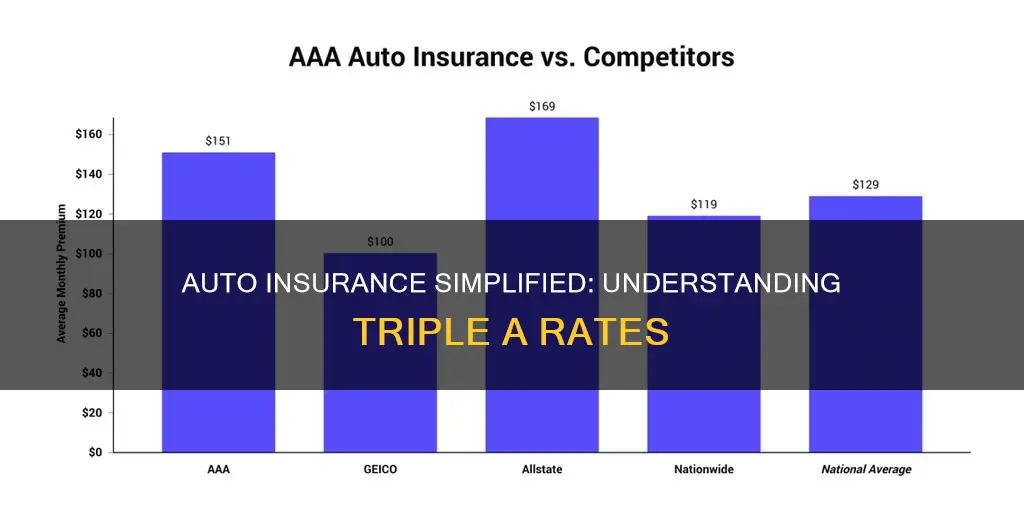

AAA, also known as Triple A, is a well-known company that offers a range of services, including auto insurance. AAA auto insurance rates tend to be higher than those of other providers, with annual full-coverage rates 14% above the market average. The cost of AAA auto insurance varies depending on factors such as location, vehicle type, age, and driving history. AAA also offers various discounts and benefits to its members, including safe driver discounts, student discounts, and loyalty discounts. Understanding AAA auto clubs and their offerings can help potential customers decide if AAA auto insurance is the right choice for their needs.

What You'll Learn

AAA insurance rates are 14% higher than the market average

There are several reasons why AAA insurance rates are higher than the market average. Firstly, AAA offers customized coverage that includes liability coverage, medical expenses for the driver and passengers, collision coverage, comprehensive coverage, rental reimbursement coverage, and new car added protection, among other benefits.

Secondly, AAA insurance is known for its excellent customer service and financial strength. Their insurance agencies have received ratings ranging from A+ (Superior) to A- (Excellent) from A.M. Best.

Thirdly, AAA offers a wide range of discounts to its customers, such as the paperless discount, multi-policy discount, vehicle safety discount, pay-ahead discount, AAA membership discount, loyalty discount, paid-in-full discount, good student discount, and safe driver discount.

Finally, AAA insurance rates may be higher due to factors such as the driver's age, gender, vehicle details, credit history, and the amount of chosen coverage. Additionally, traffic violations, accidents, comprehensive claims, and adding vehicles or drivers can also increase insurance rates.

While AAA insurance rates are higher than the market average, it is important to consider the comprehensive coverage and benefits offered by AAA, as well as the potential discounts that can help offset the higher costs.

Insurance Coverage Doubling: Is It Possible?

You may want to see also

AAA offers a range of discounts to its customers

AAA offers a 5% discount on insurance premiums for enrolling in electronic billing. Customers can also bundle their insurance policies to save up to 34% on their premiums. AAA also offers vehicle safety discounts, which include premium reductions for airbags, anti-theft devices, safety inspections and more, amounting to up to 40% in savings.

Customers can also save up to 5% on their insurance premiums by signing up for AAA car insurance at least seven days before their current policy expires. AAA members can also avail of a discount of up to 15% on their insurance. Staying with AAA for multiple years can qualify customers for a loyalty discount of up to 34%. Paying insurance premiums annually can also get customers a discount of 5%.

Full-time students or graduates up to the age of 25 with a GPA of 3.0 or higher can avail of a discount of up to 7%. AAA also offers a good student discount, where students who attend high school or college full-time and maintain a B average can save up to 15%.

AAA also offers a safe driver discount, where drivers with clean driving records can save up to 20% on their insurance premiums. AAA also offers a discount for customers who insure more than one vehicle, which can save them up to 15.7%.

AAA also offers discounts through its partners, which include deals on car rentals, hotels, restaurants, electronics, and more.

Auto Insurance Agencies: The Driving Record Factor

You may want to see also

AAA insurance costs vary depending on location

The cost of AAA membership also depends on your location, ranging from $40 to $74 per year for the Classic/Basic plan, $60 to $124 per year for AAA Plus, and $77 to $164 per year for AAA Premier. Benefits increase with higher-tiered plans. Additionally, each of the 25 AAA Auto Clubs in the US and Canada offers various insurance options and discounts. For example, AAA Northern California, Nevada, and Utah provide a discount of up to 19% if drivers allow the insurer to check annual mileage.

AAA's insurance rates are generally higher than the market average. Its annual full-coverage rates are 14% more expensive than the market average. AAA offers car insurance at $2,293 per year or $191 per month for full coverage and $542 per year or $45 per month for minimum coverage.

AAA offers a variety of discounts to its customers, including safe driver discounts, student discounts, multi-policy discounts, and loyalty discounts. The availability and amount of these discounts may vary by location and other factors.

Liability Insurance: How Much Auto Coverage?

You may want to see also

AAA insurance is only available to AAA club members

Membership to one of the 25 AAA Auto Clubs in the US and Canada provides access to various insurance options. The cost of membership depends on location and level of membership, with the AAA Classic/Basic membership costing between $40 and $74 per year, AAA Plus costing around $60 to $124 per year, and AAA Premier costing $77 to $164 per year.

AAA auto insurance rates vary depending on location, with an average annual premium of $1,903 and estimates ranging from $1,308 to $2,814. The price is influenced by factors such as location, vehicle type, age, driving history, and mileage.

AAA offers a variety of discounts to its members, including safe driver discounts, student discounts, loyalty discounts, and multi-policy discounts. Members can also take advantage of AAA's well-known roadside assistance program, which includes services such as mechanical first aid, towing, and fuel delivery.

Overall, AAA insurance provides comprehensive coverage and benefits to its members, but it is important to consider the cost of membership and insurance premiums when deciding if AAA is the right option.

Carmax Gap Insurance: What You Need to Know

You may want to see also

AAA offers excess MedPay to cover healthcare costs after an accident

AAA auto insurance costs are higher than other providers for most driver profiles. Its annual full-coverage rates are 14% more expensive than the market average. The company offers many ways to save, but policyholders of any age or driving profile consistently pay above state and national averages.

Excess MedPay only pays for medical bills that your private health plan does not cover. If you do not have any private health insurance, you must sign an affidavit declaring you have no private health insurance to trigger the benefits. This is why it is called "excess". It is excess to any private health coverage you may have.

Primary medical pay, on the other hand, pays immediately for medical bills, and you do not have to wait to bill your private health insurance first, as you do with excess medical pay coverage.

While AAA does not specify whether they offer primary or excess MedPay, they do offer auto insurance with medical payments coverage added to help pay medical bills after a car accident for both you and your passengers. AAA has over 100 years of experience protecting drivers and has earned a reputation for stellar customer service.

Auto Owners Insurance: Nationwide Availability or Regional Restrictions?

You may want to see also

Frequently asked questions

AAA car insurance costs $2,293 per year or $191 per month for full coverage, and $542 a year or $45 per month for minimum coverage. AAA's average annual auto insurance premium is $1,903, with estimates ranging from $1,308 to $2,814. The price you pay can vary depending on factors such as your location, vehicle, age, driving history, and how much you drive.

The cost of AAA car insurance can be influenced by several factors, including your location (urban areas tend to be more expensive), the type of vehicle you own (older and poorly maintained vehicles are pricier to insure), your age (older individuals typically get cheaper rates), your driving history (safe driving records can reduce your premium), and your annual mileage (driving less can result in lower premiums).

AAA offers various discounts to help reduce your car insurance premium. These include safe driver discounts, driver training discounts, multi-vehicle discounts, student discounts, good student discounts, professional discounts, anti-theft device discounts, multi-policy discounts, paid-in-full discounts, and loyalty discounts. The availability and amount of these discounts may vary based on your location and specific AAA affiliate.