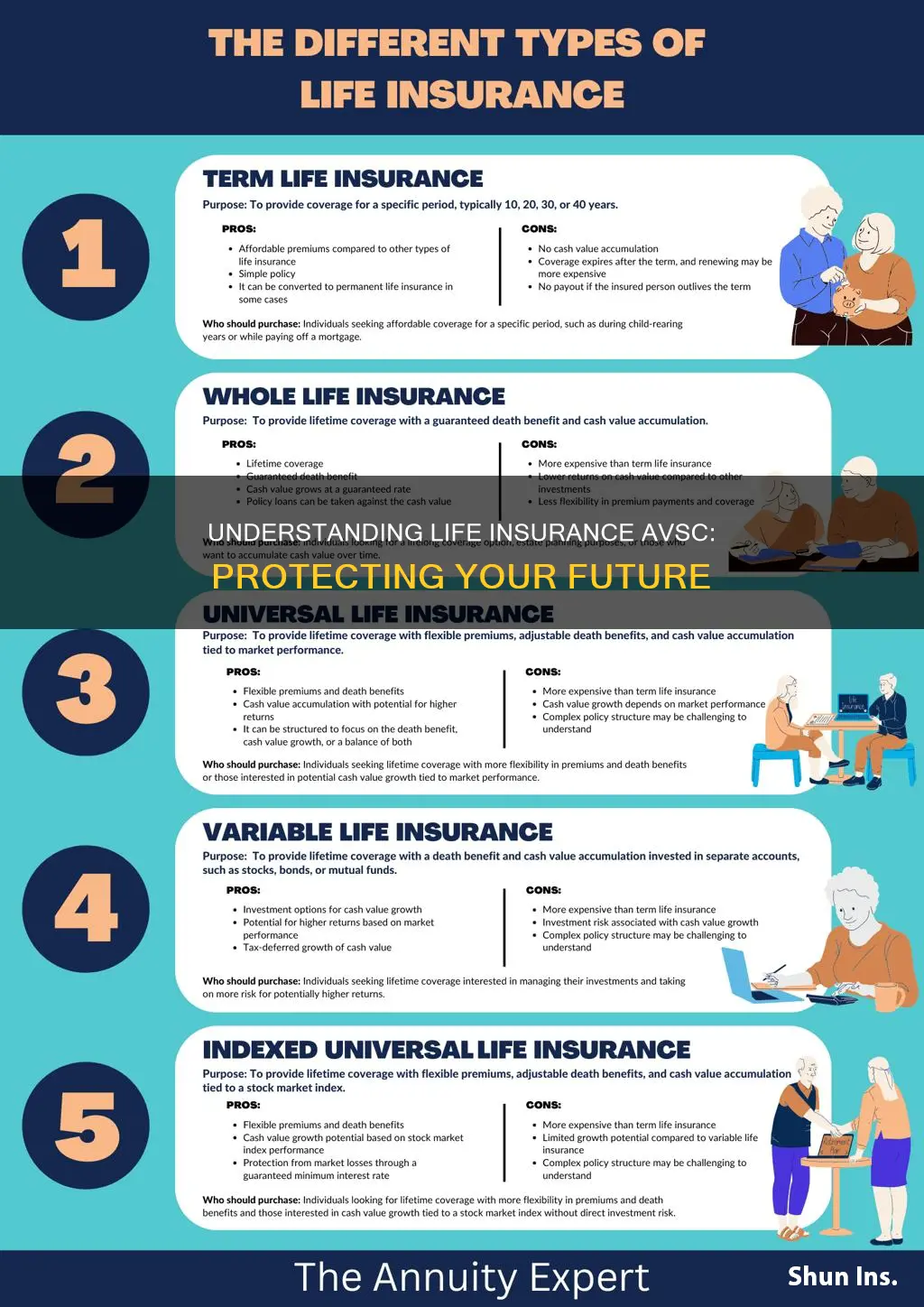

Life insurance is a crucial financial tool that provides a safety net for individuals and their families. One of the primary purposes of life insurance is to offer financial protection and peace of mind in the event of the insured's death. The term AVSC in this context refers to Assured Value Savings Component, which is a feature of certain life insurance policies. AVSC allows policyholders to accumulate cash value over time, which can be used for various purposes, such as paying for future premiums, taking out loans, or providing a tax-free savings option. This feature enhances the long-term benefits of life insurance, making it a valuable asset for individuals seeking to secure their loved ones' financial future and achieve their personal financial goals.

What You'll Learn

- Financial Security: Life insurance provides financial protection for beneficiaries in the event of the insured's death

- Peace of Mind: It offers reassurance and reduces stress by ensuring loved ones are cared for

- Debt Management: Proceeds can help pay off debts, mortgages, or other financial obligations

- Income Replacement: It can replace lost income, ensuring financial stability for dependents

- Legacy Planning: Life insurance can be used to leave a financial legacy for future generations

Financial Security: Life insurance provides financial protection for beneficiaries in the event of the insured's death

Life insurance is a vital financial tool that offers a safety net for individuals and their loved ones. Its primary purpose is to provide financial security and peace of mind, especially during challenging times. When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon their passing. This benefit is designed to offer financial protection and support to the policy's beneficiaries, who can be family members, partners, or anyone else named in the policy.

The concept of financial security is at the heart of life insurance. It ensures that the insured's family or designated recipients have a source of income or a lump sum amount to cover various expenses and maintain their standard of living. This is particularly crucial in the event of the insured's untimely death, as it prevents the beneficiaries from facing financial strain and potential debt. Life insurance policies often provide a tax-free payout, allowing the money to be used for immediate needs like funeral expenses, outstanding debts, mortgage payments, or everyday living costs.

In the context of 'Financial Security', life insurance plays a pivotal role in several ways. Firstly, it ensures that the insured's death does not result in a financial crisis for their loved ones. By providing a financial safety net, it enables beneficiaries to make informed decisions about their future, without the added stress of financial worries. This financial protection can also help beneficiaries maintain their long-term financial goals, such as purchasing a home, funding their children's education, or starting a business.

Moreover, life insurance offers a sense of stability and reassurance. It allows individuals to plan for the future, knowing that their family's financial well-being is protected. This is especially important for those with dependents, as it ensures that the basic needs of the family are met even if the primary breadwinner is no longer present. The financial security provided by life insurance can also help beneficiaries avoid making hasty financial decisions, such as selling assets or taking on high-interest debt, to cover immediate expenses.

In summary, the primary purpose of life insurance is to provide financial security and protection for beneficiaries when the insured passes away. It offers a practical solution to ensure that loved ones are not left vulnerable financially, allowing them to grieve and move forward with their lives without the added burden of financial stress. Understanding the value of life insurance in this context can encourage individuals to consider it as a vital component of their overall financial planning strategy.

Cashing in on Life Insurance: Getting Money Now

You may want to see also

Peace of Mind: It offers reassurance and reduces stress by ensuring loved ones are cared for

Life insurance, particularly in the form of an AVSC (Assured Value Savings Contract), is a financial tool that provides peace of mind and security to individuals and their families. Its primary purpose is to offer reassurance and reduce stress by ensuring that loved ones are financially protected in the event of the insured's untimely demise. This type of insurance is a long-term commitment, often lasting for decades, and it plays a crucial role in safeguarding the financial well-being of those who depend on the insured individual.

When an individual purchases life insurance, they are essentially making a promise to their beneficiaries that they will provide financial support if something happens to them. This promise is a powerful reassurance, knowing that your family or dependents will have a steady income or a lump sum amount to cover their essential expenses, daily needs, and future goals. The peace of mind that comes with this assurance is invaluable, allowing individuals to focus on their present and future without constantly worrying about financial burdens that may arise in the future.

The benefits of life insurance extend beyond the immediate financial support it provides. It offers a sense of security and stability, knowing that your loved ones will be taken care of, even if you are no longer around. This can significantly reduce stress and anxiety, especially for those with financial responsibilities, as it ensures that the family's standard of living will not be compromised. Moreover, life insurance can also provide a sense of control, allowing individuals to plan for the future and make decisions that will benefit their beneficiaries, such as choosing the right policy and coverage amount.

In the context of an AVSC, the peace of mind is further enhanced by the savings component. This type of contract combines insurance with a savings plan, allowing the insured to build a cash value over time. This cash value can be used to cover future expenses, provide a financial cushion, or even be borrowed against to meet immediate needs. The dual benefit of insurance and savings ensures that the policyholder's money is working for them, providing both financial protection and a sense of security.

In summary, the primary purpose of life insurance, especially in the form of AVSC, is to offer peace of mind and reduce stress. It ensures that loved ones are financially secure and cared for, even in the face of adversity. By providing a safety net and a sense of control, life insurance empowers individuals to make the most of their present and future, knowing that their family's well-being is protected. This financial tool is a valuable asset for anyone seeking to provide long-term security and reassurance to their loved ones.

Life Insurance: Your Ultimate Financial Safety Net

You may want to see also

Debt Management: Proceeds can help pay off debts, mortgages, or other financial obligations

Life insurance, particularly in the context of AVSC (Assured Value Savings Account), can be a powerful tool for debt management and financial stability. When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon the occurrence of a specified event, typically the insured's death. The primary purpose of this arrangement is to provide financial security to the insured's loved ones or beneficiaries.

However, the proceeds from a life insurance policy can also be utilized for various financial purposes, including debt management. Here's how:

Debt Reduction: One of the most common and practical uses of life insurance proceeds is to pay off debts. This can include credit card balances, personal loans, or any other financial obligations. By utilizing the insurance payout, individuals can eliminate or significantly reduce their debt burden, which can improve their overall financial health and creditworthiness. For example, if a policyholder passes away, the beneficiaries can use the insurance money to settle any outstanding debts, ensuring that the deceased's financial legacy is managed efficiently.

Mortgage Payment: Life insurance can also be a valuable asset in managing mortgage payments. Many people use life insurance to secure a mortgage, especially when the loan amount is substantial. The insurance policy acts as a guarantee that the mortgage lender will be repaid if the borrower were to die. This can provide peace of mind to both the borrower and the lender. In the event of the borrower's death, the life insurance proceeds can be used to pay off the remaining mortgage balance, preventing the lender from taking possession of the property due to unpaid debts.

Financial Obligations: Beyond debts and mortgages, life insurance proceeds can also be directed towards other financial obligations. This may include paying for funeral expenses, which can be a significant financial burden for families, or covering the costs of final arrangements. Additionally, the proceeds can be used to fund education expenses for dependent children or to provide financial support to a spouse or partner, ensuring their long-term financial security.

In summary, while the primary purpose of life insurance is to provide financial security to beneficiaries, the proceeds can be strategically utilized to manage debts, mortgages, and other financial obligations. This approach can help individuals and families maintain their financial stability and ensure that their loved ones are protected even in the face of unexpected circumstances. It is a practical way to leverage life insurance for long-term financial planning and debt management.

Life Insurance Options Post-Lyme Diagnosis

You may want to see also

Income Replacement: It can replace lost income, ensuring financial stability for dependents

The primary purpose of life insurance, particularly in the context of the AVSC (Assured Value Savings Contract), is to provide financial security and peace of mind to individuals and their loved ones. One of the most crucial aspects of this insurance is its ability to replace lost income, ensuring that the financial stability of dependents is maintained even in the event of the insured's untimely demise.

Income replacement is a critical feature of life insurance, especially for those with financial responsibilities such as a family, mortgage, or other long-term commitments. When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit in the event of their death. The primary benefit here is the payout, which can be a substantial sum, designed to replace the income that the deceased would have contributed to their family. This financial support can cover various expenses, including daily living costs, mortgage payments, education fees, and other financial obligations, ensuring that the family's standard of living is not significantly impacted.

For dependents, such as a spouse or children, the loss of income can be devastating, leading to financial strain and potential long-term consequences. Life insurance with an income replacement feature ensures that these dependents have a steady stream of financial support, allowing them to maintain their lifestyle and meet their essential needs. This financial stability can provide a sense of security and enable dependents to make informed decisions about their future, knowing that their financial obligations are partially or fully covered.

The amount of income replacement provided by life insurance policies can vary, and it is essential to carefully consider one's financial situation and future goals when selecting a policy. Some policies offer a lump-sum payment, while others provide a regular income stream over a specified period. The key is to choose a policy that aligns with your financial needs and ensures that your dependents are adequately protected.

In summary, the primary purpose of life insurance, especially in the context of AVSC, is to provide financial security and peace of mind. Income replacement is a vital component, ensuring that dependents can maintain their financial stability and make informed decisions about their future. By understanding the importance of this feature, individuals can make informed choices when selecting life insurance, ensuring that their loved ones are protected in the event of their passing.

Maximizing Life's Benefits: Understanding the Best Insurance Terms

You may want to see also

Legacy Planning: Life insurance can be used to leave a financial legacy for future generations

Life insurance is a powerful tool for legacy planning, allowing individuals to secure their family's financial future and leave a lasting impact on their loved ones. When considering the primary purpose of life insurance, it becomes evident that it serves as a safety net and a means to ensure financial stability for those who depend on the insured individual. However, its potential extends beyond immediate protection, making it an invaluable asset for long-term financial planning.

In the context of legacy planning, life insurance can be strategically utilized to provide financial security for future generations. This is particularly important for families who wish to ensure that their children or grandchildren have the necessary resources to pursue their dreams and maintain a certain standard of living. By taking out a life insurance policy, individuals can create a financial safety net that will be activated upon their passing, providing a lump sum or regular income to their beneficiaries.

The proceeds from a life insurance policy can be used to establish educational funds for children or grandchildren, enabling them to access quality education and potentially pursue higher degrees. This financial support can significantly impact their future opportunities and career paths. Moreover, life insurance can be structured to provide ongoing financial support for family members, ensuring that the legacy of the insured individual continues to benefit their loved ones over an extended period.

For those with a strong desire to leave a lasting impact, life insurance can be tailored to specific legacy goals. For instance, a policy can be designed to fund the construction or renovation of a family home, ensuring that future generations have a comfortable and personalized living space. Alternatively, the insurance proceeds could be used to establish a trust or foundation, which can support charitable causes or provide financial assistance to family members in need.

In summary, life insurance is not just about providing financial security during one's lifetime but also about creating a lasting legacy. By incorporating life insurance into legacy planning, individuals can take control of their financial future and that of their descendants, ensuring that their hard work and values are preserved for generations to come. It is a practical and thoughtful approach to estate planning, offering both immediate and long-term benefits.

KeyBank's Life Insurance Offerings: What You Need to Know

You may want to see also