It is mandatory to carry proof of auto insurance, and failure to do so can result in fines or imprisonment. There are several ways to obtain a copy of your auto insurance card, including contacting your insurer, using their mobile app, visiting an agent in person, or printing a copy yourself. Additionally, you can request a copy of your auto insurance history, which includes information on your coverage and claims, from your previous insurance company or the state's Department of Motor Vehicles. It is recommended to keep auto insurance records, such as insurance statements, documentation related to claims, and billing statements, until the policy expires and any outstanding claims are settled.

| Characteristics | Values |

|---|---|

| How to get a copy of your auto insurance card | Call your insurer, use their mobile app, visit an agent in person, or print a copy yourself |

| How often to get a copy of your auto insurance card | Get a new insurance card every time your policy renews, or whenever you make changes to your coverage |

| How to keep your auto insurance card safe | Keep it in your wallet, glove compartment, or center console, or as a digital file on your smartphone |

| How long to keep your auto insurance records | Keep all insurance records until your policy has expired and any outstanding claims have been settled |

| How to dispose of old insurance policies | Shred old insurance documents with a cross-cut shredder to avoid identity theft |

What You'll Learn

Contact your insurance provider

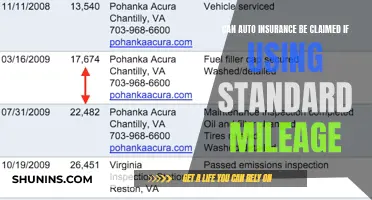

If you need a copy of your auto insurance history, the best place to start is by contacting your insurance provider. They can print out a history of your auto insurance coverages and claims, often called a letter of experience. This will include the details of your policy, such as coverage types, limits, and exclusions, as well as any claims made.

To get a copy of your insurance history, you can contact your insurance provider by phone, email, or through their website. Be prepared to provide your policy number, name, and any other details requested to verify your identity. Clearly state that you need a copy of your auto insurance history and specify why you need it. Ask about the delivery options available to you, as some companies may email the history, while others may mail it to you or offer a digital copy through their online portal. Before receiving the history, double-check that all the information is accurate and up to date.

If you need a copy of your insurance card, you can also contact your insurance provider. They can arrange to mail you a copy, or you can visit their website or mobile app to access a digital copy. Some insurance companies also have in-person agents who can provide you with a copy of your insurance card. If you can't access a digital copy, you may be able to print one yourself. It's important to always carry your insurance card with you when driving, as you may need to provide proof of insurance during a traffic stop or after an accident.

In addition to contacting your insurance provider, you may also be able to obtain your auto insurance history by contacting your state's Department of Motor Vehicles (DMV). They may have information on your previous insurance policies and can provide a copy of your motor vehicle record (MVR), which includes information on any tickets or accidents.

Get Automobile Club Auto Insurance: Benefits and Steps

You may want to see also

Provide necessary information

To get a copy of your auto insurance certificate, you will need to provide some necessary information to your insurance company. This is to verify your identity and ensure that you are the policyholder. Here is a list of the information you should be prepared to provide:

- Policy number: This is a unique number assigned to your insurance policy. It helps identify your specific policy and coverage.

- Name: Provide your full name as listed on the policy.

- Other details: Be ready to provide any additional information requested by the insurance company. This could include your date of birth, address, vehicle information, or other identifying details.

- Purpose: Specify why you need the certificate. For example, you may need it for registering a vehicle, providing proof during a traffic stop, or renting a car.

In some cases, you may also need to provide information such as your driver's license number or details about your vehicle, such as the registration certificate or vehicle identification number (VIN). It is a good idea to have this information readily available when contacting your insurance company.

Additionally, if you are obtaining a duplicate copy of your insurance certificate due to loss or misplacement, there may be a few more steps involved. These could include notifying your insurance provider immediately about the loss, filing a report with the police, and submitting an official application for a replacement certificate.

It is important to provide accurate and up-to-date information to your insurance company to avoid any delays or issues in obtaining your auto insurance certificate.

Verify Auto Insurance Coverage: Quick and Easy Steps

You may want to see also

Request a copy of your certificate

Requesting a copy of your auto insurance certificate is a straightforward process. Here are the steps you can follow:

Step 1: Contact Your Insurance Provider

Get in touch with your insurance company either by phone or through their website. You can find their contact information on their website or your insurance policy documents. It's a good idea to have your policy number and other relevant details ready when you reach out.

Step 2: Provide Necessary Information

When you connect with your insurance provider, they will likely ask for information to verify your identity and locate your policy. Be prepared to provide details such as your full name, policy number, address, and any other information they may require.

Step 3: Request a Copy of Your Certificate

Clearly communicate that you need a copy of your auto insurance certificate. Specify the reason for your request, such as replacing a lost card, registering a new vehicle, or providing proof of insurance for a loan application.

Step 4: Discuss Delivery Options

Inquire about the available options for receiving your certificate. Some insurance companies may offer to email the certificate, while others may send it by mail or provide access to a digital copy through their online portal. Choose the option that works best for you.

Step 5: Confirm the Details

Before finalising your request, take a moment to review the information on the certificate. Ensure that all the details, such as your name, policy number, coverage dates, and coverage details, are accurate and up to date.

Step 6: Receive Your Certificate

Depending on the delivery option you chose, you will receive your certificate by email, mail, or through the insurance company's online portal. If you selected mail as the delivery method, keep an eye on your mailbox for the arrival of the certificate.

Remember to keep your auto insurance certificate in a safe and accessible place, such as your wallet, glove compartment, or digital storage on your smartphone. It is essential to have proof of insurance when driving, as required by state laws, and in various situations like registering a vehicle or renting a car.

Spouse on Your Auto Insurance: Necessary?

You may want to see also

Delivery options

When it comes to getting a copy of your auto insurance certificate, there are several delivery options available. Here are the most common methods:

- Email: Some insurance companies may offer to email you a digital copy of your certificate. This option provides quick and convenient access to your insurance information.

- Mail: If you prefer a physical copy, your insurance company can send you the certificate by mail. This option may take a few business days to arrive.

- Online Portal: Many insurance companies provide online portals or websites where you can access and download your insurance documents, including the auto insurance certificate. This option allows you to retrieve your certificate instantly at any time.

- Mobile App: Some insurance companies offer mobile apps that allow you to access your insurance information on the go. You can usually log in to the app and download a digital copy of your certificate.

- In-Person: If you prefer a more personal approach, you can visit your insurance agent's office and request a copy of your certificate in person. This option may be useful if you need immediate assistance or have specific questions about your coverage.

It's important to note that the availability of these delivery options may vary depending on your insurance company and your location. It's always a good idea to contact your insurance provider or agent to inquire about the specific delivery methods they offer. Additionally, remember to confirm that all the information on your certificate is accurate and up to date before receiving it.

Surplus Auto Insurance Claim Checks: To Keep or Not to Keep?

You may want to see also

Confirm the details

Confirming the details on your auto insurance certificate is crucial to ensure its accuracy and validity. Here are the key details you should verify:

- Policyholder's Information: Check that your name and personal details are correct. This includes verifying that your name is spelled correctly and that any other relevant information, such as your address, is up to date.

- Policy Number: Confirm that the policy number on the certificate matches the one provided by your insurance company. This number is unique to your policy and is essential for identification and reference.

- Effective Dates: Verify the coverage period by checking the effective dates on the certificate. These dates indicate the start and end of your policy's validity.

- Coverage Details: Review the coverage details to ensure they align with the coverage you selected and purchased. This includes confirming the type of coverage, coverage limits, and any additional endorsements or exclusions.

- Insurance Company Information: Check that the name and contact information of the insurance company are correct. This typically includes the company's name, address, phone number, and email address.

- Vehicle Information: If applicable, confirm that the details of the insured vehicle are accurate. This may include the vehicle's make, model, year, and vehicle identification number (VIN).

- Signature and Witness Information: In some cases, insurance certificates may require signatures from authorised individuals or witnesses. Verify that these signatures are present and legible.

Remember to carefully review all the information on the auto insurance certificate before finalising it. If you find any discrepancies or errors, contact your insurance company to have them corrected. It is essential to have an accurate and up-to-date certificate to avoid any issues in the event of an accident or when requested by law enforcement.

Auto Insurance and Personal Injury: Unraveling the Monetary Support

You may want to see also

Frequently asked questions

You can get a copy of your auto insurance card by contacting your insurance provider, either by phone or through their website, and providing necessary information such as your policy number and name. You can also visit your insurer's website or app, or visit an agent in person.

An auto insurance certificate is a document that serves as proof of insurance coverage for your vehicle. It typically includes the policyholder's name, policy number, effective dates, coverage details, and the name of the insurance company.

If you lose your car insurance card, you can contact your insurance agent or customer service to request a new copy. You can also visit your insurance company's website or mobile app to access a digital copy.