Auto insurance coverage varies from state to state, but there are some common types of insurance that are required in most states. These include liability insurance, which covers damage and injuries caused to others in an accident, and uninsured/underinsured motorist coverage, which protects you if you're hit by a driver without insurance or sufficient coverage. While collision and comprehensive coverage are not mandatory, they are highly recommended. The amount of coverage you need depends on factors such as your state's minimum requirements, your budget, and the value of your car. It's generally advised to purchase the maximum coverage you can comfortably afford to ensure adequate protection in most scenarios.

| Characteristics | Values |

|---|---|

| Liability Coverage | $25,000 per person and $50,000 per accident for bodily injury and $25,000 for physical damage |

| Comprehensive Coverage | $100,000 per person for bodily injury liability, $300,000 per accident for bodily injury liability, and $100,000 for property damage |

| Collision Coverage | $250,000 per person for bodily injury liability, $500,000 per accident for bodily injury liability, and $250,000 for property damage |

| Uninsured/Underinsured Motorist Coverage | $100,000 per person for bodily injury liability, $300,000 per accident for bodily injury liability, $250,000 per person for bodily injury liability, and $500,000 per accident for bodily injury liability |

| Personal Injury Protection (PIP) | $15,000 per person and $30,000 per accident |

| Medical Payments (MedPay) Coverage | $1,000 to $10,000 per person |

What You'll Learn

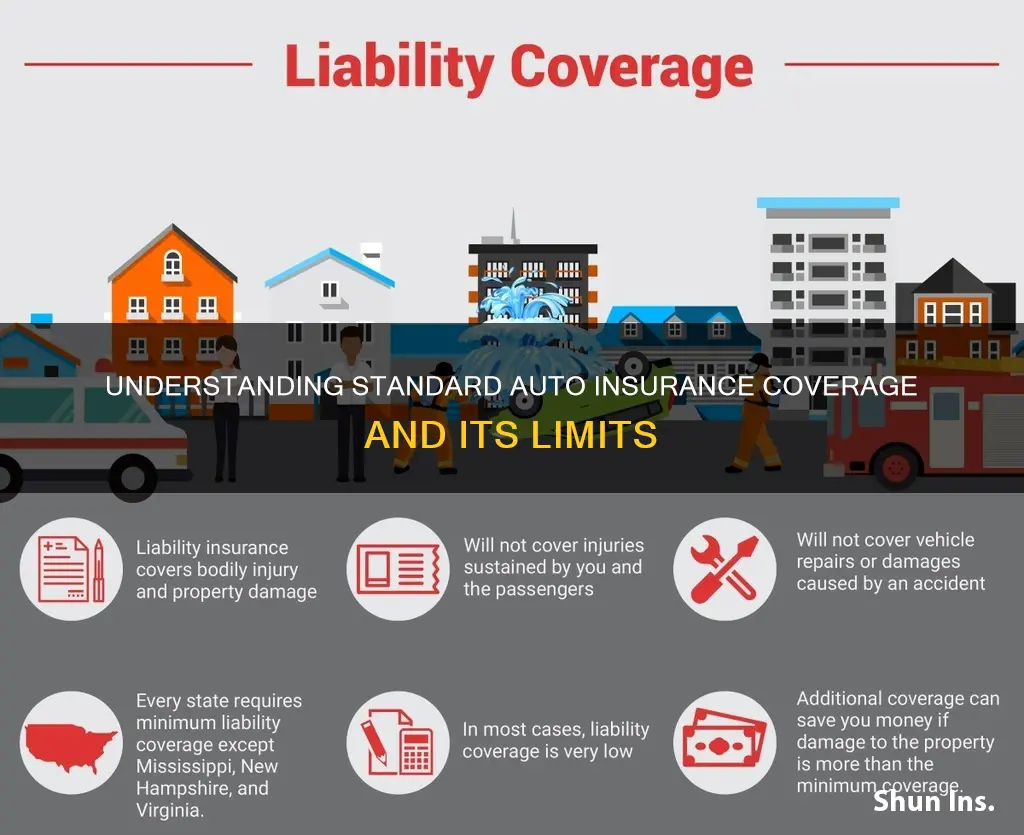

Liability insurance

The minimum liability limits vary depending on the state, but the most common minimums are $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, these amounts may not be adequate if you cause a serious accident, and it is recommended to purchase more coverage than the state minimum to protect your assets. For example, if you have a high net worth, you may want to consider a combined single limit policy, which provides a higher coverage limit that can be used for any type of liability claim.

In addition to liability insurance, some states also require other types of coverage, such as uninsured motorist coverage, personal injury protection, or medical payments coverage. It is important to review your state's requirements and your own financial situation to determine the appropriate amount of liability insurance and other types of coverage needed.

Auto Insurance Coverage: Your Lifetime Policy Copy Guide

You may want to see also

Medical payments coverage

MedPay coverage limits typically range from $1,000 to $10,000, depending on the state and insurer. It is generally recommended to carry coverage equal to your health insurance deductible. If you do not have health insurance, consider carrying a higher MedPay limit to cover potential medical bills.

MedPay is different from personal injury protection (PIP) coverage, which is required in some states. PIP covers medical expenses as well as lost wages, funeral expenses, and other costs. PIP limits and costs are typically much higher than MedPay limits.

In summary, MedPay is an important coverage option to consider, especially if you are concerned about affording medical bills after a car accident. It can provide peace of mind and help reduce the financial burden of medical expenses.

Hoosier State Auto Insurance Requirements: What You Need to Know

You may want to see also

Comprehensive coverage

The cost of comprehensive coverage will depend on factors such as the value of your vehicle, your deductible amount, and your financial circumstances. Typically, a higher deductible will result in lower insurance costs, while a lower deductible will lead to higher insurance costs. It is worth noting that comprehensive coverage has limits and will not cover normal wear and tear on your vehicle.

When deciding whether to purchase comprehensive coverage, consider the value of your vehicle, your financial situation, and your personal preferences. If your vehicle has a high cash value or you cannot afford repairs or replacement, comprehensive coverage can provide valuable peace of mind.

In summary, comprehensive coverage is an optional but important form of protection for your vehicle. It covers a range of scenarios that are beyond your control and can help ensure you are prepared for unexpected events.

Allied Auto Insurance: NAIC Number and Its Importance

You may want to see also

Collision coverage

When deciding whether to opt for collision coverage, consider the following:

- The age of your car: Collision coverage may not be worthwhile for older cars that have depreciated in value over time.

- The cost of repairs or replacement: Could you afford to repair or replace your car if you were in an accident? Collision coverage can help get you back on the road without the sudden large expense.

- The actual cash value of your car: If the cost of collision coverage is more than 10% of your car's actual cash value, you may be spending more than it's worth to protect the vehicle.

- Financing or leasing: If you are financing or leasing your car, your lender may require you to purchase collision coverage.

If you choose to add collision coverage to your policy, you will need to select a deductible, which is the amount you will pay out of pocket toward repairs if you file an insurance claim. A higher deductible will result in slightly cheaper premiums, while a lower deductible will lead to higher premiums but lower out-of-pocket expenses after a claim.

Navigating Auto Insurance for Learner Drivers: A Step-by-Step Guide

You may want to see also

Personal injury protection (PIP)

PIP insurance generally covers:

- Medical expenses from a car accident

- Lost wages due to injuries

- Rehabilitation costs

- Replacement services for tasks you can't do due to your injuries, such as childcare or house cleaning

- Funeral expenses and survivor benefits

PIP insurance does not cover:

- Bodily injuries to the other driver and their passengers

- Injuries in an accident if you are driving for work purposes

- Injuries from an accident while you were committing a crime

- Damage to someone else's property

- Damage to your vehicle

PIP Requirements by State

PIP is required in some states as part of "no-fault auto insurance" laws that restrict your ability to sue for car crash injuries. Currently, PIP is required in 15 states and Puerto Rico, optional in 4 states and Washington, D.C., and unavailable in others. The coverage limits and requirements vary by state, with minimum coverage amounts set by state governments and maximums set by insurance companies.

Even in states where PIP is optional, it can still be a valuable addition to your car insurance policy, especially if you don't have a good health insurance plan. PIP offers benefits that health insurance typically doesn't, such as reimbursement for lost wages and payments for replacement services.

Carmax Auto Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The minimum amount of car insurance you need is typically state-required liability coverage. The most commonly required liability limits are $25,000 per person for bodily injury, $50,000 in total bodily injury per accident, and $25,000 for property damage per accident. However, individual state requirements vary, so it's important to check your state's specific mandates.

Liability insurance is mandatory in nearly every state. Some states also require additional types of insurance, such as uninsured/underinsured motorist coverage, personal injury protection (PIP), or medical payments coverage (MedPay).

While the state minimum is the legal requirement, it is often recommended to purchase additional coverage to protect yourself financially. Consider your assets, including your car, home, savings, and investments. If you are underinsured and found liable for an accident, you may be responsible for paying any damages that exceed your coverage limits.