insured individual's passing are covered promptly, providing much-needed support during a challenging time. This period is especially important as it guarantees that the beneficiaries have access to the necessary funds to cover immediate costs, such as funeral expenses, outstanding debts, or daily living expenses, without having to worry about the financial implications of the insured's death.

The length of the initial benefit period can vary significantly depending on the insurance company, the type of policy, and the individual's specific needs. Some policies may offer a standard initial benefit period of two years, while others might provide a longer duration, such as five years or more. Longer initial benefit periods are often preferred by policyholders as they provide more extended coverage and peace of mind, ensuring that the beneficiaries have sufficient time to adjust and plan for the future.

It is essential for individuals to carefully review and understand the terms of their life insurance policies, including the initial benefit period. This awareness allows them to make informed decisions about their coverage and ensure that their loved ones are adequately protected. Additionally, understanding this period can help individuals assess whether their policy meets their long-term needs or if adjustments are required to provide more comprehensive coverage.

In summary, the initial benefit period is a critical component of life insurance, offering a defined timeframe for the insurance company to fulfill its financial obligations to the policyholder's beneficiaries. This period provides immediate support and financial security to the recipients, ensuring that they can navigate the challenges of losing a loved one without the added stress of financial uncertainty.

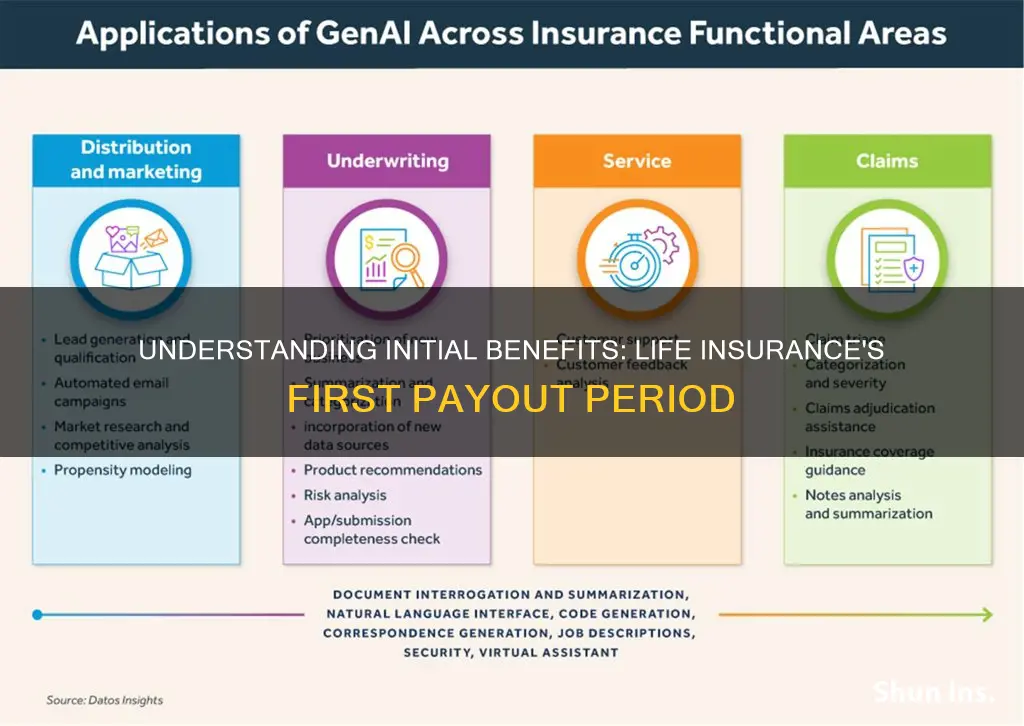

Tech-Enhanced Life Insurance: The Future of Protection

You may want to see also

Policy Duration: This period is typically a set number of years, e.g., 10, 20, or 30 years

The policy duration is a critical aspect of life insurance, especially when considering the initial benefit period. This term refers to the length of time during which the insurance company guarantees the payment of benefits to the policyholder or their designated beneficiaries. It is a predetermined period, often expressed in years, and it plays a significant role in the overall structure of the insurance policy.

In the context of life insurance, the initial benefit period is the time frame in which the policy provides financial protection to the insured individual or their family. This period is typically a set number of years, such as 10, 20, or 30 years, and it ensures that the policyholder receives the agreed-upon death benefit if they pass away during this time. For instance, if a policy has a 20-year duration, the insurance company will pay out the death benefit if the insured person dies within those 20 years, providing financial security for the beneficiaries.

The choice of policy duration is essential as it determines the length of time the insurance company is committed to providing the promised benefits. Longer policy durations often result in higher premiums, as the insurance company assumes a longer-term risk. For example, a 30-year policy duration might offer more comprehensive coverage, ensuring financial protection for a more extended period, but it will also require higher regular payments from the policyholder.

During the policy duration, the insurance company evaluates the insured individual's health and lifestyle to determine the risk associated with providing coverage. This assessment helps in setting the premium rates and ensuring the policy's financial viability. It is a crucial factor in the overall cost of the insurance, as it directly impacts the premiums paid by the policyholder.

When selecting a life insurance policy, understanding the concept of the initial benefit period and policy duration is vital. It allows individuals to choose a coverage term that aligns with their financial goals and risk tolerance. Whether it's a 10-year term for short-term protection or a 30-year policy for long-term security, the duration should be carefully considered to ensure the policy meets the specific needs of the insured and their beneficiaries.

IPTIQ Life Insurance: What You Need to Know

You may want to see also

Renewal Options: Some policies offer the option to renew the benefit period after the initial term

The initial benefit period for life insurance is a crucial aspect of understanding how long your policy will provide financial protection. This period is typically the duration for which your insurance coverage is active, and it can vary depending on the policy you choose. When you purchase life insurance, the initial benefit period is usually a set number of years, such as 10, 15, or 20 years. During this time, the insurance company promises to pay out a specified death benefit if the insured individual passes away.

Renewal options are a valuable feature offered by some life insurance providers, allowing policyholders to extend their coverage beyond the initial term. This option provides flexibility and ensures that your financial protection remains in place even as your life circumstances evolve. When the initial benefit period ends, you have the choice to renew your policy, which means you can continue receiving the death benefit for an extended duration. This is particularly beneficial for those who want long-term security and don't want to worry about reapplying for insurance or potentially facing higher premiums in the future.

Renewal policies often come with certain conditions and considerations. Firstly, the renewal process may involve a review of your current health and lifestyle factors, as insurance companies assess risk before extending coverage. This is an opportunity for you to showcase any positive changes or improvements in your well-being since the initial policy purchase. Additionally, renewal policies might have different premium structures, and you should carefully review the terms to understand any potential changes in cost.

It's important to note that not all life insurance policies offer renewal options, and the availability of this feature depends on the insurance provider and the specific policy details. When considering a life insurance policy, it is advisable to thoroughly review the terms and conditions, including the renewal process, to make an informed decision that aligns with your long-term financial goals and security needs.

In summary, understanding the initial benefit period is essential for managing your life insurance effectively. The renewal option, when available, provides a convenient way to maintain continuous coverage, ensuring that you and your loved ones remain protected even as your insurance needs may change over time. Always consult with a financial advisor or insurance specialist to explore the best options for your specific circumstances.

Life Insurance with HIV: Is It Possible?

You may want to see also

Term Limits: The initial benefit period is limited to a specific age or a maximum age, e.g., 70 or 80

When considering life insurance, understanding the concept of the initial benefit period is crucial, especially when it comes to term life insurance. This period defines the duration for which the insurance policy provides financial protection to the policyholder's beneficiaries. One common aspect of term life insurance is the inclusion of term limits, which set a specific age or a maximum age up to which the policy remains in effect.

For instance, a term life insurance policy might offer coverage for a period of 10 years, with the initial benefit period limited to the policyholder's age 70. This means that the insurance will provide financial support to the beneficiaries for the first 10 years of the policyholder's life, up to the age of 70. If the policyholder passes away during this term, the beneficiaries will receive the death benefit. Once the term limit is reached, the policy may continue, but it will no longer be term life insurance.

The term limits in life insurance policies serve multiple purposes. Firstly, they provide a sense of security and peace of mind to the policyholder, knowing that their loved ones will be financially protected for a specific period. This is particularly important for those with financial dependents, such as children or a spouse, who rely on the policyholder's income. By setting a term limit, the policyholder ensures that the insurance coverage aligns with the expected duration of financial responsibility.

Secondly, term limits help in managing the cost of insurance. Term life insurance is generally more affordable than permanent life insurance because it provides coverage for a limited time. By setting a specific age or maximum age, the insurance company can offer competitive rates, as the risk of paying out a large sum over an extended period is reduced. This makes term life insurance an attractive option for individuals seeking cost-effective coverage.

In summary, the initial benefit period in term life insurance is limited to a specific age or a maximum age, such as 70 or 80. This feature provides financial protection for a defined period, offering peace of mind and cost-effective coverage. Understanding these term limits is essential for individuals to make informed decisions about their life insurance policies and ensure that their loved ones are adequately protected.

High Blood Pressure: Getting Term Life Insurance

You may want to see also

Flexibility: Policyholders can choose the initial benefit period based on their financial goals and risk tolerance

The initial benefit period is a crucial aspect of life insurance, offering policyholders the flexibility to tailor their coverage to their unique needs and circumstances. This feature allows individuals to select the duration for which they want their life insurance policy to provide financial protection. By choosing the initial benefit period, policyholders can align their insurance coverage with their specific financial goals and risk tolerance.

When considering the initial benefit period, it is essential to understand that it represents the time frame during which the life insurance policy will provide a regular death benefit payment to the designated beneficiaries. This period can vary significantly, ranging from a few years to several decades or even the entire lifetime of the insured individual. The flexibility here lies in the ability to customize this duration, ensuring that the policyholder's financial needs are met during the most critical stages of their life.

For instance, a young professional might opt for a shorter initial benefit period, such as 10 years, to cover potential financial obligations like a mortgage or to provide a financial cushion for their family during this period. On the other hand, an older individual with a substantial estate might choose a longer benefit period, ensuring that their beneficiaries receive support over an extended time. This customization empowers policyholders to make informed decisions based on their personal circumstances.

The key advantage of this flexibility is that it allows individuals to manage their risk exposure effectively. A shorter initial benefit period can be more affordable and may be suitable for those with lower financial risks, such as non-smokers or individuals with a healthy lifestyle. Conversely, a longer benefit period might be more appropriate for those with higher financial obligations or a longer life expectancy, ensuring comprehensive coverage.

In summary, the initial benefit period in life insurance provides policyholders with the freedom to customize their coverage according to their financial goals and risk assessment. This flexibility enables individuals to make informed choices, ensuring that their life insurance policy aligns perfectly with their unique needs, providing both financial security and peace of mind. It is a powerful tool that allows individuals to take control of their insurance decisions and adapt them to their specific life circumstances.

Affording Life Insurance: Apollo Astronauts' Financial Challenges

You may want to see also

Frequently asked questions

The initial benefit period, also known as the "term" or "duration," is a specified time frame during which the life insurance policy provides financial protection to the policyholder's beneficiaries. This period is typically a fixed length, such as 10, 20, or 30 years, and it determines how long the insurance company will pay out benefits in the event of the insured's death.

The initial benefit period is a critical aspect of your life insurance policy as it defines the duration of coverage. If you choose a longer term, like 30 years, your beneficiaries will receive a death benefit for an extended period, ensuring financial security for a more extended period. Conversely, a shorter term may result in lower premiums but less coverage duration.

Yes, many life insurance policies offer the option to convert the initial benefit period. This means you can adjust the term length after purchasing the policy. For example, if you initially opted for a 10-year term and later decide to extend it, you can typically do so by paying additional premiums and meeting the insurer's requirements. However, the process and terms may vary, so it's essential to review your policy documents or consult with your insurance provider for specific details.