Term life insurance is a type of coverage that provides protection for a specific period, typically 10, 20, or 30 years. It is a popular choice for those seeking affordable coverage for a defined period, often to cover financial obligations like mortgage payments or children's education. However, if you're looking for a long-term financial safety net, you might consider the opposite of term life insurance, which is permanent or whole life insurance. This type of policy offers coverage for the entire lifetime of the insured individual, providing a sense of security that extends beyond the initial term period.

What You'll Learn

- Term Life Insurance Duration: Permanent coverage with no expiration date

- Whole Life Insurance: Permanent coverage with guaranteed death benefit

- Universal Life Insurance: Flexible coverage with potential for cash value

- Variable Life Insurance: Permanent coverage with investment options

- Final Expense Insurance: Simplified coverage for funeral and burial expenses

Term Life Insurance Duration: Permanent coverage with no expiration date

Term life insurance is a type of coverage that provides protection for a specific period, typically ranging from 10 to 30 years. It is a popular choice for individuals seeking affordable and straightforward insurance. The key feature of term life insurance is its temporary nature; it offers protection during a defined period and then expires. This type of insurance is often compared to a rental agreement, where you pay a fixed rate for a set duration, after which the coverage ends.

Now, when we consider the opposite of term life insurance, we are essentially looking for a form of coverage that provides permanent protection with no expiration date. This is in contrast to the limited-term nature of traditional term life insurance. The opposite concept would be a policy that offers lifelong coverage, ensuring financial security for the policyholder and their beneficiaries indefinitely.

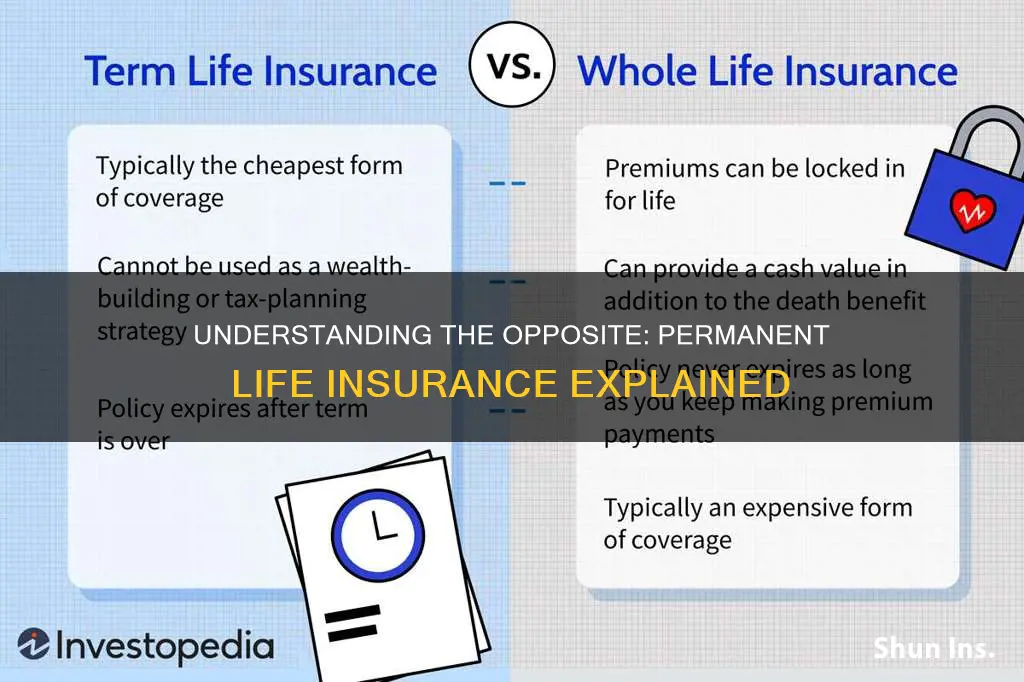

Permanent life insurance, also known as whole life insurance, is the opposite of term life in many ways. It provides coverage for the entire lifetime of the insured individual, offering a sense of long-term security. With permanent life insurance, the policyholder pays a premium, and in return, they receive a death benefit when they pass away. The premiums are typically higher compared to term life insurance, but the advantage lies in the guaranteed coverage for life. This type of insurance builds a cash value over time, which can be borrowed against or withdrawn, providing additional financial flexibility.

The key difference lies in the duration and flexibility of the coverage. Term life insurance is a straightforward, temporary solution, while permanent life insurance offers a more comprehensive and long-term approach to financial protection. It is essential to understand these differences when choosing the right insurance policy to meet your specific needs and ensure that you are adequately protected for the long term.

In summary, the opposite of term life insurance is permanent life insurance, which provides lifelong coverage and builds cash value over time. This type of insurance offers a more comprehensive solution for long-term financial security, ensuring that your loved ones are protected even after your passing. Understanding these concepts can help individuals make informed decisions when selecting the appropriate insurance coverage for their unique circumstances.

Term Life Insurance: Can You Sell Your Policy?

You may want to see also

Whole Life Insurance: Permanent coverage with guaranteed death benefit

Whole life insurance is a type of permanent life insurance that offers lifelong coverage, providing a sense of security and financial protection for your loved ones. Unlike term life insurance, which is a temporary policy with a defined period of coverage, whole life insurance is a long-term commitment that ensures your beneficiaries receive a death benefit when you pass away. This type of insurance is an excellent choice for those seeking a more permanent and comprehensive solution to their life insurance needs.

The key feature of whole life insurance is its guaranteed death benefit. This means that regardless of your age or health status at the time of your passing, your beneficiaries will receive the full death benefit amount that was agreed upon at the time of policy inception. This guarantee provides peace of mind, knowing that your family will have the financial support they need, even if you were to pass away unexpectedly. With whole life insurance, the coverage remains in force for as long as you make the regular premium payments, ensuring a consistent and reliable source of financial security.

One of the advantages of whole life insurance is its ability to accumulate cash value over time. As you make regular premium payments, a portion of the premium goes towards building up a cash reserve. This cash value can be borrowed against or withdrawn, providing you with a source of funds that can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. Additionally, the cash value can be used to pay for future premiums, ensuring that your policy remains in force even if you experience financial difficulties.

Another benefit of whole life insurance is its stability and predictability. Unlike term life insurance, which has a limited duration, whole life insurance provides long-term financial protection. This stability is particularly valuable for those who want to ensure their loved ones are taken care of for an extended period. With whole life insurance, you can rest assured that your family will have the necessary financial support, even as your needs and circumstances change over the years.

When considering whole life insurance, it is essential to evaluate your specific needs and financial goals. Consulting with a qualified insurance advisor can help you understand the different options available and determine the most suitable policy for your situation. They can guide you through the process, ensuring you make an informed decision and select the appropriate coverage amount and type of whole life insurance policy to meet your permanent coverage requirements.

Get Your Life & Health Insurance License: A Step-by-Step Guide

You may want to see also

Universal Life Insurance: Flexible coverage with potential for cash value

Universal life insurance offers a unique and flexible approach to life coverage, providing both protection and an opportunity to build long-term wealth. Unlike term life insurance, which provides coverage for a specified period, universal life insurance is a permanent policy that offers lifelong protection. This type of insurance is designed to adapt to your changing needs and financial goals, providing a level of flexibility that term life insurance cannot match.

One of the key advantages of universal life insurance is its ability to accumulate cash value over time. As you make regular premium payments, a portion of each payment goes towards building a cash reserve. This cash value can grow tax-deferred, allowing it to accumulate and potentially earn interest. The beauty of this feature is that it provides a financial safety net and can be used for various purposes, such as funding education, starting a business, or even providing retirement income.

The flexibility of universal life insurance is another significant benefit. Policyholders have the freedom to adjust their coverage as their circumstances change. They can increase or decrease the death benefit, change the premium payment amount, or even take loans against the cash value. This adaptability ensures that the policy remains tailored to the individual's needs, providing comprehensive protection without the constraints of a fixed term.

In contrast to term life insurance, which is straightforward and focused on providing coverage for a specific period, universal life insurance offers a more comprehensive and personalized experience. It combines the essential aspect of life protection with the potential for long-term financial growth. This type of policy is particularly attractive to those seeking a more dynamic and adaptable insurance solution.

When considering universal life insurance, it is essential to understand the potential risks and benefits. While it offers flexibility and the opportunity to build cash value, it may also involve higher costs and more complex policy structures. Policyholders should carefully evaluate their financial goals and risk tolerance to determine if universal life insurance aligns with their needs. Ultimately, this insurance type provides a unique and powerful tool for individuals seeking both life protection and the potential for long-term financial success.

Cashing Out Universal Life Insurance: Strategies for Beneficiaries

You may want to see also

Variable Life Insurance: Permanent coverage with investment options

Variable life insurance is a type of permanent life insurance that offers both a death benefit and investment opportunities. It is designed to provide long-term financial security and flexibility for the policyholder. This insurance product is a permanent solution, meaning it remains in force for the policyholder's entire life, unlike term life insurance, which provides coverage for a specified period.

One of the key features of variable life insurance is its investment component. Policyholders can allocate a portion of their premium payments into various investment options offered by the insurance company. These investment accounts can include mutual funds, stocks, bonds, or other securities. The performance of these investments directly impacts the cash value of the policy, which grows over time. This feature allows individuals to potentially build a substantial cash value while also having a guaranteed death benefit.

The investment options in variable life insurance provide policyholders with a degree of control and customization. They can choose to invest in different asset classes, diversify their portfolio, and potentially earn higher returns compared to traditional fixed-rate insurance products. The investment aspect also means that the policy's cash value can fluctuate, and it may increase or decrease based on market performance. This feature is particularly attractive to those who want to actively manage their investments and potentially benefit from market growth.

In addition to the investment feature, variable life insurance also provides permanent coverage. This means that the death benefit remains in force for the policyholder's entire life, ensuring financial protection for the beneficiary. The policyholder can choose the amount of the death benefit and may even have the option to increase it over time. This permanent coverage is a significant advantage for those seeking long-term financial security.

When considering variable life insurance, it is essential to understand the risks involved. The investment component introduces market volatility, and the performance of the policy's cash value is not guaranteed. Policyholders should carefully evaluate their risk tolerance and consult with financial advisors to make informed decisions. Despite the risks, variable life insurance offers a unique combination of permanent coverage and investment opportunities, making it an attractive option for those seeking both financial protection and potential wealth accumulation.

Life Insurance Industry: Evolution and the Future

You may want to see also

Final Expense Insurance: Simplified coverage for funeral and burial expenses

The opposite of term life insurance, in the context of final expense insurance, refers to a different type of coverage designed to provide financial assistance for specific, often unexpected, costs. While term life insurance is a broader policy that offers protection for a defined period, the opposite, or rather a complementary, concept is 'final expense insurance'. This type of insurance is tailored to cover the costs associated with end-of-life arrangements, ensuring that the insured's family is financially prepared for these significant expenses.

Final expense insurance is a specialized policy that provides a lump sum payment or a series of payments to cover funeral and burial costs, as well as other related expenses. It is an essential financial tool for individuals who want to ensure that their loved ones are not burdened with the financial strain of organizing their final arrangements. This insurance is particularly beneficial for those who may not have substantial savings or assets to cover these costs, offering a safety net during a challenging time.

The beauty of final expense insurance lies in its simplicity and directness. It is designed to be straightforward, ensuring that the insured and their beneficiaries can easily understand the coverage and its benefits. This type of insurance typically has clear terms and conditions, making it accessible and understandable to a wide range of individuals. By providing a clear and concise policy, final expense insurance offers peace of mind, knowing that the financial aspect of end-of-life planning is taken care of.

When considering final expense insurance, it is crucial to evaluate the specific needs and preferences of the individual. This insurance can be tailored to suit various circumstances, ensuring that the coverage aligns with the insured's requirements. Whether it's a basic policy covering funeral expenses or a more comprehensive plan that includes additional benefits, the flexibility of final expense insurance allows for personalized protection.

In summary, final expense insurance serves as a simplified and direct solution for covering funeral and burial expenses, providing a sense of security and financial preparedness for individuals and their families. It is a valuable consideration for anyone looking to ensure that their end-of-life arrangements are financially managed, offering a practical approach to a sensitive topic.

Group Life Insurance: Taxable or Not?

You may want to see also

Frequently asked questions

The opposite of term life insurance is permanent life insurance, also known as whole life insurance or universal life insurance. These policies offer lifelong coverage and typically have a cash value component that grows over time.

Permanent life insurance provides coverage for the entire lifetime of the insured individual, hence the term "permanent." It offers a guaranteed death benefit and a cash value that accumulates over time, allowing policyholders to build equity. In contrast, term life insurance is only valid for a specific period, typically 10, 20, or 30 years, and does not have a cash value component.

Yes, there are other variations, such as variable life insurance and universal life insurance. Variable life insurance offers investment options, allowing the cash value to fluctuate based on market performance. Universal life insurance provides flexible premiums and death benefits, allowing policyholders to adjust their coverage over time. These types offer unique features and benefits compared to traditional term and permanent life insurance policies.