An IRA annuity is a type of insurance product that can be purchased using funds from an individual's IRA or 401(k) account. This transaction is typically done on a tax-free basis and results in the creation of an IRA holding account or IRA annuity by the insurance company. The annuity then functions as a tax-deferred investment vehicle, providing a steady stream of income during retirement. The frequency and amount of payments from an IRA annuity can be structured according to the individual's preferences, and there are usually no setup or annual administration fees associated with this type of annuity.

| Characteristics | Values |

|---|---|

| Description | An IRA annuity is an insurance product that provides a fixed-income payment at a specified time. |

| Tax Treatment | The tax treatment of annuity payments depends on whether pre-tax or after-tax funds were used to purchase the annuity. |

| Investment Options | IRAs can hold a wide range of investments, including stocks, bonds, and mutual funds. Annuities are limited to fixed and variable annuities. |

| Fees | Annuities typically have higher fees than IRAs. |

| Contribution Limits | IRAs have annual contribution limits, while annuities do not. |

| Ownership | An IRA can have only one owner, while an annuity can be jointly owned. |

| Income Restrictions | IRAs have income restrictions, while annuities do not. |

| Withdrawal Flexibility | IRAs allow for early withdrawals, but a penalty may apply. Annuities may have surrender charges for early withdrawals. |

| Payout Options | Both IRAs and annuities offer flexible payout options, including lump-sum or periodic payments. |

What You'll Learn

Annuities can be held inside an IRA

The main advantage of an annuity in an IRA is the ability to select guaranteed interest or income options that can provide certainty in retirement. It also gives you more flexibility around required minimum distributions if you plan to keep working past age 73.

However, since both annuities and IRAs are tax-deferred, it may not make sense to combine the two. Annuities and IRAs each offer different advantages to consider based on your financial goals.

A fixed deferred annuity is the best type of annuity to hold in an IRA because it can diversify your portfolio with reliable growth, principal protection, and guaranteed income in retirement.

Annuities are insurance products that provide a source of monthly, quarterly, annual, or lump-sum income during retirement. An annuity makes periodic payments for a certain amount of time or until a specified event occurs (for example, the death of the person who receives the payments). Money invested in an annuity grows tax-deferred until it is withdrawn.

Annuities are financial products that offer a guaranteed income stream and are usually bought by retirees. They can help individuals address the risk of outliving their savings.

Annuities can be structured into various types of instruments, giving investors flexibility. An annuity can be categorized as immediate or deferred, and fixed, variable, or indexed.

Annuities are designed to provide a steady cash flow for people during their retirement years to alleviate the fear of outliving their assets. These assets may not be enough to sustain their standard of living, so some investors may turn to an insurance company or other financial institution to purchase an annuity contract.

Annuities are appropriate for investors, known as annuitants, who want stable, guaranteed retirement income. Invested cash is illiquid and subject to withdrawal penalties, so it is generally not recommended that younger individuals or those with liquidity needs use this financial product.

Auto Insurance Ratings: Nationwide's Performance Reviewed

You may want to see also

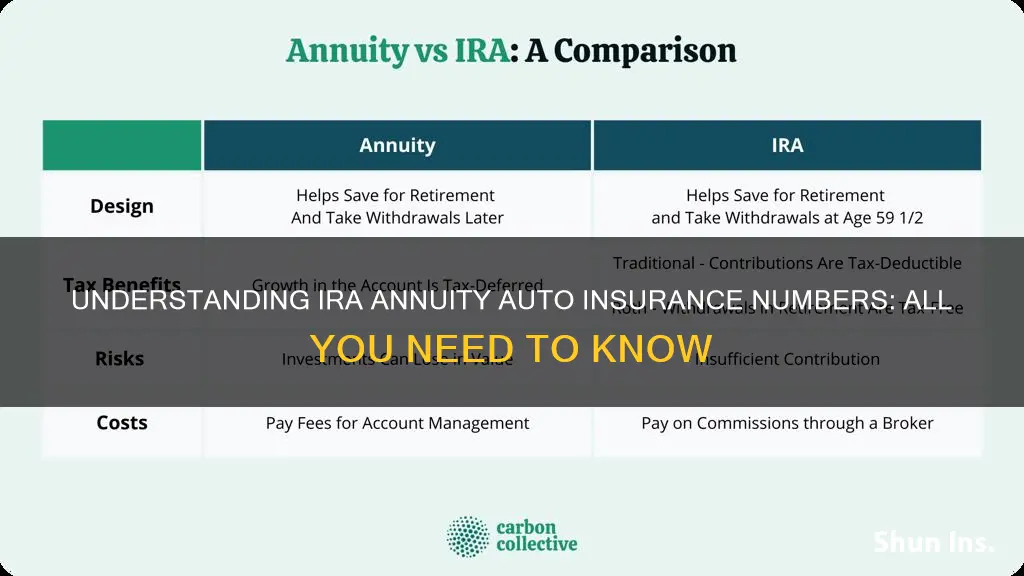

IRAs and annuities offer a tax-advantaged way to save for retirement

IRAs and annuities are two different tools for retirement saving that offer tax advantages. However, there are some key differences between the two. An IRA is an individual investment and savings account that holds retirement investments, such as stocks, bonds, and mutual funds. On the other hand, an annuity is an insurance product that provides a fixed-income stream at a specified time. Annuities are typically sold by insurance companies and can be purchased within an IRA.

IRAs

An IRA, or Individual Retirement Account, is a tax-advantaged account that holds retirement investments. IRAs are defined and regulated by the Internal Revenue Service (IRS), which sets eligibility requirements, contribution limits, and distribution rules. The main types of IRAs are traditional IRAs and Roth IRAs. Traditional IRAs are funded with pre-tax dollars, and contributions are deductible for the year they are made. Withdrawals from traditional IRAs are taxed as income. Roth IRAs, on the other hand, are funded with after-tax dollars, and withdrawals are generally not subject to tax. It's important to note that early withdrawals from both types of IRAs may incur a penalty.

Annuities

Annuities are insurance products that provide a fixed-income stream during retirement. They are typically sold by insurance companies and can be purchased within an IRA. Annuities can be immediate or deferred. With an immediate annuity, fixed payments begin as soon as the investment is made. Deferred annuities allow the principal to grow for a specific period before withdrawals begin, usually during retirement. Annuities may have higher fees and expenses compared to IRAs, and they often come with surrender charges if you decide to cash out early.

Combining IRAs and Annuities

It is possible to hold an annuity within an IRA, and this can provide certain benefits. For example, it may offer greater flexibility in taking required minimum distributions if you plan to work beyond age 72. Additionally, the tax-free income stream provided by an annuity within an IRA can be advantageous. However, combining the two may not make sense from an investment growth standpoint, as you would be placing a tax-advantaged instrument within a tax-sheltered account.

Fleet Insurance: Vehicles Count

You may want to see also

An IRA is an account that holds retirement investments

An Individual Retirement Account (IRA) is a long-term, tax-advantaged savings account that individuals with earned income can use to save for the future. IRAs are defined and regulated by the Internal Revenue Service (IRS) and are designed primarily for self-employed people who do not have access to workplace retirement accounts.

IRAs are retirement savings accounts that offer tax advantages. They work a bit like a 401(k) but don’t require an employer to sponsor them. There are several types of IRAs: traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs.

The main benefit of an IRA is the ability to have more investment options and choices. An IRA can be opened through a bank, an investment company, an online brokerage, or a personal broker.

Traditional IRA

- You make contributions with money you may be able to deduct on your tax return.

- Any earnings can potentially grow tax-deferred until you withdraw them in retirement.

- Many retirees find themselves in a lower tax bracket than they were pre-retirement, so the tax-deferral means the money may be taxed at a lower rate.

Roth IRA

- You make contributions with money you've already paid taxes on (after-tax).

- Your money may potentially grow tax-free, with tax-free withdrawals in retirement, provided that certain conditions are met.

- Contributions aren't tax-deductible, but regular contributions can be withdrawn penalty- and tax-free at any time.

- There are no taxes on investment gains when taken out during retirement.

Rollover IRA

- You contribute money "rolled over" from a qualified retirement plan.

- Rollovers involve moving eligible assets from an employer-sponsored plan, such as a 401(k) or 403(b), into an IRA.

Commercial Auto Insurance: Monthly Cost for Rideshare Drivers

You may want to see also

An annuity is an insurance product

Annuities are a way to save for retirement, offering tax advantages and a steady income stream. They are often compared to Individual Retirement Accounts (IRAs), which are also used for retirement savings. The main difference between the two is that an IRA is an account that holds retirement investments, while an annuity is an insurance product. IRAs can hold a wide range of investments, including stocks, bonds, and mutual funds, whereas annuities are limited to fixed or variable annuities. Annuities also tend to have higher fees and expenses than IRAs.

Annuities can be purchased within an IRA, and this may offer some benefits, such as greater flexibility in taking required minimum distributions. However, it is important to consider the financial circumstances and priorities when deciding whether to purchase an annuity within an IRA. Annuities have complex tax considerations, high fees, and limited investment options, so it is essential to understand how they work before making any decisions.

Overall, annuities are a useful retirement savings option for individuals seeking a stable and guaranteed income stream. They are appropriate for those who want to address the risk of outliving their savings and are willing to accept the illiquidity and potentially high fees associated with annuities.

Personal Injury Protection: Auto Insurance's Hidden Gem

You may want to see also

Annuities are assets

Annuities are used primarily for retirement income purposes. They can help individuals address the risk of outliving their savings. Annuities are financial products that offer a guaranteed income stream and are usually bought by retirees.

Annuities can be structured into various types of instruments, giving investors flexibility. They can be categorized as immediate or deferred, and fixed, variable, or indexed.

Annuities are appropriate financial products for individuals who seek stable, guaranteed retirement income. Money placed in an annuity is illiquid and subject to withdrawal penalties so this option isn't recommended for younger individuals or those with liquidity needs. Annuity holders can't outlive their income stream and this hedges longevity risk.

Annuities are often used by pension plans to secure the payment of benefits for eligible employees. But even a private annuity used by an individual is an asset.

Annuities are also used as a planning tool for married couples in which just one spouse requires long-term care. This could be nursing home care, in-home care, assisted living assistance, or adult day care.

NJ Manufacturers: Gap Insurance Coverage?

You may want to see also

Frequently asked questions

Yes, you can roll over your IRA, 401(k), 403(b), or lump sum pension payment into an annuity tax-free. Annuities funded with an IRA or 401(k) rollover are "qualified" plans, enabling an insurance company to create an "IRA annuity", into which you can deposit your retirement funds directly.

No. You are permitted to roll over these payments into an annuity tax-free because when you buy an annuity with IRA or 401(k) money, the first thing the insurance company does is create an IRA holding account to receive your transferred funds.

Yes, you can delay RMDs until age 85, on up to $125,000 or 25% of your IRAs (whichever is less) by purchasing a "QLAC".